Polyamide Market Research, 2034

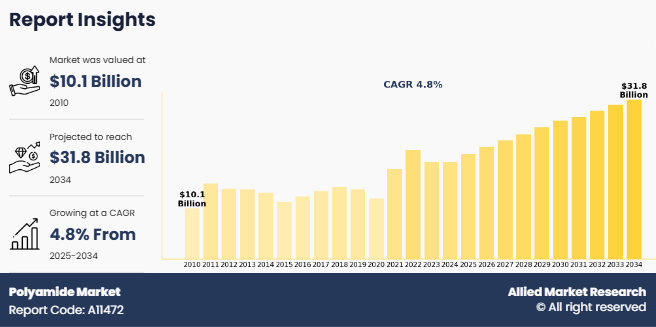

The global polyamide market was valued at $10.1 billion in 2010, and is projected to reach $31.8 billion by 2034, growing at a CAGR of 4.8% from 2025 to 2034.The demand for the polyamide market is driven by the rising consumption of lightweight, durable, and high-performance materials across diverse industries such as automotive, electronics, construction, textiles, and packaging. Rapid industrialization and urbanization, especially in emerging economies, are increasing the need for polyamide-based products used in infrastructure development, consumer goods, and advanced mobility solutions. As a result, this is expected to drive the demand for the polyamide market during the forecast period. As a result, there is drive the demand for polyamide market in the forecast period.

Introduction

Polyamides, commonly referred to as nylons, are a class of high-performance engineering thermoplastics known for their robust mechanical properties, superior chemical resistance, and excellent thermal stability. These materials are synthesized through the polymerization of monomers containing recurring amide groups and are widely utilized in diverse industrial applications due to their structural integrity, lightweight nature, and adaptability to demanding environments. Key polyamide types include PA6, PA66, PA11, PA12, and specialty grades such as PA46, PA6/12, PA610, and transparent polyamides. They are available in multiple forms including fibers, films, and molded compounds, enabling their use in industries such as automotive, electrical and electronics, textiles, packaging, medical devices, and consumer goods.

Key Takeaways

The global polyamide market has been analyzed in terms of value ($million). The analysis in the report is provided on the basis of type, product type, application, 4 major regions, and more than 15 countries.

The global polyamide market report includes a detailed study covering underlying factors influencing polyamide industry opportunities and trends.

The Key players in the polyamide market include BASF SE, DuPont, Solvay S.A., Arkema, SABIC, LG Chem, Domo Chemicals Corporation, Evonik Industries AG, UBE Corporation, Mitsubishi Chemical Group Corporation.

The report facilitates strategy planning and polyamide industry dynamics to enhance decision making for existing market players and new entrants entering the alternators industry.

Countries such as China, the U.S., Canada, Germany, and Brazil hold a significant share in the global polyamide market.

Market Dynamics

The significance of polyamides in modern manufacturing lies in their balance of performance and processability. These materials offer exceptional tensile strength, fatigue resistance, impact strength, and wear resistance. They are capable of withstanding high thermal loads while maintaining dimensional stability and long service life. As such, polyamides serve as reliable substitutes for metals in automotive structural components and are favored for high-load mechanical parts, heat-resistant electronic enclosures, and flexible yet durable fibers in the textile industry.

One of the most widely used polyamides, PA6 (polycaprolactam), finds applications in automotive components, industrial machinery, monofilaments, and textiles due to its easy processability and affordability. PA66 offers higher melting points and superior mechanical properties, making it a staple in demanding automotive and electrical applications. Bio-based variants like PA11 and partially bio-based PA610 and PA612 have been developed to address environmental concerns and reduce dependence on petroleum feedstocks. These materials exhibit comparable performance to conventional nylons while contributing to carbon footprint reduction.

Over the past decade, the polyamide market has undergone a transformation driven by technological advancements, sustainability mandates, and evolving application requirements. Automotive industry dynamics have particularly influenced market direction. With governments and manufacturers pursuing electrification, weight reduction, and emissions control, polyamides are now integral to vehicle light-weighting strategies and thermal management systems. Components such as engine covers, air intake manifolds, radiator end tanks, battery modules, brake hoses, fuel lines, and cable jackets are increasingly fabricated from PA6, PA66, PA11, and PA12. Flame-retardant and heat-stabilized polyamides are also crucial in meeting stringent safety norms in electric vehicle (EV) battery enclosures and charging infrastructure.

