Plastic Healthcare Packaging Market Research, 2032

The global plastic healthcare packaging market size was valued at $28.6 billion in 2022, and is projected to reach $48.0 billion by 2032, growing at a CAGR of 5.3% from 2023 to 2032. Plastic healthcare packaging includes a wide range of packaging products made from plastic materials, and designed for use in the healthcare industry. These products include bottles, vials, pouches, bags, trays, and containers, which are used for the storage, transport, and dispensing of pharmaceuticals, medical devices, and other healthcare products. Furthermore, plastic healthcare packaging offers numerous advantages, such as protection against contamination, ease of use, and regulatory compliance.

Market dynamics

Plastic healthcare packaging market size is driven by increase in use of plastic packaging in the healthcare industry, presence of plastic healthcare packaging industry and rise in demand for plastic packaging products from pharmaceutical industry during the COVID-19 pandemic. For instance, vaccines developed by Pfizer-BioNTech and Moderna are packaged in plastic vials, which provide a high level of protection against contamination and maintain the efficacy of the vaccine during transport and storage. In addition, the use of plastic packaging in the COVID-19 vaccine distribution ensured the safety and efficacy of the vaccines, and provided a cost-effective and convenient solution for healthcare providers. Furthermore, rise in demand for biologics and biosimilars products is a key factor driving the plastic healthcare packaging market growth. Biologics and biosimilars are complex and fragile products, which require specialized packaging to maintain the efficacy and safety of the products. Plastic healthcare packaging solutions are ideal for these products, as they offer protection against degradation and contamination. For instance, in 2021, Gerresheimer AG, a leading supplier of plastic healthcare packaging solutions, launched a new type of glass and polymer packaging system for biologics and biosimilars. The new packaging system is designed to protect these products from contamination and to maintain their efficacy during storage and transport.

Furthermore, advancements in plastic packaging technology led to development of new plastic materials and innovative packaging solutions, which are driving market growth. For instance, in July 2020, Dow, a materials science company, launched the new INNATE TF polyethylene resins for healthcare packaging. These resins are designed to offer high-performance, multi-layer packaging films that provide superior puncture resistance and toughness.

In addition, rise in demand from the pharmaceutical and medical device industries contribute toward the market growth. This is attributed to increase in demand for safe and reliable packaging solutions to protect their products.

The growth of the plastic healthcare packaging market share is expected to be driven by the developed countries such as the U.S., Canada, and Germany due to availability of raw materials for manufacturing plastic products, increase in chronic diseases, and advancement of healthcare infrastructure. Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to emergence of new medical device and pharmaceutical industries, rise in demand for enhanced healthcare services, and increase in geriatric population.

In addition, the need for cost-effective and sustainable packaging solutions contributes toward the growth of the market. For instance, in 2020, Amcor, a global packaging company, launched a sustainable polyethylene (PE) film that can be used to create flexible packaging solutions for the healthcare industry. The PE film is made from a blend of post-consumer recycled material and renewable plant-based material. In addition, Comar LL, a leading provider of plastic healthcare packaging solutions, provides eco-friendly plastic packaging products manufactured from recycled PET.

However, implementation of stringent regulatory guidelines on the use of plastic and increase in concerns over plastic waste restrain the market growth. For instance, the Food and Drug Administration (FDA) stated that plastic containers and closures used for sterile drug products should be tested for chemical compatibility with the drug product. These requirements can be time-consuming and costly for manufacturers, making it difficult for new plastic healthcare packaging industry to enter the market. Furthermore, development of new alternatives to plastic packaging due to concerns over plastic waste negatively impacted the market growth.

The COVID-19 pandemic has led to a significant increase in demand for healthcare products, including medicines, medical devices, and personal protective equipment (PPE). This has led to increase in demand for plastic healthcare packaging solutions to transport and protect these products. Furthermore, plastic packaging solutions such as bags, pouches, and containers have been widely used to store and transport these products. In addition, there has been an increase in demand for medical devices such as ventilators, which require specialized packaging to ensure their safe transport and storage. Furthermore, surge in demand for plastic healthcare packaging products post pandemic is expected to drive the market growth during the plastic healthcare packaging market forecast.

