Primary Lithium Batteries Market Research, 2032

The global primary lithium batteries market size was valued at $2.5 billion in 2022, and is projected to reach $3.9 billion by 2032, growing at a CAGR of 4.7% from 2023 to 2032. The increasing adoption of primary lithium batteries in medical devices is expected to significantly drive the demand for the primary lithium batteries market. Medical devices, ranging from life-saving implants like pacemakers and insulin pumps to portable diagnostic equipment, rely on dependable power sources to ensure continuous operation and patient safety. Primary lithium batteries offer distinct advantages in this regard, including long shelf life, high energy density, and stable voltage output throughout their lifespan. These attributes are particularly critical for medical devices requiring extended operational periods and reliability over time.

Introduction

A primary lithium battery is a non-rechargeable electrochemical power source that utilizes lithium-based compounds as the primary anode material. These batteries are widely recognized for their high energy density, longer shelf life, and excellent performance in a variety of applications. The primary anode materials in lithium batteries often include lithium manganese dioxide (LiMnO2), lithium thionyl chloride (LiSOCl2), or lithium iron disulfide (LiFeS2). The lithium anode is typically paired with a separator and an electrolyte to facilitate the flow of ions between the anode and cathode, enabling the electrochemical reactions that produce electrical energy.

An outstanding characteristic of primary lithium batteries is their prolonged shelf life, rendering them well-suited for devices that experience sporadic use or require extended periods of storage. In addition, these batteries exhibit a stable voltage output over their lifespan, ensuring consistent power delivery. Their lightweight and compact design further contributes to their widespread adoption in various electronic devices, such as cameras, watches, and medical implants.

However, the primary lithium batteries cannot be recharged and attempts to do so may lead to safety hazards. Despite their inability to be reused, their impressive energy density and reliability make primary lithium batteries a preferred choice for applications where long-lasting and dependable power sources are essential.

Key Takeaways

- The primary lithium batteries market report covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- More than 3,700 product literatures, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- The primary lithium batteries market is highly fragmented, with several players including Energizer Holdings, Inc.; Duracell; Panasonic Corporation; Tadiran Batteries; Saft Groupe S.A.; EVE Energy Co., Ltd.; Ultralife Corporation; GP Batteries International Limited; Maxell Holdings, Ltd.; and Renata SA.

Market Dynamics

Furthermore, as medical technology advances, there is a growing trend toward miniaturization and portability of devices, thus necessitating power solutions that are compact and powerful. Primary lithium batteries excel in meeting these requirements due to their lightweight nature and ability to deliver high energy in a small footprint. The stringent regulatory standards in the medical industry mandate the use of safe and reliable power sources, further underscoring the preference for primary lithium batteries known for their stable performance and low risk of leakage or failure.

Moreover, with an aging population and increase in prevalence of chronic diseases globally, the demand for medical devices is expected to continue rising, consequently boosting the market for primary lithium batteries. Thus, the increasing adoption of primary lithium batteries in medical devices is expected to drive the primary lithium batteries market growth.

However, primary lithium batteries, especially those containing lithium metal, can have environmental implications if not properly disposed of or recycled. The materials in these batteries, including lithium and other metals, can be harmful to the environment if they leach into soil or water systems. Improper disposal, such as throwing batteries into regular waste streams, contributes to environmental pollution.

Nevertheless, as the electric vehicle market continues to grow, there is an opportunity for primary lithium batteries to play a role in auxiliary applications, such as powering electronic systems within the vehicle. These batteries can be used for functions like key fobs, tire pressure monitoring systems, and other low-power components. The proliferation of IoT devices and smart technologies presents a significant opportunity for primary lithium batteries. These batteries can power a wide range of IoT sensors, devices, and gadgets, including smart home devices, environmental sensors, and industrial IoT applications. The increasing popularity of wearable devices, such as smartwatches and fitness trackers, creates a demand for compact and lightweight power sources. Primary lithium batteries, with their high energy density and long lifespan, are well-suited for these applications.

The integration of primary lithium batteries into hybrid energy storage systems, combining different battery chemistries or storage technologies, can provide customized solutions for specific applications, balancing power and energy density requirements. The growing emphasis on environmental sustainability and the circular economy presents an opportunity for manufacturers to focus on developing environmentally friendly primary lithium batteries with improved recycling capabilities.

