Pipes Market Research: 2032

The Global Pipes Market size was valued at $119.5 billion in 2020, and is projected to reach $209.1 billion by 2032, growing at a CAGR of 4.5% from 2023 to 2032. A pipe is a round cross-sectioned hollow tube used for the conveyance of products such as liquid, gas, and other fluids. Pipes are primarily made of plastic, metal, concrete, and composite materials. Plastic generally consists of Polyvinyl Chloride (PVC), high-density polymer ethene (HDPE), and other composite plastics. However, metal pipes are made using stainless steel, carbon steel, alloy steel, copper, aluminum, and others.

Market Dynamics

The pipes market is primarily driven by various factors such as rise in the number of new residential and commercial buildings, development of water supply pipelines, increase in the number of wastewater treatment facilities, public agriculture irrigation systems, and other infrastructure in developing economies. In addition, rise in the number of industrial facilities including food and beverages, chemical and petrochemicals, pharmaceuticals, and other industrial facilities globally, also positively affects the pipes market growth.

Pipes are critical for supplying anything that can flow including liquid, gas, and amorphous solids. Thus, pipes find their applications in both, industrial and non-industrial sectors. The application in non-industrial sectors includes the use of pipes in supplying wastewater to municipal wastewater treatment plants, public sewage, community water pumps, gas pipelines, pipelines for irrigation, plumbing in homes, HVAC systems in buildings, and various others. For instance, in July 2022, China started a project to upgrade old municipal gas pipelines in Heilongjiang province for higher safety.

Moreover, the ‘Jal Jeewan Mission’ of the government of India aims at providing safe and sufficient drinking water to all households in India by 2024 by spending a total of $7,395 till 2024. Under this program, the government is expected to lay thousands of kilometers of pipelines to each individual house. Similarly, in August 2020, the government of Vietnam unveiled that it would construct the country’s largest wastewater treatment plant in Ho Chi Minh City. This wastewater treatment plant is anticipated to treating 480,000 cubic meters of water/day.

In addition, to address the water shortage problems in many countries, governments of those respective countries are upgrading and expanding their water transportation infrastructure. For instance, the Mexico government has been upgrading its water infrastructure, to bring water from the central part of the country to the parts facing water shortages.

Pipes are used for a variety of purposes such as supplying steam, chemicals, oil & gas, hot or cold process water, and various others, in industrial applications. For instance, the government of India is upgrading and expanding its gas pipeline network across the country, in pursuit to increase the contribution of gas in its total energy production from 6% in the financial year 2019 to 15% in the financial year 2030. Currently, India has a gas pipeline grid of 16,905 km, which needs to be increased to 27,000 km. Moreover, in 2020, the U.S. constructed two major oil pipelines in the country. All such projects that indicate increase in high demand for pipes in the industrial and non-industrial sectors are driving the market growth.

However, the fluctuating cost of raw materials used for manufacturing pipes is expected to restrain the market growth. Even if the manufacturer does not increase the price, it is expected to affect the profitability of the company involved in making pipes and their components.

Moreover, technological development in the pipes industry is a major pipes market opportunity and is expected to provide lucrative opportunities for the key market players. For example, in May 2022, Poppe + Potthoff GmbH, a manufacturer known for producing precision steel tubes, common rails, pipes, precision turned parts, and couplings, introduced a new pipe OD6.35ID4 specifically designed for hydrogen applications at 700 bar pressure. The company utilized alloyed carbon steel in the production of the innovative pipe, incorporating its proprietary annealing treatment process to enhance its mechanical properties. As a result, this pipe surpasses the strength of a conventional steel pipe of the same thickness.

The pipes market witnesses various obstructions in its regular operations due to the COVID-19 pandemic and inflation. Earlier, the global lockdowns resulted in reduced industrial activities, eventually leading to reduced demand for pipes from various sectors such as construction and industrial. However, COVID-19 has subsided, and the major manufacturers in 2023 are performing well. Contrarily, the rise in global inflation is a new major obstructing factor for the entire industry.

The inflation, which is a direct result of the Ukraine-Russia war and few long-term impacts of the coronavirus pandemic, has introduced volatility in the prices of raw materials used for manufacturing pipes. In addition, the cost of oil & gas has also increased substantially, and many countries; especially, the countries in Europe, Latin America, North America, and Sub-Saharan Africa experience severe negative impacts in industrial production, including the production of pipes. However, India and China are performing relatively well. In addition, inflation is expected to worsen in the coming years, as the possibility of the ending of the war between Ukraine and Russia is less. Moreover, the cost of construction has risen substantially, discouraging builders from initiating new projects, which is also expected to negatively affect the pipes market growth. However, with the continued talks between different countries, a peace agreement between Ukraine and Russia can be devised, which is expected to end the war between them and reduce the global inflation.

