Polycrystalline Diamond Market Research, 2032

The global polycrystalline diamond market was valued at $900.6 million in 2022, and is projected to reach $1.6 billion by 2032, growing at a CAGR of 6.1% from 2023 to 2032.Polycrystalline diamond (PCD), a synthetic substance, is created when diamond grains are fused together under extreme heat and pressure. PCD has exceptional hardness, wear resistance, and thermal conductivity since it is composed of several diamond crystals joined in a random pattern.

Cutting tools manufactured from polycrystalline diamond blocks are known as PCD tools. Several small diamonds are melted together to form polycrystalline diamonds. Tools made of polycrystalline diamond are used in a variety of procedures, including drilling, grinding, and machining. Small diamonds are a great option for cutting strong materials like steel and titanium, since they are extremely sharp and durable when used in PCD equipment.

One of the key drivers of polycrystalline diamond's rising popularity is its exceptional capabilities in cutting and machining operations. PCD is a synthetic material created by fusing diamond granules under intense pressure and heat. PCD cutting tools are frequently considered the best option for machining difficult-to-machine materials like composites, ceramics, and nonferrous metals due to its exceptional hardness, wear resistance, and thermal conductivity. Another driving factor for PCD is its long tool life. PCD cutting tools can last much longer than conventional cutting tools composed of carbide or high-speed steel, which can decrease tool changeover time and increase production efficiency. PCD tools also produce less tool wear and generate less heat while cutting, which decreases the risk of workpiece damage and increases dimensional accuracy. The rising need for high-precision machining and surface finishing in industries like aerospace, automotive, and medical is leading to an increase in PCD usage. A lot of precision machining applications call for PCD tools to be able to produce high-quality surface finishes with low distortion and burrs. In addition, the use of PCD cutting tools can help reduce manufacturing costs by improving cutting efficiency and reducing scrap rates. All these factors are projected to drive the polycrystalline diamond market growth during the forecast period.

The decline in the oil & gas sector is expected to restrain the growth of the global polycrystalline diamond market. Regular changes in crude oil prices result in significant losses for the operator, which slows down hydrocarbon exploration and is predicted to hamper the global polycrystalline diamond market growth. The fluctuation of oil prices can affect demand for polycrystalline diamond compact (PDC) drill bits, an important use of polycrystalline diamond. Furthermore, the unavailability and cost of raw materials such as natural diamonds and tungsten carbide is expected to have an influence on the manufacturing and price of polycrystalline diamond products. Other factors, including government laws, trade policies, and market rivalry, are also predicted to hinder the growth of the polycrystalline diamond market demand in the upcoming years.

Polycrystalline diamond (PCD) is a profitable investment option for companies in a variety of sectors. PCD is a synthetic material with extraordinary physical and chemical qualities such as hardness, wear resistance, and thermal stability. Because of these characteristics, PCD is a desirable material for a variety of applications such as cutting, drilling, and machining. Another opportunity for PCD market is its ability to improve production procedures and increase efficiency. Compared to standard cutting tools, PCD tools have a longer lifespan, which reduces the need for tool replacement and downtime while also increasing productivity and lowering costs. In addition, PCD tools are capable of cutting and machining hard materials, which reduces the need for frequent tool changes and improves overall machining quality. Construction of both residential and commercial structures is steadily rising globally due to rising infrastructure and population growth. The widespread use of marble and granite in the construction sector is likely to create excellent opportunity for the market growth for polycrystalline diamond. The construction industry is driving the adoption of diamond tools due to the precise size and thickness requirements of the granite stones used in the foundations of tall buildings.

The key players profiled in this report include Sandvik Group, Mapal Kennametal, Preziss Tool, Wirutex, Ceratizat, Sumitomo Electric, Kyocera, Mitsubishi Materials, and Union Tool. Investment and agreement are common strategies followed by major market players. For instance, in May 2022, Sandvik AB, an established manufacturer of metal cutting tools, acquired Preziss, a developer of solutions for aluminum and composite machining.