Segments Overview

The polyamide market is segmented into polyamide type, end-use industry, and region. On the basis of type, the market is divided into polyamide (PA66), polyamide (PA12), polyamide (PA6), polyamide (PA11), and others. On the basis of end-use industry, the global polyamide market is categorized into textile, packaging material, electrical insulation, automotive, pharmaceutical, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the market is divided into polyamide (PA66), polyamide (PA12), polyamide (PA6), polyamide (PA11), and others. The polyamide (PA6), segment accounted for more than three-fifths of the polyamide market share in 2024 and is expected to maintain its dominance during the forecast period. This dominance is attributed to its cost-effectiveness, excellent mechanical properties, and widespread applications across automotive, electrical, and industrial sectors

On the basis of end-use industry, the global polyamide market is categorized into textile, packaging material, electrical insulation, automotive, pharmaceutical, and others. The textile segment accounted for less than half of the polyamide market size in 2024 and is expected to maintain its dominance during the forecast period driven by the widespread use of polyamide fibers in apparel, sportswear, and industrial fabrics due to their strength, elasticity, and abrasion resistance.

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region accounted for Asia-Pacific of the polyamide market share in 2024 and is expected to maintain its dominance during the forecast period.This growth is primarily driven by rapid industrialization, expanding automotive and textile industries, and increasing demand for consumer electronics in countries such as China, India, Japan, and South Korea.

Competitive Analysis

Key players in the polyamide market includes BASF SE, DuPont, Solvay S.A., Arkema, SABIC, LG Chem, Domo Chemicals Corporation, Evonik Industries AG, UBE Corporation, Mitsubishi Chemical Group Corporation.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the polyamide market analysis from 2010 to 2034 to identify the prevailing polyamide market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the polyamide market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global polyamide market trends, key players, market segments, application areas, and polyamide market growth strategies.

Polyamide Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 31.8 billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2010 - 2034 |

| Report Pages | 388 |

| By Polyamide Type |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Mitsubishi Chemical Group Corporation, SABIC, Domo Chemicals Corporation, DuPont, Evonik Industries AG, BASF SE, LG Chem, Arkema, Solvay S.A., UBE Corporation |

Analyst Review

The polyamide market is witnessing a transformative phase, where traditional performance metrics are now supplemented by sustainability goals, digitalization, and material innovation. As a C-level executive evaluating the strategic direction for investment or product development in the polyamide value chain, several key perspectives emerge.

First, the shift toward electric vehicles (EVs) and green mobility is redefining material selection criteria in the automotive industry. Polyamides have long been recognized for their high strength-to-weight ratio, thermal stability, and fatigue resistance, but their role is now expanding. With the rise in battery electric vehicles, hybrid drivetrains, and compact electronic components, the demand for flame-retardant, electrically insulative, and thermally conductive grades of polyamide is rising. CXOs from automotive OEMs and Tier 1 suppliers increasingly seek collaborations with compounders and resin producers to co-develop customized formulations for under-the-hood, battery, and connector applications.

Second, there is a clear push from regulatory bodies and global consumer brands toward bio-based and recycled polymers. Polyamide 11 and partially bio-based variants such as PA610 and PA410 are not just environmental choices but strategic levers for competitive differentiation. Investment in feedstock sustainability, carbon footprint reduction, and circular economy infrastructure is now a board-level priority. Executives in chemicals and materials companies must align R&D portfolios with ESG commitments, while ensuring the technical performance of these greener alternatives meets or exceeds that of traditional materials.

Third, digital transformation in manufacturing and supply chains is reshaping how polyamide-based products are designed, produced, and distributed. With the rise of 3D printing, particularly in aerospace and medical sectors, polyamides such as PA12 and glass-filled PA grades are enabling decentralized, agile production models. CXOs must consider the integration of additive manufacturing into their long-term strategy, balancing cost, customization, and speed-to-market advantages with existing production capabilities.

Moreover, customer expectations in end-use sectors such as packaging, consumer electronics, and medical devices are evolving rapidly. Performance, safety, compliance, and aesthetics must now be delivered alongside sustainability and traceability. For example, food. packaging manufacturers are demanding multilayer polyamide films that are recyclable yet retain oxygen barrier and mechanical strength properties. In healthcare, regulatory compliance and sterilization compatibility of polyamides are critical differentiators.

Finally, from a regional strategy standpoint, Asia-Pacific continues to drive the global demand, while Europe sets the pace in regulatory leadership and innovation in sustainability. North America, with its strong base in high-performance polymers and advanced manufacturing, offers growth opportunities in aerospace, electronics, and healthcare. CXOs must weigh geographic investment decisions carefully, considering talent availability, infrastructure maturity, supply chain resilience, and proximity to key end-user clusters.

Surge in Demand for Lightweight and High-Performance Materials in the Automotive Industry are the upcoming trends of Polyamide Market in the world.

Textiles is the leading application of polyamide market

Asia-Pacific is the largest regional market for Polyamide

The polyamide market was valued at $10.1 billion in 2010 and is estimated to reach $31.8 billion by 2034, exhibiting a CAGR of 4.8% from 2025 to 2034.

BASF SE, DuPont, Solvay S.A., Arkema, SABIC, LG Chem, Domo Chemicals Corporation, Evonik Industries AG, UBE Corporation, Mitsubishi Chemical Group Corporation are the top companies to hold the market share in polyamide

Loading Table Of Content...

Loading Research Methodology...