Pipeline Transportation Market Research, 2031

The global pipeline transportation market size was valued at $17.9 billion in 2021, and pipeline transportation industry is projected to reach $37.4 billion by 2031, growing at a CAGR of 7.7% from 2022 to 2031.

Pipeline transportation is ideal for unidirectional flow of goods and inflationary influences have minimal effect on the transport cost. In comparison with conventional transportation, pipeline transportation has many advantages such as low operating cost, environment friendliness, flexibility, and complete automation of loading and unloading operations. These are all factors that are driving the pipeline transport market and are expected to boost the growth at an extremely high pace.

There are numerous drivers for the global pipeline transportation industry. However, increase in demand for oil & gas in energy and chemical sector are key to growth of the pipeline transportations. In addition, rise in demand for cost-effective transportation system for chemicals and other liquid products drive the global pipeline transportation market. Growth in population and industrialization is expected to increase the demand for chemicals, and water resources. This means more pipeline transportation is used for transporting liquids to various end-use industries or consumers. In oil & gas industries, pipeline transportation is also used in the transportation of crude oil from the extraction area to the oil refineries where several petroleum products are extracted that are used in various end-use industries to produce chemicals and products that are used by the consumers.

Moreover, the future use of pipeline transportation to transport oil & gas in the developed countries such as India and China are expected to offer fresh opportunities for the pipeline transportation market growth. Furthermore, the increased demand for water resources in power generation application is expected to drive the demand for pipeline transportations. Pipeline transportations are used in the food processing industry, especially for liquids such as milk, beer, soft drinks and other alcoholic drinks.

Rise in the use of pipeline transportation in various industries

The use of pipeline transportation is rising rapidly in various industries such as oil & gas, petroleum, food processing, water pipelines, and others. Pipeline transportation projects under construction and in pre-construction will contribute a lifetime increase in oil and gas CO2 emissions of 170 gigatons, only 15% less than the projected lifetime CO2 emissions of the currently operating global coal plant fleet. The planned 212,000-km expansion in the global system of oil and gas transmission pipelines, amounting to $1 trillion in capital expenditures, is colliding with commitments by most large economies to transition to carbon neutrality by mid-century.

In North America, the U.S. is the leading developer of pipelines as measured by capacity, with 19.6 million barrels of oil equivalent per day in development. This expansion presents a major climate risk, since the U.S. exports of liquefied natural gas have the highest greenhouse gas intensity of any major exporter, according to Boston Consulting Group. Canada continues to plan an expansion of its export pipeline network and new Liquefied Natural Gas (LNG) export terminals despite cratering demand, and historically low prices. The Mexican government has also launched de ReyesAguascalientes-Guadalajara pipeline marking the completion of the 1,446-km Wahalajara system carrying gas from the Waha hub in Texas to Guadalajara.

Another key project is the Sur de Texas-Tuxpán pipeline (commissioned in 2019), which runs 800 km from Brownsville, Texas through the Gulf of Mexico to Tuxpán, Veracruz. At Tuxpán, the pipeline feeds into Mexico’s existing national network and will eventually connect with the proposed Tuxpán-Tula and Tula-Villa de Reyes pipelines and join the Wahalajara network at Villa de Reyes. Thus, rapid industrialization and increasing investments in the construction of pipelines will be conducive to the North America pipeline transportation market during the forecast period.

Furthermore, in Asia-Pacific, China and India are the largest countries that influence the Asia-Pacific pipeline transportation market, owing to large population and growth in demand for oil & gas resources from the industrial and transportation sector. China’s pipeline projects aim to support major increases in the country’s gas supplies from five diverse sources such as imported LNG, gas imported from Central Asia, gas imported from Russia, gas from domestic fossil gas sources, and gas produced from coal seam projects.

