Private Security Market Research, 2032

The global private security market size was valued at $241.4 billion in 2022, and is projected to reach $531.5 billion by 2032, growing at a CAGR of 7.8% from 2023 to 2032. The private security market is driven by factors such as rising demand for specialized security services such as cybersecurity and risk assessment and increasing concerns over terrorism, crime rates, & cybersecurity threats. However, high initial investment costs for implementing advanced security technologies and increasing competition among private security firms leading to price pressures restrict the private security market demand. Moreover, expansion opportunities in emerging markets with high demand for security services are expected to offer new opportunities in the coming years.

Market Overview

Private security services are defined as the execution of protective measures, monitoring, and handling of risks by privately held organizations or people, as opposed to government law enforcement agencies. These services cover a wide range of operations suited to the safety requirements of clients, which may include corporations, residential areas, events, and high-profile persons. Private security businesses provide a variety of solutions, including manned guards, electronic monitoring, detection systems, control of access, executive protection, and security protocol consultancy. The goals of private security firms frequently include deterring criminal behavior, protecting assets and persons, enforcing safety regulations, and responding to crises. These services follow legal frameworks and rules relevant to the geographical areas they serve, and they usually engage with governmental law enforcement agencies when appropriate. As a whole, security firms play an important role in protecting parts of society, helping to maintain peace and security in public and private sectors.

Key Takeaways of Private Security Market Report

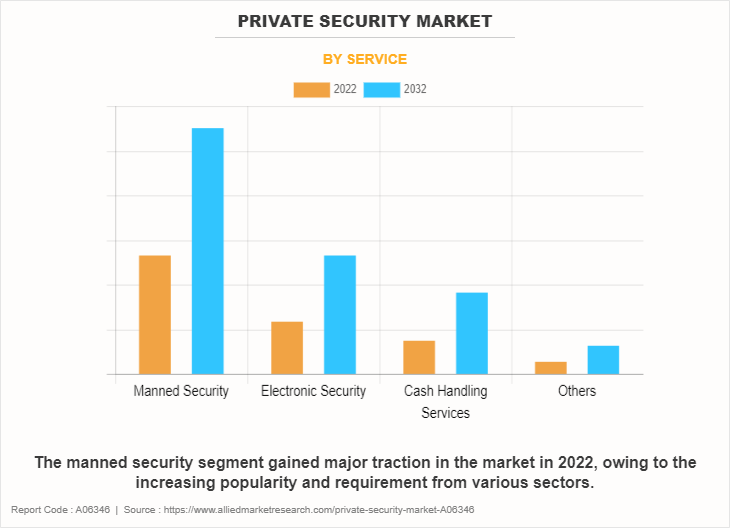

- According to the private security market in 2022, on the basis of service, the manned security segment was the highest contributor to the private security market.

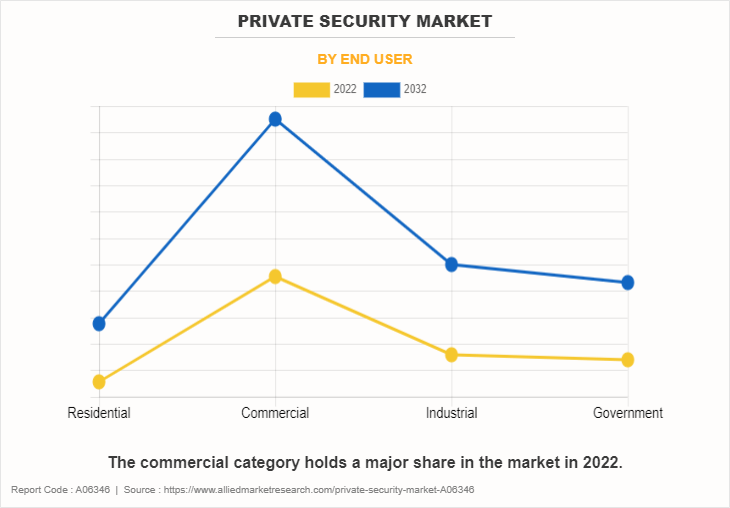

- According to the private security market, on the basis of end user, commercial segment generated the highest revenue in 2022, and is likely to grow at a substantial rate during the forecast period.

