Power Electronics Market Research, 2033

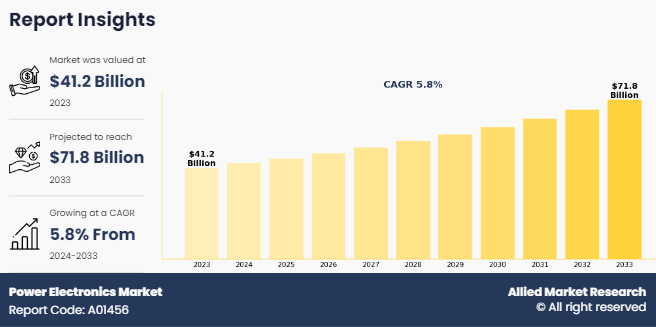

The Global Power Electronics Market was valued at $41.2 billion in 2023, and is projected to reach $71.8 billion by 2033, growing at a CAGR of 5.8% from 2024 to 2033.

Power electronics is a branch of electrical engineering dedicated to the efficient conversion, control, and management of electrical power through the use of semiconductor devices. It involves transforming electrical energy from one form to another using components such as diodes, transistors, and thyristors. Power electronics systems are designed to handle high voltage and current with rapid switching and high efficiency. These systems are crucial in applications such as electric vehicles, renewable energy, and industrial automation, where they ensure reliable power management and enhance energy efficiency. This field plays a vital role in developing advanced technologies that improve energy utilization and overall system performance.

A power module is a set of power components integrated in power semiconductor devices. Power devices can attain extremely low resistance and high-frequency switching. These properties are exploited in high-efficiency power supplies, electric vehicles (EVs), hybrid electric vehicles (HEVs), photovoltaic inverters, and RF switching. These devices are applicable in power supplies for server, IT equipment, high efficiency & stable power supplies, and EV & HEV devices. This is attributed to the fact that these devices facilitate control and conversion of electrical power effectively and efficiently.

The prominent factors that drive the power electronics market growth include advancements in automotive electronics, increased adoption of renewable energy, and rise in adoption of power electronics components in electric vehicles. Moreover, surge in demand for SiC-based photovoltaic cells in the developing countries, including China, Brazil, and India, fuels the growth of the global market. Power resistors, power capacitors, and portable cell phone battery are essential components in the power electronics market, enabling efficient energy conversion, storage, and management in various electronic devices and systems.

The increasing demand for power electronics components across various industry verticals significantly drives the growth of the power electronics market. As industries such as automotive, telecommunications, consumer electronics, and renewable energy expand, they require advanced power electronics to manage and optimize electrical power efficiently. In the automotive sector, for example, power electronics are crucial for electric vehicles and advanced driver assistance systems. In telecommunications, they ensure reliable power management for network infrastructure. Power electronics is the branch of electronics that deals with the control and conversion of electrical power.

The characteristics of silicon carbide (SiC) semiconductors, such as higher breakdown electric field strength and wider band gap enable their usage in power electronics. For instance, these devices play an extremely crucial role in controlling automotive electronics such as electric power steering, hydro electric vehicles main inverter, seat control, and braking system. In addition, SiC power electronics facilitate energy conversion in generators and actuators integrated in aircraft. The growth of the power electronics market is driven by an increase in usage of power electronics in several applications such as industrial motor drives, electric grid stabilization, and consumer electronics. Therefore, effective power control and management features for industrial operations or functioning of electrical/electronic devices make it suitable for different industry verticals, thereby augmenting the global market growth.

For instance, in February 2024, Murata launched three new power systems such as PE25208, PE24109 and PE24110 that are set to revolutionize the semiconductor landscape. These innovations aim to enhance the efficiency and performance of semiconductor devices, addressing the growing demands for power solutions in various applications such as data centers, telecom, and industrial markets. The new power systems are designed to improve energy management, reduce heat, and boost overall system reliability, marking a significant step forward in Murata's power solutions portfolio.

However, the high cost of power electronic devices is expected to hamper the growth of the market, globally, due to significant investment required for advanced technologies. Power electronics components, such as high-performance semiconductors and integrated circuits, often involve complex manufacturing processes and expensive materials.

