Plastic Door And Window Market Research, 2032

The Global Plastic Door and Window Market size was valued at USD 65.5 billion in 2022, and is projected to reach USD 113.3 billion by 2032, growing at a CAGR of 5.5% from 2023 to 2032.

Plastic door and window market is primarily made of uPVC owing to its high energy performance, cheaper price, and durability. A plastic door is a flat movable panel, installed at the doorway between the two spaces of a building. The primary purpose of a door is to control the excess of room or some other space from other places. Moreover, a plastic window is an opening in a wall of a building, consisting of single-, double-, and multi-panel made of plastic. Common types of plastic windows available in the market are sliding, casement, tilt and turn, bay window, fixed, and others.

Plastic Door And Window Market Dynamics

The Plastic Door and Window Market is largely driven by factors such as a rise in the number of new residential and commercial buildings, increasing investments in home and building improvements, repair and renovation, and also due to various advantageous factors associated with the door and windows made with plastic. The presence of a substantial population within any nation gives rise to a range of challenges for its authorities, encompassing issues like resource depletion, job scarcity, and numerous others. Among these challenges, one of the most prominent is the swift urbanization that places strain on existing urban infrastructure, notably in the spaces of residential and commercial construction. Consequently, both government bodies and private enterprises allocate substantial resources to the development of new, cost-effective, and high-end structures, particularly apartment complexes, individual residences, and commercial edifices. This, in turn, propels the plastic door and windows market

The world population is also expected to increase to9.7 billion by 2050, from 8 billion in 2022. Thus, around the world, a sharp rise in the building construction sector can be seen to accommodate the increasing population. For example, in October 2021, the Dubai and Indian governments agreed to develop infrastructures such as industrial parks, multipurpose towers, logistics centers, a medical college, and a specialized hospital in the state of Jammu & Kashmir, India. Moreover, the government of Indonesia has planned to shift its capital from Jakarta to Nusantra, where a number of new buildings will be constructed. Moreover, according to Stastista, the size of the construction market amounted to $6.4 trillion in 2020, and it is expected to reach $14.4 trillion in 2030.

Such factors are propelling the demand for plastic doors and windows market. Moreover, plastic doors and windows hold various advantages over aluminum and wood. Plastic doors and windows require minimal maintenance. Plastic doors and windows require minimal maintenance. They do not need painting, staining, or sealing like wood, and they are resistant to rot, corrosion, and pests. Unlike aluminum, uPVC frames do not corrode, which is particularly advantageous in coastal areas or regions with high humidity. Plastic frames are resistant to UV radiation, so they don't fade or degrade when exposed to sunlight over time. In addition, plastic door and window market are more energy efficient as uPVC frames often come with built-in thermal insulation properties.

Moreover, modern plastic doors and windows often come with advanced locking systems, enhancing security for your home. Plastic frames are typically lightweight, which can make the installation process easier and more cost-effective. Such advantages of plastic doors and windows are driving the plastic door and window market growth.

However, the fluctuating cost of raw materials used for manufacturing plastic doors and windows is expected to restrain the market growth. The price of crude oil rose to 72.7% in 2021, contributing to an uptick of plastic prices by 33.4% in 2021. Even if the manufacturer does not increase the price, it is expected to affect the profitability of the company involved in making plastic door and window and their components.

Moreover, the growing demand for sustainable products in all industrial sectors including the construction sector is a major plastic door and window market opportunity. uPVC especially is a sustainable material, as it has high strength and lightweight thermoplastic polymer structure allowing it to be melted, reformed, and repurposed up to ten times with no loss of quality or performance. Moreover, uPVC has become an ideal material for manufacturing doors and windows and has replaced timber all across the world. The use of uPVC eliminates dependence on wood which, in turn, helps in forest conservation. This positively affect the plastic door and window market overview.

The plastic door and window market witnessed various obstructions in its regular operations due to the COVID-19 pandemic and economic slowdown. Earlier, the global lockdowns resulted in reduced construction activities, eventually leading to reduced demand for plastic doors and windows. However, COVID-19 has subsided, and the major manufacturers in 2023 are performing well. Contrarily, the rise in the global economic slowdown is a new major obstructing factor for the entire industry. The inflation, which is a direct result of the Ukraine-Russia war and few long-term impacts of the coronavirus pandemic, has introduced volatility in the prices of raw materials used for manufacturing plastic doors and windows.

