Polyethylene Terephthalate (PET) Market Overview

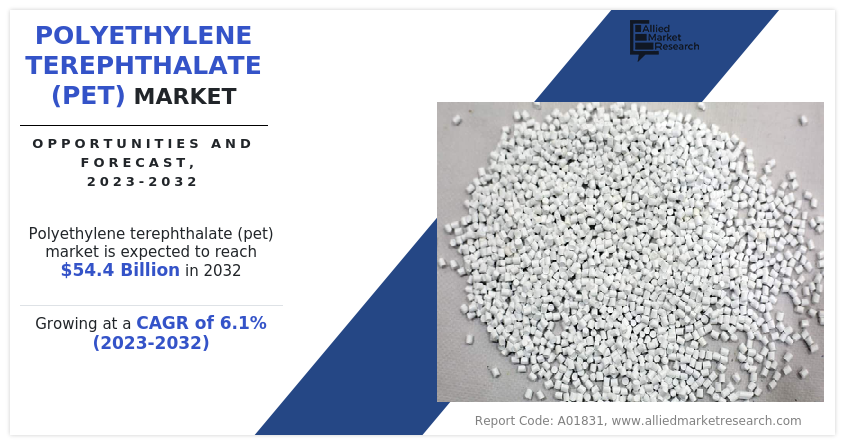

The global polyethylene terephthalate market size was valued at $30.3 billion in 2022, and is projected to reach $54.4 billion by 2032, growing at a CAGR of 6.1% from 2023 to 2032.

PET is utilized in the medical field. In recent years, the demand for PET-based materials that are stable and durable for antimicrobial property coatings has increased owing to the surge in nosocomial infections and novel drug-resisting bacteria. Besides, PET can be utilized as a plasticizer for the production of other products. The polymeric plasticizer is obtained from PET plastic waste to further make nitrile rubber and rubber sheets of nitrile-PVC via alcoholysis depolymerization.

Key Takeaways

- The polyethylene terephthalate market is highly fragmented, with several players including BASF SE, DSM, DuPont, Indorama Ventures Public Company Limited, LANXESS, LOTTE Chemical CORPORATION, LyondellBasell Industries Holdings B.V., NAN YA PLASTICS CORPORATION, RTP Company, and SABIC.

- More than 5,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study covers nearly 20 countries. The segment analysis of each country in terms of value and volume during the forecast period 2022-2032 is covered in the polyethylene terephthalate market report.

Introduction

Polyethylene terephthalate is also known as PET/PETE and is the most common thermoplastic polymer resin in the polyester family. It is produced by combining raw materials such as monoethylene glycol and purified terephthalic acid. It is used in thermoforming applications such as in fibers for clothing, containers for liquids and foods, and in combination with glass fiber for engineering resins. It is widely used for the formation of plastic bottles, which are increasingly adopted across the food & beverage industry, owing to its excellent water and moisture barrier material properties. PET is produced from ethylene glycol, which is usually called monoethylene glycol (MEG). It is made from a combination of MEG and dimethyl terephthalate (DMT) (C6H4(CO2CH3)2) but mostly terephthalic acid.

Market Dynamics

Growing demand for packaged beverages is expected to drive the growth of the polyethylene terephthalate market. One of the key advantages of PET in beverage packaging is its lightweight nature, which significantly reduces transportation costs and carbon footprint compared to traditional materials like glass or metal. Furthermore, PET bottles are shatter-resistant, ensuring consumer safety during handling and transportation. These features have made PET the default material for single-use beverage bottles globally. In May 2025, Coca-Cola Europacific Partners (CCEP) invested $75 million in its Richlands plant in Brisbane, Australia, to meet the growing demand for energy drinks like Monster. The facility now features a canning line capable of producing 120,000 cans per hour. Additionally, PET’s ability to maintain carbonation and protect the beverage’s flavor integrity over time has made it highly suitable for packaging soft drinks. The material can also be easily molded into various shapes and sizes, allowing brands to differentiate their products visually on retail shelves.

However, environmental concerns and plastic bans are expected to hamper the growth of the packaged beverages market. Environmental concerns and the rising momentum against single-use plastics present a significant restraint on the growth of the Polyethylene Terephthalate (PET) market. Over the past decade, public awareness of plastic pollution, particularly marine litter and landfill overflow, has intensified. PET, while recyclable, is still a major contributor to plastic waste when not properly managed. This has led to growing criticism and regulatory pressure on its use, particularly in single-use formats such as water bottles and food packaging. In 2022, Tetra Pak invested $2.5 million in a new cardboard recycling facility, aiming to process 8,000 tons of used beverage cartons annually by 2023 a clear sign of the industry pivoting towards sustainable packaging in response to environmental concerns and regulatory pressure.

