Polysulfone Market Research, 2031

The global polysulfone market was valued at $2.1 billion in 2021, and is projected to reach $3.4 billion by 2031, growing at a CAGR of 5.1% from 2022 to 2031.

Report key highlighters

- Quantitative information mentioned in the global polysulfone market includes the market numbers in terms of value (USD Million) and volume (Tons) with respect to different segments, pricing analysis, annual growth rate, CAGR (2022-31), and growth analysis.

- The analysis in the report is provided based on type, grade, application, and end-use industry. The study will also contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter's Five Force Analysis, key regulations across the region, and value chain analysis.

- A few companies, including Asahi Kasei Medical Co., Ltd., BASF SE, Ensinger, PEXCO, Polymer Industries, RTP Company, SABIC, Solvay S.A., Toray Medical Co., Ltd., Trident Plastics Inc., hold a large proportion of the polysulfone market.

- This report makes it easier for existing market players and new entrants to the polysulfone business to plan their strategies and understand the dynamics of the industry, which ultimately helps them make better decisions.

Polysulfone (PSU) is a transparent thermoplastic polymer that has high-temperature resistance, good mechanical properties, and good chemical resistance. It belongs to the sulfone polymer family. It can be manufactured using a variety of methods, including injection molding, extrusion, thermoforming, and blow molding. It is used in applications that require a combination of high strength, heat resistance, and chemical resistance. This includes applications in the automotive, aerospace, and electronics industries. In addition to that, polysulfone is used in medical devices and food processing equipment.

Polysulfone has high heat resistance, with a glass transition temperature of around 180°C to 250°C. It can withstand exposure to high temperatures without degrading or losing its mechanical properties. Moreover, it is a transparent thermoplastic polymer, a polymeric material for applications where visual inspection is important. Polysulfone is commonly used in the production of dialysis membranes for blood dialysis machines.

Polysulfone membranes in blood dialysis machines are subject to repeated cycles of cleaning, disinfection, and sterilization to maintain their effectiveness and ensure patient safety. Polysulfone is highly resistant to degradation and can withstand these repeated sterilization cycles without affecting its properties, making it ideal for this application. According to the National Kidney Foundation, over 2 million people worldwide currently receive treatment with dialysis, which boosts the growth of the market.

In addition, polysulfone is used in applications that require high-performance materials, such as aerospace and automotive components, electronic parts, and medical devices. The demand for high-performance materials is driven by the need for better efficiency, reliability, and safety. All these factors have escalated the demand for polysulfone.

However, polysulfone has a high melting temperature that is over 500 °C, which makes it challenging to process using traditional methods such as injection molding. The processing difficulties can increase production costs and limit its use in some applications. Polysulfone has poor weathering ability. It is susceptible to degradation due to its sensitivity to UV radiation and moisture. UV radiation can cause the material to discolor and become brittle, while moisture can lead to hydrolysis and degradation of the polymer chains, which limits its use in outdoor applications or environments with exposure to UV radiation and moisture. All these factors allow consumers to choose alternatives over polysulfone that hampers the market growth.

The COVID-19 pandemic disrupted global supply chains, which could lead to shortages of raw materials and delay in production. This resulted in higher costs and longer lead times for polysulfone products. Lockdowns and restrictions imposed in many countries reduced industrial activity, resulting in a decrease in the production of some materials. This had an impact on the production and demand for polysulfone materials.

On the other hand, the pandemic caused a shift in demand for certain products, such as a higher demand for medical devices and personal protective equipment (PPE). Polysulfone is commonly used in the production of medical equipment such as dialysis membranes, blood oxygenators, and other medical devices. Therefore, the demand for polysulfone in the healthcare industry increased during the pandemic and remains high in the post-COVID-19 era.

