Plastics Processing Machinery Market Research, 2031

The Global Plastics Processing Machinery Market size was valued at $26.2 billion in 2021, and is projected to reach $40.7 billion by 2031, growing at a CAGR of 4.4% from 2022 to 2031.

Plastic processing machines convert raw plastic such as polyolefin, polyethylene terephthalate (PET), polyvinyl chloride (PVC), acrylonitrile butadiene styrene (ABS), and others available in pellets, strings, sheets, and other forms into useful plastic products. Different industries that make use of plastics processing machinery are packaging, automotive, construction, consumer goods, and others.

Market Dynamics

The global population has been rising significantly, along with the surge in urbanization and an increase in the disposable income of the masses. This demographic growth is playing an important role in driving the growth of industries such as construction, and automotive which are among the top users of plastic products, thereby driving the demand for plastics processing machinery. These industries are witnessing increased growth in developing countries such as India, China, Vietnam, and South Africa, as well as in Middle Eastern countries such as Saudi Arabia, UAE, and Qatar. For instance, Saudi Arabia, an economy excessively dependent on crude oil and its derivatives is shifting toward investment in mega-projects such as NEOM, Qiddiya Entertainment City, King Abdullah Economic City, the Line, and others that are estimated to bring a large number of tourists and pilgrims in the near future. Similarly, Foster + Partners a major UK-based architect firm announced in March 2022, that it will build a city called "The Global City," in Ho Chi Minh city of Vietnam.

The project includes high- and low-rise residential buildings, public housing and villas and other buildings. The construction industry uses various plastic components such as pipes, cables, ducts, extruded sections for panels of doors and windows, and others, which are produced using plastic processing machines. Therefore, the growth in construction across the world is projected to boost the growth of the plastics processing machinery market.

However, plastic is negatively affecting the earth’s environment, causing pollution, and disturbing life in the ocean as well as on land; thus, there are various government regulations that strictly regulate the plastic market. Therefore, this is expected to hamper the growth of the plastics processing machinery market growth. In addition to this, the high cost of many plastics processing machinery such as injection molding machinery is also a negative factor restraining the plastics processing machinery market growth.

Moreover, technological innovations are expected to provide lucrative opportunities for players that operate in the plastics processing machinery market. For example, Husky Technologies, a major player in the plastics processing machinery market constantly innovates its products and has launched technologically advanced machines. For instance, in May 2022, it introduced its revolutionary HyPET®HPP5e Recycled Melt to PreformTM (RMTP) system. This has been developed by successfully integrating pre-form injection molding system with a melt decontamination unit; thereby, enabling the direct conversion of washed flake to pre-form. Such technologies are expected to improve the operations of plastics processing machinery; thereby creating opportunities for the growth of the plastics processing machinery market during the forecast period. Similarly, Sumitomo Heavy Industries, SACMI Group and others offer technologically advanced plastics processing machinery.

The demand for plastics processing machinery decreased in 2020, owing to low demand from different industries due to lockdowns imposed by the government of many countries. The COVID-19 pandemic has shut down production of various products for plastics processing machinery end-users, owing to prolonged lockdowns in major global countries. This has hampered the growth of the plastics processing machinery market significantly during the pandemic. The major demand for equipment and machinery was previously noticed from countries including the U.S., Germany, Italy, the UK, India, and China, which were severely affected by the spread of coronavirus, thereby halting demand for equipment and machinery.

Furthermore, it has been more than two years since the outbreak of this pandemic, and many companies have already shown notable signs of recovery. Contrarily, as of beginning of 2023, the number of COVID-19 infection cases is surging again, especially in China, this has brought negative sentiments in the market, which may have a negative impact on the plastics processing machinery market. Equipment and machinery manufacturers must focus on protecting their workforce, operations, and supply chains to respond to immediate challenges and find new ways of working after COVID-19 infection cases start to decrease.

Segmental Overview

The plastics processing machinery market is segmented on the basis of type, material, end user industry, and region. By type, the market is divided into extruder machines, injection molding machines, blow molding machines, vacuum forming, and others. By material, the market is classified into polyolefin, polyethylene terephthalate (PET), polyvinyl chloride (PVC), acrylonitrile butadiene styrene (ABS), and others. By end user industry, the market is categorized into packaging, automotive, construction, consumer goods, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