The expansion of China’s access to sources of gas has spurred the world’s largest expansion of gas pipelines on the basis of length, including 4,646 km of gas pipelines under construction and a further 13,345 km of gas pipelines in pre-construction development. Considering the expected 50-year lifespan of oil and gas pipelines, this major expansion is at odds with China’s recent pledge to improve climate change by becoming carbon neutral by 2060. In India, gas imports increased from 31% of total gas supply in 2012 to 50% in 2019. Six LNG import terminals were commissioned during this time and four more are scheduled to come online by 2023. The Indian government is making its first ever direct grant for the construction of a gas pipeline, contributing $770 million toward the $1.9 billion Jagadishpur Haldia-Bokaro-Dhamra gas pipeline that will carry gas from the Dhamra LNG Terminal. As of August 2020, the 750-km north-western Phulpur-Varanasi, Gaya-Patna-Barauni section of this pipeline had been commissioned.

In Northeast India, the 30.9 billion cubic meters (bcm)/year Ennore-Tuticorin gas pipeline is being built to deliver gas from the recently commissioned Ennore LNG Terminal. The above-mentioned factor is expected to be conducive for the pipeline transportations market.

However, production of pipeline transportations is expected to be hampered, owing to demand for huge initial investment for the construction. The pipelines can be laid over difficult terrain as well as underwater. It ensures the steady and constant supply of liquids and gases to the places at a long distance. It minimizes the transshipment losses and delays. The presence of above-mentioned advantages is expected to boost the development of pipeline transportation.

On the other hand, development of pipeline transportation to substitute various other transportations that are dependent on fossil fuels will have a significant impact on the environment. This is expected to reduce environmental pollution to minimize health and safety concerns about air pollution and other hazards. Research is still required to improve the security of the transportation of materials through pipelines to avoid sabotage and leakage due to natural hazards. Thus, the development of security solutions for pipeline transportation offers lucrative opportunities for the global pipeline transportation market growth.