Moreover, the rise in demand for plug-in electric vehicles (PEVs) and innovation in power metal–oxide– semiconductor field-effect transistor (MOSFET) is anticipated to provide lucrative opportunities for expansion of the power electronics market. Advancements in metal-oxide-semiconductor field-effect transistors (MOSFETs) present a significant opportunity for the power electronics market due to their enhanced performance and efficiency in managing electrical power.

Innovations such as the development of advanced materials such as silicon carbide (SiC) and gallium nitride (GaN), along with improved fabrication techniques, enable MOSFETs to handle higher voltages and currents with greater efficiency. These innovations lead to smaller, lighter, and more reliable power electronics systems, which are crucial for applications ranging from consumer electronics and automotive systems to renewable energy and industrial machinery. For instance, the introduction of silicon carbide (SiC) and gallium nitride (GaN) MOSFETs offers superior performance compared to traditional silicon MOSFETs, particularly in high-voltage and high-frequency applications. This results in higher efficiency, faster switching speeds, and reduced overall system costs.

As industries increasingly demand more efficient and compact power solutions, the enhanced capabilities of advanced MOSFETs align well with these needs, thus driving growth in the power electronics market. Therefore, the continued evolution of MOSFET technology not only addresses current market demands but also opens new opportunities for innovation and application across various sectors. For instance, in March 2024, Infineon Technologies launched its OptiMOS 7 80 V MOSFET, the IAUCN08S7N013, designed to enhance power density and efficiency for automotive applications. This new MOSFET, available in a compact 5 x 6 mm² SSO8 package, is ideal for 48 V systems in electric vehicles, including DC-DC converters and motor control.

Segment Overview

The power electronics industry is segmented into device type, material, application, end use, and region.

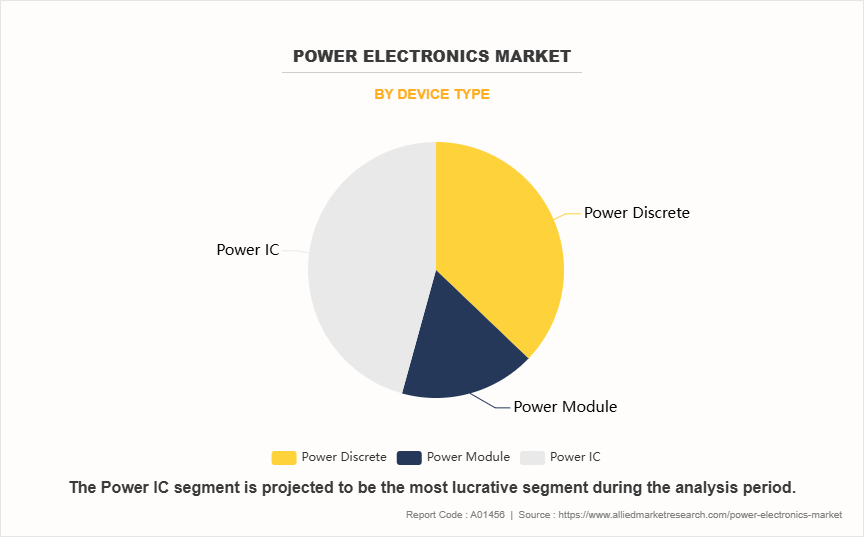

On the basis of device type, the market is classified into power discrete, power module, and power IC. By device type segment, Power IC segment is leading in the 2023 and expected to continue its dominance over the forecast period. The expansion of the consumer electronics market is a significant driving factor for Power ICs in the power electronics sector. As consumer electronics, including smartphones, tablets, and wearable devices, become more advanced and widespread, the demand for Power ICs intensifies. These integrated circuits are crucial for managing power distribution, optimizing battery performance, and ensuring energy efficiency within these devices. With continuous innovation and increasing functionality in consumer electronics, Power ICs must handle higher power demands and provide reliable performance, thereby driving growth in the power electronics market. The need for compact, efficient, and durable Power ICs aligns with the ongoing advancements in consumer technology.

