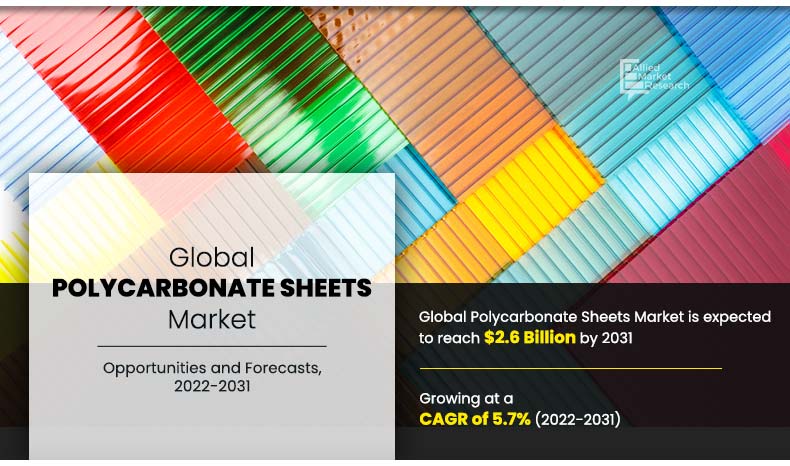

Polycarbonate Sheets Market Overview

The global polycarbonate sheets market size was valued at $1.5 billion in 2021, and is projected to reach $2.6 billion by 2031, registering a CAGR of 5.7% from 2022 to 2031.

Polycarbonate sheets are durable, lightweight, and transparent thermoplastic materials known for their high impact resistance and excellent optical clarity. These sheets are made from polycarbonate resin, which offers a unique combination of strength, flexibility, and heat resistance, making them an ideal alternative to glass in various applications. Polycarbonate sheets are commonly used in construction, automotive, electronics, and safety equipment industries due to their ability to withstand extreme conditions without cracking or breaking. They also provide excellent insulation properties, UV protection when coated, and can be easily molded or cut to fit specific needs, making them a versatile material for both industrial and commercial uses.

Market Dynamics

The rising demand in the construction industry is a major driver for the growth of the polycarbonate sheets market. As modern architectural designs increasingly prioritize energy efficiency, durability, and aesthetic appeal, polycarbonate sheets have become a preferred material due to their excellent strength-to-weight ratio, impact resistance, and thermal insulation properties. These sheets are widely used in roofing, skylights, wall panels, and greenhouses, offering a cost-effective and lightweight alternative to traditional glass. Moreover, their ability to withstand extreme weather conditions and provide UV protection makes them ideal for both residential and commercial construction projects. The rapid pace of urbanization and infrastructure development, particularly in emerging economies, further boosts the demand for polycarbonate sheets in the global construction sector.

Polycarbonate sheets are transparent thermoplastic sheets. These are highly tough in nature with moisture-absorbing as well as flame-retardant, chemical resistant, and impact-resistant properties. Polycarbonate sheets are used in numerous applications such as window glazing, medical equipment, food processing, skylights, and roofs. Further, these sheets are used in various industries such as automotive, building & construction, and electrical & electronics. Their properties such as high strength, optical clarity, thermal stability, and exceptional dimensional stability make them material of choice in production of electric components, riot shields, headlamp lenses, vandal-proof glazing, baby-feeding bottles, and safety helmets.

Polycarbonate sheets are used to produce a wide range of electrical and hardware accessories. Polycarbonate sheets are promising materials for building sensor components, LCD pieces, switching relays, laptops, mobile phones, cables, CDs, and DVDs, owing to its lightweight and high impact properties. Besides, polycarbonate sheets are used in constructing greenhouse, livestock breeding, and nurseries for plants.

