Plastic Compounding Market Size & Insights:

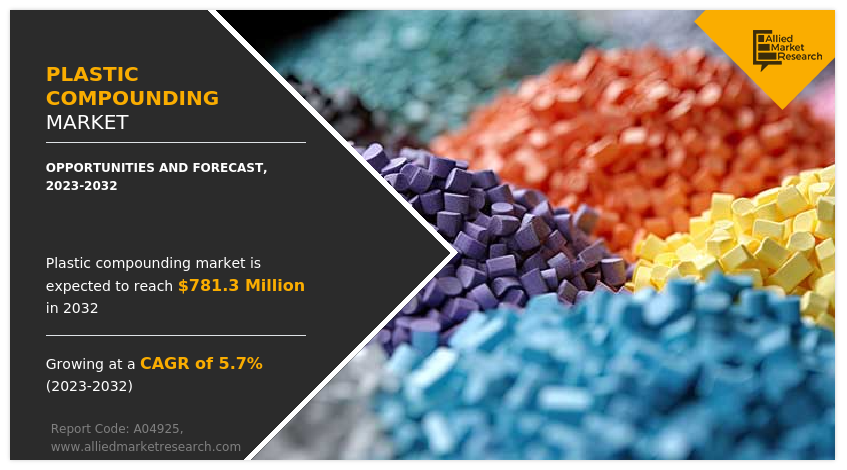

The global plastic compounding market size was valued at $448.3 million in 2022, and is projected to reach $781.3 million by 2032, growing at a CAGR of 5.7% from 2023 to 2032. The increasing demand for lightweight materials in the automotive industry, driven by the need for improved fuel efficiency and reduced carbon emissions, is significantly boosting the Plastic Compounding Market. Lightweight plastics, such as those used in automotive components, offer enhanced performance while reducing vehicle weight. As a result, there is drive the demand for plastic compounding market in forecast period.

Introduction

Plastic compounding is the process of blending and mixing various raw materials, such as resins, fillers, additives, and colorants, to create a plastic material with specific properties and characteristics. This technique allows manufacturers to modify the performance, durability, and aesthetic qualities of plastics to meet the requirements of diverse applications. The compounding process typically involves the use of extruders or mixers, where the materials are heated, melted, and combined to form a homogeneous mixture. Once the desired formulation is achieved, the compounded plastic is cooled, solidified, and then pelletized for further use in production.

Report Key Highlighters:

The plastic compounding market is fragmented in nature with few players such as Asahi Kasei Corporation, BASF SE, Celanese Corporation, Covestro AG, DowDuPont Inc., Kingfa Sci. and Tech. Co., Ltd., LyondellBasell Industries Holdings B.V., Polyone Corporation, SABIC, and Solvay SA., which hold a significant share of the market.

The report provides complete analysis of the market status across key regions and more than 15 countries across the globe in terms of value ($ Million).

Top winning strategies are analyzed by performing a thorough study of the leading players in the plastic compounding market. Comprehensive analysis of recent developments and growth curves of various companies helps us to understand the growth strategies adopted by them and their potential effect on the market.

The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

Market Dynamics

Plastic compounding is a process in the plastics industry where various ingredients and additives are combined to create a customized plastic material with specific properties. This process involves blending a polymer compounds (such as polyethylene, polypropylene, and PVC) with various additives, fillers, reinforcements, and colorants to achieve the desired characteristics, such as strength, flexibility, flame resistance, UV resistance, color, and more.

Plastic compounds are widely used in the electronic and electrical industries for electromagnetic shielding and antistatic applications. In addition, they are replacing metal components in the automotive industry. This has helped in increasing car safety by reducing the total weight of the vehicle. Plastic compounding has also lowered carbon emissions and increased fuel efficiency and performance of vehicles in the automotive industry which in turn boosts the growth of plastic compounding market.

However, volatility in plastic resin prices is a significant restraint that hampers the growth of the Plastic Compounding Market. The cost of raw materials, particularly plastic resins, can fluctuate due to various factors such as changes in oil prices, supply-demand imbalances, and geopolitical events. Since resins are a primary component in the plastic compounding process, price fluctuations can directly affect the overall cost of production for compounded plastics. This unpredictability makes it challenging for manufacturers to plan and budget effectively, which may lead to increased production costs or reduced profit margins. All these factors hamper the growth of the plastic compounding market.

Rapid industrialization and increase in disposable income of individuals across the emerging economies such as India and China, have fueled the demand for automobiles. Rise in production of light weight vehicles and increase in demand for electric vehicles are some of the major drivers of this market. Asia-Pacific is the leading manufacturer of electronic and electrical devices.

Over the past few years, there has been an increase in demand for electronic and electrical devices across the region owing to R&D and technological advancements in the electrical & electronic industry. Many leading electronic component manufacturers have set up plants in India, China, Indonesia, and South Korea. This is expected to drive the growth of the plastic compounding market.