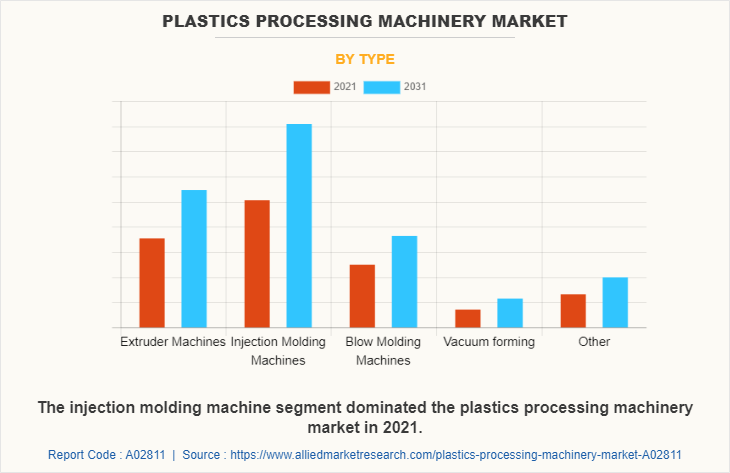

By Type:

The plastics processing machinery market is divided into extruder machines, injection molding machines, blow molding machines, vacuum forming, and others. In 2021, the injection molding machines segment dominated the plastics processing machinery market, in terms of revenue, and the vacuum forming segment is expected to grow at the highest CAGR during the forecast period. In the injection molding machine, melted plastic is injected into the molds and then the plastic is allowed to cool down, and the final product is taken out. Injection molding machines are used extensively owing to their high productivity and efficiency, along with lower operating costs. Moreover, vacuum processing is a type of thermoforming, in which a plastic sheet is softened using heat and placed against a mold. The sheet is then vacuumed around the mold; hence, molding the plastic sheet into the desired shape.

By Material

The polyethylene terephthalate (PET) segment is expected to grow with the highest CAGR.

By Material:

The plastics processing machinery market is classified into polyolefin, polyethylene terephthalate (PET), polyvinyl chloride (PVC), acrylonitrile butadiene styrene (ABS), and others. The polyolefin segment dominated the plastics processing machinery market, in terms of revenue in 2021. Polyolefin mainly constitutes polypropylene and polyethylene. Materials such as Low-Density Polyethylene (LDPE), Liner Low-Density Polyethylene (LLDPE), and High-Density Polyethylene (HDPE) are part of the polyolefin family. Different types of polyolefins have a wide range of properties such as flexibility, rigidity, high strength, and others. Products such as carrier bags, milk carton coatings, and heavy-duty industrial bags, stretch films, and others are made using polyolefins.

By End User Industry:

The plastics processing machinery market is categorized into packaging, automotive, construction, consumer goods, and others. The packaging segment dominated the plastics processing machinery market, in terms of revenue in 2021. The consumer goods segment was the second-highest revenue-grossing segment in 2021 and is also expected to grow with the highest CAGR during the forecast period. The packaging segment includes the use of plastics processing machinery for producing packaging materials such as plastic bags, pouches, bottles, cans, blister packaging, and others. Growth of food & beverages, and pharmaceuticals industry is anticipated to drive the growth of the packaging segment. Furthermore, the consumer goods segment includes the use of plastics processing machinery for producing cases for electronics items, toys, utensils, and others. Growth in the number of households and increase in disposable income of people are the major factors driving the growth of products included in the consumer goods segment; therefore, this is positively affecting the plastics processing machinery market growth.

By Region

Asia-Pacific dominated the market in terms of revenue in 2021, and LAMEA is expected to grow with the highest CAGR.

By Region:

The plastics processing machinery market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Asia-Pacific had the highest plastics processing machinery market share. LAMEA is anticipated to grow with the highest CAGR during the forecast period. The major players are striving to develop manufacturing units in these markets to improve production quantities as well as serve the Asian industries including packaging, automotive, construction, consumer goods, and other. Moreover, the population of the Asia-Pacific region is anticipated to grow at a substantial rate. Countries such as India, Vietnam, Malaysia, and others will see especially high growth rates. In addition, India, Vietnam, and China are also the countries that are witnessing a boom in economic growth. This influences the overall growth of construction and manufacturing facilities in these regions. Thus, the improvement in overall production facilities is projected to create opportunities for the growth of the plastics processing machinery market in this region.

Moreover, major players in the plastics processing machinery market are expanding their foothold in the market. For instance, in April 2022, Haitian Huayuan Japan Machinery Co, Ltd moved to a new location, Nagoya City Minato-ku, Aichi Prefecture, in the country. This move will allow the company to cater for a wider customer base, as this new location is a major industrial hub in the country. Moreover, China is one of the major exporters of plastics processing machinery globally. The rapid industrial development of China has motivated plastics processing machinery manufacturers to establish their production units in the country. For instance, in March 2021, Haitian group held a groundbreaking ceremony for the construction of a Smart Factory for advanced component and machinery manufacturing.