Furthermore, factors driving growth of greenhouses include climate change challenges and high demand for food, owing to increase in population and rise in sustainable farming practices, owing to rapid urbanization. This consequently increases demand for polycarbonate sheets in greenhouse applications. Also, polycarbonates are used in medical devices and processes, such as cardiac surgery, renal dialysis, IV connectors, and surgical instruments. In the medical industry, polycarbonate sheet offers an exceptional combination of rigidity, strength, and toughness that helps prevent potentially life-threatening material failures. In addition, it provides glass-like clarity, a vital characteristic for diagnostic and clinical settings in which visibility of blood, tissues, and other fluids is required.

Demand for polycarbonate sheets is expected to increase in the future, owing to rise in demand for product roofing systems. In addition, growth in the automotive industry is expected to boost the market growth. There is increased use of polycarbonate sheets for producing headlamps, mirrors, and vehicle body parts globally. Furthermore, growth in the construction industry, owing to urbanization and industrialization mainly escalates demand for polycarbonate sheets. These sheets are mainly used for roofing structures, such as sheds, pet enclosures carports, railway stations, schools, stadiums, and bus stops as they provide superior protection against storms & heavy winds and are low maintenance.

Moreover, corrugated polycarbonate sheets are widely used in the packaging industry, owing to their strength & durability as an alternative to paperboards and wooden packaging. Furthermore, manufacturers such as Palram Industries offer SUNTUF corrugated polycarbonate sheets. It is an excellent roofing material and is favored by professionals for noncorrosive industrial structural roofing & siding and by homeowners for various DIY applications, owing to its wide service temperature range and high impact strength. These sheets are available in a wide assortment of colors. Hence such factors are expected to fuel the market growth.However, negative environmental impacts of polycarbonate sheets hamper the steady growth of the market. Nonetheless, growth of the agriculture industry, along with rise in demand from the sector is anticipated to create lucrative opportunities for the polycarbonate sheets market growth.

Segment Overview

The global polycarbonate sheets industry is segmented on the basis of type, end-use industry, and region. By type, the market is classified into solid, multiwall, corrugated, and others. By end use-industry, the market is categorized into building & construction, electrical & electronics, automotive & transportation, aerospace & defense, packaging, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Region wise, Asia-Pacific holds the highest global polycarbonate sheets market share, owing to surge in demand for these sheets in commercial applications in the region.

By Region

Asia-Pacific held a dominant position in 2021 and would continue to maintain the lead over the forecast period.

Global Polycarbonate Sheets Market, by Region

Asia- Pacific occupies the largest part of the polycarbonate sheets market. The market growth in the region is driven by growth in end-use industries. In addition, rise in demand from construction and electronics industries is anticipated to propel the market growth in the coming years.

By Type

Multiwall segment held major share in the global polycarbonate sheets market in 2021

Global Polycarbonate Sheets Market, by Type

The multiwall segment dominated the global polycarbonate sheets market, in terms of revenue, in 2021, owing to its properties such as high impact strength, high clarity, and lightweight. Besides, it is widely used in applications such as canopies, displays, conservatories, roof lights, signage, vertical glazing, swimming pool roofs, insulation, walkways, and others.

By End-use Industry

Electrical and Electronics segment held major share in the global polycarbonate sheets market in 2021

Global Polycarbonate Sheets Market, by End-Use Industry

The electrical & electronics segment held the highest global polycarbonate sheets market size, in 2021, owing to growth of the electronics industry along with growing inclination towards smart homes and smart offices environment in the region. Polycarbonate sheets are a promising material for building sensor components, LCD pieces, switching relays, laptops, mobile phones, cables, CDs, and DVDs, owing to its lightweight and high impact properties.

Major Market Players

The key players profiled in the report include COVESTRO AG; Emco Industrial Plastics; Exolon Group; Jiaxing Innovo Industries Co., Ltd; PALRAM INDUSTRIES LTD.; Polyvalley Technology Co., Ltd.; SABIC; Spolytech; TEIJIN LIMITED; and UVplastic Material Technology Co., Ltd. Other players in the value chain of the polycarbonate sheets market include Suzhou Omay Optical Materials co., Ltd., Gallina, Spartech, Koscon Industrial S.A., ISIK Plastik, Safplast Company, Brett Martin Ltd., and others.