Moreover, the rising adoption of recycled PET (rPET) is expected to offer lucrative opportunities in the packaged beverages market. As environmental sustainability becomes a central concern for both consumers and regulators, the shift toward circular economy practices intensifies. One of the most promising developments in this space is bottle-to-bottle recycling, where post-consumer PET bottles are collected, processed, and reused to manufacture new containers. This closed-loop recycling approach not only reduces the environmental footprint but also decreases reliance on virgin petrochemical-based raw materials. The Single-Use Plastics Directive (SUPD), effective from January 2025, mandates that PET beverage bottles contain at least 25% recycled content. While this has bolstered rPET demand, challenges persist due to the higher cost of recycled materials compared to virgin PET and uncertainties regarding enforcement mechanisms.

Segment Overview

The polyethylene terephthalate market is segmented on the basis of type, application, and region. By type, the market is segmented into virgin and recycled. By application, the market is classified into packaging, automotive, construction, medical, and others. By region, the polyethylene terephthalate market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Polyethylene Terephthalate (PET) Market By Region

On the basis of region, Asia-Pacific dominated the polyethylene terephthalate market in 2022. Polyethylene terephthalate (PET) plays an important role in the economic and industrial fabric of Asia-Pacific countries, with its usage driven by surging demand across packaging, textiles, and consumer goods sectors. As a lightweight, durable, and recyclable polymer, PET is extensively used in the packaging industry for beverage bottles, food containers, and pharmaceutical products. Countries like China and India lead the region in PET consumption, supported by their expanding middle-class populations, rapid urbanization, and increasing disposable incomes, which are fueling demand for packaged foods and bottled drinks. In December 2024, India's PET recycling industry, the largest globally by capacity, has attracted investments exceeding (₹10,000 crore) $1.2 billion over the past three years, with plans to triple this amount. This capital infusion aims to enhance recycling capacities and promote the use of recycled PET (rPET) in packaging, thereby reducing plastic waste and carbon emissions.

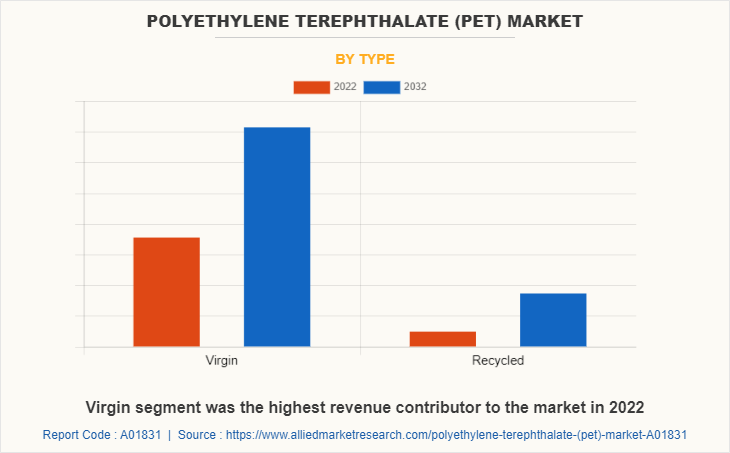

Polyethylene Terephthalate (PET) Market By Type

On the basis of type, the virgin segment dominated the global polyethylene terephthalate market in 2022. Virgin polyethylene terephthalate (PET) is the pure, non-recycled form of PET produced from petrochemical feedstocks primarily purified terephthalic acid (PTA) and monoethylene glycol (MEG). Virgin PET is also utilized in the textile industry, where it is extruded into fibers known as polyester. These fibers are widely employed in apparel, home furnishings (like curtains and upholstery), and industrial applications such as conveyor belts and safety belts. In March 2025, India's Food Safety and Standards Authority (FSSAI) revised regulations to permit the use of recycled PET in food contact materials, provided they meet specific safety standards. This move aims to promote recycling and reduce reliance on virgin PET in food packaging.

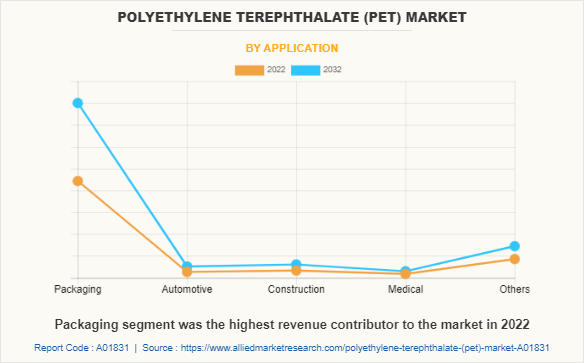

Polyethylene Terephthalate (PET) Market By Application

On the basis of application, the packaging segment dominated the global polyethylene terephthalate industry in 2022. In the packaging industry, PET is predominantly used for bottling beverages such as water, soft drinks, juices, and edible oils, thanks to its ability to maintain product freshness and prevent flavor contamination. Additionally, PET is favored for packaging food items including ready-to-eat meals, fruits, and snacks as it can be easily thermoformed into rigid containers or flexible films. In November 2024, a consortium including Indorama Ventures, Suntory, and others launched the world's first bio-PET bottle derived from used cooking oil packaging. This initiative aims to reduce CO₂ emissions and promote sustainable packaging solutions.