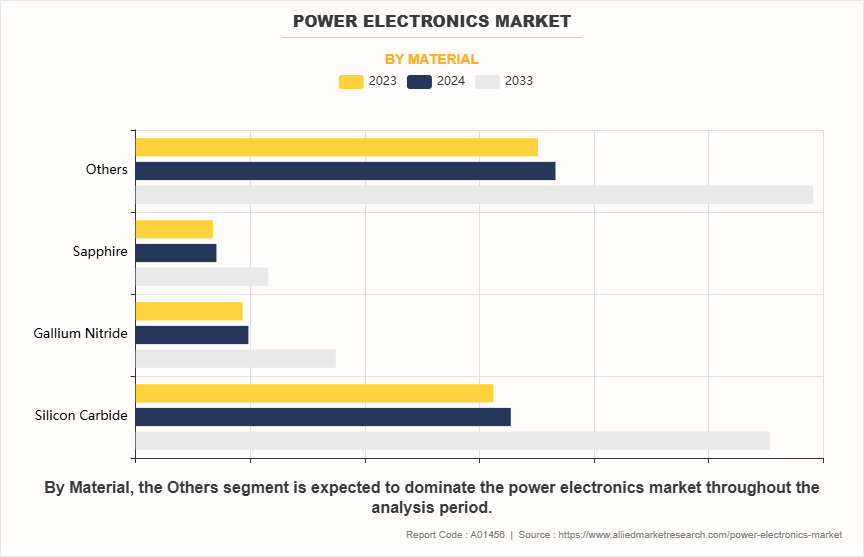

By material, it is categorized into silicon carbide, gallium nitride, sapphire, and others. By material, silicon carbide segment is leading in 2023 and expected to continue its dominance over the forecast period. The rapid growth of the electric vehicle (EV) market is a key factor driving the demand for Silicon Carbide (SiC) semiconductors. SiC-based power devices are becoming increasingly essential in EV powertrains and charging infrastructure due to their superior efficiency, high thermal conductivity, and ability to handle higher voltages compared to traditional silicon semiconductors. These advantages translate into reduced energy losses, extended driving range, and improved overall vehicle performance. As the automotive industry intensifies its focus on enhancing battery efficiency and shortening charging times, SiC semiconductors are expected to play a critical role in advancing electric mobility and supporting the broader transition to sustainable transportation solutions.

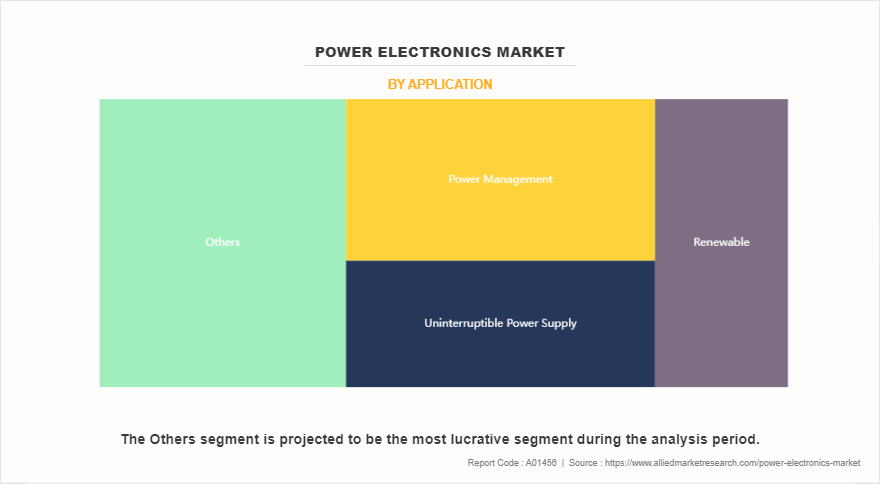

By application, the market is classified into power management, uninterruptible power supply (UPS), renewable, and others. Others segments are leading in 2023 and expected to continue their dominance over the forecast period. The others segment include transportation, rail traction, utility system, and drivers. The transportation industry is one of the rapidly growing markets and requires innovative power conversion systems to meet stringent requirements in terms of cost, especially for electric vehicles, size, weight, power density, and reliability. A driver is a circuit used to control another circuit or component, such as liquid crystal display (LCD) and high-power transistor. In addition, gate driver accepts low-power input from a controller IC and produces a high-current drive input for the gate of a high-power transistor such as an IGBT or power MOSFET.

