Point Of Care Diagnostics Market Research, 2030

The global Point of Care Diagnostics Market Size was valued at $29,478.63 million in 2020 and is projected to reach $55,275.73 million by 2030, growing at a CAGR of 6.5% from 2021 to 2030.

The point-of-care (POC) diagnostics are medical devices used to get an immediate result in the investigation (diagnosis & monitoring) of various diseases, such as cancer, diabetes, cardiac diseases, and others.

Point of Care Diagnostics Market GrowthTrends is the rise in the prevalence of chronic and infectious diseases in developing economies. The prevalence of chronic diseases, such as diabetes, rheumatism, or cancer, is increasing globally, due to various reasons, such as an increase in the geriatric population, sedentary lifestyles, unhealthy food habits, and environmental factors. For instance, chronic diseases kill more than 38 million people each year, globally. Cardiovascular diseases account for most chronic disease deaths, or 17.5 million people, annually, followed by cancers (8.2 million), respiratory diseases (4 million), and diabetes (1.5 million). The aforementioned diseases account for 82% of all chronic disorder deaths. Point-of-care diagnostics is gaining wide acceptance by different patients globally, as samples are collected from the patient’s location for performing tests, and the results can be achieved in very less time, due to the use of micro fluids, chips, and nano diagnostics.

Point of Care Diagnostics Market Size was valued at $29,478.63 million in 2020 and is projected to reach $55,275.73 million by 2030, growing at a CAGR of 6.5% from 2021 to 2030.

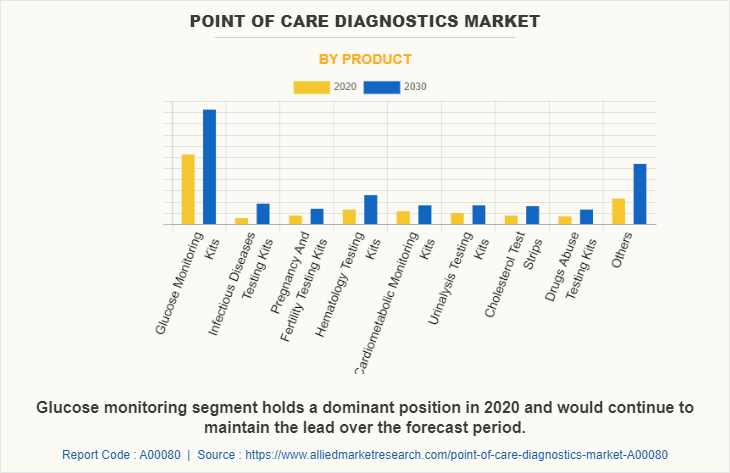

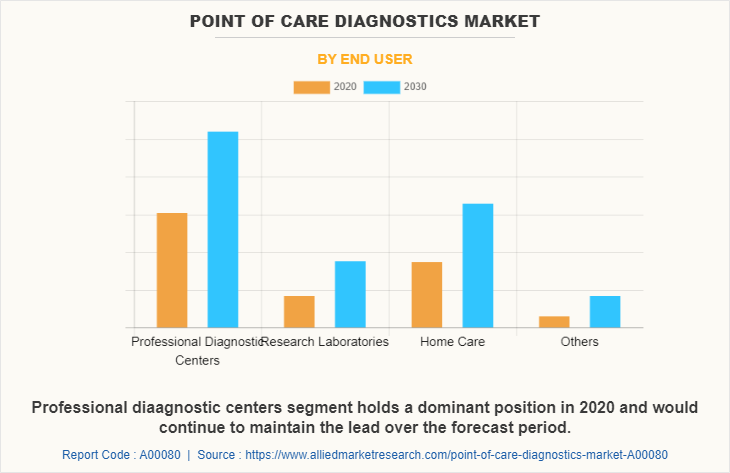

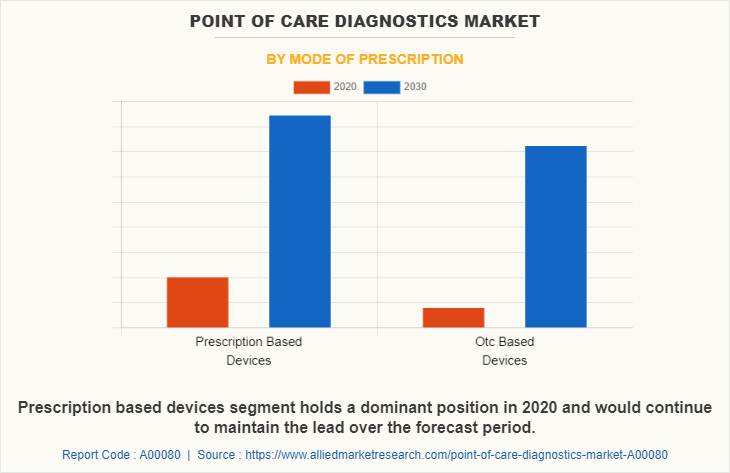

The global POC Diagnostics market is segmented on the basis of product, end-user, mode of prescription, and region. By product, the point-of-care diagnostic kit market is segmented into glucose monitoring kit, infectious diseases testing kit, pregnancy, and fertility testing kit, hematology testing kit, cardiometabolic monitoring kit, urinalysis testing kit, cholesterol test strips, drug of abuse testing kit, and others. By end-user, the global point-of-care diagnostics market is segmented into professional diagnostic centers, research laboratories, homes, and others. By mode of prescription, the global point-of-care diagnostics market is segmented into prescription-based point-of-care diagnostics and over-the-counter (OTC)-based point-of-care diagnostics market. The prescription-based point-of-care diagnostics are most frequently used in healthcare facilities and prescribed by healthcare professionals. Geographically, the market is segmented across four major regions, such as North America, Europe, Asia-Pacific, and LAMEA.