Segmental Overview

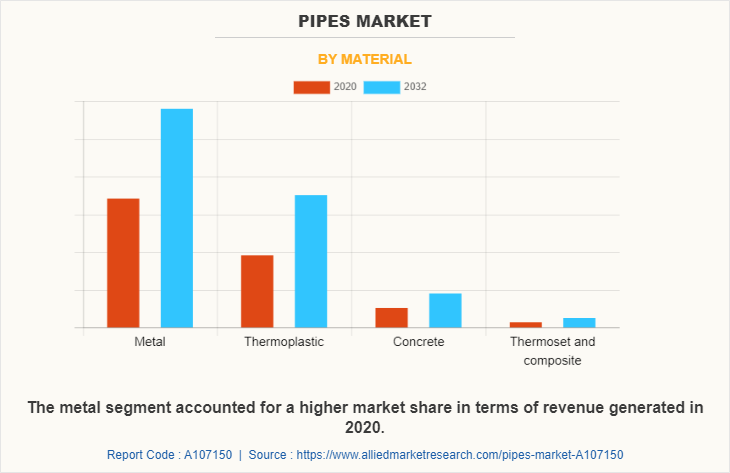

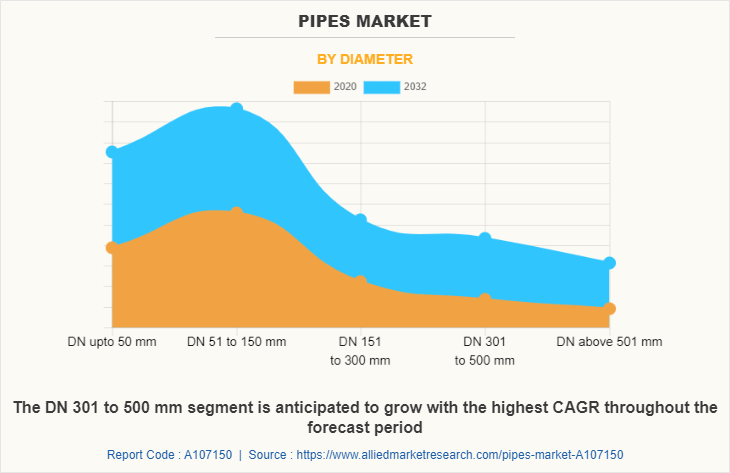

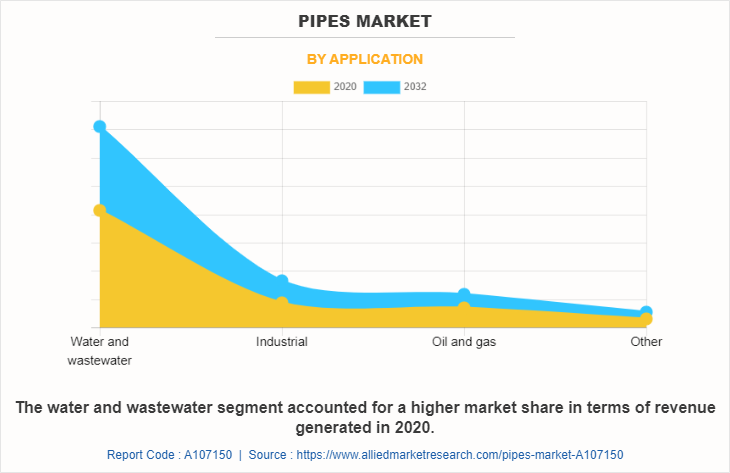

The pipes market is segmented on the basis of material, diameter, application, and region. By material, the market is divided into metal, thermoplastic, concrete, and thermoset & composite. Depending upon the diameter, the market is categorized into DN up to 50 mm, DN 50 to 150 mm, DN 150 to 300 mm, DN 300 to 500 mm, and DN above 500 mm. On the basis of application, it is divided into water & wastewater, industrial, oil & gas, and others. Region-wise, it is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, Italy, UK, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

By Material:

The pipes market is divided into metal, thermoplastic, concrete, and thermoset & composite. In 2022, the metal pipes segment dominated the pipes market share, in terms of revenue, and the thermoplastic pipes segment is expected to witness a higher CAGR during the forecast period. Metal pipes are widely used in industrial, oil & gas, and water & wastewater treatment facilities. The rise in these end-user sectors of pipes drives the growth of this segment. However, the thermoplastic pipes segment is expected to generate higher CAGR.

By Diameter:

The pipes market is divided into DN up to 50 mm, DN 50 to 150 mm, DN 150 to 300 mm, DN 300 to 500 mm, and DN above 500 mm. In 2022, the DN 50 to 150 mm segment dominated the market, in terms of revenue, and the DN 150 to 300 mm segment is expected to dominate the pipes industry by registering a higher CAGR during the forecast period. Pipes of DN 50 to 150 mm are extensively used in domestic, and irrigation as well as industrial applications for the transmission of water, chemicals, steam, air, and others. On the other hand, the high CAGR of the DN 150 to 300 mm segment is attributed to the increasing industrialization, which is a large sector making use of such pipes.

By Application:

The pipes market is divided into water & wastewater, industrial, oil & gas, and others. The water & wastewater segment accounted for the highest market share in 2022, owing to the growing population, which drives the demand for pipes for the transmission of potable and wastewater to and from the communities where the population lives. However, the industrial segment is anticipated to register a higher growth rate during the forecast period, owing to rise in industrialization, especially in the developing nations.

