POS Payment Market Research, 2032

The global POS payment market was valued at $96.6 Billion in 2022, and is projected to reach $277.9 billion by 2032, growing at a CAGR of 11.4% from 2023 to 2032.

Point of sale (POS) is a device that helps in processing transactions by retail customers. Cash register is one type of POS. Electronic POS terminals have replaced cash register. Electronic POS terminals are used for processing debit cards, credit cards and cash. POS is either a physical device in a physical store or it can be checkout point in a web store. The importance of POS software is increasingly growing as it helps retailers to monitor inventory and buying trends, track pricing accuracy and collect marketing data.

Point of sale payment systems help in streamlining retail operations by automating transaction processes and tracking relevant sales data. Electronic cash register and software helps in coordinating data collection from daily purchase. In addition, retailers can increase their functionality with data capture devices such as card readers and barcode scanners. Furthermore, POS payment software also helps retailers to track pricing, accuracy, inventory changes, gross revenue and sales patterns, catch price discrepancies, avoid customer service issues such as out of stock sales and tailor purchasing and marketing to consumer behavior.

The report focuses on growth prospects, restraints, and trends of the POS payment market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the POS payment market outlook.

Segment Review

The POS payment market is segmented into Component, Type and End User.

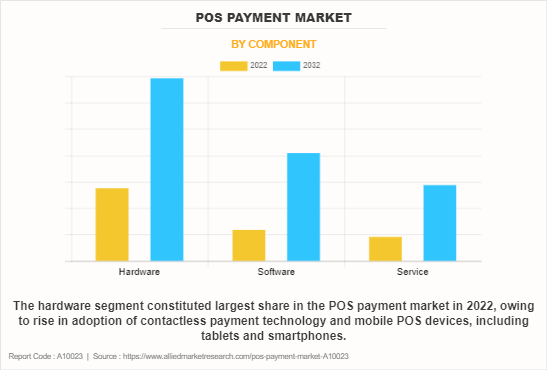

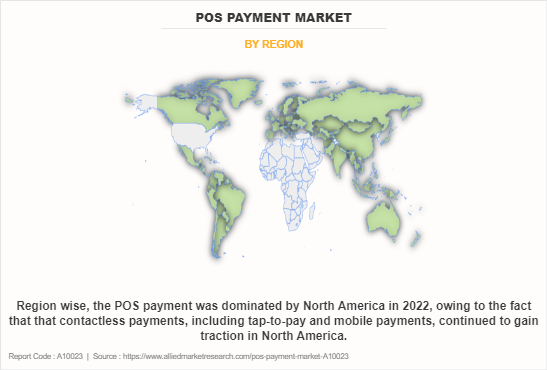

The global POS payment market is segmented into component, type, end user, and region. On the basis of component, the market is categorized into hardware, software, and service. Based on type, the market is segmented into fixed and mobile. By end user, the market is divided into retail, hospitality, healthcare, entertainment, transportation, and others. Region-wise, the POS payment market is studied across into North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

On the basis of component, the hardware segment acquired a major POS payment market share in 2022. This is attributed to factors such as increasing competition in businesses, enterprise operational needs, and customers preference for quicker checkout/transaction times and a secure system transmits transactions by POS hardware terminals.

Based on region, the North America segment dominated the POS payment market size in 2022. This is attributed to integration of artificial intelligence (AI) and advanced analytics into POS systems becoming more prevalent. Further, POS providers in the region are focusing on enhancing security measures. Compliance with Payment Card Industry Data Security Standard (PCI DSS) and other regulations has become a priority for the providers in the North America region.

Competition Analysis

Competitive analysis and profiles of the major players in the POS payment market include Acrelec, Aures Group, Hewlett Packard Development LLP, NCR Corporation, Oracle, Revel Systems, Diebold Nixdorf, Incorporated, Moneris, Pax Technology Limited, Posiflex Technology. These players have adopted various strategies to increase their market penetration and strengthen their position in the POS payment market.

