Polished Concrete Market Research, 2031

The global polished concrete market was valued at $2.2 billion in 2021 and is projected to reach $3.7 billion by 2031, growing at a CAGR of 5.3% from 2022 to 2031. Rise in demand for aesthetic and durable flooring solutions, coupled with advancements in polishing techniques and equipment, is significantly driving the growth of the polished concrete market. Modern consumers and businesses prioritize flooring options that combine visual appeal with long-lasting performance, that make them polished concrete a preferred choice for various applications.

Introduction

Polished concrete is a high-performance flooring solution created by mechanically grinding, honing, and polishing a concrete surface to achieve a smooth, glossy, and refined finish. This process involves the use of progressively finer abrasives and often incorporates chemical densifiers to enhance durability and hardness. Known for its aesthetic appeal, low maintenance requirements, and exceptional resistance to wear and stains, polished concrete is a sustainable and cost-effective option for residential, commercial, and industrial applications, offering a modern and versatile alternative to traditional flooring materials.

Market Dynamics

Polished concrete is created by physically honing, polishing, and grinding a concrete floor with bonded abrasives to smooth up the surface. After that, it is altered for each cut until the appropriate level of look is obtained. In this procedure, a penetrant substance known as a hardener is also utilized. After penetrating the concrete, the concrete hardener triggers a chemical process that hardens and dust-proofs the surface. Concrete polishing involves processing the surface over several steps using progressively finer grinding instruments.

One of the main reasons for the increase in demand for polished concrete is the strong demand for the construction of hotel flooring and other commercial structures. This is primarily due to the several benefits of polished concrete, which include a good visual appeal for floors and resistance to sliding and wear and tear from heavy foot traffic. Significant growth in demand is projected both in the Asia-Pacific region as well as the Middle East and Africa. The demand for polished concrete is likely to rise as a result of considerable investments in housing developments and rapid industrialization in these developing countries. A building's or facility's increased aesthetic appeal is anticipated to fuel the demand for polished concrete market size.

The cost of the raw materials and energy used to manufacture polished concrete is volatile, and this tendency is expected to continue during the forecast period. The cost of raw materials could increase due to fluctuations in the price of crude oil and petroleum products, which would subsequently increase the cost of cement, sealants, and adhesives used in polished concrete. As a result, the cost of these components has a direct impact on the cost of polished concrete. Vendors boost the price of their product's profit margins in reaction to rising raw material costs, limiting the potential of the polished concrete market share to grow.

During the forecast year, there will be a surge in the number of redevelopment and renovation projects in non-residential facilities. The structures of their establishments are also being renovated by hotel and resort owners in an effort to increase their customers and improve the accommodation experience. For instance, JW Marriott debuted a new hotel in Canberra, Australia, in September 2019. The hotel has polished concrete flooring, which further improves the visual appeal of the floors, and it has the latest design accents. Furthermore, a rise in investments from industry players in the residential construction and retail sectors is projected to hasten the use of polished concrete.

The key players for polished concrete analysis in this report include Pittsburgh Plate Glass Industries, Inc., 3M, BASF SE, Sika AG, Ultra Tech Cement Limited, The Sherwin Williams Company, Boral Limited, Solomon Colors Inc., Vexcon Chemicals Inc., and The Euclid Chemical Company.

