Power Converter Market Research, 2032

The global power converter market size was valued at $20.9 billion in 2022, and is projected to reach $44.6 billion by 2032, growing at a CAGR of 7.8% from 2022 to 2032.

Report Key Highlighters:

- The power converter industry covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global power converter market and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key market players in the power converter market share are ABB Group, Siemens, Schneider Electric, Delta Electronics, Inc, Emerson Electric, Eaton, General Electric (GE), Mitsubishi Electric Corporation, Texas Instruments, and Vicor Corporation. Companies have adopted strategies such as acquisition, product launch, merger, and expansion to strengthen their position in the market.

A power converter is a device that transforms electrical energy from one form to another, facilitating the efficient and controlled transfer of power between different components or systems. A power converter is defined as a device that converts electrical energy from one voltage or current level to another, typically altering the form of the power waveform as well. The primary aim is to match the electrical characteristics of the input source to those of the output load, ensuring compatibility and optimal performance.

The applications of power converter market overview span across a wide range of domains, with one of the most common types being AC (Alternating Current) to DC (Direct Current) converters and vice versa. These converters are fundamental in electronic devices, as many gadgets and appliances operate on DC power while the main power supply is often in the form of AC. In power converters serve to bridge the gap, enabling seamless integration between the power source and the electronic device.

In the renewable energy sector, power converters are integral components in solar inverters and wind turbine systems. Solar panels generate DC power, which needs to be converted into AC power for distribution and use in homes and industries. Similarly, wind turbines generate variable-frequency AC power, which needs to be converted to a stable frequency for grid integration. Power converters play a pivotal role in optimizing the efficiency of renewable energy systems.

Power converters find extensive use in the field of electric transportation. Electric vehicles (EVs) and hybrid electric vehicles (HEVs) rely on power converters to manage the energy flow between the battery and the electric motor. DC-DC converters are employed to adjust the voltage level, while inverters are crucial for converting DC power stored in batteries to AC power for driving the electric motor.

In the aerospace industry, power converters are utilized in avionics and other electronic systems on aircraft. These converters ensure the compatibility of power sources with the diverse array of electronic components on board, contributing to the reliability and safety of air travel. They also play a role in converting power from engine generators to meet the specific requirements of different aircraft systems.

Increasing demand for energy efficiency drives the power converter market growth.

The global focus on sustainable and green technologies has led to increased demand for power converters that operate with high efficiency. Many industries are implementing regulations that encourage or mandate the use of energy-efficient devices, including power converters. Energy-efficient power converters contribute to reducing the overall carbon footprint by minimizing energy losses in the conversion process. This is especially relevant in applications such as renewable energy systems and electric vehicles, where the goal is to maximize the use of clean energy.

The demand for energy-efficient power converters is prominent in consumer electronics and Internet of Things (IoT) devices. Consumers and manufacturers are increasingly focused on devices that consume less power during operation, leading to longer battery life and reduced environmental impact.

In December 2022, Infinix, a smartphone manufacturer, unveiled the Infinix Zero Ultra in India. The key highlight of this smartphone is its remarkable 180W wired charging capability. The device is equipped with an 8C cell 4,500 mAh battery, and with the included GaN charger, it claims to charge from 0% to 100% in just 12 minutes. This announcement reflects the ongoing trends in the smartphone industry, driving advancements in charging technologies. The push for faster charging speeds also signifies the need for upgraded hardware features and improved efficiency in AC-DC power adapters to support these evolving technologies.

The complexity of designing and manufacturing high-efficiency converters is expected to restrain the growth of the power converter market.

The complexity of high-efficiency converter designs makes thorough testing and validation crucial. Ensuring that the converters meet performance specifications under various operating conditions requires sophisticated testing facilities and methodologies, adding to the overall complexity and cost of the development process. Disruptions in the supply chain adversely affect production schedules and costs. The manufacturing processes for power converters are more intricate than standard designs, requiring investments in advanced manufacturing techniques and rigorous quality control measures. This commitment to precision adds complexity to the production process but is crucial for ensuring consistent and high-quality output.