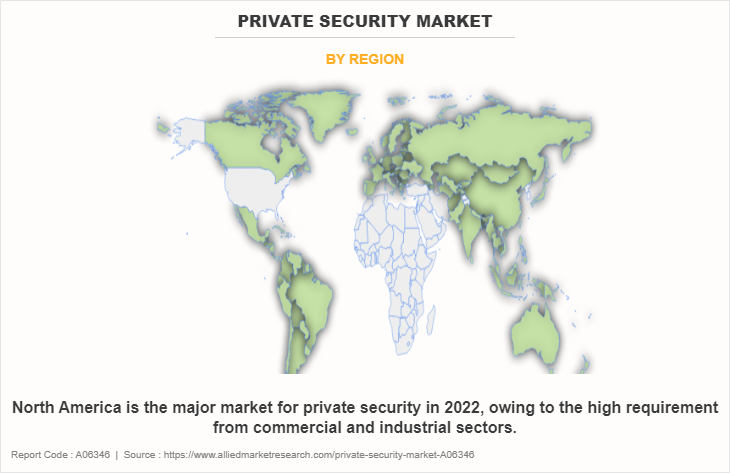

- According to the private security market, on the basis of region, the North America region was the major revenue contributor in 2022 and is estimated to grow at a significant CAGR during the forecast period.

MARKET DYNAMICS

Increasing concern over criminal activity, terrorism, and cybersecurity risks.

The growing concerns about terrorist activities, criminal activity, and cybersecurity risks are driving the expansion of the private security business. Individuals, corporations, and governments have become more vulnerable to numerous types of security risks in today's linked world, where technological improvements have made data more readily available and increased the visibility of weaknesses. The advent of global terrorism has created a sense of urgency for increased security measures, driving businesses to invest in strong security solutions to safeguard their possessions, infrastructure, and workers.

Furthermore, rising crime rates in cities, spurred by socioeconomic issues and organized criminal syndicates, highlight the need for stronger security measures to maintain safety for citizens and property protection. Furthermore, the expansion of digital technology has provided new opportunities for cybercriminals to capitalize on network weaknesses, resulting in security breaches, monetary losses, and damage to reputation. As a result, the need for specialized cybersecurity services has increased as businesses attempt to strengthen their digital defenses against emerging cyber threats.

Increasing demand for access control and screening personnel post COVID

Following COVID-19, there has been a considerable increase in requirements for control of access and screening staff, which is pushing the expansion of the private security sector. Following the pandemic, organizations from all sectors have increased their attention on establishing severe safety and health protocols to reduce the risk of viral transmission and maintain compliance with regulatory norms. As companies progressively reopen and begin operations, the demand for strong security measures and screening processes has grown to protect staff, consumers, and visitors. Private security organizations play an important part in this endeavor by providing specialized services customized to their clients' changing needs. Access control technologies include a wide range of measures, from physical obstacles and biometric identification systems to guest management procedures, all aimed to govern admission and monitor movements within facilities.

Screening workers, who are properly trained and equipped, are responsible for conducting health screens, temperature checks, and adhering to hygiene regulations, all of which contribute to the overall risk management plan. Furthermore, the incorporation of technologically advanced technologies, such as thermal imaging devices and contactless authentication systems, demonstrates the industry's dedication to creativity and efficacy in solving developing difficulties. As a result, the greater focus on control of access and screening procedures after COVID-19 not only confirms the necessity of private security services, but also creates considerable development potential for enterprises in this industry.

High initial investment costs for implementing advanced security technologies

The substantial upfront costs for integrating modern security technologies are a significant barrier to the expansion of the private security business. While these technologies provide greater flexibility and efficiency in tackling security risks, the initial expenses of obtaining, setting up, and incorporating these kinds of systems can be prohibitively expensive for many organizations, particularly smaller firms and businesses with limited resources. Furthermore, recurring expenditures such as maintenance, updates, and training add to the monetary burden, rendering it harder for some businesses to justify investing in modern security solutions. Furthermore, the complexity of integrating these technologies, along with the requirement for specialized knowledge to manage and run them efficiently, adds another degree of difficulty for organizations that lack in-house competencies or resources.