Segmental Overview

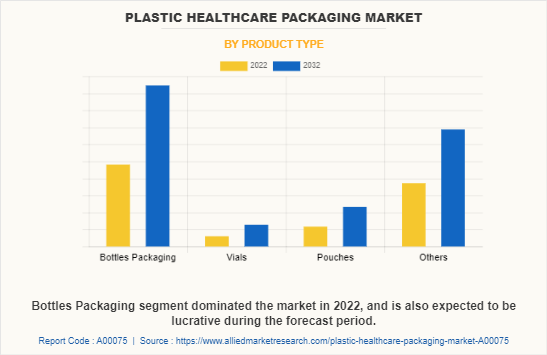

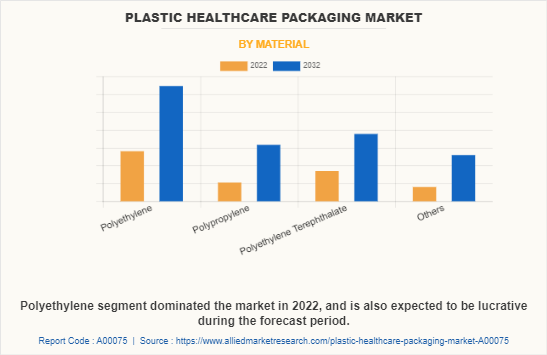

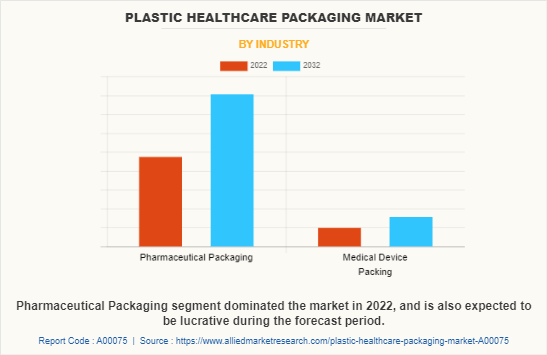

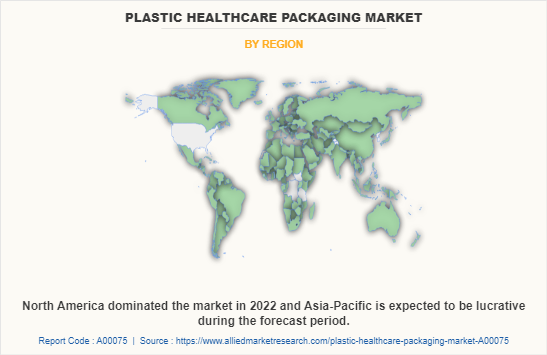

The plastic healthcare packaging market share is segmented into product type, material, industry.and region. On the basis of product type, the market is classified into bottles packaging, vials, pouches, and others (container, jar, cap & closure, and tubes). As per material type, it is segregated into polyethylene, polypropylene, polyethylene terephthalate, and others (polyvinyl chloride (PVC), polyolefin, and polyester). On the basis of end user, it is fragmented into pharmaceutical packaging and medical device packing. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Product Type

Depending on product type, the bottles packaging segment dominated the global market in 2022 and is expected to remain dominant throughout the forecast period. This is attributed to increase in demand for oral solid dosage forms such as tablets and capsules and are cost-effectiveness.

By Material Type

By material type, the polyethylene segment led the global market in 2022 and is expected to remain dominant throughout the forecast period, owing to high flexibility, durability, and chemical & moisture resistance offered by polyethylene. Furthermore, PE is lightweight and easy to process, making it a cost-effective option for manufacturers.

By Industry

By industry, the pharmaceutical packaging segment dominated the global market in 2022 and is anticipated to continue this trend during the forecast period, owing to increase in demand for medicines and significant advances in packaging technologies, such as the development of new materials and the use of smart packaging solutions.

By Region

North America accounted for a major share of the plastic healthcare packaging market in 2022 and is expected to maintain its dominance during the forecast period.

