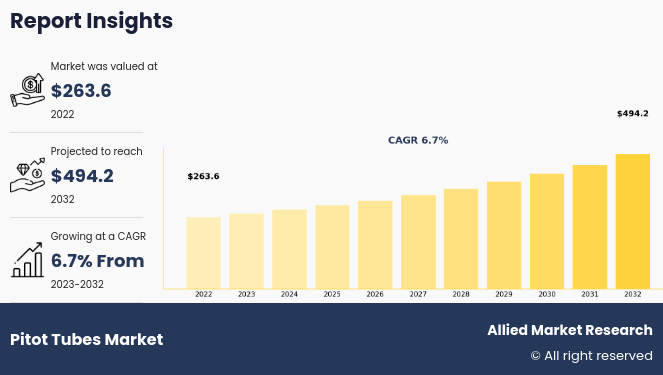

The global pitot tubes market size was valued at $263.6 million in 2022, and is projected to reach $494.2 million by 2032, growing at a CAGR of 6.7% from 2023 to 2032.

Factors such as growth in demand for aircraft globally, regulatory requirements, and growth in military aviation are driving the growth of the pitot tubes market across the globe. Furthermore, an increase in demand for military aircraft and surge in demand in emerging markets are expected to create ample opportunities for the growth of the market during the forecast period.

An aircraft pitot tube is a tool utilized in aviation to measure airspeed, altitude, and other critical parameters associated with the aircraft's flight. It includes a small tube mounted on the exterior of the aircraft, usually on the fuselage or wing. With one end open to the rushing air and the other connected to pressure sensors inside the plane, using the pressure of the air around it to gauge the aircraft's speed and height above ground. This information is crucial for pilots and the aircraft's control systems, ensuring that every flight is not only safe but also smooth and efficient. The pitot tube operates on the principle of air pressure differentials, using the stagnation pressure at the open end of the tube to determine the plane's airspeed and altitude. By correctly measuring those parameters, pitot Tubes offer crucial data for pilots and flight manipulate systems, ensuring sure safe and efficient flight operations.

Key Takeaways

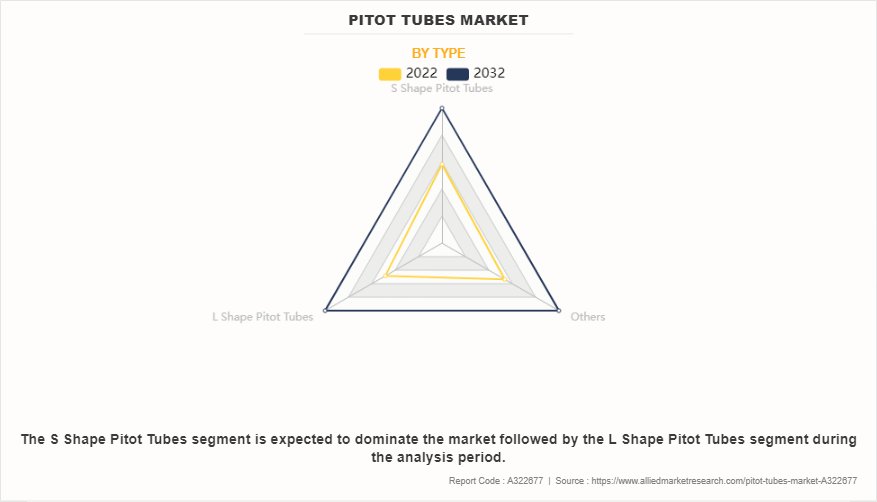

- On the basis of type, the S shape pitot tubes segment held the largest share in the pitot tubes market in 2022.

