Printing Software Market Research, 2031

The global printing software market was valued at $1.2 billion in 2021, and is projected to reach $6.3 billion by 2031, growing at a CAGR of 18.4% from 2022 to 2031.

Major drivers of the printing software market growth include increase in the use of big data platform, measures to cut down on office paper usage, and strengthened information security.

Many business processes such as invoicing, record keeping, and shipping require timely printing of documents. It is essential for a business to handle print jobs effectively to save resources: paper, ink & toner, time and money. Hence, many companies are using software that can make their printing easier, better controlled, and cost effective. Printing software is designed to coordinate and optimize tasks and processes related to printing. A good print manager should allow to automate printing of files, facilitate print jobs, track printer and/or paper usage, take full control of printing processes, ideally, and cut overall costs.

Additionally, system software that queues, spools, and arranges printer output from an application for printing. In modern operating systems, applications communicate with the printing system via a programming interface (API). The printing system causes the output to be converted into a printer language such as PostScript, PDF and PCL or formatted as final output in the form of a bitmap (rasterized). The printing system comprises printer driver, which includes commands required by a specific printer.

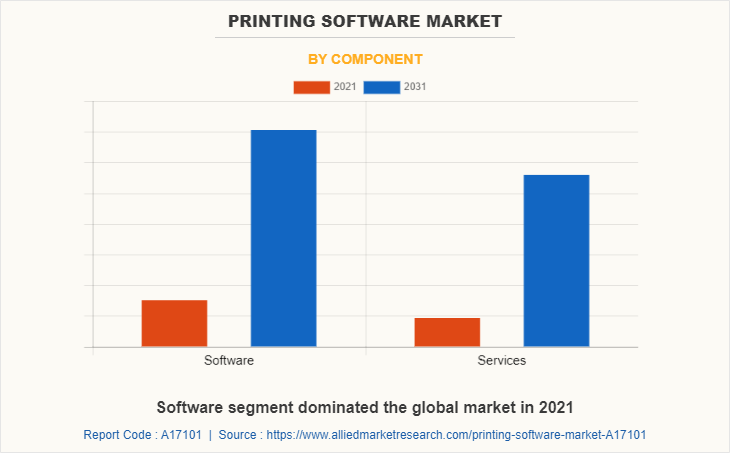

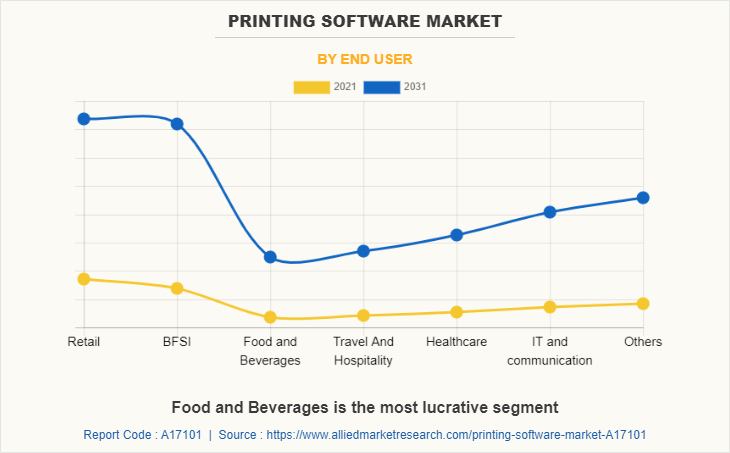

The printing software market is segmented into Component, Deployment Model, Organization Size and End User.By component, it is segmented into software and services. The service segment is further categorized into professional services and managed services. By managed services, it is further categorized into print management, device management, discovery & design, and document imaging. By deployment model, the market is categorized into on-premise and cloud. By organization size, it is categorized into SMEs and large enterprises. By end user, it is categorized into retail, BFSI, foods & beverages, travel & hospitality, healthcare, IT & communication, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific and LAMEA.

On the basis of component, the software segment dominated the printing software market in 2021, and is expected to maintain the dominance in the upcoming years. Printing software joins with existing printing infrastructure and opens the possibility to save vast amount of money on toner, paper, electricity, and costly maintenance. However, the services is expected to witness the highest growth rate during the Printing Software Market Forecast period. Print service helps to find out true cost per-page, discover actual cost of ownership for each printer, error, and history reports deliver valuable information to improve fleet management, optimize fleet for improved workflows, easy-to-use web interfaces provide visibility to help staff members and its teams do their jobs more efficiently and free up IT staff to focus on core business objectives and training.

In 2021, On the basis of end user, the retail segment dominated the Printing Software Market Share in 2021, and is expected to maintain its dominance in the upcoming years. Moreover, retailers can give better services such as improved customer communications, content management, operational workflow automation, documents, and data, owing to managed printing services. In addition, evolving security threat scenarios and data loss propel demand for printing software in the retail industry. In retail printers, electronic devices are designed specifically for printing of labels and receipts and are used within the retail space. A retail printer uses ribbons and labels working in tandem to get an image printed. The consumables used with retail printers are labels, ribbons, and paper. These consumables are readily available in the market, which propels the Printing Software Industry growth.

North America is a rapidly growing region in the global printing software market, in terms of technological advancements and adoption. It possesses well-equipped infrastructure and the ability to afford printing software solutions. Furthermore, the huge market share is due to the presence of a substantial industrial base in the United States, government initiatives to promote innovation, and large purchasing power. North America’s growth is primarily concentrated on the United States. Companies that use big data solutions frequently use print management systems to cut costs, improve operations, and boost worker productivity. As managed print services have been widely adopted by healthcare and government sectors in the U.S. North America is anticipated to hold the greatest market share in 2021. It is anticipated that strategic acquisitions and newly established programs to raise awareness of managed print services will fuel demand. The market is expanding as a result of rising demand for cloud-based managed print services in North America.

