Power Line Communication (PLC) Systems Market Overview:

The global power line communication (PLC) systems market is anticipated to reach around $14 billion by 2022, growing at a CAGR of 18.4% from 2016 to 2022. Power line communications is a comparatively new area of telecommunication. It is a communication technology that allows transfer of data over existing power cables. Using the power line as a communication medium is also a cost-effective way as compared to other methods because it uses an existing infrastructure, and wires subsist to every household connected to the power line network. The potential implementation of PLC, with the main emphasis on Internet access, is being adopted in various European and Asian countries as well as in the U.S.

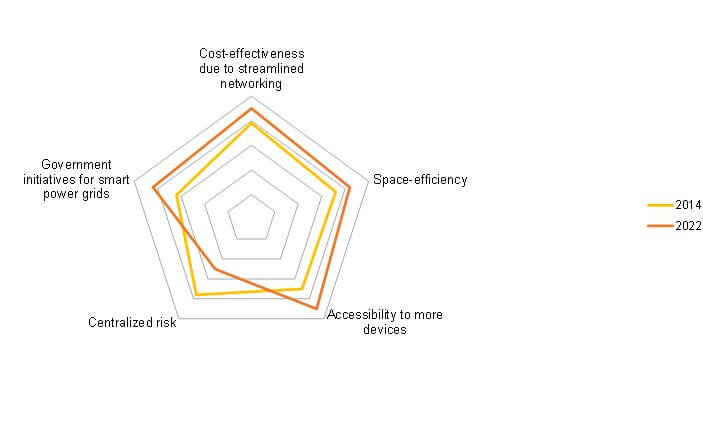

Increase in adoption of PLC in residential, commercial, and industrial sectors is due to cost-efficiency of PLC infrastructure as compared to traditional or competitive technologies. Therefore, the global PLC market is expected to witness moderate growth in the near future, owing to space efficiency and additional power circulation by this technology. However, dependency of the user for power and data over the same line increases the centralized risk factor and this could hamper the market growth. Proactive government initiatives to promote PLC and smart grids utilizing PLC are expected to provide lucrative opportunities to the market.

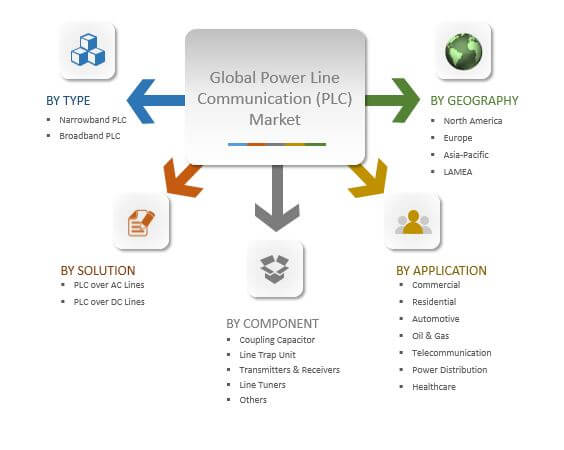

Segment Overview

The global PLC systems market is segmented based on type, solution, component, application, and geography. The type segment is bifurcated into narrowband PLC and broadband PLC. In 2015, broadband PLC segment dominated the global market, in terms of revenue, and is expected to maintain this trend throughout the forecast period, owing to evasion from expense for maintaining a dedicated network of antennas, radios, and routers in a wireless network.

The solution segment is classified as PLC over AC lines and PLC over DC lines. The PLC over AC lines segment dominated the global market, in terms of revenue, and is expected to maintain this trend head as well. However, the PLC over DC lines is also witnessing rapid growth in home networking, lighting, and solar applications as well as in transportation vehicles.

Market Segmentation

Geographical Scenario

Competition Analysis

Comprehensive competitive analyses and profiles of major market players, including Cypress Semiconductor, ST Microelectronics, Texas Instruments, Maxim Integrated, Marvell, Qualcomm Atheros, Microchip, Sigma Designs, Inc., Broadcom Corporation, and Echelon Corporation are provided in this report. Currently, these players have adopted growth strategies such as product launch and acquisition. Companies, such as Broadcom Corporation and Qualcomm Atheros, have launched new power modules to expand their customer base and increase their market shares.

