PVDF Resin Market Research, 2032

The global PVDF resin market was valued at $2.2 billion in 2022 and is projected to reach $4.6 billion by 2032, growing at a CAGR of 7.6% from 2023 to 2032.

Key Report Highlighters:

- The report depicts detailed insights into the PVDF resin industry trends and new growth opportunities.

- The report provides a complete analysis of the market status across key regions and more than 15 countries across the globe in terms of value ($ Million) and volume (Tons)

- The report identifies the PVDF resin market growth segments and emerging application areas in each country as listed.

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence, and key strategic developments by prominent manufacturers

- The report facilitates strategic planning and industry dynamics to enhance decision-making for existing market players and new entrants entering the PVDF resin industry.

Polyvinylidene fluoride (PVDF) resin is a versatile polymer with exceptional chemical resistance, high thermal stability, excellent mechanical properties, and unique electrical characteristics. It is used in different applications including chemical processing equipment, electrical insulation, wire and cable insulation, sensors, actuators, and others. Furthermore, it is used as a powder to make solutions and additives. It has high chemical resistance toward chlorine, bromine, iodine, and other acids at high temperatures.

It is available as piping products, sheets, tubing, films, plate, and an insulator for premium wire. It may be injected, molded, or welded and is commonly used in the chemical, semiconductor, medical, and defense industries, as well as in lithium-ion batteries. In addition, it is available as a cross-linked closed-cell foam, used increasingly in aviation and aerospace applications. In addition, it has been used in the global automotive and transportation, agricultural, packaging, military, oil and gas, biotechnology, pharmaceutical, and chemical industries.

PVDF resin is extensively used in the medical and pharmaceutical industries in medical tubing, surgical instruments, and implantable devices for its biocompatibility and sterilization resistance. The rise in demand for advanced healthcare solutions and the need for reliable and safe materials in the medical sector have contributed to the increased use of PVDF resin.

Increased demand for Li-ion batteries

The rise in demand for PVDF resins in lithium-ion batteries due to profound bonding insulating healthy capacity, and high voltage stability coupled with the increased production of e-vehicles, is the key factor driving the growth of the PVDF resins market. The demand for PVDF resins in lithium-ion batteries is projected to expand due to the shift in consumer preferences toward electric and hybrid vehicles owing to strict environmental protection legislation. There is a two-fold increase in the sales of electric vehicles globally in 2021, after witnessing a decline in 2020 during the pandemic.

Electric vehicles including hybrid and plug-in cars, also gained market share. These accounted for 19% of all car sales in Europe. The European Commission is seeking to have at least 30 million electric vehicles on the roads by the end of this decade. This is a significant increase from the current 1.4 million EVs on the European streets. Increased electric vehicles on the roads is one of the major factors driving the demand for Li-ion batteries thus driving the demand for PVDF resin.

The automobile sector contributes 49% to the manufacturing GDP of India and 7.1% to the GDP of India. As part of the Paris Agreement in 2015, India committed to reducing the emission intensity of its gross domestic product (GHG emissions per unit GDP) by 33% - 35% over 2005 levels by 2030. The government is keen to shift the narrative towards electric vehicles to meet its global commitment and mitigate the adverse impact of automobiles.

The shift towards electric vehicles is projected to drive the demand for Li-ion batteries. This, in turn, is driving the demand for PVDF resin. In addition, India is witnessing investments of $12.6 billion across the automotive value chain over the next five years. Overall, global spending by governments and consumers on electric cars has significantly increased in the past few years, exceeding $400 billion in 2022. These factors are expected to drive the demand for PVDF resins.

PVDF raw material prices have increased due to an increase in PVDF applications and demand across a range of end-use industries. One of the most crucial basic elements used in the production of PVDF is R142b. R14b's ex-factory price has increased from $2,455.32 per ton to $5,970.48 per ton, with certain international orders exceeding $6,599 per ton in 2020. The increased usage of polyvinylidene fluoride for Li-ion batteries, coatings, and other applications has led to a significant increase in the total amount of raw material used to manufacture polyvinylidene fluoride products. Moreover, the limited supply and insufficient production demand is hampering the growth of the PVDF resins market.

Key Market Trends:

Ongoing research and development efforts have focused on enhancing the properties of PVDF resin and developing new applications. For example, manufacturers have been working on improving the thermal stability and processability of PVDF, expanding its potential usage in additive manufacturing (3D printing) and other emerging fields. PVDF is used in the manufacturing of back sheets for solar panels due to its excellent weather resistance and electrical insulation properties. The PVDF resin market has witnessed growth in response to the expanding photovoltaic industry as the demand for renewable energy, particularly solar power, has been increasing.

In addition, these cables are used in commercial and military electronics, railways, avionics, satellites, helicopters, aircraft, ships, and offshore platforms. Further, the developing electronics industry owing to the rise in sales of smartphones, portable computer devices, and gaming systems influences the market positively. In addition, governments of several countries are spending heavily in the renewable energy sector, which is anticipated to stimulate market expansion.