Top Impacting Factors

The key impacting factors are growth in the use of big data platform, measures to cut down on office paper usage, and strengthened information security primarily drive growth of the global printing software market. However, recurring expense hamper the Printing Software Industrygrowth to some extent. Moreover, increase in spending on print security are expected to provide lucrative opportunities for the market growth during the forecast period.

Growth in the use of big data platform

Many firms are implementing big data platform to have an advantage over rival companies. Big data refers to massive amounts of data sets that cannot be neatly stored using conventional methods and need to be processed using more advanced technology to yield valuable insights. Businesses are finding it harder and harder to acquire, manipulate, analyze, and process data as it grows in size using ordinary computing tools. A big data strategy can, therefore, be funded by about 42% of businesses within a year. Print services are being adopted by businesses utilizing big data platform more frequently to reorganize their processes, cut costs, and boost productivity at work. Printing software enables companies to more effectively sort and arrange vital documents using optical character recognition (OCR).

In addition, printing software offers improved security capabilities that will aid in shielding the sensitive data from network intrusions. Many advantages that it offers, printing software usage is thus steadily rising among businesses looking to use big data platform, which is further projected to propel the market growth.

Measures to cut down on office paper usage

Organizations are increasingly embracing one or more green initiatives, owing to positive effects that green initiatives can have on their customers and their bottom line. In addition, a lot of businesses are concentrating on lowering their office paper usage as a quick, easy, and efficient way to achieve more ambitious sustainability objectives. For instance, a research found that an organization produces 7.8 metric tons of waste year on average. Paper is one of the wastes that makes up almost 40% of that garbage. The survey also reveals that firms could save roughly $1 billion if they reduced their paper waste by just 1%, thus many organizations are looking for ways to do so. Organizations can permanently advance, in terms of efficiency, owing to printing software.

It enables enterprises of any size to eliminate print servers, streamline print management, and permanently reduces consumables usage rather than just offering one or two temporary strategies to conserve paper. In addition, using printing software enables firms to proactively manage their printer fleet, allowing adoption of programs to lower their carbon impact. Adoption of printing services is also anticipated to increase in the coming years, owing to a significant movement toward robotics and automation that has led to growth of digitalization projects.

COVID-19 Impact Analysis

COVID has caused crises in social, economic, and energy areas and medical life worldwide throughout 2020. This crisis had many direct and indirect effects on all areas of society. In the meantime, the digital and artificial intelligence industry can be used as a professional assistant to manage and control the outbreak of the virus.

In post-pandemic circumstances, organizations strived to minimize operational and running costs around all the business functions to recover the losses incurred in COVID times. Companies rapidly adopted print software to track printer usage and department costs. Companies are now seeking Software that are capable of consolidating and optimizing their printer fleets. Therefore, during the projected period, the need to manage costs in post-COVID-19 environments will undoubtedly be a significant growth driver for the use of print management software across various enterprises.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the printing software market analysis from 2021 to 2031 to identify the prevailing printing software market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the printing software market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global printing software market trends, key players, market segments, application areas, and market growth strategies.

Printing Software Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Deployment Model |

|

| By Organization Size |

|

| By End User |

|

| By Region |

|

| Key Market Players | Pcounter, ePaper Ltd., Canon, Lenovo, Maprinter, Ringdale UK Ltd., PaperCut Software International, Canon Inc., Epson, Nuance Communications, TE, Printix.net, Xerox, Hewlett-Packard Development Company, L.P., Honeywell, HID Global, Print Manager |

Analyst Review

Demand for printing software for simulation purposes is driven by rapid rise in digitization and increase in use of cutting-edge technologies such as Industry 4.0, smart factories, robotics, machine learning, and others. These innovations raise likelihood that this technology will be adopted and used more widely throughout industries, including aerospace, automotive, and healthcare.

In the digital era where artificial intelligence and internet of things have taken over the world, there seems to be a comparatively less growth rate of the printing software market than digital marketing. Through various studies it has been observed that many countries across the globe are experiencing massive digital disruptions in advanced manufacturing technologies. U.S. is a potential user of printing technology. In 2018, the U.S. Department of Defense included this technology as an important capability in their budget. Even tech software giants such as Autodesk, Microsoft, and HP have launched products aimed at additive and printing manufacturing. For instance, the automotive industry is expected to show a huge adoption of this technology. Rapid tooling incorporated with additive manufacturing has become the priority of many automotive manufacturers. Customization of automotive interiors is another major application of this technology in the automotive industry.

In addition, with the robust expansion of the label printing market, demand for advanced methods is expected to pile up. As per the analysis, there would be some major technologies and trends that can revolutionize the printing market. There has been a significant rise in demand for reducing weight of product packaging, which is expected to benefit the market.

The global printing software market was valued at $1,205 million in 2021, and is projected to reach $6,337.4 million by 2031, registering a CAGR of 18.4%.

Retail segment dominated the printing software market in 2021

Rise in cloud printing service usage and increased print security spending will significantly drive demand for print software

North America dominated the global market in 2021

Key players operating in the market include Canon, Inc., Epaper Ltd., Seiko Epson Corporation, Hewlett-Packard Inc., HID Global, Honeywell International Inc., Lenovo Group Ltd., L.P. Printing, MaPrinter Ltd, Nuance Communications, PaperCut Software International, Pcounter, Print Manager, Printix.net, Ringdale UK Ltd., Te Connectivity, Xerox Corporation.

Loading Table Of Content...