Segmental Overview

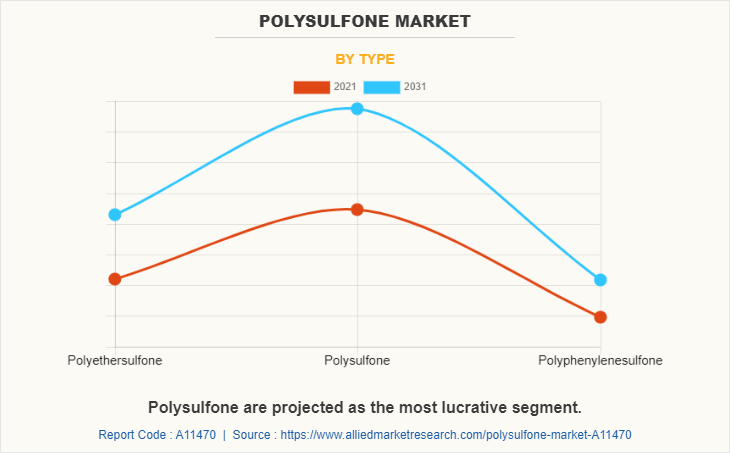

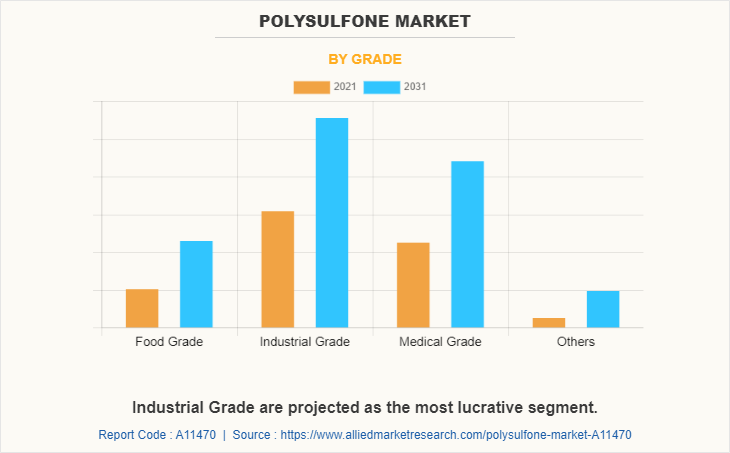

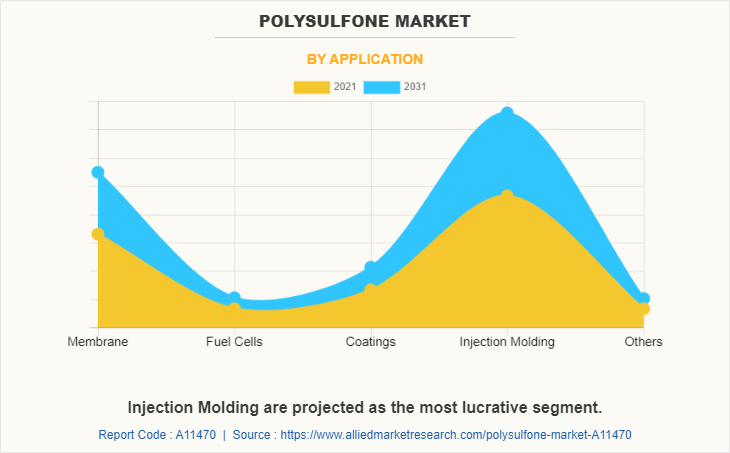

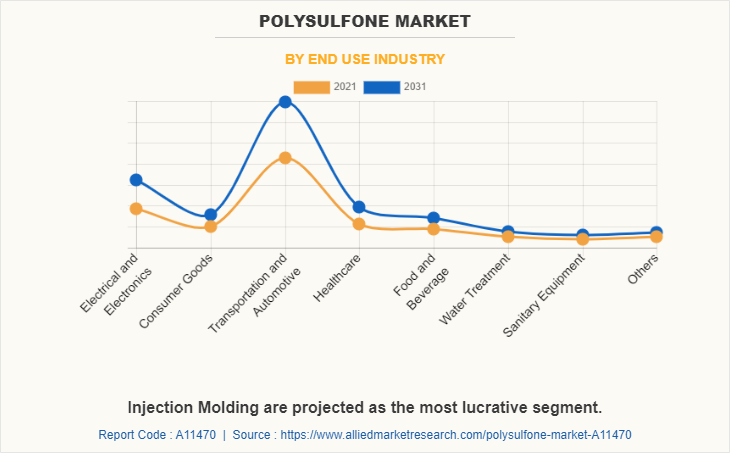

The polysulfone market is segmented on the basis of type, grade, application, end-use industry, and region. By type, the market is divided into polyethersulfone (PES), polysulfone (PSU), and polyphenylenesulfone (PPSU). By grade, the market is categorized into food grade, industrial grade, medical grade, and others. By end-use industry, the market is classified into electrical and electronics, consumer goods, transportation & automotive, healthcare, food & beverage, water treatment, sanitary equipment, and others. By healthcare, is the market is further fragmented into surgical instruments, dental instruments, hemodialysis, nebulizers, filtration, and others. By application, the market is segregated into membranes, fuel cells, coatings, injection molding, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the market is divided into polyethersulfone (PES), polysulfone (PSU), and polyphenylenesulfone (PPSU). PSU is the most widely used polysulfone type in the production of ultrafiltration membranes, which are commonly used in the food industry. PSU membranes have been used for the separation and purification of different solutions due to their excellent chemical and thermal stability.

By grade, the market is categorized into food grade, industrial grade, medical grade, and others. PSU 1000, PSU 1650, and PSU 3180 are different grades of polysulfone. PSU 1000 is a rigid, high-strength, semi-tough, and transparent plastic that outperforms polycarbonate in terms of heat resistance and hydrolytic stability. PSU 1650 and PSU 3180 are other grades of polysulfone that have unique properties. PSU 1650 is a medical-grade polysulfone that is used in surgical instruments and devices, whereas PSU 3180 is an extrusion-grade polysulfone used in a variety of applications such as electrical components.

