Portfolio Management Software Market Research, 2032

The global portfolio management software market was valued at $3.2 billion in 2022, and is projected to reach $11.8 billion by 2032, growing at a CAGR of 14.2% from 2023 to 2032.

Portfolio management software is a digital tool or application designed to help individuals and organizations effectively manage their investment portfolios. It allows users to track and analyze various types of investments, such as stocks, bonds, real estate, and others. Its key features include performance tracking, risk assessment, asset allocation optimization, reporting, and often real-time market data. This software assists users in making informed decisions about their investments, ensuring they align with their financial goals and risk tolerance. It simplifies the process of monitoring and optimizing investment portfolios, ultimately aiding in wealth management and financial planning.

One of the key drivers of the portfolio management software market is an increase in demand for efficient asset management. As more individuals and businesses seek to optimize their investments and assets, there is a growing demand for portfolio management software to help streamline the process and make informed decisions.

Furthermore, continuous advancements in technology, such as artificial intelligence and data analytics, have enhanced the capabilities of portfolio management software, making it more powerful and attractive to users. Thus, technological advancements drive the adoption of portfolio management tools and propel the market growth. In addition, regulatory compliance and risk management promote the portfolio management software market growth. Stricter regulatory requirements and the need for effective risk management have led to the adoption of portfolio management software, which can help ensure compliance and mitigate risks more effectively.

However, the cost and complexity of portfolio management software and data security concerns hamper the growth of the portfolio management software market by affecting customer trust and confidence. On the contrary, the increasing demand for digital transformation is expected to provide lucrative growth opportunities to the portfolio management software market size in the upcoming years because businesses and financial institutions are recognizing the benefits of going digital.

The report focuses on growth prospects, restraints, and trends of the portfolio management software market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the portfolio management software market outlook.

Segment Review

The portfolio management software market is segmented into component, deployment mode, enterprise size, end user, and region. By component, the portfolio management software market is differentiated into solution and service. Depending on the deployment mode, it is fragmented into on-premise and cloud. By enterprise size, the market is divided into large enterprises and small and medium-sized enterprises. By end user, the portfolio management software market is divided into business and individual. Region-wise, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

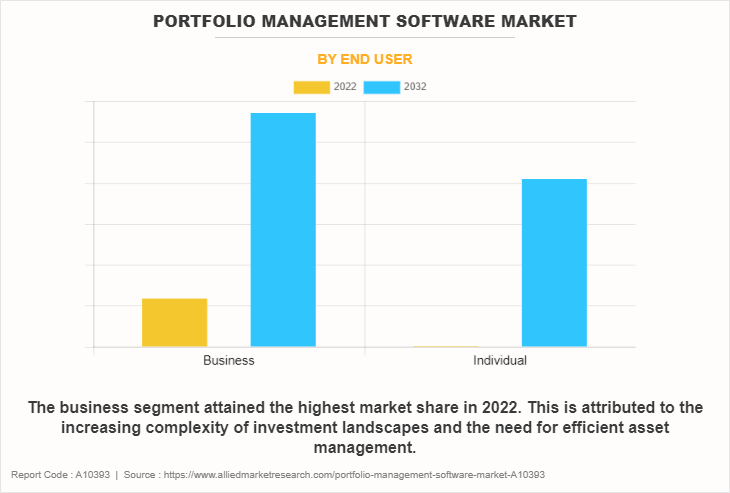

By end user, the business segment acquired a major portfolio management software market share in 2022. The growth of the portfolio management software market in businesses is primarily driven by the increasing complexity of investment landscapes and the need for efficient asset management. Businesses across various sectors, from finance to real estate, face the challenge of managing diverse portfolios of assets, and portfolio management software provides them with the tools to optimize asset allocation, mitigate risks, and make data-driven investment decisions. However, the individual segment is expected to be the fastest-growing segment during the forecast period. This is attributed to the democratization of investment opportunities, the desire for personal financial empowerment, and technological advancements.