The rapid growth of the renewable energy industry is projected to further boost the growth of the PVDF resin market during the forecast period. An increase in the use of PVDF resin in electrical and electronic components is projected to provide lucrative opportunities for the PVDF resin market. Photovoltaic cells and panels use PVDF resins for weather durability, dirt resistance, chemical resistance, prolonged reflectivity, and smoke resistance.

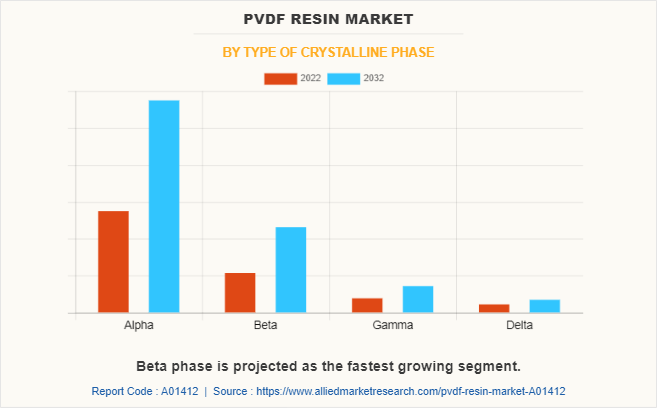

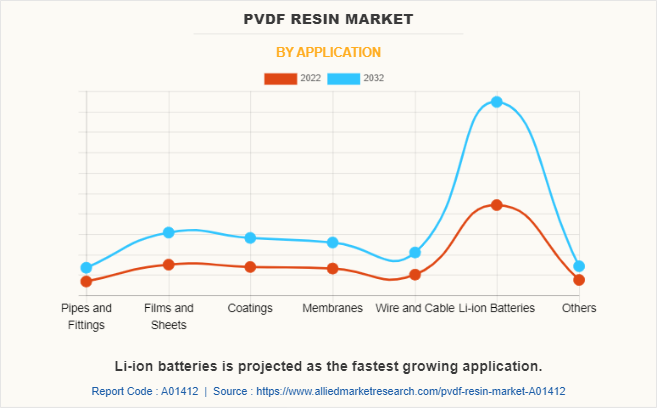

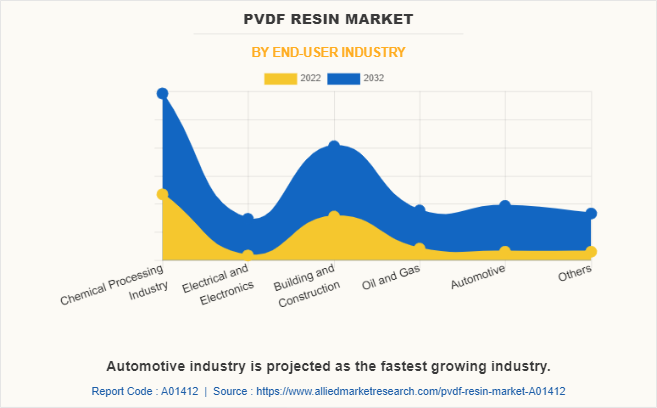

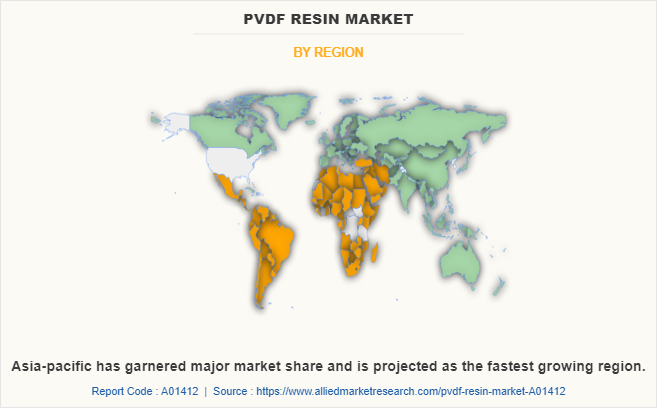

The PVDF resin market is segmented into type of crystalline phase, application, end-use industry, and region. By type of crystalline phase, the market is classified into alpha, beta, gamma, and delta. By application, the market is divided into pipes and fittings, films and sheets, coatings, membranes, wire and cable, Li-ion Batteries, and others. By end-use industry, the market is categorized into chemical processing, electrical and electronics, building and construction, oil and gas, automotive, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the global PVDF resin market are 3M Company, Arkema, Daikin Industries Ltd., Dongyue Group Limited, Gujarat fluorochemicals limited, Kureha Corporation, RTP Company, SABIC, Shanghai Ofluorine Co. Limited, Solvay and Zhejiang Fotech International Co. Ltd. Other players operating in the PVDF resin market are Agiplast, SKC, Sinochem Lantian, and Dongyue Group.