Product Segment Review

Point of Care Diagnostics Industry is segmented into glucose monitoring kit, infectious diseases testing kit, pregnancy, and fertility testing kit, hematology testing kit, cardiometabolic monitoring kit, urinalysis testing kit, cholesterol test strips, drug of abuse testing kit, and others. The glucose monitoring segment dominates the market. Furthermore, the other segment is the second-largest segment that dominates the overall market owing to the increase in incidences of chronic diseases such as tumors and the introduction of innovative and advanced kits in the market.

End-User Segment Review

POC Diagnostics Industry is segmented into professional diagnostic centers, research laboratories, homes, and others. Among these end users, the professional diagnostic center segment dominates in the global point-of-care diagnostic market. Owing to an increase in the prevalence of various chronic and infectious diseases globally.

Mode of Prescription Segment Review

On the basis of the mode of prescription, the global point-of-care diagnostic market is segmented into prescription-based point-of-care diagnostics and over-the-counter (OTC)-based point-of-care diagnostic market. The prescription-based point-of-care diagnostics are most frequently used in healthcare facilities and prescribed by healthcare professionals.

Region Segment Review

By region, the market is segmented across four major regions, such as North America, Europe, Asia-Pacific, and LAMEA. North America accounted for the largest market share in the point-of-care diagnostic market. The growth in this region is mainly due to factors, such as product innovations and the rise in the prevalence of chronic and infectious diseases. In addition, Asia-Pacific is expected to emerge as the region with maximum growth potential due to the growth in the focus of key players in emerging economies and improvement in healthcare infrastructure in the region.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the POC Diagnostics Market Size analysis from 2020 to 2030 to identify the prevailing point of care diagnostics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the point of care diagnostics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global Point of Care Diagnostics Market Share trends, key players, market segments, application areas, and market growth strategies.

Point of Care Diagnostics Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By MODE OF PRESCRIPTION |

|

| By END USER |

|

| By Region |

|

| Key Market Players | Danaher Corporation, Becton Dickinson and Company, bioMrieux SA, Abbott Laboratories, sysmex corporation, Hoffmann La Roche Ltd, Johnson and Johnson, Sinocare Inc., Siemens AG, Nova Biomedical |

Analyst Review

The utilization of point-of-care diagnostic devices is expected to witness a significant rise with the increase in diagnostic procedures for diseases and innovative and advanced applications of devices. The point-of-care diagnostic market is the point of interest of healthcare providers due to several benefits offered by these devices to investigate and manage various medical conditions. Remarkable technological advancements in the POC diagnostic devices to provide advanced diagnosis options for the investigation of diseases, such as diabetes, cardiac diseases, cancer, and others are also observed. As the market is saturated and grows at a steady rate in developed nations, Asia-Pacific and LAMEA regions are expected to offer high growth opportunities to key players in the market.

An increase in the prevalence of various infectious diseases, technological advancements, and a rise in emphasis on early prevention are some of the major factors that drive the market. However, a lack of reimbursement and stringent regulations for the approval of POC diagnostic devices hamper the growth of the market. Currently, glucose monitoring kits are the largest segment in the global point-of-care diagnostics market, followed by hematology testing kits. The rise in incidences coupled with growth in the geriatric population and initiatives are taken by various government associations for free blood check-ups add to the growth of the point-of-care diagnostic market. The infectious disease testing kits segment is the most attractive segment of the point-of-care diagnostics market, owing to the increase in the need for these devices at hospitals and other healthcare facilities.

The professional diagnostic centers are the major end-user in the point-of-care diagnostic devices. This is due to the increase in the number of healthcare facilities that include hospitals and clinics globally. Furthermore, the POC diagnostic devices are usually prescribed by healthcare professionals due to extensive knowledge about the various medical conditions among healthcare professionals and their management. Thus, the prescription-based POC diagnostic devices segment holds the largest market share in the market.

In addition, emerging markets gain more importance for the majority of the POC diagnostic device manufacturers and distributors. Rapid growth was observed in the shipments of these devices to provide improved healthcare services in emerging nations, and this is expected to offset the challenging conditions in mature markets such as North America and Europe. North America is expected to dominate the global point-of-care diagnostics market during the forecast period, followed by Europe.

No, there is no value chain analysis provided in the Point of Care Diagnostic Market report

The upcoming trends of Point of Care Diagnostics Market are rising prevalence of chronic and infectious diseases in developing economies and an increasing number of regulatory approvals for novel immunoassay techniques, technological advancements, and the rising usage of home-based POC devices, are expected to drive the market growth

North America is the largest regional market for the Point of Care Diagnostics Market

The global Point of Care Diagnostics market was valued at $29,478.63 million in 2020 and is projected to reach $55,275.73 million by 2030, registering a CAGR of 6.5% from 2021 to 2030.

The top companies to hold the market share in the Point of Care Diagnostics Market are

Yes, I Point of Care Diagnostics companies are profiled in the report

Loading Table Of Content...