Segments Overview

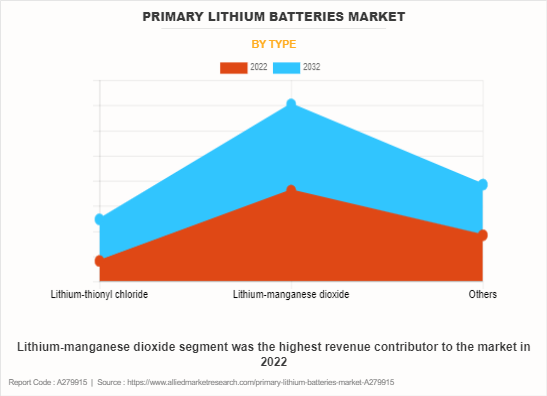

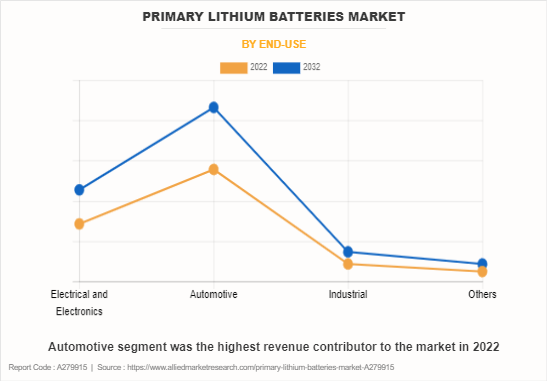

The primary lithium battery market is segmented on the basis of type, end-use industry, and region. By type, the market is divided into lithium-thionyl chloride, lithium-manganese dioxide, and others. By end-use industry, the market is divided into aerospace & defense, medical, electronics, and others. Region-wise, the primary lithium batteries market share is studied across North America, Europe, Asia-Pacific, and LAMEA.

The lithium-manganese dioxide segment dominated the market, accounting for more than two-fifths of the global primary lithium batteries industry revenue growing with a CAGR of 5.0%. The healthcare industry extensively utilizes lithium-manganese dioxide primary lithium batteries in medical devices such as implantable cardiac pacemakers, defibrillators, infusion pumps, and hearing aids. The stable voltage output and long operational life are crucial for the reliable functioning of these life-saving medical devices.

The automotive segment dominated the market in 2022, accounting for more than half of the global primary lithium batteries market revenue growing with a CAGR of 4.6%. In vehicles with advanced electronics, primary lithium batteries might be used as backup power sources for memory functions. These batteries help retain settings and data when the main power source is disconnected. Some automotive systems, like the vehicle's real-time clock or memory modules that store certain settings, may use primary lithium batteries to maintain timekeeping and memory when the vehicle is turned off.

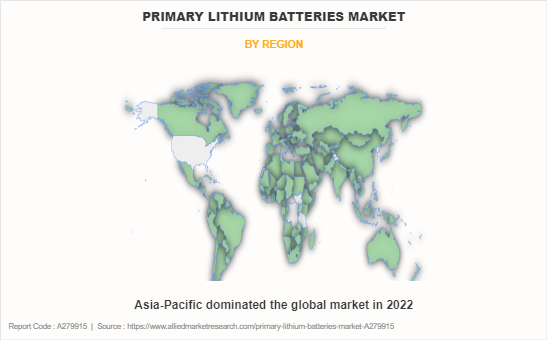

Asia-Pacific held the highest market share accounting for more than two-fifths of the global primary lithium batteries market growing with a CAGR of 5.0%. Asia-Pacific is home to some of the world's largest consumer electronics markets, including China, Japan, South Korea, and India. The region's strong presence in the manufacturing and consumption of smartphones, laptops, wearables, and other portable electronic devices has been a major driver for the primary lithium batteries market.

Emerging economies in Asia-Pacific, such as India and Southeast Asian countries, are experiencing rapid urbanization and increasing disposable income. This has resulted in a growing market for consumer electronics, boosting the demand for primary lithium batteries. Some countries in the Asia-Pacific region have shown a commitment to investing in renewable energy and electric vehicles. While primary lithium batteries are not the primary energy storage solution for electric vehicles, the overall growth in the energy storage sector can indirectly impact the battery market in the region.