This is a joint initiative between Haitian and the governments of Guangdong and Foshan in China. This can be attributed to relatively lower labor cost and availability of raw materials. Furthermore, India is considered a major emerging market for most industries including, automotive, construction, food and beverages, and others. In addition to this, India’s pharmaceutical industry is one of the largest producers of generic drugs. These industries are among the major users of plastic products; therefore, their growth is expected to be a positive factor to the plastics processing machinery market.

Competition Analysis

Competitive analysis and profiles of the major players in the plastics processing machinery industry, ARBURG GmbH Co. KG., Graham Engineering Company, LLC, Husky Technologies, Hillenbrand, Inc. (Milacron), Sumitomo Heavy Industries, Ltd., Nissei Plastic Industrial CO., Ltd, Shibaura Machine CO., LTD, SACMI Group, Haitan International Holdings Ltd., Wilmington Machinery, Inc, are provided in this report. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the plastics processing machinery market.

Some examples of product launches in the market

In July 2022, Husky Technologies, a major player in the plastics processing machinery industry, upgraded its mold controller software offering, and launched the second-generation control algorithm for its line of Altanium® mold controllers, known as the Advanced Reasoning Technology (ART 2.0). The new offering is technologically advanced and is more productive and efficient compared to various offerings in the market. Similarly, in December 2021, SACMI Group, another major player in the market, launched IPS 300, a PET preform production machine. The machine utilizes IoT, making it fully automated, and digital.

Business Expansions in the market

In July 2022, SACMI group opened its new regional headquarters in Mumbai, India, dedicated to its Rigid Packaging Business. Moreover, in January 2021, Haitian Vietnam Ltd. a subsidiary of Haitian group in Vietnam opened its new showroom in Ho Chi Minh City. The new 1000 sq.m. building contains multifunctional space modules for product display and meeting areas, after-sales training, spare parts storage, and offices.

Key Benefits For Stakeholders

The report provides an extensive analysis of the current and emerging plastics processing machinery market trends and dynamics.

In-depth plastics processing machinery market analysis is conducted by constructing market estimations for key market segments between 2021 and 2031.

Extensive analysis of the plastics processing machinery market is conducted by following key product positioning and monitoring of top competitors within the market framework.

A comprehensive analysis of all the regions is provided to determine the prevailing plastics processing machinery market opportunities.

The plastics processing machinery market forecast analysis from 2022 to 2031 is included in the report.

The key players within the plastics processing machinery market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the plastics processing machinery market industry.

Plastics Processing Machinery Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 40.7 billion |

| Growth Rate | CAGR of 4.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 343 |

| By Type |

|

| By Material |

|

| By End User Industry |

|

| By Region |

|

| Key Market Players | ARBURG GmbH Co. KG., Sumitomo Heavy Industries, Ltd., Husky Technologies, Nissei Plastic Industrial CO., Ltd, SACMI Group, Hillenbrand, Inc. (Milacron), Graham Engineering Company, LLC, Shibaura Machine CO., LTD, Haitan International Holdings Ltd., Wilmington Machinery, Incorporated. |

Analyst Review

The plastics processing machinery market has witnessed significant growth in past few years, owing to surge in demand for packaging products such as plastic pouch, bottles, and others.

The rise in the automotive and construction industries in countries such as the U.S, Canada, India, and China has fueled the demand for plastic parts and components for these industries; thereby, driving demand for plastic processing machines. Furthermore, plastic has various advantageous features over other metal, paper, and textiles, such as light-weight, flexibility, affordability, and long life. Injection molding machines are widely used among all the types of plastic processing machinery, owing to its high efficiency. However, high investment cost of most of the plastic processing machinery including injection molding machines is expected to restrain the market growth.

Moreover, advancements in technology such as integration of IoT and other latest features in the machines is expected to provide lucrative growth opportunities for the plastics processing machinery market growth.

Factors such as rise in demand for packaging solutions, rise in automotive, and packaged food industry, are few of the upcoming trends of Plastics Processing Machinery Market in the world.

Plastic processing machinery are widely used for turning raw plastic into useful products such as packaging, components for automobiles, and others.

Asia-Pacific accounted for a large market share in 2021.

The plastics processing machinery market valued at $26,210.35 million in 2021.

Key companies profiled in the plastic processing machinery market report include ARBURG GmbH Co. KG., Graham Engineering Company, LLC, Husky Technologies, Hillenbrand, Inc. (Milacron), Sumitomo Heavy Industries, Ltd., Nissei Plastic Industrial CO., Ltd, Shibaura Machine CO., LTD, SACMI Group, Haitan International Holdings Ltd., Wilmington Machinery, Inc.

The plastics processing machinery market is estimated to reach $40,691.40 million by 2031.

By end user industry, the packaging segment held a major share of the plastic processing machinery market in 2021.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Loading Table Of Content...