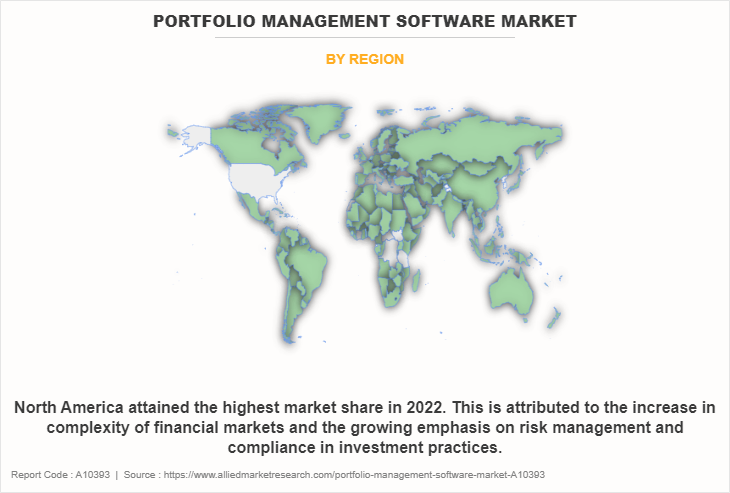

Region-wise, North America dominated the portfolio management software market in 2022. This is attributed to the increase in complexity of financial markets and the growing emphasis on risk management and compliance in investment practices. However, Asia-Pacific is considered to be the fastest-growing region during the forecast period. The growth of the portfolio management software market in Asia-Pacific is fueled by the region's economic growth, the rising interest in investments, and the adoption of technology in the financial sector.

Competition Analysis

Competitive analysis and profiles of the major players in the portfolio management software market include MProfit Software Private Limited, Oracle, BlackRock, Inc., Beiley Software, Inc., Miles Software, SS&C Advent, Quicken Inc., Ziggma Analytics Inc., Planview, and FinFolio Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the portfolio management software industry.

Recent Partnerships in the Portfolio Management Software Market

In May 2023, Planview, the leading platform for connected work from portfolio planning to delivery, formed a partnership with NTT DATA, a global digital business and IT services leader. Featuring Planview Tasktop Hub and Planview Tasktop Viz, the company’s Value Stream Management (VSM) solution is now available as part of NTT DATA’s global ecosystem of technology solutions, offering organizations improved time-to-market predictability and efficiency that unlocks capacity and de-risks strategic bets.

In December 2021, Planview, a global leader in portfolio management and work management solutions, announced that Standard Chartered, a leading international banking group, has selected Planview as the organization’s enterprise-wide solution to manage the Bank’s portfolio of technology projects. The partnership offers teams at Standard Chartered the flexibility to manage projects across waterfall, agile, and hybrid governance models while offering critical visibility and consolidated reporting to all levels of management.

Recent Acquisition in the Portfolio Management Software Market

In June 2022, Planview, the global leader in portfolio management and work management acquired Enrich, a product portfolio analytics company that empowers R&D organizations with complex portfolios to make strategic business decisions in real-time.

In January 2021, Planview, the enterprise software company acquired for $1.6 billion by TPG and TA Associates, made an acquisition of Seattle-based Changepoint and San Mateo, Calif.-based Clarizen. The three companies are similar, offering software for project portfolio management, or PPM.

Market Landscape and Trends

As investment strategies become more intricate, there is a greater need for accurate data analysis and risk management. The investment portfolio management software can provide the necessary analytics and modeling capabilities to evaluate the potential outcomes of complex investment decisions. It helps investors make informed choices and adapt to changing market conditions swiftly. In a world where precision and agility in investment are crucial, the portfolio management software market is growing due to its ability to assist users in managing the complexities of modern investment strategies. Furthermore, merchant banking software companies provide portfolio management software services to high-net-worth individuals and corporate investors. These services include a selection of securities, portfolio monitoring and review, advice on the rationalization of portfolios, and tax planning which drives the merchant banking services market opportunity.

In addition, key players in the portfolio management software market adopt partnership, product launch, and business expansion as their key development strategies to sustain their growth in the market. For instance, in July 2023, Planview, the leading platform for digital connected work from portfolio planning to delivery, announced a first-to-market offering, digital product insights, that combines portfolio management and agile planning with delivery insights from value stream management (VSM) and objectives & key results (OKRs).

Top Impacting Factors

Increase in Demand for Efficient Asset Management

The increase in demand for asset management is driving the popularity of portfolio management software. This software helps organizers to keep track of all investments in one place. It provides insights and recommendations on what to buy or sell to make the most money while managing risks. As more individuals and businesses seek to optimize their investments and assets, there is a growing demand for portfolio management software to help streamline the process and make informed decisions.

In addition, key players in the market adopted partnership as their key development strategy to provide the visibility, transparency, and flexibility needed to propel the banking group into a new era of digitalization and client service. For instance, in December 2021, Planview, a global leader in portfolio management and work management solutions, announced that Standard Chartered, a leading international banking group selected Planview as the organization’s enterprise-wide solution to manage the bank’s portfolio of technology projects. This partnership offers teams at Standard Chartered the flexibility to manage projects across waterfall, agile, and hybrid governance models while offering critical visibility and consolidated reporting to all levels of management. Therefore, such factors drive the growth of the portfolio management software market.

Technological Advancements

Technological advancements have been a significant driving factor behind the growth of the portfolio management software market. These advancements have transformed the capabilities of portfolio management software, making it more sophisticated and efficient. With the power of modern technology, such as artificial intelligence and advanced data analytics, these software tools can process vast amounts of financial data rapidly and accurately.