The ongoing Ukraine-Russia conflict has introduced considerable volatility into oil and gas prices, directly influencing the costs of plastic production. Crude oil, a significant raw material used in the production of plastic. Furthermore, the expenses associated with oil and gas have seen substantial increases, particularly affecting countries in Europe, Latin America, North America, and Sub-Saharan Africa, with adverse repercussions on industrial production, including the manufacturing of plastic doors and windows. Moreover, widespread inflation experienced by many nations has led to a decline in the purchasing power of their citizens, resulting in reduced expenditure within the construction sector. Nevertheless, the construction industries in India and China are displaying relatively robust performance, contributing to heightened demand for plastic doors and windows.

Segmental Overview

The plastic door and window market is segmented on the basis of type, installation type, application, and region. By type, the market is divided into door and window. Depending upon the installation type, the market is categorized into new construction and replacement. On the basis of application, it is divided into residential and non-residential. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

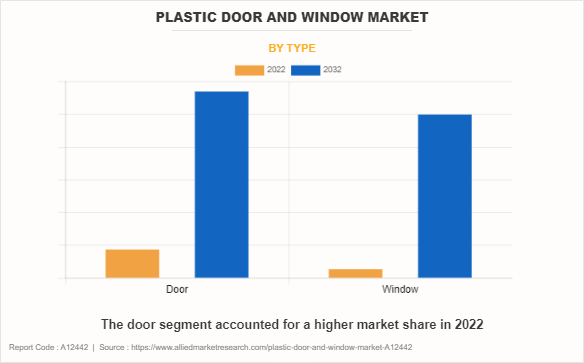

By Type:

The plastic door and window market is divided into door and window. The door segment is further fragmented into sliding doors, slide and folding doors, casement doors, and others. Similarly, the window segment is further categorized into slide, casement, tilt and turn, bay, fixed, and others. In 2022, the door segment dominated the plastic door and window market share, in terms of revenue, and the window segment is expected to grow with a higher CAGR during the forecast period. The rising number of households as a result of an increasing population, and the rising trend of living in nuclear families in developing countries is a major driving factor growth of both the segments. In addition, the rising construction of non-residential buildings is witnessing a boom, which is also positively affecting the market.

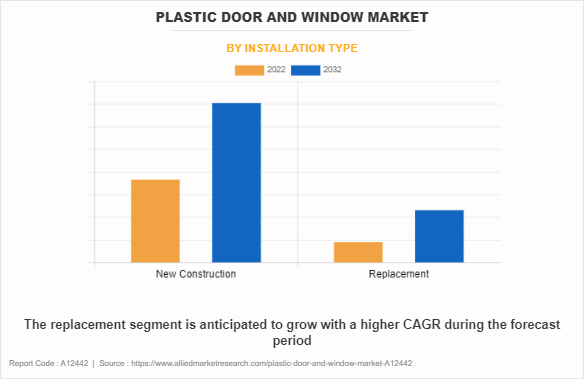

By Installation Type:

The plastic door and window market is divided into new construction and replacement. In 2022, the new construction segment dominated the market, in terms of revenue, and the replacement segment is expected to dominate plastic door and window market forecast by growing with a higher CAGR. The growth of the new construction segment is directly associated with the growth in building construction which is eventually driven by rising urbanization and population. However, the high CAGR of the replacement segment is due to the fact that homeowners are gradually increasing the money they spend on home renovation due to an increase in disposable income. In addition to this, governments of their respective countries are offering financial incentives to homeowners who renovate their homes with energy-efficient and sustainable building components.

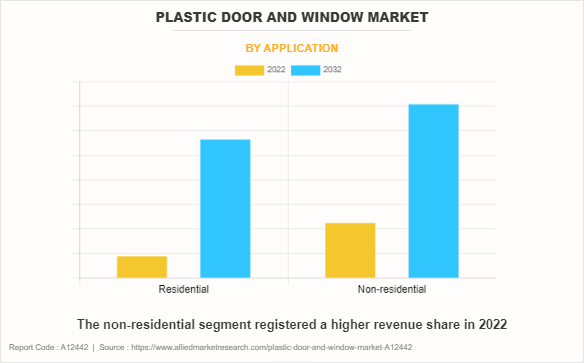

By Application:

The plastic door and window market is divided into residential and non-residential. The non-residential segment accounted for the highest market share in 2022, owing to the high cost of commercial plastic doors and windows and also due to increased demand for commercial buildings driven by rising urbanization. However, the general public is realizing the benefits of plastic doors and windows, which is a reason for the high growth rate of the residential segment.