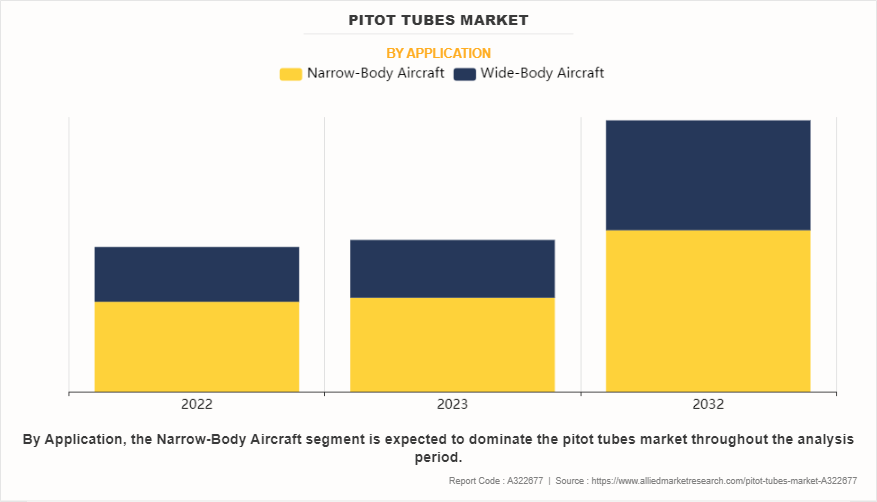

- By application, the narrow-body aircraft segment held the largest share in the market in 2022.

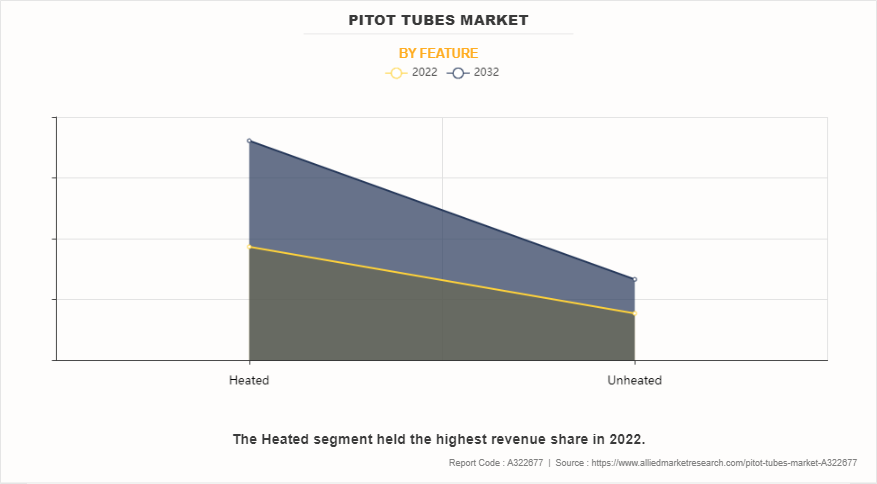

- On the basis of feature, the heated segment held the largest market share in 2022.

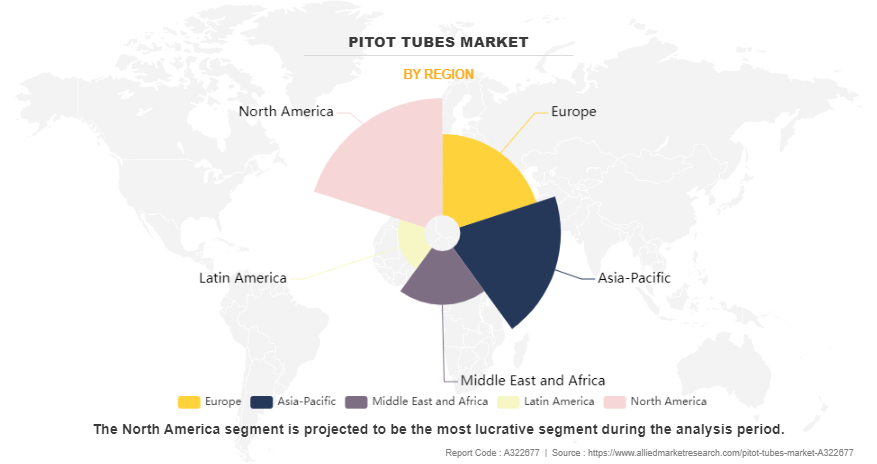

- On the basis of region, North America held the largest market share in 2022.

Pitot Tubes Market in United States

The U.S., being a hub for the aerospace industry, is witnessing a steady increase in the demand for pitot tubes. These devices are crucial for measuring airspeed and altitude, thereby ensuring safe and efficient flight operations. The defense sector in the United States is a significant consumer of pitot tubes for military aircraft and defense applications. With increasing defense budgets and modernization initiatives, there is a growing demand for advanced pitot tube systems with enhanced performance and reliability to meet the stringent requirements of military operations.