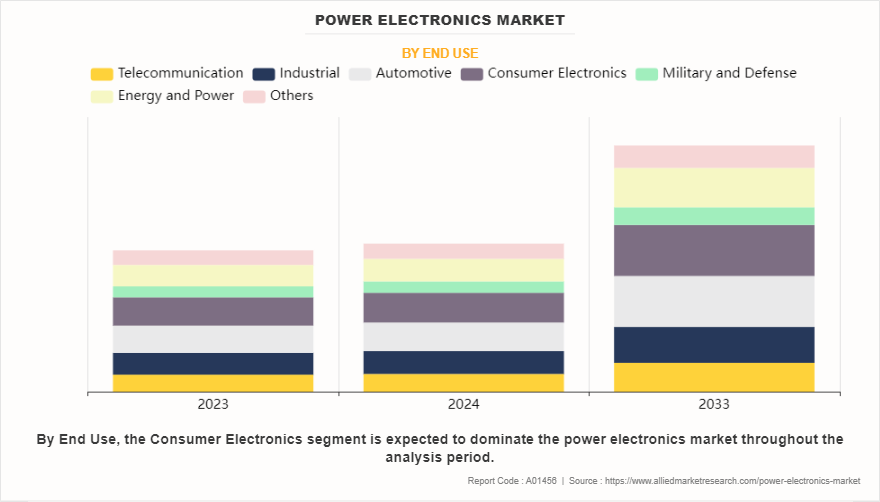

By end use, the market is fragmented into telecommunication, industrial, automotive, renewable, consumer & enterprise, military & defense, energy & power, and others. The consumer electronics segment is leading in 2023 and expected to continue its dominance over the forecast period. The surge in demand for consumer electronics products and rise in technological awareness are projected to offer lucrative opportunities for the growth of the global power electronics market. As consumers increasingly seek advanced gadgets such as smartphones, laptops, and smart home devices, the need for efficient power management and conversion solutions intensifies. Power electronics play a critical role in enhancing the performance and energy efficiency of these products. Moreover, rising technological awareness drives the adoption of innovative power electronics technologies, supporting advancements in device performance and sustainability. This growing demand, coupled with heightened consumer interest in cutting-edge technology, is propelling the expansion of the power electronics market, leading to greater innovation and investment in this sector.

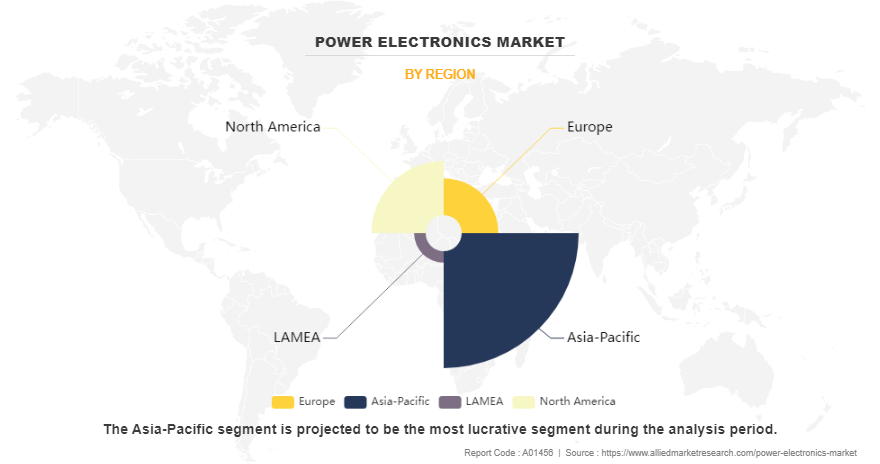

Region wise, the market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). Asia Pacific region is leading in 2023 and expected to continue its dominance over the forecast period. Rapid industrialization in Asia-Pacific countries such as China, India, and Southeast Asian nations, is fueling the demand for power electronics. As industries expand and modernize, they require advanced power management solutions to optimize energy efficiency, ensure reliable operation, and support automation processes. This growth drives the need for innovative power electronics that can handle high power loads, reduce energy waste, and improve overall operational efficiency in the industrial sector.

Competitive Landscape

Competitive analysis and profiles of the major power electronics industry players, such as ABB Group, Fuji Electric Co. LTD, Infineon Technologies AG, Microsemi Corporation, Mitsubishi Electric Corporation, Renesas Electronics Corporation, Rockwell Automation, Inc., STMicroelectronics, Texas Instruments Incorporated, and Toshiba Corporation, are provided in this report. Market players have adopted various strategies such as product launch, expansion, collaboration, partnership, innovation, investment, new product development, and acquisition to expand their foothold in the power electronics market.