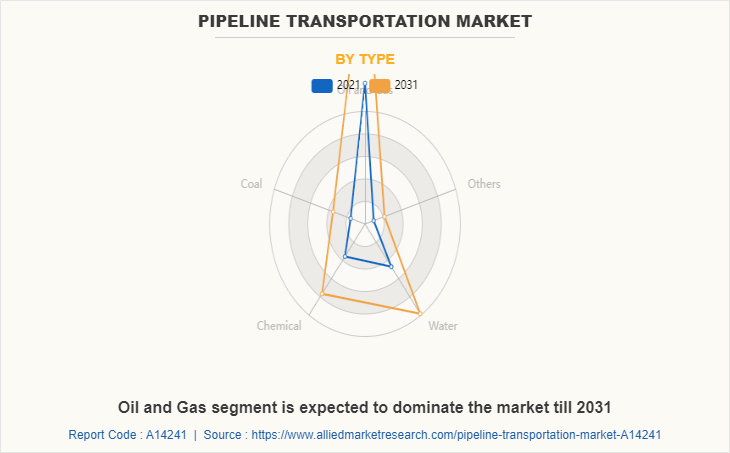

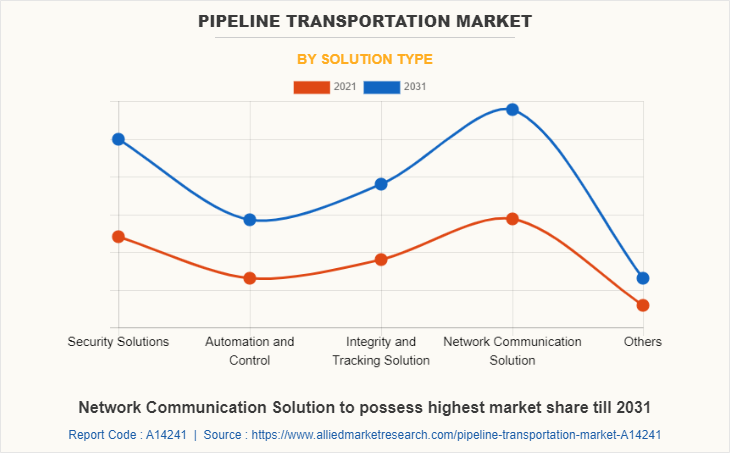

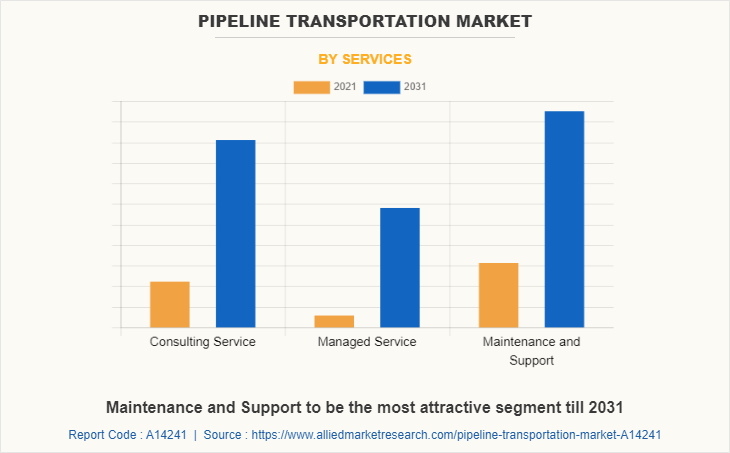

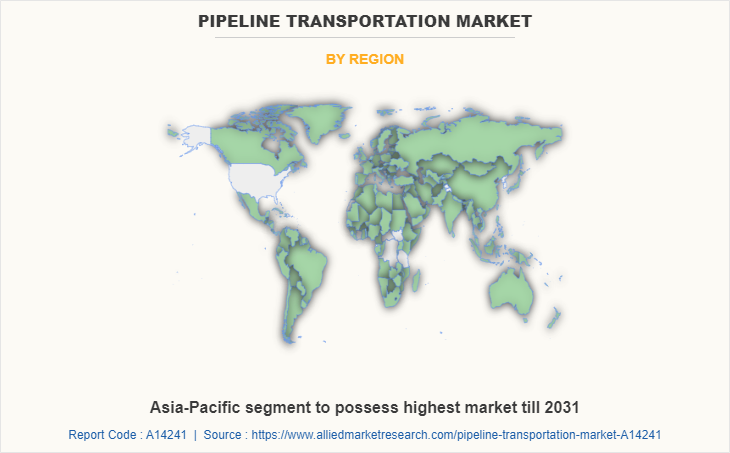

The global pipeline transportation market forecast is segmented on the basis of type, solution, service, and region. By type, the market is divided into oil & gas, coal, chemical, water, and others. By solution, it is divided into security solutions, automation and control, integrity and tracking solution, network communication solution, and others. On the basis of service, the market is divided into consulting services, managed services, and maintenance and support. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the oil and gas segment accounted for 51.6% of the pipeline transportation market share in 2021, and is expected to maintain its dominance during the forecast period. This is due to its wide range of end-use oil and gas applications in chemicals, automotive, and paints industries. By solution, it is divided into security solutions, automation and control, integrity and tracking solution, network communication solution, and others. The network communication solution segment accounted for the largest revenue share in the global pipeline transportation market in 2021.

By solution type, Network Communication Solution segment accounted for the largest share in 2021 and is expected to support its dominance during the forecast period. Rapid upgrades in the pipeline transportation system toward virtualization and the connectivity of the detection and management equipment with the communication equipment is a major factor increasing the demand for network communication solutions in the pipeline transportation market. The need for cost-efficient and safe modes of transport for hazardous chemicals and other liquids & gases is boosting the demand for the market. The presence of illegal activities and the danger due to the intervention of terrorists are some factors that will provide many opportunities for the growth of the pipeline transportation market.