Top Impacting Factors

Cost-effectiveness due to streamlined networking

Rise in concerns regarding distribution issues and extra cost for setting up a data communication network have enforced various organizations to invest for improving the infrastructure of data networking techniques. PLC plays a crucial role in smart grids to control power distribution at high voltages and enhance efficiency. It can be a method of extending an existing network into new areas without adding new cables. Currently, U.S. possesses the most number of grids with smart grid capabilities, owing to the technological development in the region.

Centralized risk

PLC allows one to transmit and receive data by moving a controlled carrier signal over existing power lines. Interconnection has increased with the arrival of the Internet and new networking technologies like PLC. This collectively increases the risk of failure and security breaching in the system. Network security has become more important to personal computer users, organizations, and the military. However, technological developments would like to eradicate the effect of this factor in the near future.

Key Benefits:

- The study provides an in-depth analysis of the global power line communication systems market to elucidate the prominent investment pockets.

- Current trends and future estimations are outlined to determine the overall market potential, and single out profitable trends to gain a stronger foothold in the market.

- The report provides information regarding key drivers, restraints, and opportunities along with their impact analyses.

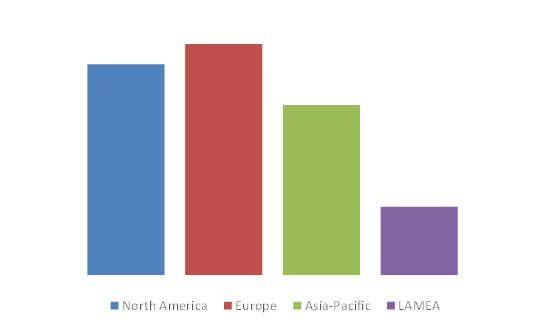

- The market is analyzed based on various regions, namely, North America, Europe, Asia-Pacific, and LAMEA.

Global Power Line Communication (PLC) Systems Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Solution |

|

| By Component |

|

| By Application |

|

| By Geography |

|

| Key Market Players | MARVELL, TEXAS INSTRUMENTS INC., SIGMA DESIGNS, INC., QUALCOMM ATHEROS INC., CYPRESS SEMICONDUCTOR CORPORATION, MAXIM INTEGRATED, MICROCHIP TECHNOLOGY INC., ECHELON CORPORATION, BROADCOM LIMITED, STMICROELECTRONICS |

Analyst Review

The global power line communication (PLC) systems market is expected to witness significant growth in the near future owing to increase in need for power management technologies. Earlier, PLC was used in medium- and low-voltage application industries; however, other industries, such as heavy industries, energy & power, oil & gas, and automotive, have adopted it to efficiently manage power, owing to the advent of advanced technology and increase in awareness about the benefits of PLC. Market players focus on developing innovative products for applications in smart grids and healthcare sector to enhance their efficiency. It enables power management to improve energy efficiency and prevent power loss. Low power consumption and intense competition in the market have enforced industries to adopt PLC technology, which has stimulated the market growth.

PLC has the ability of proposing the data rate, performance, flexibility, consistency, and cost-efficiency required to support whole-home multimedia networking. As transmissions are sent over a wired medium, lower latencies can be attained benefiting real-time streaming applications such as VoIP and IPTV and interactive services. However, prominent players have developed low-cost, compact, affordable, and energy-efficient PLC systems to increase the efficiency of the applications. Proactive government initiatives to establish high-voltage direct current (HVDC) and smart grid provide growth opportunities to market players. Public and private organizations have substantially invested in R&D activities to develop technologies and applications for PLC. Europe is the major revenue contributor to the global market, followed by North America. It is projected that the market growth in Asia-Pacific and LAMEA is expected to significantly increase during the forecast period.

Loading Table Of Content...

%20Systems%202014-2022%20(2).jpg)