By application, the market is segregated into membranes, fuel cells, coatings, injection molding, and others. The membrane segment is the fastest-growing segment and is expected to continue this trend during the forecast period. Owing to the excellent chemical and thermal resistance of polysulfone, it is widely used to manufacture membranes for water treatment, gas separation, and other filtration applications. Polysulfone ultrafiltration membranes are used in the food industry and oil & gas industries.

By end-use industry, the market is categorized into electrical & electronics, consumer goods, transportation & automotive, healthcare, food & beverage, water treatment, sanitary equipment, and others. The demand for polysulfone is growing rapidly due to its wide applications in various industries, mainly in the food and beverage industry. Polysulfone is used in the production of ultrafiltration membranes that are widely used in the food industry. In addition, polysulfone is used in food processing equipment where high-temperature resistance and mechanical strength are required.

By region, the market is categorized into North America, Europe, Asia-Pacific, and LAMEA. North America is expected to be the leader in the production of polysulfones, with surge in demand from U.S. and Canada. Furthermore, U.S. is the most extensive base for electronics production globally with electronic products, such as smartphones, TVs, wires, cables, other personal electronic devices, home appliances that recorded the highest growth in the electronics segment.

Some of the major companies that operate in the polysulfone market include Asahi Kasei Medical Co., Ltd. , BASF SE, Ensinger, PEXCO, Polymer Industries, RTP Company, SABIC, Solvay S.A., Toray Medical Co., Ltd., Trident Plastics inc. These players have adopted product launch, acquisition, and business expansion as their key strategies to increase their market shares.

COVID 19 Impact Analysis

Polysulfone is a type of thermoplastic polymer that is used in various industries such as healthcare, automotive, and aerospace. The COVID-19 pandemic had a mixed impact on the polysulfone market. On one hand, the demand for polysulfone-based products such as medical devices, personal protective equipment, and air filtration systems increased due to the pandemic. Polysulfone is used in the production of medical devices such as dialysis membranes, oxygenators, and blood filters, which are crucial in the treatment of COVID-19 patients. In addition, polysulfone membranes are used in the production of air filtration systems that help reduce the transmission of the virus.

On the other hand, the pandemic disrupted global supply chains, which led to a shortage of raw materials used in the production of polysulfone. The shutdown of manufacturing facilities and restrictions on transportation caused delays in the delivery of raw materials, which impacted the production of polysulfone-based products. Overall, the impact of the COVID-19 pandemic on the polysulfone market has been mixed, with increased demand for some products and disruptions in the supply chain for raw materials.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the polysulfone market analysis from 2021 to 2031 to identify the prevailing polysulfone market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the polysulfone market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global polysulfone market trends, key players, market segments, application areas, and market growth strategies.

Polysulfone Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3.4 billion |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 450 |

| By Type |

|

| By Grade |

|

| By Application |

|

| By End use industry |

|

| By Region |

|

| Key Market Players | Polymer Industries, RTP Company, Asahi Kasei Medical Co., Ltd., BASF SE, Solvay S.A., Trident Plastics inc., TORAY MEDICAL CO., LTD., PEXCO, SABIC, Ensinger |

Analyst Review

According to the opinions of various CXOs of leading companies, polysulfone market is rapidly growing day by day due to its wide applications in the food & beverage, automotive, electronics & electrical industries. In catering business, coffee machines, juice mixers, and grinders are made up of polysulfones. In automotive industry, polysulfone is used as the mixer in manufacturing of car headlights and in electronics & electrical industry; it is used for refrigerator parts, LED parts, washing machine parts and many others.

Polysulfone has rigid, transparent, and high meltable property. Moreover, urbanization is another factor that boosts the growth of the polysulfone market since the use of water purifiers has increased since the last two decades. Polysulfone is used as resistant in fuel and lubricant in the automotive industry. Rise in demand for polysulfone in the pharmaceutical sector across the globe is one of the key drivers that foster the market growth.

Polysulfone is a recyclable polymer that can be reused to make new products. As there is an increasing focus on sustainability, there is a growing demand for eco-friendly polymers like polysulfone.

Electrical & electronics and transportation & automotive are the potential customers of polysulfone market industry.

North America region will provide more business opportunities for polysulfone market in coming years.

The market players are adopting various growth strategies and also investing in R&D extensively to develop technically advanced unique products which are expected to drive the market size.

Asahi Kasei Medical Co., Ltd. , BASF SE, Ensinger, PEXCO, Polymer Industries, RTP Company, SABIC, Solvay S.A., Toray Medical Co., Ltd., Trident Plastics inc. are the top players in polysulfone market.

Loading Table Of Content...

Loading Research Methodology...