Poly Vinyl Alcohol Fiber Market Size & Insights:

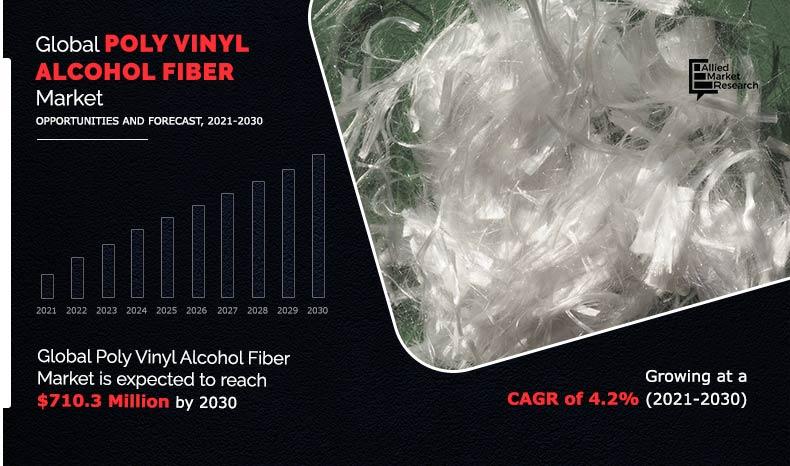

The global poly vinyl alcohol fiber market size was valued at $470.7 million in 2020, and is projected to reach $710.3 million by 2030, growing at a CAGR of 4.2% from 2021 to 2030.

How to Describe Poly Vinyl Alcohol Fiber

Poly vinyl alcohol (PVA) is a water-soluble synthetic polymer that is used to form a synthetic fiber by wet spinning method. It is resistant to abrasion and wrinkling. Some of the PVA fibers are more hygroscopic than any other synthetic fiber. Staple PVA fibers are used in the production of fabrics for clothing, linens, and curtains. The PVA are produced in many countries under the trade names Vinol (USSR), Vinylon and Kuralon (Japan), and Winalon (Korea). Globally, poly vinyl alcohol fiber is used in construction, chemical, textile, and other industries.Rise in demand for cement in the construction industry and growth in use of poly vinyl alcohol fiber in the textile industry are expected to be the driving factors for the growth of the global poly vinyl alcohol fiber market.

However, varying prices of the petrochemical feedstock globally restrains the market growth. Moreover, factors such as research on improvement in poly vinyl alcohol fiber strength, increase in demand from developing regions such as Asia-Pacific, may attract global players to invest and possess growth opportunities for the global PVA fiber market.

Poly Vinyl Alcohol Fiber Market Segment Review:

The poly vinyl alcohol (PVA) fiber market is segmented on the basis of product, application, and region. On the basis of product, poly vinyl alcohol fiber is segmented into staple fibers, filament fibers, and others. The applications covered in the study include textile, construction, non-woven fabrics and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Global Poly Vinyl Alcohol Fiber Market, By Region

Asia-Pacific accounted for a major market share in 2020, owing to the presence of developing countries such as India and China. The presence of huge population and developing countries in this region are main driving actors for the growth of the market. The recent investments of Indian government toward infrastructure such as high-speed bullet train, metro rail, and national highways require huge amount of reinforced concrete. The presence of textile industry in China and India, the ever-growing exports of textile related products in this region is another important factor boosting the growth of poly vinyl alcohol fiber market. The above applications will provide ample opportunities for the growth of poly vinyl alcohol fiber (PVA) market.

By Region

Asia Pacific holds a dominant position in 2020

Global Poly Vinyl Alcohol Fiber Market, By Product

The staple segment accounted for a major share in the honeycomb core materials market in 2020, owing to the rapid innovation and development of technologies leading to the increase in application of poly vinyl alcohol fiber market. Chemical industry has become an important part of modern life as they provide basic raw materials for the manufacturing of various products. The major accidents taken place in the chemical industries has forced industries to implement strict safety regulations such as people working in such industries must strictly follow dress code to avoid accidents. The increase in awareness among the people toward the health care has increased the demand for sanitary products.

By Product

Staple is projected to create abundant $ opportunity till 2030

Global Poly Vinyl Alcohol Fiber Market, By Application

The textile segment accounted for a major share in the poly vinyl alcohol fiber market in 2020, owing to the rapid innovation and development of technologies lead to increase in application of poly vinyl alcohol fiber in textile industry. The growing awareness among the people toward healthcare has increased the demand for sanitary products in all walks of life, especially in the case of women, children and in hospitals. China and India are top textile producing countries in the world and are still developing to meet the demand of the costumers across the globe.

By Application

Textile is projected as the most lucrative segment.