Segment Overview:

The plastic compounding market is segmented on the basis of polymer type, end use, and region. On the basis of type, the market is categorized polypropylene (PP), polyethylene (PE), polyvinyl chloride (PVC), polystyrene (PS) and expanded polystyrene (EPS), polyethylene terephthalate (PET), polyurethane (PU), acrylonitrile butadiene styrene (ABS), and other polymers. On the basis of end use industry, it is divided into automotive, building & construction, packaging, electrical & electronics, medical, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

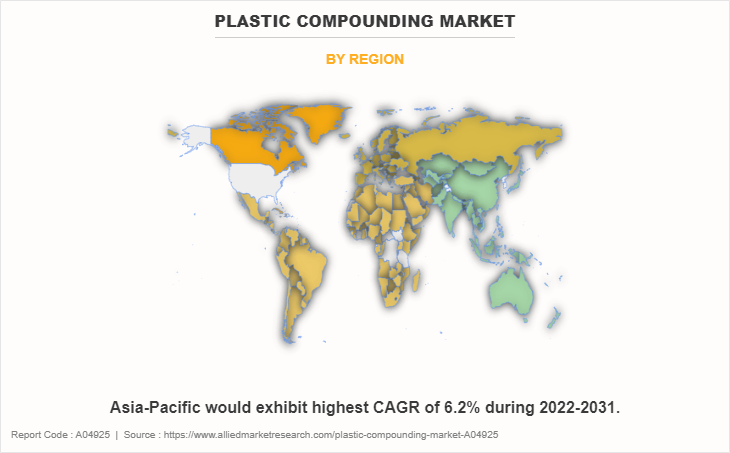

Plastic Compounding Market By Region

The Asia-Pacific plastic compounding market size is projected to grow at the highest CAGR of 5.7% during the forecast period and account for 46% of Plastic compounding market share in 2022. In China, plastic process sector is growing rapidly, which in turn has enhanced the performance of the plastic compounds market in the region. According to an article published by Earth organization in March 2022, China alone produced 60 million tons of plastic in 2020.

Moreover, countries such as India and Australia have witnessed a rapid increase in automotive sectors where plastic compounds are used to make auto components, such as instrumental panels, glass interlayer, interior trim, and door handles. For instance, according to a report published by the Indian Ministry of Commerce and Industry, the transportation sector in India is expected to grow at a compound annual rate (CAGR) of 5.9%, owing to the development of highways, widespread railway networks, aviation ports, and waterways structure. Furthermore, well-established chemical industries in India, Japan, South Korea, and other Asia-Pacific region have enhanced the production capacities for plastic compounds.

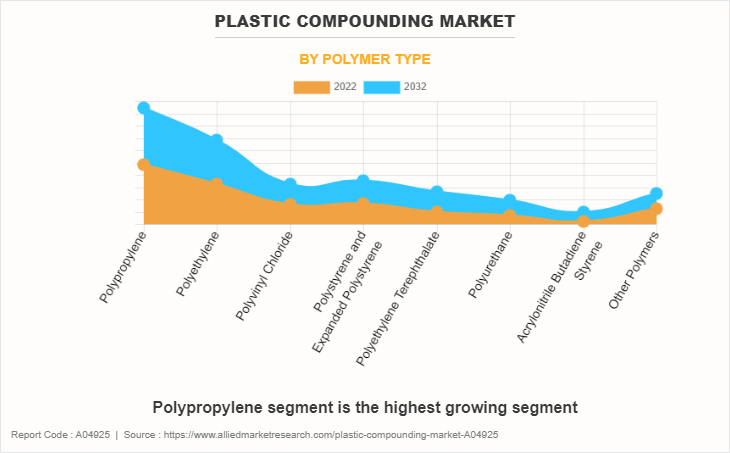

Plastic Compounding Market By Polymer Type

By polymer type, the polypropylene segment dominated the global market in 2022, and is anticipated to grow at a CAGR of 6.0% during forecast period. The growing automotive sector attributed to increasing purchasing power of customers has surged the popularity of polypropylene based plastic compounds, where it is widely used for manufacturing of automobile components such as, automotive bumpers, bumper facias, instrumental panels, door trims, and wheel covers. This factor is expected to boost the demand for polypropylene-based plastic compounds in the increasing automotive industry; thus, fueling the market growth.

Furthermore, well established industrial sectors in both developed and developing economies have enhanced the demand for polypropylene based compounds where it is used for making plastic-based machinery, equipment, and other industrial equipment.

