Polybutylene Adipate Terephthalate Market Overview

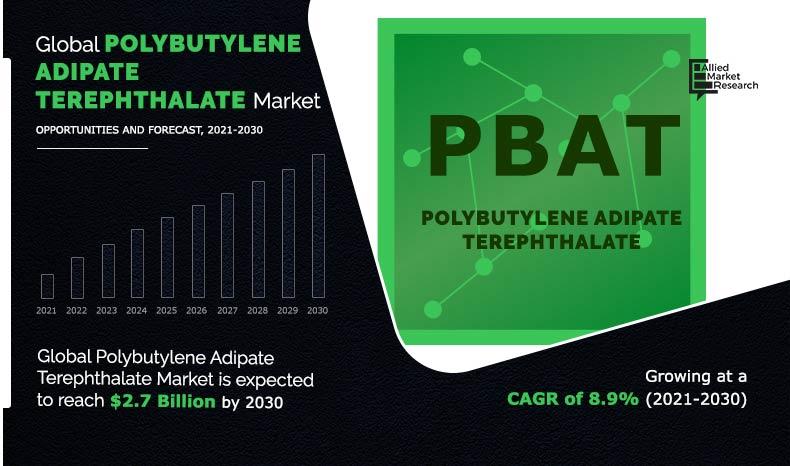

The global polybutylene adipate terephthalate market size was valued at $1.1 billion in 2020, and is expected to reach $2.7 billion by 2030, registering a CAGR of 8.9% from 2021 to 2030.

Polybutylene adipate terephthalate (PBAT) is copolymer of adipate acid and is a class of biodegradable plastic. It is an elastomeric polymer known for improving mechanical properties. PBAT is highly flexible and tough, used in wide range of applications including packaging materials, hygiene products, biomedical fields, and industrial composting.

Demand for PBAT is mainly driven by its adoption as a suitable substitute to low density Polyethylene (LDPE). PBAT shows similar properties of LDPE including flexibility and resilience making it preferable in packaging bags. Some of the basic factors driving the growth for PBAT include favorable government policies toward green procurement, rise in use of biodegradable plastic in packaging, and increase in consumer preference for packaged food. Cling bags used in food packaging, plastic bags used in gardening and agriculture, and water resistance coating adopted in paper cups are manufactured from PBAT due to their zero toxicity and greater biodegradation. Cling bags are majorly in demand due to rise in consumer preference on packaged food, which is ultimately driving the demand for PBAT. However, high production cost and low thermos-mechanical properties of PBAT based plastics restricts the application; thus, negatively affecting the polybutylene adipate terephthalate market growth.

Segment Overview

The polybutylene adipate terephthalate market is segmented into application, and region. By application, the market is classified into packaging & bags, consumer durables, agriculture & horticulture, textiles, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The polybutylene adipate terephthalate market is analyzed and estimated in accordance with the impacts of the drivers, restraints, and market opportunities. The period studied in this report is from 2021 to 2030. The report includes the study of the market with respect to the growth prospects and restraints on the basis of regional analysis. The study includes Porter’s five forces analysis of the industry to determine the impact of suppliers, competitors, new entrants, substitutes, and buyers on the market growth.

Polybutylene adipate terephthalate market, by application

By application, the packaging & bags segment held the largest polybutylene adipate terephthalate market share in 2020. This is attributed to quick decomposition of such plastic bags in a time of 3 to 6 months. In addition, lower carbon footprint compared to petroleum-based plastics makes it a more suitable choice for environment. Moreover, rapid growth of the packaged food & beverages industry in the regions such as Asia-Pacific and Europe are expected to boost the demand for biodegradable plastic products such as polybutylene adipate terephthalate during the analyzed time frame.

By Application

Packaging & Bags is projected as the most lucrative segment.

Polybutylene adipate terephthalate market, by region

Asia-Pacific garnered highest share in the polybutylene adipate terephthalate market in 2020, in terms of revenue, and is anticipated to maintain its dominance throughout the forecast period. This is attributed to key players and huge consumer base in the region.

By Region

Asia-Pacific holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

In addition, rise in awareness towards the use of biodegradable plastics along with increase in government policies to promote the use of bioplastics is anticipated to fuel the demand for polybutylene adipate terephthalate in the region during the forecast period. Rapid urbanization and rise in consumer spending toward online shopping and food & beverages in countries such as India, Japan, Australia, South Korea, and China is further projected to propel the growth of the market in the upcoming years.