Competitive Analysis

The major key players operating in the polyethylene terephthalate market include BASF SE, DSM, DuPont, Indorama Ventures Public Company Limited, LANXESS, LOTTE Chemical CORPORATION, LyondellBasell Industries Holdings B.V., NAN YA PLASTICS CORPORATION, RTP Company, and SABIC. These players have adopted several strategies to drive the growth of the polyethylene terephthalate industry.

Recent Key Developments in the Polyethylene Terephthalate Market

In May 2024, Pact Collective and Eastman announced the qualification of clean, multicolor polyethylene terephthalate (PET) waste as feedstock for Eastman’s methanolysis technology. This innovative process addresses the recycling challenges posed by multicolored PET, which is often unsuitable for mechanical recycling. The collaboration aims to convert this waste into high-quality copolyesters and PET for the beauty industry, promoting sustainability and reducing reliance on less eco-friendly disposal methods. This initiative represents a significant step toward a circular economy in beauty packaging.

In April 2023, SABIC introduced its new LNP ELCRIN WF0051iQ compound, enhancing sustainability in the electrical industry by incorporating post-consumer polyethylene terephthalate (PET) water bottles. This innovative compound features thin-wall, non-brominated/non-chlorinated flame retardance and contributes to SABIC's goal of diverting over 400 million PET bottles from landfills. The compound reduces the carbon footprint by 11% compared to traditional fossil-based resins, showcasing SABIC's commitment to chemical upcycling and sustainable practices in manufacturing electrical components and medical devices.

In August 2023, Indorama Ventures expanded its PET recycling facility in Brazil, aiming to process up to 50 billion bottles annually. In 2022, the company also launched a PET recycling plant in the Philippines in partnership with Coca-Cola Beverages Philippines.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the polyethylene terephthalate market analysis from 2022 to 2032 to identify the prevailing polyethylene terephthalate market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the polyethylene terephthalate market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global polyethylene terephthalate market trends, key players, market segments, application areas, and market growth strategies.

Polyethylene Terephthalate (PET) Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 54.4 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 283 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | NAN YA PLASTICS CORPORATION, BASF SE, DSM, LANXESS, RTP Company, SABIC, DuPont, Indorama Ventures Public Company Limited, LyondellBasell Industries Holdings B.V., LOTTE Chemical CORPORATION |

Analyst Review

According to the opinions of various CXOs of leading companies, the polyethylene terephthalate market is expected to witness increased demand during the forecast period. Polyethylene terephthalate is a strong and stiff synthetic fiber, which belongs to the polyester family of polymers. PET has several applications in packaging, electrical & electronics, consumer goods, automotive, and others and is blow molded into disposable bottles, spun into fibers for fabrics, and extruded into magnetic recording tape and photographic film.

High demand from packaging and electrical & electronics application segments boosts the growth of the market. Moreover, an increase in demand from developing countries, such as China and India, owing to rapid urbanization and a rise in consumer spending capabilities, drives global market growth.

The European PET market offers numerous opportunities for the manufacturers, owing to enhanced production of PET resins in Germany, France, Russia, and the UK and an increase in the number of manufacturers. In addition, growth in demand for efficient and cost-effective packaging materials and a rise in disposable income in developing economies, such as Poland and the Netherlands, drive the European market. Asia-Pacific is estimated to account for the largest market share, followed by Europe.

The polyethylene terephthalate market valued for $30.3 billion in 2022 and is estimated to reach $54.4 billion by 2032, exhibiting a CAGR of 6.1% from 2023 to 2032

Surge in demand from packaging industry is the key driver for Polyethylene Terephthalate Market.

Packaging is the leading application of Polyethylene Terephthalate Market.

Asia-Pacific is the largest regional market for Polyethylene Terephthalate.

the top companies to hold the market share in Polyethylene Terephthalate include BASF SE, DSM, DuPont, Indorama Ventures Public Company Limited, LANXESS, LOTTE Chemical CORPORATION, LyondellBasell Industries Holdings B.V., NAN YA PLASTICS CORPORATION, RTP Company, and SABIC.

Loading Table Of Content...

Loading Research Methodology...