Moreover, pitot tube market manufacturers in U.S. have received orders for advanced pitot tubes for airliners. For instance, in February 2022, Collins Aerospace and Hainan Airlines entered into a long-term agreement to enhance the fleet of 500 Airbus A320 and A330 as well as Boeing 737NG aircraft with upgraded pitot and air data sensors. Specifically, the Airbus fleet will be retrofitted with Collins's 0851MC pitot probe, while the 737NGs will receive new Collins air data sensors. These new pitot probes meet the latest FAA and EASA requirements for ice crystal and mixed-phase icing. This enhancement aims to improve aircraft performance in icing conditions, elevate safety standards, and ensure timely and punctual flight operations. Such developments increases pitot tubes market share of the major players.

Moreover, the global pitot tubes market is witnessing several significant trends and factors that are shaping its growth trajectory. One notable trend is the increasing demand for pitot tubes from the commercial aviation sector. As air travel continues to grow globally, airlines are expanding their fleets by acquiring new aircraft, which invariably requires pitot tubes for accurate airspeed measurement. According to the International Civil Aviation Organization’s (ICAO) yearly worldwide statistics, in 2022, there was a substantial rise in the volume of air travelers, estimated at 47% higher than in 2021. This increase is attributed to the swift recovery of numerous international flight routes.

In addition, in 2022, the number of passenger aircraft in operation reflects the broader recovery in air traffic, with current projections indicating that it has reached 75% of pre-pandemic levels. The statistics suggest a rise in air passenger traffic over the years internationally. This rise is expected to result in a tremendous surge in demand for new airplanes globally, which in turn supports the market growth.

Segment Review

The pitot tubes market is segmented on the basis of type, application, feature and region. By type, it is divided into S shape pitot tubes, l shape pitot tubes, and others. By application, the market is classified into narrow-body aircraft, and wide-body aircraft. By feature, the market is classified into heated, and unheated. By region, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

By Type

On the basis of type, the S shape pitot tubes segment generated maximum revenue in 2022, owing to This can be attributed to the growing need from the commercial aviation sector. In addition, these aerodynamically designed pitot tubes are commonly used in commercial aircraft due to their ability to minimize airflow disturbances and provide accurate airspeed measurements. The need for S-shaped pitot tubes is predicted to increase in line with airlines' ongoing fleet expansion and acquisition of new aircraft.

By Application

On the basis of application, the narrow-body aircraft segment generated maximum revenue in 2022, As more narrow-body aircraft are produced and older fleets are updated, there is an increasing need for pitot tubes to outfit these aircraft. Popular commercial aircraft families such as the Boeing 737 and Airbus A320 are included in this segment. An increase in orders for narrow-body aircraft has been reported from airlines globally due to the growing demand for air travel and the need for fuel-efficient and cost-effective operations. As new narrow-body aircraft are built and existing fleets are upgraded, the demand for pitot tubes to equip these aircraft increases.

By Feature

On the basis of feature, the heated segment was the highest revenue contributor to the market in 2022, owing to commercial and military aircraft operators are actively looking for heated pitot tube solutions in order to ensure reliable and safe operations in a range of weather scenarios. The market for heated pitot tubes has expanded as a result of strict rules and regulations being implemented by aviation authorities globally.

By Region

Based on region, North America dominated the pitot tubes market in 2022. The demand for pitot tubes in this region is driven by the existence of significant aircraft manufacturers such as Boeing and Bombardier, as well as a thriving commercial and military aviation industry. The need for innovative and reliable pitot tube solutions is also fueled by North America's strict regulatory framework and emphasis on safety.

Competitive Analysis

Some of the major companies that operate in the global pitot tubes market are Dynon Avionics, Air Power Inc., Honeywell International, Rockwell Collins, Thales Group, Aeroprobe Corporation, Tokyo Aircraft Instrument (TKK), Garmin International Inc., Aerosonic, LLC, and Aerocontrolex Group.

Market Dynamics

Growing Demand for Aircraft Globally

With a rise in global demand for air travel, airlines are driven to augment their fleets to meet the growing needs of passengers. This results in an increased necessity for new aircraft, consequently fueling the demand for advanced aerostructures. For instance, in 2022, Airbus witnessed a significant increase in its commercial aircraft deliveries, providing 661 aircraft to 84 customers. This marked an 8% increase compared to the previous year. In addition, the company reported 820 net new orders, surpassing the 2019 figure of 768. By the end of 2022, Airbus had 7,239 aircraft in its backlog, which was the highest number since 2019. Economic expansion in diverse regions correlates with a surge in disposable income and heightened business activities.