By service, the maintenance and support service segment accounted for the largest share in 2021 and is expected to support its dominance during the forecast period. The increase in oil spills from subsea pipeline transportation and the leakage of hazardous chemicals during the past few years have increased the demand for maintenance and support-based services in the pipeline transportation market. It also supplies necessary services, repairing the detection equipment and other supporting facilities such as erosion & corrosion of material used in the pipeline are some of the factors driving the growth of the maintenance and support services.

Region-wise, Asia-Pacific accounted for the largest share in the market and is projected to grow at a CAGR of 8.1% during the forecast period. This region accounts for more than 29% of the global pipeline market in 2020. The presence of developing and highly populated countries such as China, and India has increased the demand for various needs, which led to the development of pipeline transportation systems. In this region, China, India, and Indonesia are in the top 20 countries in the world with huge pipeline transportation networks. China has nearly 86,921 Km of pipeline transportation and ranks fourth, while India with 35,676 Km of pipeline length ranks tenth in the world respectively in terms of length of pipeline systems.

Impact of Covid-19 on Global Pipeline Transportation Market

The COVID-19 outbreak negatively affected most of the pipeline transport market's development. The government's efforts to halt the spread of the virus resulted in a global lockdown, resulting in the shutdown of various industries, which resulted in a drop in demand for petroleum and chemical raw materials used to manufacture finished products; the lack of a workforce resulted in the bankruptcy of many manufacturing industries around the world. The COVID-19 pandemic has stimulated the demand for pipeline transportation as they are directly connected to the source of raw materials such as oil fields, refineries, and other chemical plants. Overcoming transportation constraints imposed by the pandemic led to government investment in the deployment of transportation pipelines.

Competitive Landscape

Key players in pipeline transportation industry include Alstom, ABB Ltd., Schneider Electric, Siemens, ESRI, Emerson, Trimble Navigation Limited, Rockwell Automation, FMC Technologies, and Alcatel-Lucent.

Key players are focusing on collaboration and investment to expand their product portfolio and to strengthen their production capacity. For instance, in 2022, Trimble and Exyn Technologies, a pioneer in multi-platform robotic autonomy for complex, GPS-denied environments, announced a strategic collaboration to explore the use of autonomous construction surveying technology. The solution will integrate Boston Dynamics' Spot®robot, the ExynPak™ powered by ExynAI™ and the Trimble® X7 total station. It will enable fully autonomous missions inside complex and dynamic construction environments, which can result in consistent and precise reality capture for production and quality control workflows.

Key players in pipeline transportation are also focusing on launching new products for various applications to attract customers as well as to expand their product portfolio. For instance, in 2021, ABB launched the world’s fastest, most sensitive drone-based gas leak detection and greenhouse gas measuring system. This product is expected to transform the safety and environmental measurement capabilities of operators of millions of kilometers of pipelines traversing the globe.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pipeline transportation market analysis from 2021 to 2031 to identify the prevailing pipeline transportation market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pipeline transportation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pipeline transportation market trends, key players, market segments, application areas, and market growth strategies.

Pipeline transportation Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 37.4 billion |

| Growth Rate | CAGR of 7.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 266 |

| By Type |

|

| By Solution Type |

|

| By Services |

|

| By Region |

|

| Key Market Players | Rockwell Automation, Inc., Emerson Electric Co., Siemens AG, Schneider Electric, ABB Ltd., ESRI, Alcatel-Lucent Enterprise International, Alstom SA, FMC Technologies, Trimble Navigation Limited |

Analyst Review

As per CXO Perspective, the global pipeline transportation is expected to witness increased demand during the forecast period, due to rapid increase in the demand for cost efficient transportation of large quantity of fossil oil & gas and hazardous chemicals across the globe throughout the forecast period. Pipeline transportation is the long-distance transportation of liquid or gas through a system of pipeline to a market area for consumption. Pipelines exist for the transport of crude and refined petroleum, fuels such as oil, natural gas and biofuels. In addition to this, it also includes transportation of other fuels such as sewage, slurry, water, beer, hot water or steam for shorter distances. It is also useful for the transporting water for drinking or irrigation over long distances.