North America is a highly developed region with advanced healthcare systems. The region has a large aging population and a high prevalence of chronic diseases, which led to an increased demand for healthcare products such as medicines and medical devices. This increased demand has driven the need for plastic healthcare packaging solutions to transport and protect these products. Furthermore, North America is a hub for technological advancements and innovations in the healthcare industry. The region is home to many leading pharmaceutical and medical device companies that are investing heavily in research and development to develop new and advanced healthcare products. These products require specialized packaging solutions, which has led to an increased demand for plastic healthcare packaging solutions.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributed to increase in use of plastic packaging products. Moreover, the region has a large and rapidly growing population, which drives the demand for healthcare products and services. Furthermore, rise in healthcare expenditure in countries such as China and India has led to increased investment in healthcare infrastructure, pharmaceuticals, and medical devices, creating a significant demand for plastic healthcare packaging solutions.

Competition Analysis

Competitive analysis and profiles of the major players in the plastic healthcare packaging market include Amcor Plc, Beacon Converters, Inc, Origin Pharma Packaging, Gerresheimer AG, Constantia Flexibles Group, Nipro Europe Group Companies, TekniPlex, Comar, LLC, Mondi, and Klockner Pentaplast. Major players have adopted agreement, product launch, acquisition, and product approval as a key developmental strategies to improve their product portfolio and gain a strong foothold in the plastic healthcare packaging market.

Recent Agreement in the Plastic healthcare packaging Market

In May 2023, Amcor Inc., one of the global leader in packaging solutions, signed a definitive agreement to acquire Moda Systems. The acquisition aims to complement Amcor strength in film, and offer an end-to-end packaging solution to encompasses primary packaging, equipment, onsite technical service, and parts.

In January 2023, Amcor Inc. has entered into an agreement to acquire MDK, a leading provider of medical device packaging. This acquisition will strengthen Amcor's presence in Asia-Pacific.

Recent Product Launch in the Plastic healthcare packaging Market

In April 2022, Amcor Inc. launched more sustainable high shield laminates. The launch of high shield laminates will help the company to strengthen its pharmaceutical packaging portfolio.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the plastic healthcare packaging market analysis from 2022 to 2032 to identify the prevailing plastic healthcare packaging market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the plastic healthcare packaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global plastic healthcare packaging market trends, key players, market segments, application areas, and market growth strategies.

Plastic Healthcare Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 48 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 251 |

| By Industry |

|

| By Product Type |

|

| By Material |

|

| By Region |

|

| Key Market Players | Mondi, Comar, LLC., Amcor Plc, Beacon Converters, Inc., Constantia Flexibles Group, Gerresheimer AG, Origin Pharma Packaging, Nipro Europe Group Companies, TekniPlex Inc., Klockner Pentaplast |

Analyst Review

As per the insights of the CXOs of leading companies, plastic packaging in healthcare refers to the use of plastic materials to package and protect pharmaceutical products, medical devices, and other healthcare-related products. Development of advanced biodegradable and recyclable materials and increase in use of plastic packaging in healthcare and medical device industry boost the growth of the market.

Furthermore, increase in product approvals and new product launches by the key players are expected to create opportunities for the market growth. For instance, in April 2020, Amcor, a global leader in sustainable packaging, launched a more sustainable packaging solution for pharmaceuticals. Genesis, is a fully recyclable, polyethylene-based laminated material that replaces traditional PVC-based blister packaging. It offers several benefits over traditional PVC-based packaging, such as reduced carbon footprint and improved recyclability.

The top companies that hold the market share in plastic healthcare packaging market are Amcor Plc, Beacon Converters, Inc, Origin Pharma Packaging, Gerresheimer AG, Constantia Flexibles Group, Nipro Europe Group Companies, TekniPlex, Comar, LLC, Mondi, and Klockner Pentaplast

Asia-Pacific is anticipated to witness lucrative growth during the forecast period, owing to new packaging material development, development of pharmaceutical industry, and increase in healthcare expenditure

The key trends in the plastic healthcare packaging market are due to increase in demand for innovative plastic packaging solutions

The base year for the report is 2022.

North America is the largest regional market for plastic healthcare packaging Market

The total market value of plastic healthcare packaging Market market is $28,598.5 million in 2022 .

The forecast period in the report is from 2023 to 2032

Major restraints in the plastic healthcare packaging Market are increase in environmental concerns regarding plastic waste

Loading Table Of Content...

Loading Research Methodology...