Pitot tubes market research factors coupled with improved accessibility to air travel, trigger an increased demand for air transportation services. In response, airlines expand their fleets, creating a direct need for pitot tubes to facilitate the production of new aircraft.

Moreover, in 2023, ADS Group, a UK based trade association delivered 1,265 new aircraft, representing an 11% increase from 2022. At current production rates and aircraft prices, the backlog is estimated to be worth approximately $312.80 billion (£244 billion) to the UK, and it amounts to nearly thirteen years' worth of work. It is essential that the pitot tube producers effectively incorporate the anticipated surges in output during the forthcoming months. Furthermore, policies such as incentives, regulatory frameworks, or subsidies that push airlines to buy newer, more efficient aircraft also play a big role in the continuous increase in aircraft production, which in turn increases the demand for pitot tubes.

Regulatory Requirements

Aviation authorities and governing bodies impose strict regulations regarding aircraft safety and performance. These regulations mandate the installation and maintenance of Pitot tubes for airspeed measurement, altitude calculation, and other critical flight parameters. Compliance with these regulations is essential for aircraft manufacturers and operators to ensure the safety and reliability of aircraft operations. Furthermore, there are various standards set for pitot tube probes such as TSO C-16, DOD MIL-T-5421B, BS2G.135, SAE AS393, TSO C-16B, and AN5813.

In the aerospace industry, various regulatory bodies, such as the Federal Aviation Administration (FAA) in the U.S. and the European Union Aviation Safety Agency (EASA) in Europe, establish stringent guidelines and standards to ensure the safety and reliability of aircraft operations. For instance, in June 2021, the European Union Aviation Safety Agency (EASA) strengthened its warning regarding pitot tubes for aircraft being reintroduced into service. A new airworthiness directive advises airlines to thoroughly inspect external air data probes due to instances of speed discrepancies in flightdeck instruments, possibly caused by blocked sensors, following prolonged pandemic storage. As a result, the demand for pitot tubes is driven by the need to meet regulatory standards and obtain certifications, creating a steady market demand for these essential components in the aerospace industry. These regulations mandate the use of pitot tubes for measuring airspeed, altitude, and other vital flight parameters.

Overall, regulatory requirements serve as a primary driver for the pitot tubes market by ensuring the continued demand for these essential components in the aerospace industry and stimulating innovation to meet evolving safety standards and regulatory expectations.

Competition from Alternative Technologies

Pitot tubes are susceptible to various environmental factors, such as icing, debris accumulation, or mechanical wear, which can degrade their performance over time. As advancements in aerospace technology continue, alternative methods for measuring airspeed, altitude, and other flight parameters emerge, challenging the dominance of traditional pitot tube systems. These alternative technologies may include newer sensor-based systems, laser-based systems, or other innovative approaches that offer comparable or enhanced performance compared to traditional Pitot tubes.

The emergence of these alternative technologies intensifies competition within the market as manufacturers vie for market share and customer adoption. Aircraft manufacturers and operators may increasingly consider these alternative solutions as viable alternatives to traditional Pitot tubes, particularly if they offer advantages such as improved accuracy, reliability, or cost-effectiveness. To remain competitive amid the rise of alternative technologies, pitot tube manufacturers must innovate and differentiate their products to address evolving customer needs and preferences.

Limited Number of Applications

The limited range of applications acts as a restraint on the pitot tubes industry, hampering its growth potential within the aerospace industry. Pitot tubes are mostly utilized in a plane to measure airspeed, altitude, and other essential flight parameters, making them crucial components for aviation protection and overall performance tracking. However, their application scope is confined to aerospace and aviation contexts, limiting their usage beyond those specific industries.

Unlike versatile technology or components with wide applicability throughout diverse sectors, pitot tubes are tailor-made particularly for aviation functions, catering completely to aircraft manufacturers, operators, and maintenance companies. This narrow scope limits the market's growth potential because pitot tube manufacturers heavily depend on aerospace industry demand to maintain their businesses.