Oil pipelines are generally made from steel or plastic tubes which are usually buried. The oil is moved through the pipelines by pump stations along the pipeline. Natural gas is pressurized into liquids known as Natural Gas Liquids. Natural gas pipelines are made of carbon steel and transmit natural gas, whereas hydrogen pipeline transports hydrogen to various end-use industries through a pipe. Pipeline transportation is one of the safest ways of transporting materials as compared to road or rail. The application of petroleum feedstock in chemical and other sectors led to the demand for cheap transportation solutions. Increase in production of crude oil and application of extracted by-products from this are used in the power plant, while pipelines are used for transportation of the fuels. The increase in offshore oil and gas production and the search of fossil fuel resources led to the demand for cheap subsea transportation resources. Approximately 641 million barrels of oil and 882 billion cubic feet of gas were produced in the Gulf of Mexico in 2020, according to offshore federal production data, which have significant impact on the demand for various service and solutions segments in this market.

The depletion of land-based petroleum resources led to exploration of resources offshore and increase in the chemical manufacturing companies led to increase in demand for transport pipelines for flammable corrosive chemicals, which is a major factor driving the growth of the pipeline transportation market. Oil pipelines are mainly targeted by the military personnel during war times in order to break the energy source of the enemy. Pipelines can be target of vandalism or sabotage and face the challenges in steady and smooth operations with need of constant surveillance and monitoring. Many pipelines across the world carry chemical stable and flammable materials over long distance and have to cross water expansions, terrains and hills which led to an increase in the vandalism and leakage of flammable gas & fuels. The above-mentioned are expected to be the factors hampering the growth of the pipeline transportation market during the forecast period.

Rapid development in detection technologies such as sensors, batch trackers and pipeline management systems as the operator can make right decisions at the right time, as a wrong decision can lead to huge losses. Increase in innovation in the information communication technology to streamline management and improve efficiency in regards with the surveillance and monitoring in order to avoid environmental pollution and dangerous hazards such as gas leakage and others, have a positive impact on the development of the market. The increasing investment of the developing countries toward development of oil & gas, and water transport pipelines in order to reduce GHG emission from the transportation vehicles; in addition to this, increase in chemical manufacturing industries will also provide opportunity for the development of the pipeline transportation market. Moreover, companies are expected to adopt acquisitions, product launches, and business expansion strategies to boost the growth of the pipeline transportation market throughout the forecast period. The future demand for large quantities of petroleum and chemical materials is expected to foster the growth of the pipeline transportation market

Increase in demand for oil & gas and rise in production of offshore resources and demand for cost-efficient transportation system for chemicals and other liquids are the key factors boosting the Pipeline transportation market growth.

Network communication solution is projected to increase the demand for Pipeline transportation Market

Alstom, ABB Ltd., Schneider Electric, Siemens, ESRI, Emerson, Trimble Navigation Limited, Rockwell Automation, FMC Technologies, and Alcatel-Lucent.

The market value of Pipeline transportation in 2031 is expected to be $37.4 billion

The global pipeline transportation market forecast is segmented on the basis of type, solution, service, and region. By type, the market is divided into oil & gas, coal, chemical, water, and others. By solution, it is divided into security solutions, automation and control, integrity and tracking solution, network communication solution, and others. On the basis of service, the market is divided into consulting services, managed services, and maintenance and support. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Emerging technologies to overcome pipeline transportation restraints is the Main Driver of Pipeline transportation Market.

The COVID-19 pandemic has stimulated the demand for pipeline transportation, as they are directly connected from the source of raw materials such as oil fields, refineries and other chemical plants. The government invested in the construction of transportation pipes in order to overcome the transportation constraints brought on by the pandemic outbreak

Loading Table Of Content...