Competitive Analysis

The players operating in the global primary lithium batteries market are Energizer Holdings, Inc.; Duracell; Panasonic Corporation; Tadiran Batteries; Saft Groupe S.A.; EVE Energy Co., Ltd.; Ultralife Corporation; GP Batteries International Limited; Maxell Holdings, Ltd.; and Renata SA. The unique technologies and innovative approaches of the abovementioned companies contribute to the advancement of the primary lithium batteries market.

Historical Trends of Primary Lithium Batteries Market

- Initial research on lithium batteries began in the 1960s. Researchers explored the use of lithium as an anode material due to its high electrochemical potential.

- The first commercial primary lithium batteries were introduced in the 1970s. Lithium-manganese dioxide (Li-MnO2) cells were among the first types to be commercially available. These batteries offered high energy density and found applications in early electronic devices.

- During the 1980s, researchers and manufacturers began diversifying the chemistries of primary lithium batteries. Lithium-thionyl chloride and lithium-sulfur dioxide chemistries gained popularity for their high energy density and long shelf life.

- During the 1990s, primary lithium batteries became increasingly popular in various applications, including medical devices, military equipment, and industrial sensors. Their lightweight design, long shelf life, and reliability contributed to their widespread adoption.

- The 2000s saw significant technological advancements in primary lithium batteries. Researchers focused on improving safety features, energy density, and overall performance. New cathode materials, anode materials, and manufacturing processes were developed.

- The primary lithium batteries market continued to grow in the 2010s. The increasing demand for portable electronic devices, wireless sensors, and IoT applications contributed to the expansion of the market. However, concerns about the environmental impact of battery disposal and recycling gained attention.

- In recent years, ongoing research and development have focused on further improving the performance and sustainability of primary lithium batteries. Advances in materials science, nanotechnology, and manufacturing processes continue to shape the landscape of lithium battery technology.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the primary lithium batteries market analysis from 2022 to 2032 to identify the prevailing primary lithium batteries market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the primary lithium batteries market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global primary lithium batteries market trends, key players, market segments, application areas, and market growth strategies.

Primary Lithium Batteries Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.9 billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 105 |

| By Type |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | EVE Energy Co., Ltd., Ultralife Corporation., Renata SA., Saft Groupe S.A., Duracell, GP Batteries International Limited, Tadiran Batteries GmbH, Panasonic Corporation, Energizer Holdings, Inc., Maxell Holdings, Ltd. |

Analyst Review

According to the insights of the CXOs of leading companies, the primary lithium battery market has seen a significant increase in demand for primary lithium batteries due to the widespread use of portable electronic devices such as smartphones, laptops, digital cameras, and wearable devices. Primary lithium batteries have been widely adopted in various industrial applications, including oil and gas exploration, remote monitoring systems, and other applications where reliable, long-lasting power is crucial.

However, the environmental impact of lithium batteries, including primary lithium batteries, has raised concerns. Disposal of batteries, especially if not done properly, can lead to soil and water contamination due to the presence of toxic materials. Recycling lithium batteries can be challenging, and expensive, and improper disposal may contribute to environmental issues.

The CXOs further added that the advances in cathode materials, such as manganese dioxide and lithium iron disulfide, have contributed to increased energy density and improved overall performance of primary lithium batteries. The use of nanostructured materials in electrodes and electrolytes has been explored to enhance the surface area and conductivity, leading to improved energy storage capacity and faster charging/discharging rates. These technological advancements in primary lithium batteries are anticipated to offer numerous market growth opportunities in coming years.

The primary lithium batteries market was valued at $2.5 billion in 2022, and is estimated to reach $3.9 billion by 2032, growing at a CAGR of 4.7% from 2023 to 2032.

Asia-Pacific is the largest regional market for Primary Lithium Batteries.

The major players operating in the global primary lithium battery market are Energizer Holdings, Inc.; Duracell; Panasonic Corporation; Tadiran Batteries; Saft Groupe S.A.; EVE Energy Co., Ltd.; Ultralife Corporation; GP Batteries International Limited; Maxell Holdings, Ltd.; and Renata SA.

Automotive is the leading application of Primary Lithium Batteries Market.

Primary lithium battery market is expected to possess high growth potential in the coming years, due to growing demand from electronics, medical, and aerospace & defense industries.

Loading Table Of Content...

Loading Research Methodology...