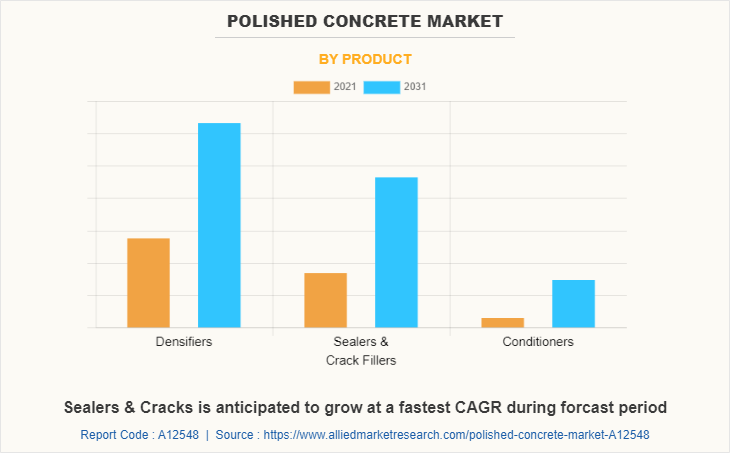

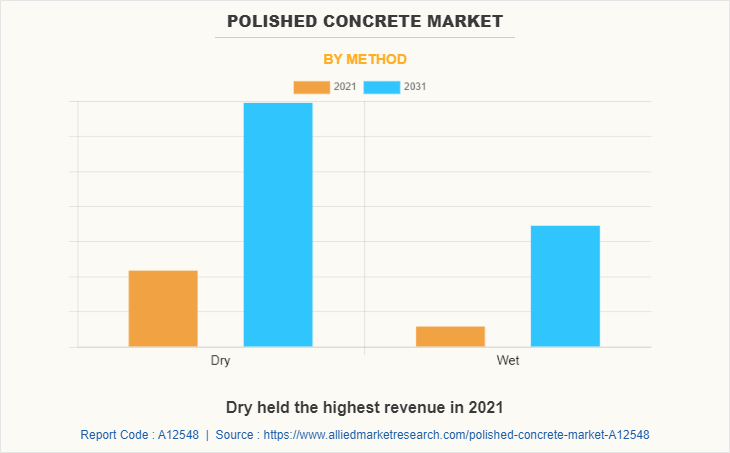

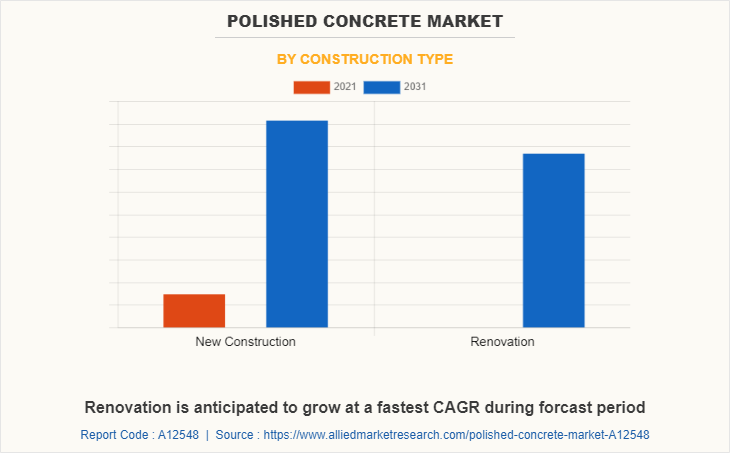

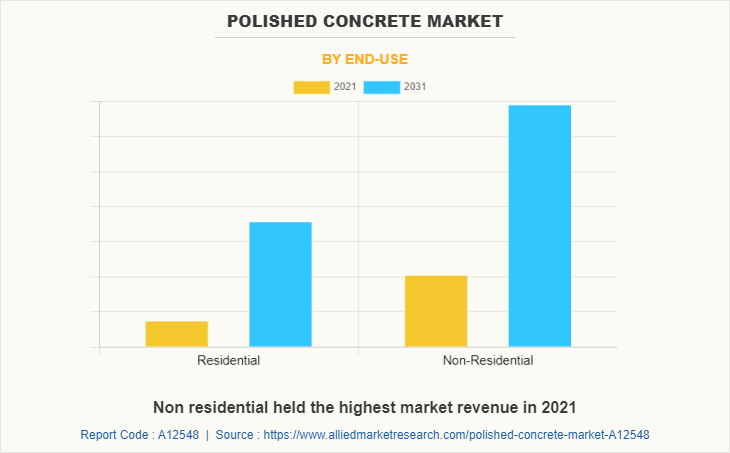

The global polished concrete market size is segmented by product, method, construction type, end-use, and region. By product, the market is sub-segmented into densifiers, sealer & crack filler, and conditioner. By the method, the market is sub-segmented into dry and wet. By construction type, the market is classified into new construction and renovation. By end use, the market is classified into residential and non-residential. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The polished concrete market is segmented into Product, Method, Construction Type, and End-Use.

By product, the densifiers sub-segment dominated the polished concrete market in 2021. On top of the concrete slab, concrete densifiers is utilized as chemical hardener. The densifiers are used in the modification stage of slab polishing. These concrete densifiers increase the density of the slab's surface by filling its pores. Manufacturers are employing cutting-edge tactics to take a big portion of the market. For example, W.R. Meadows' Induroshine, a green concrete grinding, and polishing densifier is used to polish concrete flooring systems. This densifier is extremely long-lasting and VOC-free. The Indochine densifiers offer the flooring a dense, resilient, and visually pleasant appearance. This densifier is utilized in a range of applications, including shopping center floors, airports, schools, museums, stadiums, and warehouses.

The sealer & crack sub-segment is projected to be the fastest growing during the forecast period. For making the flooring more durable, the sealer and crack filler significantly increase the value of the polished concrete. Crack filler and sealer can be used in environments where the temperature swings a lot. As a result, polished concrete sealer and crack filler can be used in industrial and commercial settings, as well as on the exterior of homes. During the forecast period, this aspect may have a substantial impact on the polished conditioner market growth.