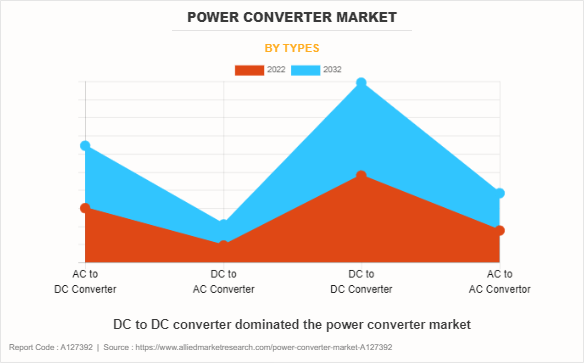

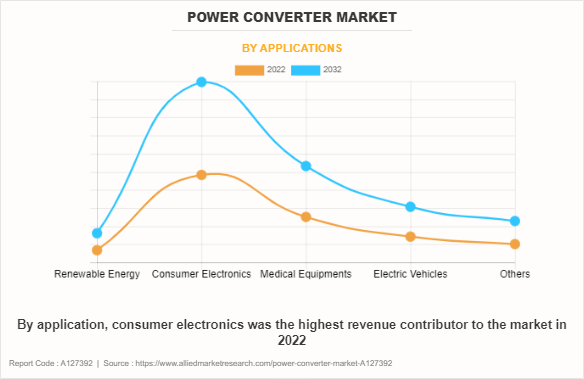

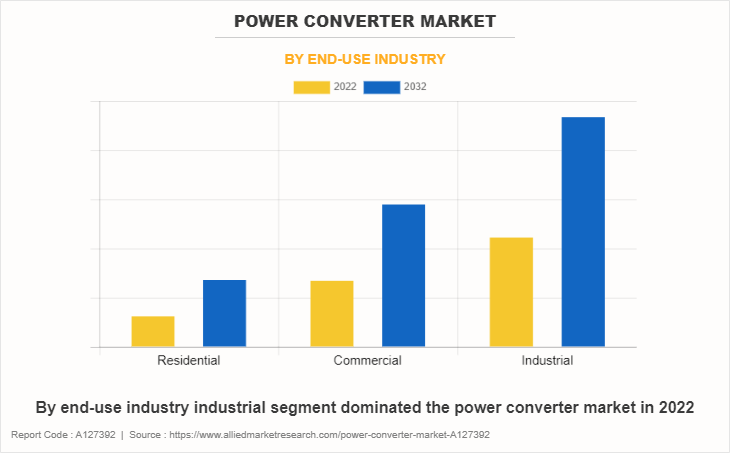

The power converter market is segmented into type, application, end-use industry, and region. On the basis of type, the market is classified into AC to DC converter, DC to AC converter, DC to DC converter, and AC to AC converter. On the basis of the application, the market is divided into renewable energy, consumer electronics, medical equipment, electric vehicles, and others. On the basis of the end-use industry, the market is divided into residential, commercial, and industrial. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

By type, DC to DC converter segment dominated the power converter market accounted for half of the market share growing with the CAGR of 7.6% in 2022. DC to DC converters play a crucial role in electronic systems by enabling the efficient conversion of voltage levels from one direct current (DC) value to another. These converters are essential in various applications, ranging from power supplies in electronic devices to renewable energy systems. The primary purpose of a DC to DC converter is to step up or step down the voltage as needed, ensuring compatibility between different components in a given system.

In February 2021, Vitesco Technologies introduced a groundbreaking DC/DC converter designed to enhance the functionality of the electrically heated EMICAT catalyst. The key innovation lies in the converter's ability to supply electricity to the heating discs of the catalyst in high-voltage vehicles. This development is particularly significant as it facilitates the achievement of minimal emissions in real-world operations, aligning with upcoming regulations like Euro 7. Notably, the recently engineered DC/DC converter plays a crucial role by transforming the high voltage from the drive system into the low voltage and power required for the efficient operation of the heating disc.

On the basis of application, consumer electronics segment dominated the power converter market accounted for half of the market share growing with the CAGR of 7.5% in 2022. Consumer electronics often rely on direct current (DC) power sources, while the electricity supplied to homes is typically alternating current (AC). Power converters, specifically AC to DC converters, bridge this gap by converting the incoming AC power to the DC power required by most electronic devices. This conversion is vital because many electronic components, such as integrated circuits and microprocessors, operate on DC power.

By end-use industry, the industrial segment dominated the power converter market report accounted for more than half of the market share growing with a CAGR of 7.7% in 2022. As industries increasingly embrace sustainable practices, power converters play a vital role in integrating renewable energy sources. Solar panels and wind turbines generate DC power, which needs to be converted to AC for use in industrial facilities. Power converters facilitate this transition, allowing industries to harness clean energy and reduce their dependence on traditional power sources.

Region wise, Asia-Pacific dominated the power converter market growing with the CAGR of 8.3% to the market. China, being one of the major economic powerhouses in the region, operates on a 220V standard. Power converters are commonly used, especially by international travelers and businesses, to adapt devices designed for different voltage standards. The country's manufacturing sector also relies on power converters to integrate machinery from various sources.

Japan uses a 100V standard, and power converters are essential for tourists and expatriates bringing electronic devices from regions with higher voltage standards. The prevalence of advanced electronics in Japan makes the use of reliable power converters crucial for both residents and visitors.

