Pressure Vessel Composite Materials Market Overview:

Global Pressure Vessel Composite Materials Market was valued at $434 million in 2016, and is expected to reach at $1,871 million by 2023, growing at a CAGR of 23.0% from 2017 to 2023. Pressure vessels are ergonomically designed chambers that enclose gases or liquids at a pressure substantially different from the ambient pressure. These vessels consist of various shapes, the most common being cylindrical and conical for industrial applications. They form an integral part of the industrial infrastructure for safe handling of gases and liquids. These vessels are made of steel alloy, other metal alloy, and composites. Furthermore, the use of composites has increased for manufacturing these vessels, owing to enormous possibilities in design and high strength-to-weight ratio.

The global pressure vessel composite materials market is segmented based on material, end-use industry, and geography. Based on material, it is classified into epoxy resin, carbon fiber, and glass fiber. Based on end-use industry, it is categorized into CNG vehicles, hydrogen vehicles, and gas transport. The market is analyzed based on geography into North America, Europe, Asia-Pacific, and LAMEA.

In 2016, epoxy resin accounted for the largest market in terms of volume and is expected to maintain its dominance in the global market during the forecast period. Its high adhesion property and high mechanical strength makes it suitable for fabrication of composite pressure vessels. It enables improved impact-resistance, better dynamic-fatigue, and low-temperature performance. Moreover, it is coated on most of the pressure vessels due to high weather resistant properties. In 2016, the CNG vehicles segment accounted for the highest revenue in the global market, owing to the lower cost as compared to other vehicles. The metallurgical skills and equipment needed to produce them are widely available across the globe. In addition, CNG counterparts reduce the weight of the storage container by 30-40%. Moreover, the hydrogen vehicles segment is estimated to register the highest growth rate during the forecast period, as it eliminates pollution and has higher fuel efficiency than CNG and other gas engines vehicles.

Global Pressure Vessel Composite Materials Market Segmentation

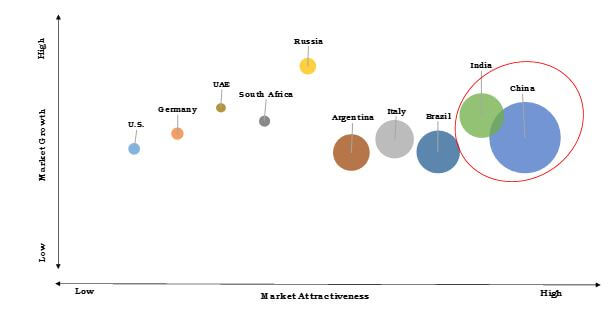

Top Investment Pocket

China and India dominated the global pressure vessel composite materials market in 2016, owing to the surge in the number of automobile manufacturers including Toyota, BMW, Ford, and Nissan. The number of natural gas vehicles (NGVs) has increased from 1.5 million units in 2012 to 5 million units in 2016. Similarly, for India, the number for NGVs was 1.25 million units in 2012, and has reached 1.8 million units in 2016. These trends are expected to drive the growth of the global pressure vessel composite materials market.

Pressure Vessel Composite Materials Market Top Investment Pockets By Key Countries

Segment Review

The CNG vehicle segment dominated the global market in 2016. Approximately, more than 80% of the heavy and medium trucks and transit buses use CNG-based fueling systems. Emerging economies exhibit the maximum demand for CNG pressure vessels. In 2008, around 90% of 2 million CNG vehicles were delivered to customers outside Europe and North America. Approximately 32 million CNG vehicles were delivered to customers outside North America and Europe during 2009-2013; thereby, indicating high demand for these vehicles in developing economies.

Natural Gas Vehicle Fleet, By Region, 2004-2016

LAMEA Review

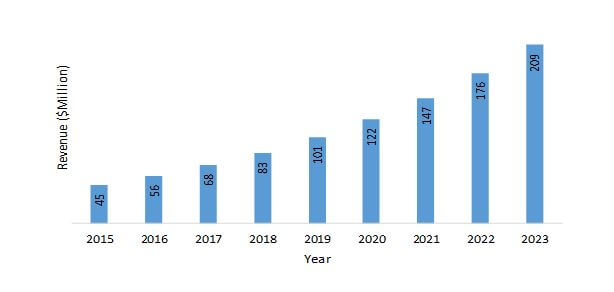

Brazil and Argentina are the most lucrative pressure vessel composite materials markets in LAMEA. Major players in these countries have expanded their manufacturing units to produce CNG vehicles. Inflex-Argentoil S.A., an Argentina-based supplier of pressure vessels for CNG vehicles, has expanded its business throughout South America and Middle East by entering into a joint-venture with local manufacturers. This is expected to increase the demand for composites material for manufacturing pressure vessels for automobiles.

Brazil Pressure Vessel Composite Materials Market, 2015-2023 ($Million)

The key players operating in the global pressure vessel composite materials market are Samuel Pressure Vessel Group, Doosan Heavy Industries & Construction, Mitsubishi Heavy Industries, Ltd., Bharat Heavy Electricals Limited, Larsen & Toubro Limited, Westinghouse Electric Company LLC, General Electric, Halvorsen, IHI Corporation, and Pressure Vessels (India).

The other players (not profiled in the report) operating in this market are Babcock and Wilcox Enterprises, Inc., Dongfang Electric Machinery Co., Ltd., Abott, and Alloy Products Corp.

Key Benefits for Stakeholders

- This report provides an extensive analysis of the global pressure vessel composite materials market trends, future estimations, and dynamics from 2016 to 2023 to identify the prevailing opportunities.

- A detailed analysis of the key segments demonstrates the consumption of composite materials in different end-use industries.

- Detailed analysis is conducted by following key product positioning and monitoring the top competitors within the market framework.

- Key players are profiled and their strategies are analyzed thoroughly to understand the competitive outlook of the market.

Pressure Vessel Composite Materials Market Report Highlights

| Aspects | Details |

| By Material |

|

| By End Use Industry |

|

| By Geography |

|

| Key Market Players | WESTINGHOUSE ELECTRIC COMPANY LLC., LARSEN & TOUBRO LIMITED, DOOSAN HEAVY INDUSTRIES & CONSTRUCTION, HALVORSEN, IHI CORPORATION, BHARAT HEAVY ELECTRICALS LIMITED, MITSUBISHI HEAVY INDUSTRIES, LTD., SAMUEL CNG PRESSURE VESSEL GROUP, GENERAL ELECTRIC, CNG PRESSURE VESSELS (INDIA) |

Analyst Review

A pressure vessel is a close container that hold gases or liquids at a pressure substantially different from the gauge pressure in another vessel. These are containers for the containment of pressure either externally or internally. The pressure is applied from an external source or by the application of heat from a direct or indirect source or by combination of both sources. These vessels are used in industrial compressed air receivers, domestic hot water storage tanks, diving cylinders, recompression chambers, distillation towers, autoclaves, oil refineries or petrochemical plants, nuclear reactor vessels, pneumatic, and hydraulic reservoirs.

Epoxy resin contributed for the highest volume share in the global market in 2016, owing to high mechanical strength and corrosion resistance, which improve the impact resistance of pressure vessels. It enables efficient performance of vehicles at low-temperature. Greater design flexibility, high tensile strength, and lightweight of carbon fiber facilitate reduction in the overall weight of vehicles. Moreover, the market is driven by the increase in the number of natural gas vehicles (NGVs) globally. In 2018, the number of NGVs is estimated to be around 10 million units, which would reach 65 million units by 2023. The CNG vehicles segment dominated the global market in 2016, as the metallurgical skills and equipment required for its production are available across the globe.

Loading Table Of Content...