Key Polybutylene Adipate Terephthalate Companies

The global market covers in-depth information of the major polybutylene adipate terephthalate industry participants. Some of the major players in the market include Amco Polymer, BASF SE, Chang Chun Group, Cosmos Plastics & Chemicals, Eastman Chemical Company, Far Eastern New Century Corporation, Go Yen Chemical Industrial Co., Ltd., Hangzhou Peijin Chemical Co., Ltd., Jin Hui Zhao Long High-Tech Co., Ltd. and LOTTE Fine Chemical.

Other players operating in the value chain of the global polybutylene adipate terephthalate market are Jiangsu Tories biomaterials co., Ltd., Novamont S.p.A., K.D. Feddersen, Shanxi Junhui Group, Huaian Ruanke Trade Co, Ltd., FillPlas Co. Ltd., and others.

Key Benefits For Stakeholders

The report provides an extensive qualitative and quantitative analysis of the current polybutylene adipate terephthalate market trends and future estimations of the global market from 2021 to 2030 to determine the prevailing opportunities.

A comprehensive polybutylene adipate terephthalate market analysis of the factors that drive and restrict the market growth is provided.

Estimations and polybutylene adipate terephthalate market forecast is based on factors impacting the market growth, in terms of value.

Profiles of leading players operating in the market are provided to understand the global competitive scenario.

The report provides extensive qualitative insights on the significant segments and regions exhibiting favorable market growth.

Polybutylene Adipate Terephthalate Market Report Highlights

| Aspects | Details |

| By Application |

|

| By Region |

|

| Key Market Players | GO YEN CHEMICAL INDUSTRIAL CO., LTD., FAR EASTERN NEW CENTURY CORPORATION, JIN HUI ZHAO LONG HIGH-TECH CO., LTD., EASTMAN CHEMICAL COMPANY, COSMOS PLASTICS & CHEMICALS., LOTTE FINE CHEMICAL, CHANG CHUN GROUP, AMCO POLYMERS, BASF SE, HANGZHOU PEIJIN CHEMICAL CO., LTD. |

Analyst Review

Polybutylene adipate terephthalate is considered as the major innovation from renewable material as the world is discovering alternatives to single use plastic products. It is being adopted as a perfect substitute to single use plastic as this plastic decomposes after a definite period of time by causing no harm to environment.

Increase in number of manufacturers, favorable government policies for the adoption of sustainable and biodegradable products, and rise in availability of renewable feedstock such as starch and PLA boost the growth of the PBAT market. Rise in consumer acceptance due to various awareness and education programs regarding biobased plastic products is providing a new perspective to eliminate usage of conventional plastic. However, higher price of PBAT as compared to traditional plastic coupled with low performance standards hamper the polybutylene adipate terephthalate market growth in the upcoming years.

At present, the use of PBAT based biodegradable plastic in packaging & bags is the highest valued segment and is projected to remain the same through the forecast period on account of its favorable properties. The production of bioplastics is highest in Asia-Pacific owing to the huge availability of renewable feedstock. Despite being biodegradable, one of the key advantages is its properties are similar to the conventional plastic, which makes biodegradable plastic a perfect substitute to conventional plastic.

Eco-friendly nature and rise in consumer adoption of PBAT based biodegradable plastics are key factors drives the polybutylene adipate terephthalate market growth during the forecast period.

In terms of revenue, the market size of polybutylene adipate terephthalate market was valued at $1.1 billion in 2020 and is anticipated to reach $2.7 billion by 2030, growing at CAGR of 8.9% from 2021 to 2030.

Amco Polymer, BASF SE, Chang Chun Group, Cosmos Plastics & Chemicals, Eastman Chemical Company, Far Eastern New Century Corporation, Go Yen Chemical Industrial Co., Ltd., Hangzhou Peijin Chemical Co., Ltd., Jin Hui Zhao Long High-Tech Co., Ltd. and LOTTE Fine Chemical are the most established players of the global polybutylene adipate terephthalate market.

Packaging & bags and consumer durables industries are projected to increase the demand for polybutylene adipate terephthalate Market.

Segments covered in polybutylene adipate terephthalate Market report are application and region.

Rise in demand for PBAT from packaging and bags applications is anticipated to be the main driver of polybutylene adipate terephthalate market.

Packaging & bags and consumer durables applications are expected to drive the adoption of polybutylene adipate terephthalate.

Loading Table Of Content...