These companies compete for the share of the market through product launch, joint venture, partnership, and expansion of the production capabilities to meet the future demand for the polycarbonate sheets market during the forecast period. For instance, in 2021, Seraphin Group, the parent company of Exolon, acquired Covestro’s European polycarbonate sheets business, which comprises manufacturing units in Belgium and Italy, central management operations, and sales support in Europe. This acquisition has strengthened its polycarbonate sheet business.

Key Benefits for Stakeholders

This report provides a detailed quantitative analysis of the current global polycarbonate sheets market trends and estimations from 2021 to 2031, which assists to identify the prevailing opportunities.

An in-depth analysis of polycarbonate sheets market across the globe is anticipated to provide a detailed understanding of the current trends to enable stakeholders formulate specific plans.

A comprehensive analysis of the factors that drive and restrain the growth of the market is provided.

Region-wise market conditions are comprehensively analyzed in this report.

The projections in this report are made by analyzing the current trends and future market potential from 2022 to 2031 in terms of value.

An extensive analysis of various regions provides insights that are expected to allow companies to strategically plan their business moves.

Key market players within the market are profiled in this report and their strategies are analyzed thoroughly, which help to understand the competitive outlook of the global polycarbonate sheets market.

Polycarbonate Sheets Market Report Highlights

| Aspects | Details |

| By Type |

|

| By End-Use Industry |

|

| By Region |

|

Analyst Review

The polycarbonate sheets market is driven by factors such as wide application scope of polycarbonate sheets and growth in automotive industry across the globe. The polycarbonate sheets are primarily used in various end-use industries including building & construction, electrical & electronics, automotive & transportation, aerospace & defense, and others. The growth is attributed to its exceptional physical and chemical properties such as lightweight, high toughness, high impact strength, chemical & heat resistance, transmittance, UV resistance, and others. However, negative environmental impacts of polycarbonate sheets are anticipated to hamper the market growth.

The Asia-Pacific is the dominating region in the global polycarbonate sheets market. In Asia-Pacific, polycarbonate sheets are majorly consumed in electrical & electronics, automotive, and construction industries, which acts as a key driving force for the market. China, South Korea, and Japan have the presence of established automotive and electrical & electronics sectors. In addition, the demand for polycarbonate sheets increased from the healthcare sector due to the emergence of COVID-19.

Growth of the polycarbonate sheets market is driven by growth in the automotive industry, along with increase in demand from the construction sector for roofing applications, modern building walls, and decoration of commercial building.

The global polycarbonate sheets market was valued at $1,490.6 million in 2021, and is projected to reach $2,597.4 million by 2031, registering a CAGR of 5.7% from 2022 to 2031.

The most established players of the global polycarbonate sheets market include COVESTRO AG; Emco Industrial Plastics; Exolon Group; Jiaxing Innovo Industries Co., Ltd; PALRAM INDUSTRIES LTD.; Polyvalley Technology Co., Ltd.; SABIC; Spolytech; TEIJIN LIMITED; and UVplastic Material Technology Co., Ltd.

Electrical & electronics industry is projected to increase the demand for polycarbonate sheets

Type and end-use industry segments are covered in polycarbonate sheets market report

Growth in automotive industry along with increased demand from the construction sector for roofing application, modern building wall, decoration of commercial building, and others is the main driver of polycarbonate sheets market

Electrical & electronics and aerospace and defense applications are expected to drive the adoption of polycarbonate sheets market

The polycarbonate sheets market witnessed value chain disruption owing to spread of COVID-19 and lockdown in major manufacturing countries. COVID-19 pandemic has led to a decline in demand from myriad end-use industries such as electrical & electronics, building & construction, automotive & transportation, and other industries, which negatively impacted the polycarbonate sheets market globally. However, with the COVID-19 vaccination campaign across the globe and as the economies are getting stable, there is growth in the demand from end-use industries, which in turn is anticipated to augment the demand for polycarbonate sheets worldwide.

Loading Table Of Content...