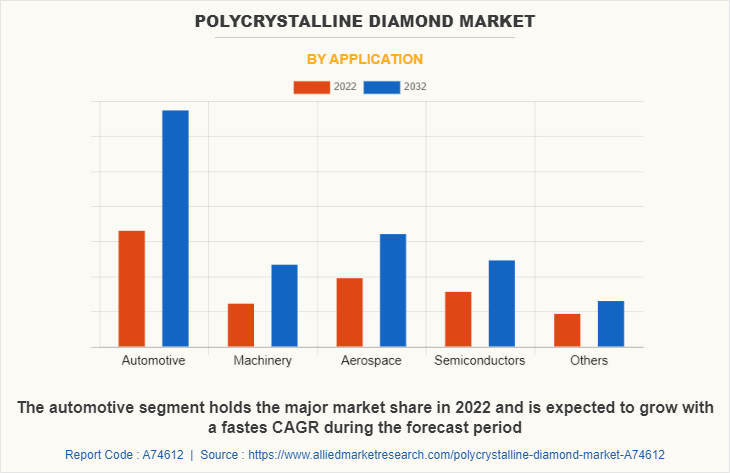

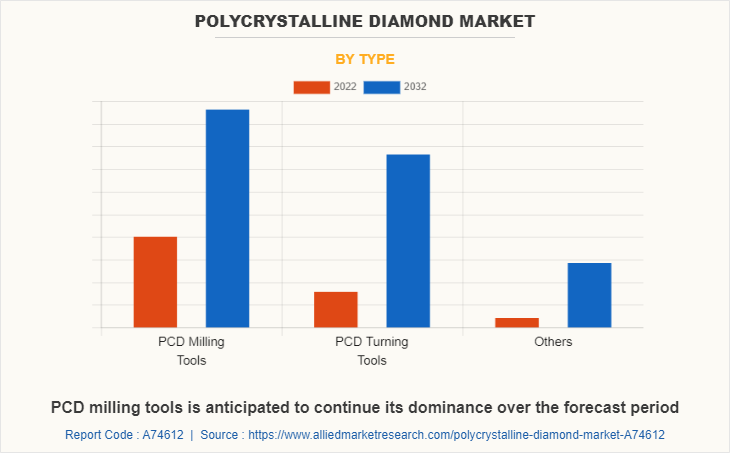

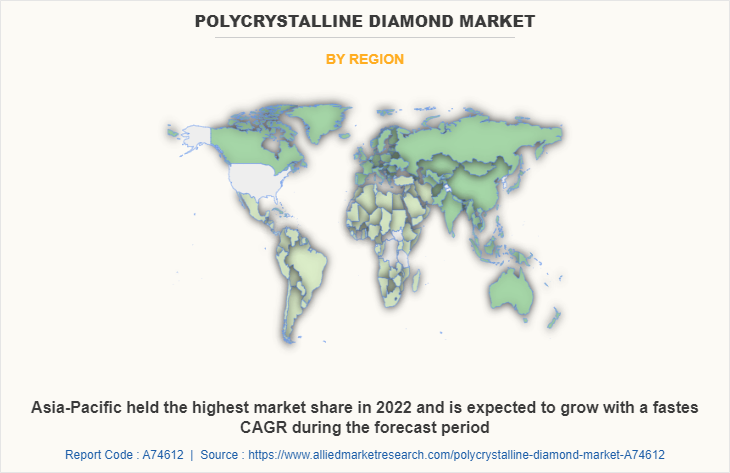

The polycrystalline diamond market is segmented on the basis of type, application, and region. By type, the market is divided into PCD milling tools, PCD turning tools, and others. By application, the market is classified into automotive, machinery, aerospace, semiconductors, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The polycrystalline diamond market is segmented into Application and Type.

By application, the automotive sub-segment dominated the global polycrystalline diamond market share in 2022. The automotive industry is one of the biggest and most demanding industries, thus there are high expectations for dependability, effectiveness, and quality. Polycrystalline diamond (PCD), which has a number of benefits over traditional materials, had a considerable use in the automotive sector. One of PCD's main advantages in the automotive sector is its durability, which makes it perfect for cutting composites, carbon fiber, and other high-strength materials utilized in contemporary car designs. In addition, PCD has a high thermal conductivity, which increases dimensional accuracy and minimizes thermal damage to the work by allowing heat generated during the machining process to be removed more quickly.