As a result, many firms may choose conventional or cost-effective security methods, postponing or avoiding the use of new technology entirely. Despite the obvious benefits of these technologies in terms of improving security measures and risk management, the significant upfront investment costs continue to be a substantial barrier to wider adoption, restricting the private security market potential development.

Increasing competition among private security firms leading to price pressures

The growing rivalry among private security services is providing substantial hurdles to the private security market growth. As more competitors compete for market share, price pressures have increased as businesses try to distinguish themselves and attract customers through competitive pricing techniques. This dynamic may help customers in the short term by lowering costs, but it ultimately puts a burden on security organizations' profitability and sustainability, restricting their ability to devote resources in creativity, recruitment & retention of talent, and service growth. Furthermore, the emphasis on price competitiveness is resulting in heightened competition, with quality and standards sacrificed in favor of cost-cutting techniques, thereby weakening the overall efficacy and dependability of security services.

Furthermore, smaller enterprises may struggle with competing with bigger, reputable rivals that benefit from economies of scale and greater resources, thereby worsening the competitive environment. As a result, the drive to cut costs may dissuade enterprises from investing in technological advances, training, and staff, suffocating innovation, and hindering the private security market's overall development prospects.

Partnerships and collaborations with technology firms to enhance service offerings

Partnerships and cooperation with technology companies provide a big development prospect for the private security industry. Security organizations may increase operational efficiency, keep ahead of changing security risks, and expand their service offerings by using technology companies' experience and skills. These agreements provide security organizations access to cutting-edge technology such as machine learning, artificial intelligence, biometrics & surveillance, and data analytics, which have the potential to revolutionize security operations and deliver enhanced proactive and anticipatory solutions. For instance, combining modern surveillance equipment with AI-powered analytics might offer real-time threat identification and quick reaction capabilities, hence improving overall security posture.

Furthermore, collaborations with technology corporations enable security providers to deliver more complete and customized solutions targeted to their clients' individual needs, whether in vital infrastructure security, healthcare, or retail. Furthermore, partnership with technology businesses promotes innovation and the creation of new goods and services, allowing security corporations to distinguish from one another in an extremely competitive landscape. Agreements and partnerships with technology corporations allow security providers to improve their skills while also providing prospects for revenue development, market expansion, and better client fulfilment in the dynamic and ever-changing world of private security market.

Development of customized security services to cater to specific client needs.

The creation of customized protection services suited to unique client requirements provides a substantial possibility for the private security business. In today's varied and complicated security world, organizations have distinct needs and concerns that cannot be met by one-size-fits-all solutions. As a result, there is an increasing need for security providers that can provide personalized and adaptable services that are tailored to each client's distinct risk profiles, industry requirements, and operating conditions. Security businesses may provide tailored security solutions that suit their customers' issues and goals by utilizing a thorough grasp of their demands and engaging closely with them. These customized services may include a wide range of solutions, such as control of access, tracking, cybersecurity, executive protection, and risk mitigation.

Furthermore, the creation of customized security services allows security providers to distinguish themselves in a competitive market, cultivate long-term customer relationships, and charge premium prices for specialized knowledge and value-added services. Furthermore, as organizations recognize the value of proactive risk reduction and resilience strategy, there is a rising need for customized safety procedures that go beyond standard reactive measures.

SEGMENTAL OVERVIEW

The private security market is segmented into service, end user, and region. Depending on service, the market is segregated into manned security, electronic security, cash handling services, and others. By end user, it is categorized into residential, commercial, industrial, and government. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, France, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific), Latin America (Brazil, Argentina, and the rest of Latin America), and Middle East & Africa (Saudi Arabia, South Africa, United Arab Emirates, and Rest of Middle East & Africa).

BY SERVICE

On the basis of service, the manned security segment dominated the private security market in 2022 and is expected to dominate the market during the private security market forecast period. The human presence creates a feeling of security and caution that technology alone may not provide. Clients frequently appreciate the apparent presence and attentiveness of security staff in protecting their properties. Additionally, manned security provides instant intervention and judgement in dealing with security issues, providing a level of flexibility that computerized systems may lack.