Recent Partnership in the POS Payment Market

- In December 2022, Diebold Nixdorf Inc. partnered with Phos, a London-based POS software provider to help businesses in adding POS orchestration as an option to existing payment. The solution is expected to help retailers to expand their payment acceptance points. In addition, the solution is expected to also help Diebold Nixdorf to launch a solution for the existing acquiring that their retail customers are utilizing. Furthermore, through this launch retailers is expected to be able to accept card and digital wallet payments directly on any NFC enabled smartphone and tablet in a secure and contactless way. Moreover, Phos currently has 14 certified acquirer connections and recently Apple Inc. announced that it is expected to allow third party SoftPOS providers to deploy their technology on IOS devices.

- In October 2023, Castles Technology partnered with Worldline to support Worldline’s deployment of android payment terminals and associated services including repair staging. Castles Technology is a global leader in payment industry and Worldline is a French multinational payment and transactional services company. The partnership is expected to strengthen Castles Technology position in the Europe, Middle East, and Africa region. In addition, the strategy is expected to also drive Castles Technology growth in other regions by offering a variety of products and services globally.

Recent Product Launch in the POS Payment Market

- For instance, in June 2023, Helcim, a financial technology and payment startup launched latest hardware product called smart terminal. The wireless processor assists SMEs to allow the acceptance of credit card and debit card payment through tap, chip and PIN. It also helps in managing inventory and issue receipts. The Smart Terminal, which comes preloaded with Helcim’s point-of-sale app, aims to eliminate the need for merchants to manage multiple devices with the benefit of no contracts and monthly fees. Instead, merchants pay via an interchange-plus-fee model, which Helcim claims saves businesses 22 percent on an average. This strategic move is expected to strengthen Helcim position in the POS payment market.

- In February 2021, Auvers Technologies launched Komet, a multi environment and multifunction kiosk solution. The solution is designed for several sectors such as retail, hospitality & catering, food & beverage, and leisure & services.

Market Landscape and Trends

Consumers and businesses are adopting contactless cards, mobile wallets and touchless payment methods. Furthermore, mobile payment applications such as Apple Pay, Google Pay, and Samsung Pay are getting increasingly integrated with e-commerce platforms and are providing omnichannel features to businesses to serve different customers across various channels. POS payment industry is heavily investing in security technologies such as tokenization, encryption, and biometric authentication to provide safe transaction processing and protect sensitive data.

Top Impacting Factors

Increasing Adoption of Contactless Payment

Consumer preferences are increasingly shifting toward more seamless and frictionless payment experience. Contactless payments are making it easier for consumers to make smooth transactions. Furthermore, the widespread acceptance of contactless payments and POS credit card reader by retailers, restaurants and other businesses is contributing further to the overall growth of the POS payment market. In addition, the government are also implementing various initiatives to promote cashless economy. Moreover, increasing advancement in technology is further pushing the market growth. Technology such as near field communication (NFCs) is enhancing the performance of contactless payment and making them more reliable and secure. Therefore, all these factors are expected to drive the POS payment market growth for the forecast period.

Rise in Omnichannel Retailing

Omnichannel retailing allow customers to switch between different channels such as physical stores, websites, mobile applications, clover payment and social media and POS systems that integrate with omnichannel providing highly efficient payment operability to users across different touchpoints. Furthermore, omnichannel retailing provides various full-fill options such as buy online, pick-up in-store, or ship from store. POS systems are connected with these options to assist customers to select the best method to have better payment experience. Moreover, the combination of POS system and omnichannel retailing provides real time inventory benefit. Customers identify accurate product availability and implement purchase through updated inventory POS systems. Therefore, all these factors are expected to enhance the growth of the POS payment market during the forecast period.