The major players operating in the power converter market include ABB Group, Siemens, Schneider Electric, Delta Electronics, Inc, Emerson Electric, Eaton, General Electric (GE), Mitsubishi Electric Corporation, Texas Instruments, and Vicor Corporation.

Historic Trends of Power Converter Market

- In 1920, the introduction of the mercury-arc rectifier, a type of high-voltage direct current (HVDC) converter. Development of the first solid-state rectifiers, paving the way for more efficient and reliable power conversion.

- In the 1950s, the introduction of the Silicon-Controlled Rectifier (SCR) marked a significant milestone in the field of semiconductor power devices. The SCR is a type of semiconductor device that allows control of electric power. It operates as a unidirectional current switch, conducting current only when a control signal is applied to its gate terminal.

- In the 1980s, the emergence of Insulated Gate Bipolar Transistors (IGBTs) marked a significant milestone in the field of power electronics. IGBTs are semiconductor devices that combine the advantages of Metal-Oxide-Semiconductor Field-Effect Transistors (MOSFETs) and Bipolar Junction Transistors (BJTs).

- In the 2000s, advancements in digital signal processing (DSP) and microcontroller technologies enable more sophisticated control algorithms in power converters, enhancing efficiency and performance.

- In the 2010s, increasing focus on energy efficiency and power density led to the development of wide-bandgap (WBG) semiconductors such as silicon carbide (SiC) and gallium nitride (GaN).

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the power converter market analysis from 2022 to 2032 to identify the prevailing power converter market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the power converter market forecast assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global power converter market trends, key players, market segments, application areas, and market growth strategies.

Power Converter Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 44.6 billion |

| Growth Rate | CAGR of 7.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Type |

|

| By Application |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | ABB Group, Eaton Corporation, Vicor Corporation, General Electric, Delta Electronics, Schneider Electric, Siemens AG, Texas Instruments Inc., Emerson Electric, Mitsubishi Electric |

Analyst Review

According to the opinions of various CXOs of leading companies, the global power converter market was dominated by the DC to DC converter segment. DC to DC conversion involves changing the voltage level of a direct current (DC) signal. This process is vital because different components and systems often require different voltage levels to operate optimally. There are two primary types of DC to DC converters: step-up (boost) converters and step-down (buck) converters.

The rise in demand for renewable energy integration drives the growth of the power converter market. Renewable energy sources such as solar and wind are inherently variable. Power converters play a crucial role in efficiently converting and managing the diverse energy inputs from these sources into a form suitable for the electrical grid or specific applications. Power converters facilitate the seamless integration of renewable energy systems into existing power grids. They help regulate voltage and frequency, ensuring the stability and reliability of the grid despite fluctuations in renewable energy output.

However, the complexity of designing and manufacturing high-efficiency converters is expected to restrain the growth of the market. Achieving high efficiency in power converters often involves intricate engineering solutions, complex control algorithms, and precision in component selection. This technical complexity is a barrier for some companies, especially those with limited expertise or resources. The competitive nature of the industry exert pressure on companies to bring products to market quickly. Balancing the need for speed with the intricacies of designing high-efficiency converters poses a challenge.

The Asia-Pacific region is projected to register robust growth during the forecast period. Travelers in the Asia-Pacific often encounter the need for power converters due to these differences. International standards organizations such as the International Electrotechnical Commission (IEC) and the International Organization for Standardization (ISO) strive to harmonize electrical standards globally. However, achieving uniformity across the APAC nations remains a complex task, given the existing infrastructure and economic considerations.

The global power converter market was valued at $20.9 billion in 2022, and is projected to reach $44.6 billion by 2032, growing at a CAGR of 7.8% from 2022 to 2032.

Asia-Pacific is the largest regional market for power converter.

Rise in adoption of 5G technology in developed countries are the upcoming trends of power converter market in the world.

ABB Group, Siemens, Schneider Electric, Delta Electronics, Inc, Emerson Electric, Eaton, General Electric (GE), Mitsubishi Electric Corporation, Texas Instruments, and Vicor Corporation. These are the top companies of the power converter market.

The leading application of power converter market renewable energy, consumer electronics, medical equipment, electric vehicles, and others.

The power converter market is segmented into type, application, end-use industry, and region. On the basis of type, the market is classified into AC to DC converter, DC to AC converter, DC to DC converter, and AC to AC converter. On the basis of the application, the market is divided into renewable energy, consumer electronics, medical equipment, electric vehicles, and others. On the basis of the end-use industry, the market is divided into residential, commercial, and industrial.

Rise in adoption of electric vehicles and surge in usage of DC/DC converter in railway application are the driving factors of the power converter market.

Loading Table Of Content...

Loading Research Methodology...