BY END USER

According to the private security market, on the basis of the end user, the commercial segment dominated the market in 2022 and is expected to maintain its dominance during the forecast period. Investment in private security services is essential for companies in the commercial sector as to run their operations smoothly, they have to safeguard their assets from outside potential threats of theft, burglary, and others. Furthermore, the commercial sector frequently operates in environments containing high-value assets or confidential data, which increases the demand for specialized security measures tailored to their specific requirements.

BY REGION

According to the private security market statistics, on the basis of the region, the North America region dominated the private security market in 2022 and is expected to dominate the market during the forecast period. The region's wide socioeconomic landscape, which includes businesses that are as varied as technology, banking, and entertainment, demands rigorous safety precautions to protect assets and information. Furthermore, concerns about the prevalence of crime, terrorist attacks, and cyber threats have raised the importance of private security services amongst businesses and people in North America.

COMPETITIVE ANALYSIS

Players operating in the private security market have adopted various developmental strategies to expand their private security market share, increase profitability, and remain competitive in the market. Key players profiled in this report include Allied Universal Security Services, LLC, ADT Inc., Securitas AB, Secom Co., Ltd., Prosegur Compania de Seguridad, S.A, The Brink's Company, ISS A/S, GardaWorld Corporation, Loomis AB, and SIS Group Enterprise.

Recent Developments in Private Security Market

- In May 2023, Gallagher Group Limited enacted an exclusive distribution deal with Gasbot Pty Ltd. to launch a satellite-based liquid monitoring system in North America. The Gallagher Satellite Liquid Monitoring System employs Gasbot's most advanced wireless sensor technology to deliver real-time information on liquid levels in tanks, allowing farmers to make more educated decisions regarding fluid use and management.

- In February 2023, i-PRO Co. Ltd., a leader in professional security solutions for surveillance and public safety, introduced the MonitorCast Access Control software. With the addition of mercury-based intrusion detection feature in the new version of MonitorCast, access control and intrusion detection can be easily combined without the need for additional hardware or integrations.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the private security market analysis from 2022 to 2032 to identify the prevailing private security market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the private security market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global private security market trends, key players, market segments, application areas, and market growth strategies.

Private Security Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 234 |

| By Service |

|

| By End User |

|

| By Region |

|

| Key Market Players | SIS Group Enterprise., Prosegur Compania de Seguridad, S.A, GardaWorld Corporation, ADT Inc.,, Securitas AB, Loomis AB, Allied Universal Security Services LLC, The Brink's Company, Secom Co., Ltd., ISS A/S |

Analyst Review

According to the CXOs, they have identified several trends and growth factors driving the expansion of the private security market. The growing worry about terrorism, criminal activity, and cybersecurity risks has fueled the need for complete safety measures in a variety of sectors, including government, business, and residential. Furthermore, the globalization of business and the growth of digital technology have generated new risks, increasing the demand for specialized security services such as cybercrime and risk assessment. Furthermore, the use of new technology such as artificial intelligence, biometrics & surveillance and drones is changing the landscape of private security by providing more effective and efficient methods to monitor and respond to security risks. Expansion potential in emerging nations, where growing urbanization and economic expansion are driving consumer interest in security services, additionally contributes to boosting the industry. Furthermore, as organizations seek cost-effective solutions and knowledge from specialized security businesses, the market is projected to expand. The private security industry is positioned for further growth and creativity as it adapts to changing threats and embraces technology improvements to fulfil the demands for a diversified client base globally.

The private security market size was valued at $225.6 billion in 2022 and is projected to reach $352.3 billion by 2032, registering a CAGR of 5.5% from 2023 to 2032.

The private security market registered a CAGR of 5.5% from 2023 to 2032.

Raise the query and paste the link of the specific report and sales executive will revert with the sample.

The forecast period in the private security market report is from 2023 to 2032.

The top companies that hold the market share in the private security market include Allied Universal Security Services, LLC, ADT Inc., Securitas AB, Secom Co., Ltd., and Prosegur Compania de Seguridad

The private security market report has two segments. The segments are service, and end user.

By region, Europe in the private security market has the highest growth rate at a CAGR of 7.2% from 2023 to 2032.

Post-COVID-19, the private security market is witnessing new heights of growth and is recovering from its losses. Moreover, the increasing requirement for private security services from different sectors has provided a new boost to the market growth.

Loading Table Of Content...

Loading Research Methodology...