Historical Data & Information

The global power electronics market is highly competitive, owing to the strong presence of existing vendors. Vendors in the market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in the market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Recent Key Strategies and Developments

- In May 2023, ABB Power Conversion introduced compact and efficient 1/16th-brick DC/DC converters, the KBVS008 and KBVW010 modules, designed to meet the power needs of 5G equipment. These converters offer adjustable output voltage ranges, high power density, and robust protection features, making them suitable for various applications, including 5G radios.

- In August 2023, Fuji Electric Co., Ltd. announced the launch of the P633C Series 3rd-generation small IPMs, which helps reduce the power consumption of the equipment on which it is mounted, such as

- home appliances and machine tools.

Key Benefits For Stakeholders

- This report provides a quantitative power electronics market analysis of the market segments, current trends, estimations, and dynamics of the power electronics market forecast from 2023 to 2033 to identify the prevailing power electronics market opportunities. The power electronics market size is in $billion.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network. Power electronics market data, and power electronics market insights are covered in the report.

- In-depth analysis of the power electronics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.Power electronics market share by key players is included in the report.

- The report includes the analysis of the regional as well as global power electronics market trends, key players, market segments, application areas, and market growth strategies.

Power Electronics Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 71.8 billion |

| Growth Rate | CAGR of 5.8% |

| Forecast period | 2023 - 2033 |

| Report Pages | 411 |

| By Device Type |

|

| By Material |

|

| By Application |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Mitsubishi Electric Corporation, ABB, Ltd, Toshiba Corporation, FUJI ELECTRIC CO, LTD., Microsemi Corporation, Renesas Electronics Corporation, STMicroelectronics N.V., Rockwell Automation, Inc., Infineon Technologies AG, Texas Instruments Incorporated |

Analyst Review

According to insights from CXOs of leading companies, silicon carbide power devices play a revolutionary role in the power electronics market. The current business scenario has been witnessing an increase in demand for power electronics modules across various industry verticals, particularly in the developed regions such as the U.S., Europe, and Asia-Pacific. Companies in this industry have been launching a variety of products, such as silicon carbide Schottky barrier diodes, and power MOSFETs, owing to their increasing usage in photovoltaic inverters, industrial motor drives, and electro-mobility, which significantly contributes toward the growth of the global power electronics market.

Furthermore, an increase has been witnessed in adoption of power devices integrated with power electronics, as they can be operated at higher voltages and higher temperatures as compared to traditional silicon semiconductors devices. In addition, lesser power loss and reduction in the size of power circuits with the usage of these SiC devices fuel the growth of the market, globally. With increase in new entrants in the China power electronics market, Asia Pacific is expected to show the strongest growth rate during the forecast period. Moreover, rise in usage of electric vehicles, photovoltaic inverters, and power devices is expected to boost the global market growth.

Asia-Pacific exhibits the highest adoption of silicon carbide power devices, and thus is expected to grow at a faster pace during the forecast period. The power electronics market provides numerous growth opportunities to the players such are ABB Group, Fuji Electric Co. LTD, Infineon Technologies AG, Microsemi Corporation, Mitsubishi Electric Corporation, Renesas Electronics Corporation, Rockwell Automation, Inc., STMicroelectronics, Texas Instruments Incorporated, and Toshiba Corporation.

The global power electronics market was valued at $ 41.8 billion in 2023, and is projected to reach $71.7 billion by 2033, registering a CAGR of 5.8% from 2023 to 2033

The Asia Pacific is largest region and projected to register the highest growth rate in the coming years

Depending on application, others segment has dominated the power electronics market, in terms of revenue in 2023.

The key players profiled in the report include Infineon Technologies AG, Mitsubishi Electric Corporation, ABB, Ltd., FUJI ELECTRIC CO, LTD., Microsemi Corporation, Rockwell Automation, Inc., Renesas Electronics Corporation, Texas Instruments Incorporated, STMicroelectronics N.V., and Toshiba Corporation. Market players have adopted various strategies such as product launch, expansion, collaboration, partnership, innovation, investment, new product development, and acquisition.

Upcoming trends in the global power electronics market include increased adoption of wide-bandgap semiconductors, growth in electric vehicles, enhanced energy efficiency, advancements in renewable energy integration, and the rise of smart grids and IoT applications driving demand for innovative power solutions.

Loading Table Of Content...

Loading Research Methodology...