By method, the dry sub-segment dominated the polished concrete market in 2021. Higher shine, more hardening and condensing of the floor, and its effectiveness in both wide regions and small sections are all contributing factors to the polished concrete market growth. Using industrial-sized polishing machinery, the concrete surface is ground for the dry concrete polishing procedure. Different abrasive polishing discs are required for each stage of the process, frequently combining diamond grit with coarser textures for early stages and finer ones to achieve the desired shine. All these factors are predicted to boost polished concrete market share and raise demand for dry polished concrete.

By construction type, the new construction sub-segment dominated the global polished concrete market share in 2021. Due to the increase in demand for new construction projects such as warehouses, office buildings, and residential homes, it is projected that the new construction sub-segment of the polished concrete market size would experience rapid expansion. For instance, in the U.S., which is renowned for its burgeoning infrastructure and construction projects, $20,000 million was invested in Hudson Yards' construction in New York. One of the largest construction projects in Chelsea and Hudson Yards. In the next years, a number of these new construction projects are anticipated to boom the global polished concrete industry.

By end use, the non-residential sub-segment dominated the global polished concrete market share in 2021. Due to the strong demand for polished concrete from hospitals, restaurants, commercial complexes, and other locations, the non-residential sub-segment is anticipated to have the largest market share in the global industry. For example, polished concrete has a brilliant luster, a glossy appearance, outstanding performance, and long-lasting durability. During the projected period, these advantages are anticipated to fuel the polished concrete market growth of the non-residential polished concrete sub-segment.

By region, the North America dominated the global market in 2021. The revenue increase is attributed to reasons such as technological improvements and expansion of the construction and building sectors, rising demand for lustrous and attractive flooring systems in suburban buildings, and high demand for the construction of logistic hubs. The e-commerce industry's rapid developments have raised North America's need for additional logistical hubs and warehouses. To attract top e-commerce corporations like Amazon and Home Depot, for instance, The Atlanta Business Chronicles developers in the metro Atlanta area have constructed 18 million square feet of warehouse space. In the end, all these factors will influence polished concrete demand in North America.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the polished concrete market forecast, segments, current trends, estimations, and dynamics of the polished concrete market analysis from 2021 to 2031 to identify the prevailing polished concrete market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the polished concrete market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global polished concrete market trends, key players, market segments, application areas, and market growth strategies.

Polished Concrete Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3.7 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 350 |

| By Product |

|

| By Method |

|

| By Construction Type |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | Ultra Tech Cement Limited, Sika AG, PPG Industries, Inc., Vexcon Chemicals, Inc., BASF SE, The 3M Company, Solomon Colors Inc., The Sherwin Williams Company, the euclid chemical company, Boral Limited |

Analyst Review

The polished concrete industry is anticipated to experience considerable growth in the coming years due to the rise in demand for polished concrete in both residential and commercial construction. Additionally, it is anticipated that the market for polished concrete will be supported during the forecast period by growth in the construction of new homes and businesses as well as an increase in demand for flooring options that are beautiful, long-lasting, and low maintenance. As a result, the market is anticipated to experience revenue growth during the forecast period. However, in response to rising raw material costs, vendors may raise the price of their goods or reduce their profit margins, which will have a negative influence on market expansion and is likely to impede the growth of the worldwide polished concrete market during the forecast period. The Leadership in Energy and Environmental Design (LEED) -friendly polished concrete floors enable sustainable building construction without the release of volatile organic compounds (VOCs). Furthermore, essential advantages may create profitable market opportunities for the industry's players in the years to come.

Among the analyzed regions, North America is expected to account for the highest revenue in the market by the end of 2027. The rapid advancements in the e-commerce industry have increased the demand for construction of new warehouses and logistics hubs in North America and thus are the key factors responsible for dominating position of North America in the global polished concrete market.

Increase in construction activities around the world is a major factor in the polished concrete industry’s rapid expansion. In addition, another important factor which is population growth in rise in economies such as China and India are causing the construction industry to expand quickly thus it is expected to fuel revenue growth of the market in the forecast timeframe.

The major growth strategies adopted by polished concrete market players are investment and merger & acquisitions.

Concrete manufacturers, builders, and contractors are the major customers in the global polished concrete market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global polished concrete market from 2022 to 2031 to determine the prevailing opportunities.

The reconstruction and remodeling activities in residential & commercial sector is increasing the demand for smooth and aesthetically pleasant flooring at cost-effective price which in turn is anticipated to boost the polished concrete market in the upcoming years.

The non-residential sub-segment of the component segment acquired the maximum share of the global polished concrete market in 2021.

Asia-Pacific will provide more business opportunities for the global polished concrete market in future.

Pittsburgh Plate Glass Industries, Inc., 3M, BASF SE, Sika AG, Ultra Tech Cement Limited, The Sherwin Williams Company, Boral Limited, Solomon Colors Inc., Vexcon Chemicals Inc., and The Euclid Chemical Company are the major players in the polished concrete market.

Loading Table Of Content...