By Region:

Asia-Pacific accounted for the highest market share in 2022 and LAMEA is expected to grow with a highest CAGR during the forecast period. Asia-Pacific is a highly developing region with the fastest growing population. According to the United Nations, nearly two-thirds of the world population resides in Asia-Pacific, with China and India alone accounting for one-third of the global population. In addition, the rate of urbanization in Asia-Pacific is also high. Thus, owing to high population growth and urbanization in the region, the industrial, construction and agriculture sector witness a rapid rise, thereby, demand for pipes, which are extensively used in these sectors is anticipate to rise in the coming years. However, the manufacturing sector in LAMEA has a greater potential for growth, which is anticipated to be a major reason for the rise in demand for pipes. In addition, countries in LAMEA have large concentrations of oil & gas, which are further expected to enhance the growth potential of the pipes market in the region.

Competition Analysis

Competitive analysis and profiles of the major players in the pipes market are provided in the report. Major companies in the report include ASTRAL LIMITED, Prince Pipes And Fittings Ltd., ArcelorMittal, JM EAGLE, INC., Nippon Steel Corporation, Tata Steel Limited, Tenaris SA., United States Steel Corporation, Sumitomo Corporation, and Nucor Corporation (Nucor Tubular Products).

Major players to remain competitive adopt development strategies such as product launches, business expansion, acquisitions, expansion, partnerships, and mergers. For instance, in August 2020, Prince Pipes & Fittings Ltd., a major manufacturer of plastic pipes and fittings, launched ‘Cablefit’, a cable ducting pipe used in electrical applications. Moreover, in August 2021, ArcelorMittal acquired the remaining 66% shares of Condesa Tubos, one of Europe’s leading manufacturers of welded steel tubes and profiles. With this acquisition, Condesa Tubos is expected to be a wholly-owned subsidiary of ArcellorMittal. Furthermore, in October 2023, two U.S.-based wholly-owned pipe manufacturing subsidiaries of Sumitomo Corporation, Premier Pipe LLC and Pyramid Tubular LLC, merged to form a new company.

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging pipes market trends, and historic data.

- In-depth pipes market analysis is conducted by constructing market estimations for key market segments between 2020 and 2032.

- Extensive analysis of the pipes market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The pipes market revenue and volume forecast analysis from 2023 to 2032 is included in the report.

- The key players within the pipes market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the pipes industry.

Pipes Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 209.1 billion |

| Growth Rate | CAGR of 4.5% |

| Forecast period | 2020 - 2032 |

| Report Pages | 190 |

| By Material |

|

| By Diameter |

|

| By Application |

|

| By Region |

|

| Key Market Players | Tenaris S.A., ArcelorMittal, ASTRAL LIMITED, Nippon Steel Corporation, Prince Pipes And Fittings Ltd, JM EAGLE, INC., Nucor Corporation (Nucor Tubular Products), United States Steel Corporation, Tata Steel Limited, Sumitomo Corporation |

Analyst Review

The pipes market has witnessed significant growth in the past few years, owing to increase in construction activities, rise in industrialization, and increase in investments to improve potable water supply infrastructure and wastewater treatment facilities.

Metal, plastic, concrete, and composite types of pipes are available in the market; however, their use is dependent on the type of application and cost. For example, in industrial sectors where the pressure inside the pipes can increase extensively, and the temperature of the fluid can go above 100 degrees Celsius, the use of metal pipes is preferred. However, in domestic applications where the pressure inside the pipes is often near atmospheric pressure, and the temperature does not go over 100 degrees Celsius, plastic pipes such as PVC and HDPE pipes are used. Moreover, about 80% of the plastic pipes market share includes PVC pipes. In addition, the majority share of the market is inclined toward metal pipes; however, the demand for plastic pipes is expected to be higher in the coming years.

The global pipes market is a mix of consolidated as well as fragmented manufacturing. For example, the steel pipes market is consolidated into a few major global players, however, other metal pipes, including the plastic pipes market are relatively fragmented. Furthermore, the demand for composite pipes is anticipated to increase with the introduction of new materials and advancements in pipe manufacturing technologies.

Key factors driving the growth of the pipes market include rise in the number of new buildings, rise in infrastructural development in developing economies, and rise in industrialization in developing economies.

The latest version of the global pipes market report can be obtained on demand from the website.

The global pipes market size was valued at $1,19,528.9 million in 2020.

The global pipes market size is projected to reach $2,09,083.3 million by 2032, registering a CAGR of 4.5% from 2023 to 2032.

The forecast period considered for the global pipes market is 2023 to 2032, wherein, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year. Moreover, historic period will include a duration of 2020-2021

Asia-Pacific is largest regional market for pipes.

ASTRAL LIMITED, Prince Pipes And Fittings Ltd, ArcelorMittal, JM EAGLE, INC., Nippon Steel Corporation, Tata Steel Limited, Tenaris SA., United States Steel Corporation, Sumitomo Corporation, and Nucor Corporation (Nucor Tubular Products).

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...

Loading Research Methodology...