High Cost of Implementation and Maintenance

Small and medium businesses are finding it difficult to install POS payment system due to budget constraints. The cost of buying hardware and software and then to train a team in operating that hardware and software is very high. Furthermore, the total cost of ownership that includes initial setup costs, ongoing operational expenses is very high and can impact SMEs profitability. Moreover, implementing POS system technology requires enough time for small and medium businesses, thus resulting in a delay of other services to consumers. Therefore, all these factors are expected to propel the growth of POS payment market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the POS payment market analysis from 2022 to 2032 to identify the prevailing POS payment market opportunity.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the POS payment market segmentation assists to determine the prevailing POS payment market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as POS payment market trends, key players, market segments, application areas, and market growth strategies.

POS Payment Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 290 |

| By Component |

|

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Acrelec Informatica Group SL., PAX Technology Limited, Moneris Solutions, Diebold Nixdorf, Incorporated, Posiflex Technology, Hewlett Packard Development LLP, Aures Group, Revel Systems, Oracle, .NCR CORPORATION |

Analyst Review

POS payment refers to a purchase made by customer from a business. The process involves transfer of money between the customer and merchant’s account. Key players in the POS payment market adopted partnership and acquisition as their key development strategies to sustain their growth in the market. For instance, in October 2022, Ingenico partnered with Live Payments to offer retailers and taxis with seamless, convenient payment and commerce solutions. Ingenico is expected to distribute their AXIUM range of Android Smart POS for Live Payments customers across Australia. The strategy is expected to assist live payments to build value-added applications and provide customized experiences for individual segments and merchants. The strategic move is expected to also strengthen Ingenico position in the Australian POS payment market. Furthermore, in March 2023, Ingenico acquired 100% shares of Phos, a leading provider of POS software. Phos offers soft POS solution. Soft POS software helps smartphones and tablets to become payment terminals while complying with high standards of payment security. This strategy is expected to strengthen Ingenico position in the POS payment industry. Furthermore, in an effort to make payments in the food and beverage industry more accessible and straightforward for customers, Worldline, a pioneer in global payment services, integrated a payment solution with the Oracle MICROS symphony POS system in March 2023. Worldline's payment solution combined with Oracle MICROS Simphony POS has been selected by SSP, a prominent operator of food and beverage shops in travel sites throughout 35 countries globally, as their preferred payment system for Germany. The unique cloud-based, end-to-end solution enables consumers to pay with all major payment brands and currencies. It also caters for the needs of international travelers through the integrated Dynamic Currency Conversion (DCC) capabilities and provides a user-friendly experience for both customers and restaurant staff. It is expected to be rolled out to SSP’s operations in the Germany, Austria and Switzerland (DACH region), starting with the deployment of POS terminals in Germany. Therefore, such strategies adopted by key players propel the growth of the POS payment market for the forecast period.

The COVID-19 impact resulted in contactless payment. People used online digital payment applications to make payments and complete transactions. COVID-19 forced businesses to upgrade their POS systems to support online and mobile payments. COVID-19 resulted in a rise in the use of mobile wallets. Popular online payment applications such as Google Pay, Apple Pay and Samsung Pay achieved greater recognition due to COVID impact.

The key players in the POS payment market include Acrelec, Aures Group, Hewlett Packard Development LLP, NCR Corporation, Oracle, Revel Systems, Diebold Nixdorf, Incorporated, Moneris, Pax Technology Limited, and Posiflex Technology. These players have adopted numerous strategies to increase their marketplace penetration and strengthen their position in the POS payment market.

The POS payment market is estimated to grow at a CAGR of 11.4% from 2023 to 2032.

The POS payment market is projected to reach 227.91 billion by 2032.

Increasing adoption of contactless payment, rise in omnichannel retailing, and technological advancements majorly contribute toward the growth of the market.

The key players profiled in the report include POS payment market analysis includes top companies operating in the market such as Acrelec, Aures Group, Hewlett Packard Development LLP, NCR Corporation, Oracle, Revel Systems, Diebold Nixdorf, Incorporated, Moneris, Pax Technology Limited, Posiflex Technology.

The key growth strategies of POS payment players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...