By type, the PCD milling tools sub-segment dominated the market in 2022. Popularity of polycrystalline diamond (PCD) milling tools has increased in the machining industry due to its better attributes and advantages over other types of tools. One of the primary benefits of adopting PCD milling tools is their high wear resistance and strength. PCD tools may retain their cutting edge for longer than standard carbide or ceramic tools, reducing the need for frequent tool changes and increasing productivity. In addition, PCD milling tools provide quicker machining speeds and feed rates, resulting in shorter cycle times and more efficiency. Due to the excellent thermal conductivity of PCD, heat generated during the cutting process may be dissipated more rapidly, reducing the risk of thermal damage to the workpiece and improving dimensional accuracy. These are predicted to be the major factors affecting the polycrystalline diamond market size during the forecast period.

By region, Asia-Pacific dominated the global market in 2022 and is projected to be the fastest-growing region during the forecast period. In Asia-Pacific, demand for polycrystalline diamonds (PCD) has dramatically increased in recent years. This increase is due to the region's rapid industrialization and development of manufacturing businesses. The electronics, aerospace, and automotive industries in Asia-Pacific have shown a significant preference for PCD tools and components because of its superior performance, longer lifespan, and cost-effectiveness. Due to the favorable PCD manufacturing environment in the region, which includes the accessibility of qualified workers and reasonably priced production techniques, local PCD enterprises have developed. The increase in need for high-quality products and the desire to follow stringent industry standards have both contributed to an increase in the use of PCD tools and components in the region.

Impact of COVID-19 on the Global Polycrystalline Diamond Industry

- The COVID-19 pandemic negatively impacted various industries such as automotive that has led to a drastic decline in automotive sales, impacting the demand for raw materials and the ability of companies to manufacture and distribute polycrystalline diamond products.

- The pandemic led to reduced demand for polycrystalline diamond products in some industries, particularly in the automotive and aerospace sectors. This has impacted the demand for polycrystalline diamond products used in these industries, such as cutting tools for the aerospace industry.

- The global crisis also opened up new possibilities for the utilization of polycrystalline diamond in sectors such as electronic devices and medical care. For instance, polycrystalline diamond is utilized in the production of electronic parts and healthcare equipment, both of which are in higher demand as a result of the pandemic.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the polycrystalline diamond market analysis from 2022 to 2032 to identify the prevailing polycrystalline diamond market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the polycrystalline diamond market segmentation assists to determine the prevailing polycrystalline diamond market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global polycrystalline diamond market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global polycrystalline diamond market trends, key players, market segments, application areas, and market growth strategies.

Polycrystalline Diamond Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.6 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 280 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Sumitomo Electric, Mitsubishi Materials, Preziss Tool, Kyocera, Union Tool, Ceratizat, kennametal, Wirutex, Sandvik Group, mapal |

The need for diamond tools in the stone processing sector is expected to increase as a result of increasing urbanization, government spending, investment, and consumer spending, which will accelerate the development of infrastructure for the building and construction industry. The global shift towards more advanced automotive industry has led to an increase in the demand for diamond tools. Diamond tool exports and imports have both grown significantly over time and is estimated to generate excellent opportunities in the polycrystalline diamond market.

The major growth strategies adopted by polycrystalline diamond market players are investment and agreement.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global polycrystalline diamond market from 2022 to 2032 to determine the prevailing opportunities.

Increasing adoption of inorganic strategies and rising technological advancement are the major trends in market.

PCD milling tools sub-segment of the type acquired the maximum share of the global polycrystalline diamond market in 2022.

The automotive and aerospace industries are the major customers in the global polycrystalline diamond market.

Asia-Pacific will provide more business opportunities for the global polycrystalline diamond market in the future.

Sandvik Group, Mapal, Kennametal, Preziss Tool, Wirutex, Ceratizat, Sumitomo Electric, Kyocera, Mitsubishi Materials, and Union Tool are the major players in the polycrystalline diamond market.

Loading Table Of Content...

Loading Research Methodology...