Which are the Leading Companies in Poly Vinyl Alcohol Fiber

The key players operating in the global poly vinyl alcohol fiber market report include Mitsubishi Chemical Corporation, Eastman Chemical Company, KURARAY CO., LTD., EI du Pont de Nemours and Company, BouLing Chemical Co., Limited, Sinopec Sichuan Vinylon, MiniFIBERS, Inc., UNITIKA LTD., Nycon, Hunan Xiangwei Co., Ltd., and Inner Mongolia Shuangxin Environment-Friendly Material Co., Ltd. These major companies are adopting a number of strategies such as product launch, merger & acquisition, research, developments in poly vinyl alcohol fiber performance, and others to maintain outsmarting in the market.

What are the Key Benefits For Stakeholders

- This report provides a detailed quantitative analysis of the current poly vinyl alcohol fiber market trends and estimations from 2020 to 2030, which assists to identify the prevailing opportunities.

- An in-depth poly vinyl alcohol fiber market analysis of various regions is anticipated to provide a detailed understanding of the current trends to enable stakeholders formulate region-specific plans.

- A comprehensive analysis of the factors that drive and restrain the growth of the poly vinyl alcohol fiber market is provided.

- Region-wise and country-wise market conditions are comprehensively analyzed in this report.

- The projections in this report are made by analyzing the current trends and future market potential from 2019 to 2026 in terms of value.

- An extensive analysis of various regions provides insights that are expected to allow companies to strategically plan their business moves.

- Key market players within the market are profiled in this report and their strategies are analyzed thoroughly, which help to understand the competitive outlook of the global poly vinyl alcohol fiber market.

Poly Vinyl Alcohol Fiber Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By APPLICATIO |

|

| By Region |

|

| Key Market Players | Bouling Chemical Co. Limited, MiniFIBERS, Inc., Hunan Xiangwei Co., Ltd, Nycon Corporation, Mitsubishi Chemical Corporation, Inner Mongolia Shuangxin Environment-Friendly Material Co., Ltd, Eastman Chemical Company, Dupont De Nemours, Inc., KURARAY CO., LTD., Unitika Ltd. |

Analyst Review

The global Poly Vinyl Alcohol Fiber market is expected to witness increased demand during the forecast period, due to rapidly growing construction, chemical and textile industry throughout the forecast period.

Increasing pollution and increasing global warming gas emissions associated due to the production of poly vinyl alcohol fiber raw materials coupled with volatility of raw material prices are anticipated to hinder the growth of the poly vinyl alcohol fiber market during the forecast period. However, increasing demand for poly vinyl alcohol fiber in textile industry and several end-use applications such as construction, healthcare, water treatment, oil & gas industries, textile, and chemical industries are some of the key factors expected to provide enormous growth opportunities of poly vinyl alcohol fiber market throughout the forecast period. In addition, increase in safety awareness and stringent regulations toward the industrial and commercial facilities, and rapid increase in the development of infrastructure facilities in developing countries are expected to drive the global poly vinyl alcohol fiber market demand throughout the forecast period. The poly vinyl alcohol fiber is mostly used as reinforcement to building materials such as cement, and glass fiber, which are used in the construction industry. In addition to this, growing awareness among the people regarding health care have boosted the demand for sanitary products. Hence, the increase in demand for sanitary products and their advantages are expected to drive the growth of the poly vinyl alcohol fiber market during this forecast period.

The COVID-19 pandemic has negatively impacted the global poly vinyl alcohol fiber market in the chemical industry sector as most of the industries are low in demand for this raw material or shut down due to lack of staff.

Moreover, companies are inheriting merger and acquisition strategies to boost the growth of the poly vinyl alcohol fiber market throughout the forecast period.

Rise in the demand for cement in construction industry, increase in demand for Poly Vinyl Alcohol Fiber in the textile industry are the key factors boosting the poly vinyl alcohol fiber market growth

The expected market value of poly vinyl alcohol fiber by 2030 is US$ 710.3 million

Mitsubishi Chemical Corporation, Eastman Chemical Company, KURARAY CO., LTD., EI du Pont de Nemours and Company, BouLing Chemical Co., Limited, Sinopec Sichuan Vinylon, MiniFIBERS, Inc., UNITIKA LTD., Nycon, Hunan Xiangwei Co., Ltd., and Inner Mongolia Shuangxin Environment-Friendly Material Co., Ltd.

Textile and construction industry is projected to increase the demand for poly vinyl alcohol fiber Market

The poly vinyl alcohol (PVA) fiber market is segmented on the basis of product, application, and region. On the basis of product, poly vinyl alcohol fiber is segmented into staple fibers, filament fibers, and others. The applications covered in the study include textile, construction, non-woven fabrics and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Rapid innovation to overcome restraints and the increasing demand form developing countries is the Main driver of poly vinyl alcohol fiber market

Textile, construction and non-woven fabrics is expected to drive the adoption of poly vinyl alcohol fiber

Emergence of COVID-19 had a negative impact on the growth of the global poly vinyl alcohol fiber market for a short period.

Loading Table Of Content...