Furthermore, technology has enhanced the predictive and analytical capabilities of portfolio management software. It provides users with insightful forecasts and risk assessments, allowing them to optimize their investment strategies and manage potential risks more effectively. For instance, in July 2023, Planview, the leading platform for digital connected work from portfolio planning to delivery, announced a first-to-market offering, digital product insights, that combines portfolio management and agile planning with delivery insights from value stream management (VSM) and objectives & key results (OKRs). Therefore, the combination of technological advancements and improved usability has attracted more users to portfolio management software, driving its market growth substantially.

Increase in Demand for Digital Transformation

The increasing demand for digital transformation is expected to boost the portfolio management software market in the upcoming years because businesses and financial institutions are recognizing the benefits of going digital. They are investing in portfolio management software that helps them to make their investment processes more efficient and effective by providing tools to keep track of investments, analyze data, and make smart decisions. As more companies adopt digital strategies, the need for these software solutions grows, creating a lucrative opportunity for portfolio management software providers.

For instance, in July 2022, Planview, a global leader in portfolio management and work management, announced the establishment of its regional headquarters in Singapore. The expanded Asia-Pacific operations support the growing demand for software solutions to accelerate agility and business transformation.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the portfolio management software market analysis from 2022 to 2032 to identify the prevailing portfolio management software market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- The porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the portfolio management software market segmentation assists to determine the prevailing portfolio management software market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the portfolio management software market players.

- The report includes the analysis of the regional as well as portfolio management software market trends, key players, market segments, application areas, and market growth strategies.

Portfolio Management Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 11.8 billion |

| Growth Rate | CAGR of 14.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 215 |

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By End User |

|

| By Region |

|

| Key Market Players | MProfit Software Private Limited, Planview, Quicken Inc., SS and C Advent, Beiley Software, Inc. , FinFolio Inc., Oracle Corporation, BlackRock, Inc., Miles Software, Ziggma Analytics Inc. |

Analyst Review

Portfolio management software for an asset manager typically denotes a front office system used for portfolio modeling. Users can create an investment portfolio account that deals in stocks, fixed income, debt, cash, structured products, and other individual securities. Furthermore, the increasing complexity in investment strategies offers a lucrative growth opportunity for the portfolio management software market because investors now deal with a wide range of investment options and strategies. Portfolio management software helps to manage these complex portfolios and helps investors keep track of various assets, analyze their performance, and assess risks effectively. As more people and organizations seek to diversify their investments and navigate this complexity, the demand for portfolio management software is expected to rise, making it a profitable market.

For instance, in June 2022, FinFolio, a leading solution for investment management and trading software, formed a partnership with Redtail, the market-leading CRM solution for financial advisors. The integration allows investment and wealth managers to synchronize data across systems, streamlining workflows and operations. The integration synchronizes clients, notes, tasks, investment accounts, and position values. Users can control which items are synced, the directionality of the sync, and how often the sync happens.

The COVID-19 pandemic had a significant impact on the portfolio management software market size. As the pandemic disrupted global financial markets and caused uncertainty, many investors sought out portfolio management software to better track and manage their investments in volatile times. This led to a short-term boost in demand for these tools. However, the economic fallout from the pandemic led to budget cuts in various sectors, including financial services. Some firms reduced their spending on software, including portfolio management tools. Therefore, while the portfolio management software market experienced a temporary surge, its growth trajectory was influenced by the evolving economic conditions and the changing needs of businesses during and after the pandemic.

The key players in the portfolio management software market include MProfit Software Private Limited, Oracle, BlackRock, Inc., Beiley Software, Inc., Miles Software, SS&C Advent, Quicken Inc., Ziggma Analytics Inc., Planview, and FinFolio Inc. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With an increase in awareness & demand for portfolio management software across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The portfolio management software market is segmented into component, deployment mode, enterprise size, end user, and region. By component, the market is differentiated into solution and service. Depending on deployment mode, it is fragmented into on-premise and cloud. As per enterprise size, the market is divided into large enterprises and small and medium-sized enterprises. According to end user, the market is divided into business and individual. Region-wise, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

North America is the largest regional market for Portfolio Management Software.

The portfolio management software market size was valued at $3,182.75 million in 2022 and is projected to reach $11,805.40 million by 2032, growing at a CAGR of 14.2% from 2023 to 2032.

The key players operating in the portfolio management software market include MProfit Software Private Limited, Oracle, BlackRock, Inc., Beiley Software, Inc., Miles Software, SS&C Advent, Quicken Inc., Ziggma Analytics Inc., Planview, and FinFolio Inc.

Loading Table Of Content...

Loading Research Methodology...