By type of crystalline phase, the alpha phase of PVDF resin held the largest market share of more the two-thirds of the global PVDF resin market, owing to an increase in demand for electrical & electronics, chemical processing, and other industries. In addition, the advantages of PVDF resins, including ease of processing, non-polar conformation, insulation, excellent chemical resistance, low weight, and high mechanical strength are anticipated to drive the demand for PVDF resins. The beta phase is the fastest growing segment with a CAGR of 8.1%, as beta PVDF resins are a reliable material for use in electrical and electronic applications because of its electrical characteristics, which include piezoelectric, pyroelectric, and ferroelectric capabilities. Therefore, it is projected that throughout the forecast period, growing demand for beta PVDF resins from the electrical industry will boost the market growth.

The Li-ion batteries segment accounted for the largest share in 2022, contributing to more than two-fifth of the global PVDF resin market revenue, and is projected to register the fastest CAGR of 8.0% during the forecast period. Governments worldwide are implementing policies and regulations to promote the adoption of electric vehicles and renewable energy sources. These initiatives include financial incentives, subsidies, and emission reduction targets. Such policies create a favorable market environment for Li-ion batteries, leading to increased demand for PVDF resin.

The chemical processing industry accounted for the largest share in 2022, contributing to more than one-third of the global PVDF resin market revenue, and is projected to register a CAGR of 7.7% during the forecast period. The increase in demand for PVDF resins from the chemical processing industry for usage in filtration & separation equipment, high-purity water systems, and protective coatings, among others, is likely to drive the PVDF resin market throughout the forecast period. In addition, macroeconomic factors such as urbanization and economic expansion in developing countries have fueled the PVDF resin industry. The automobile industry is projected to register the fastest CAGR of 8.6% during the forecasted period.

Asia-Pacific holds the largest market share in terms of revenue in 2022, accounting for more than two-thirds of the global PVDF resin market, and is projected to register the highest CAGR of 7.8% during the forecast period. The development in urbanization and industrialization in countries such as China, India, and others is increasing the need for architectural coatings, hence driving the market's expansion over the forecast period. In addition, the high rate of urbanization has led to a growth in the building and food processing industries' use of PVDF resins. These resins are utilized in membranes, which are applications used for water purification. China is one of the largest consumers and producers of PVDF resin in the Asia-Pacific region. The developments in chemical processing, construction, and electrical industries in China drive the demand for PVDF resin. The growing chemical industry, especially in areas such as water treatment, pharmaceuticals, and specialty chemicals, drives the demand for PVDF resin.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the PVDF resin market analysis from 2022 to 2032 to identify the prevailing PVDF resin market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the PVDF resin market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global PVDF resin market trends, key players, market segments, application areas, and market growth strategies.

PVDF Resin Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.6 billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 471 |

| By Type of Crystalline Phase |

|

| By Application |

|

| By End-user industry |

|

| By Region |

|

| Key Market Players | Zhejiang Fotech International Co. Ltd, RTP company, Gujarat Fluorochemicals Limited, Shanghai Ofluorine Co. Limited, Dongyue Group Limited, 3M Company, Arkema, SABIC, DAIKIN INDUSTRIES LTD., KUREHA CORPORATION, Solvay |

Analyst Review

According to the perspectives of the CXOs of leading companies in the global PVDF resin market, increase in demand for PVDF resins in developing economies such as Asia-Pacific, rapid growth of the electronics industry, rise in demand for purified water & industrial wastewater treatment, and growth of end users are major factors driving the growth of the PVDF resin market. Companies are focusing on whether the benefits offered by PVDF resin outweigh the higher material costs and if it aligns with budget and financial goals and evaluating if the performance characteristics of PVDF resin align with company's product requirements and if it provides a competitive advantage to the company. Companies like Solvay, Kureha, and Arkema have taken various research and development initiatives within the sector. This is projected to result in better PVDF resin characteristics and lower costs. In terms of both volume and value, China has overtaken all other countries in the PVDF resin market. This is ascribed to a number of elements, including regional major players, industrial facilities, and R&D infrastructure.

Growing demand for Li-ion batteries is the upcoming trend in the PVDF resin market.

Li-ion batteries application of PVDF resin is expected to drive the adoption of the PVDF resin market, owing to an increase in demand for resins from the automotive industry as there is increased demand for Li-ion batteries from electronic vehicles.

Asia-Pacific is the largest regional market for PVDF resin.

The PVDF Resin Market was valued at $2.2 billion in 2022 and is estimated to reach $4.5 billion by 2032, exhibiting a CAGR of 7.6% from 2023 to 2032

Solvay, 3M, Kureha Corporation, Dongyue Group, and Arkema S.A. are some of the leading companies to hold a major market share in PVDF resin.

Loading Table Of Content...

Loading Research Methodology...