By Region:

In 2022, the Asia-Pacific region dominated the market share, it is also anticipated to experience the most significant compound annual growth rate (CAGR) during the forecast period. Asia-Pacific is a dynamic region characterized by rapid population growth. According to the United Nations, approximately two-thirds of the global population resides in Asia-Pacific, with China and India alone constituting one-third of the world's population. Furthermore, urbanization rates in Asia-Pacific are notably high. Consequently, the construction industry in the region is experiencing a swift expansion, leading to an increased demand for plastic doors and windows. In addition, it is worth noting that the plastic door and window market in India is expected to grow by nearly 25% in the next decade. However, the construction sector in LAMEA has a greater potential for growth, which is anticipated to be a major reason for the rise in demand for plastic doors and windows.

Competition Analysis

Competitive analysis and profiles of the major players in the plastic door and window market are provided in the report. Major companies in the report include YKK Corporation aluplast GmbH, Aparna Enterprises Ltd., Cornerstone Building Brands, Inc. (Atrium Corporation), DCM Shreeram Limited, Duroplast Extrusions Private Limited, Hurst Plastics Limited, JELD-WEN Holding, Inc., MI Windows and Doors, LLC., and Prominance Window Systems. Major players to remain competitive adopt development strategies such as product launches, and business expansion. For instance, in July 2022, Deceuninck, which offers profiles for UPVC windows and doors, launched ‘The Slim Slide Door’ for the Indian market. The company claims that this offering will suit every space with its multiple solid & wooden finishes available alongside excellent thermal & sound insulation.

Key Benefits for Stakeholders

The report provides an extensive analysis of the current and emerging plastic door and window market trends.

In-depth plastic door and window market analysis is conducted by constructing market estimations for key market segments between 2022 and 2032.

Extensive analysis of the plastic door and window market is conducted by following key product positioning and monitoring of top competitors within the market framework.

A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

The plastic door and window market revenue and volume forecast analysis from 2023 to 2032 is included in the report.

The key players within the plastic door and window market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the plastic door and window industry.

Plastic Door and Window Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 113.3 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 235 |

| By Type |

|

| By Installation Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Hurst Plastics Limited, JELD-WEN Holding, Inc., Aluplast GmbH, DCM Shreeram Limited, MI Windows and Doors, LLC., Duroplast Extrusions Private Limited, Aparna Enterprises Ltd., YKK Corporation, Prominance Window Systems, Cornerstone Building Brands, Inc. (Atrium Corporation) |

Analyst Review

The plastic door and window market has witnessed significant growth in the past few years owing to an increase in construction activities, rise in industrialization, and an upsurge in investments in home & building improvements.

Plastic has become a primary choice for doors and windows owing to its high sustainability. In addition, the plastic door and window market has occupied a majority share of Europe’s and North America's doors and windows market. In addition, countries such as the UK, Canada, the U.S., and other developed countries have set strict and ambitious targets to achieve carbon neutrality by 2030. Such targets are projected to help the plastic door and windows market grow, and also significantly drive the replacement segment of the market. On the other hand, in developing countries such as India, China, Indonesia, South Africa, and others, the penetration of plastic in door and window market is still not at par with the developed countries; however, the potential for growth of plastic door and window market in these countries is immense.

The global plastic door and window market is a mix of consolidated as well as fragmented manufacturing. In developing countries, the market is mostly dominated by small manufacturers. In India, more than 60% of plastic door manufacturing is fragmented, making the market highly competitive.

Key factors driving the growth of the plastic door and window market include increase in building renovation and improvement activities, increasing demand for buildings, and benefits of plastic doors and windows.

The latest version of the global plastic door and window market report can be obtained on demand from the website.

The global plastic door and window market size was valued at $65,518.1 million in 2022.

The global plastic door and window market size is estimated to reach $1,13,318.8 million by 2032, registering a CAGR of 5.5% from 2023 to 2032.

The forecast period considered for the global plastic door and window market is 2023 to 2032, wherein, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year.

Asia-Pacific is the largest regional market for plastic door and window market.

Key companies profiled in the tire recycling market report include YKK Corporation aluplast GmbH, Aparna Enterprises Ltd., Cornerstone Building Brands, Inc. (Atrium Corporation), DCM Shreeram Limited, Duroplast Extrusions Private Limited, Hurst Plastics Limited, JELD-WEN Holding, Inc., MI Windows and Doors, LLC., and Prominance Window Systems.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...

Loading Research Methodology...