Owing to its narrow range of applications, the market for pitot tubes is vulnerable to changes in the aerospace industry, which can have an impact on consumer demand and technological advancements. Pitot tube demand can be directly impacted by economic downturns, changes in customer preferences, or modifications to aviation regulations, creating challenging conditions for market expansion and profitability.

Increase in Demand for Military Aircraft

Military aircraft play a crucial role in national defense, security operations, and combat missions, necessitating advanced instrumentation and air data measurement systems for optimal performance and safety.

As defense budgets increase and geopolitical tensions escalate, governments worldwide are investing heavily in the modernization and expansion of their military fleets, leading to a surge in demand for new military aircraft and upgrades to existing platforms. Moreover, the U.S. President Joe Biden enacted the 2023 fiscal year National Defense Authorization Act, granting the Department of Defense $816.7 billion in funding. Moreover, European Union member states are increasing military budgets substantially, with spending that reached approximately $295 billion in 2023 as the alliance mobilizes support for Ukraine against Russia's invasion. In addition, the Russian government stated its intention to significantly hike defense allocation by 68% for 2024. This heightened demand encompasses a wide range of military aircraft types, including fighter jets, transport aircraft, reconnaissance drones, and helicopters, among others.

Pitot tubes are essential components integrated into military plane systems to degree essential flight parameters consisting of airspeed, altitude, and angle of attack, supplying pilots with real-time statistics for navigation, maneuvering, and tactical decision-making. With the growing complexity and class of modern military planes, there may be a corresponding need for advanced pitot tube technology to assemble stringent performance necessities and working in hard environments. Pitot tube producers can grow their marketplace presence and increase sales in the aerospace zone. They can obtain this by assembly fulfilling defense requirements, tapping into the rising demand for army aircraft, and securing contracts via strategic product development efforts. Therfore, increase in demand for military aircraft further support the growth of the pitot tubes industry.

Surge in Demand in Emerging Markets

The surge in demand for pitot tubes from emerging markets presents a significant growth opportunity for manufacturers in this industry. Many developing economies, such as China, India, and countries in Southeast Asia, are witnessing a rapid expansion of their aviation sectors. This growth is driven by factors such as rise in incomes, urbanization, and increase in air travel demand.

Boeing, a major aircraft manufacturer, predicts a demand for 42,600 new commercial aircraft in the coming two decades. It anticipates that over 40% of this global demand will stem from Asia-Pacific markets, with China alone accounting for half of that. Furthermore, the fleet in South Asia is expected to witness growth by over 7% each year, marking the fastest rate globally, and India is projected to contribute over 90% of the passenger traffic in this region.

Furthermore, many emerging nations are modernizing their military forces, including their air force assets. For instance, in February 2023, India proposed a defense budget of $72.6 billion (5.94 trillion rupees) for 2023-24, up 13% from the previous period, aiming to bolster its fighter jet fleet and border infrastructure vis-a-vis China. Pitot tube producers will be well-positioned to benefit from the surge in demand since they can provide affordable, dependable, and high-quality products that fulfill the stringent demands of both commercial and military aviation programs in these emerging markets.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pitot tubes market analysis from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pitot tubes market trends, key players, market segments, application areas, and market growth strategies.

Pitot Tubes Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 494.2 million |

| Growth Rate | CAGR of 6.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 350 |

| By Type |

|

| By Application |

|

| By Feature |

|

| Key Market Players | TOKYO AIRCRAFT INSTRUMENT CO., LTD., Collins Aerospace, Aeroprobe corporation, Air Power Inc., AeroControlex Group, Inc., Thales Group, aerosonic, llc, Honeywell International Inc., United Sensor Corp., Dynon Avionics, Inc. |

The global pitot tubes market was valued at $263.6 million in 2022, and is projected to reach $494.2 million by 2032, growing at a CAGR of 6.7% from 2023 to 2032.

Dynon Avionics, Air Power Inc., Honeywell International, Rockwell Collins, Thales Group, Aeroprobe Corporation, Tokyo Aircraft Instrument (TKK), Garmin International Inc., Aerosonic, LLC, and Aerocontrolex Group.

Largest regional market for Pitot Tubes is North America.

Leading application of Pitot Tubes Market is narrow-body aircraft.

Upcoming trends of Pitot Tubes Market are an increase in demand for military aircraft and surge in demand in emerging markets.

Loading Table Of Content...

Loading Research Methodology...