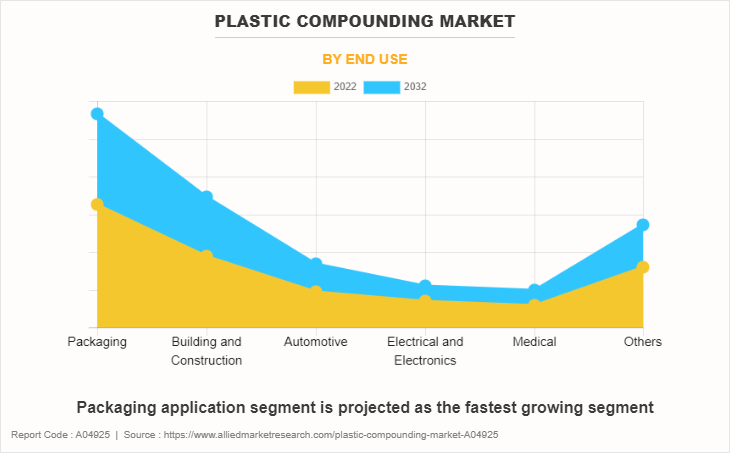

Plastic Compounding Market By End Use Industry

In 2022, the packaging segment was the largest revenue generator, and is anticipated to grow at a CAGR of 5.7% during the forecast period. The packaging industry is one of the booming sectors across the globe owing to rise in disposable income, busy schedule of people, and rise in consumption of packaged food has bolstered the plastic compounds market.

For instance, according to an article published by Indian Brand Equity Foundation in March 2021, the Indian packaged industry is expected to double in the next 5-10 years. Plastic compounds are extensively used in making plastic containers, jars, bottles, and other products. This acts as a one of the key drivers responsible for the growth of plastic compounds market in upcoming years.

Competitive Analysis:

The global plastic compounding market profiles leading players that include Asahi Kasei Corporation, BASF SE, Celanese Corporation, Covestro AG, DowDuPont Inc., Kingfa Sci. and Tech. Co., Ltd., LyondellBasell Industries Holdings B.V., Polyone Corporation, SABIC, and Solvay SA. Other players operating in this market include Mexichem Specialty Compounds Inc., Coperion GmbH, Adell Plastics, Inc, Sojitz Corporation, and Polyvisions Inc. The global Plastic compounding market report provides in-depth competitive analysis as well as profiles of these major players.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the plastic compounding market analysis from 2022 to 2032 to identify the prevailing plastic compounding market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the plastic compounding market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global plastic compounding market trends, key players, market segments, application areas, and market growth strategies.

Plastic Compounding Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 781.3 million |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 353 |

| By Polymer Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Kingfa Science & Technology (India) Limited, LyondellBasell Industries Holdings B.V., SABIC, Avient Corporation., Covestro AG., Celanese Corporation, Asahi Kasei Corporation, Solvay, BASF SE, DuPont |

Analyst Review

According to CXOs of leading companies, the global Plastic compounding market is expected to exhibit high growth potential. Plastic compounds are used in various end use industries such as, building and construction, automotive, medical, textile, packaging, and others. Plastic compounds possess mechanical, chemical, and physical properties. It is resistant to high heat, good source of electric conductivity owing to which it is widely used in high performance applications. Polyethylene and polypropylene-based plastic compounds are used in making pipes, door panels, window profile, and others. Changing consumers preferences for packaged foods and canned goods has enhanced the performance of plastic compounds. It is mainly used to make plastic containers, bottles, jars, trays, plates, and others. In addition, high production, and consumption rate of plastic compounds in countries such as the U.S., China, India, and others is expected to boost the market. Furthermore, factors such as flexibility in operation, ease of application, and cost-effective properties of plastics will enhance performance of plastic compounds in several end-use industries. CXOs further added that sustained economic growth and development of the building & construction sector have increased the popularity of plastic compounds.

Plastic compounding is a process of transforming the characteristics of basic plastics and thermoplastics using a mixture of plastics and additives. Plastic compounds have superior physical properties such as wide range of conductivity, flame retardancy, wear resistance, and are light weight. These properties increase their demand in various automotive, building and construction, packaging and electrical & electronics and thus boosting the growth of the global plastic compounding market.

Research and development efforts focused on developing advanced compounds with superior performance characteristics. Nanotechnology, polymer blends, and functional additives were being used to achieve desired properties.

Asahi Kasei Corporation, BASF SE, Celanese Corporation, Covestro AG, DowDuPont Inc., Kingfa Sci. and Tech. Co., Ltd., LyondellBasell Industries Holdings B.V., Polyone Corporation, SABIC, and Solvay SA

Packaging is the leading application of plastic compounding market.

Asia-Pacific is the largest regional market for plastic compounding.

The plastic compounding market is segmented on the basis of polymer type, end use, and region. By polymer type, it is categorized into polypropylene (PP), polyethylene (PE), polyvinyl chloride (PVC), polystyrene (PS) and expanded polystyrene (EPS), polyethylene terephthalate (PET), polyurethane (PU), acrylonitrile butadiene styrene (ABS), and other polymers. On the basis of end use industry, it is divided into automotive, building & construction, packaging, electrical & electronics, medical, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The global plastic compounding market was valued at $448.3 million in 2022, and is projected to reach $781.3 million by 2032, growing at a CAGR of 5.7% from 2023 to 2032.

Loading Table Of Content...

Loading Research Methodology...