Prosthetic Heart Valve Market Research, 2035

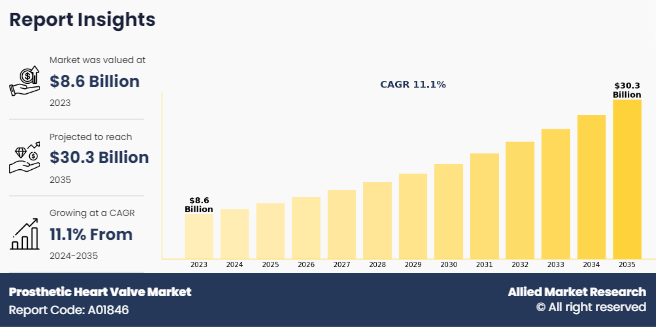

The global prosthetic heart valve market was valued at $8.6 billion in 2023, and is projected to reach $30.3 billion by 2035, growing at a CAGR of 11.1% from 2024 to 2035. Rise in number of heart valve replacements and rise in prevalence of heart diseases fuels market growth. According to the Texas Heart Institute, in the U.S., surgeons performed about 106,000 heart valve operations each year. In addition, an article published by National Center for Biotechnology and Information (NCBI) in 2023, American Heart Association estimated that 2% of the U.S. population suffered from valvular heart disease. An article published by National Library of Medicine in 2021, stated that, more than 180,000 heart valve replacement surgeries performed each year in the U.S., thus rise in number of heart valve replacement surgeries fuels market growth.

A prosthetic heart valve is an artificial device designed to replace a diseased or malfunctioning natural heart valve. These valves are used in patients who suffer from valvular heart disease, where one or more of their heart valves are damaged or not functioning properly. Prosthetic heart valves can be made from various materials, including metal, plastic, and biological tissue (such as animal tissue or human tissue)

Key Takeaways

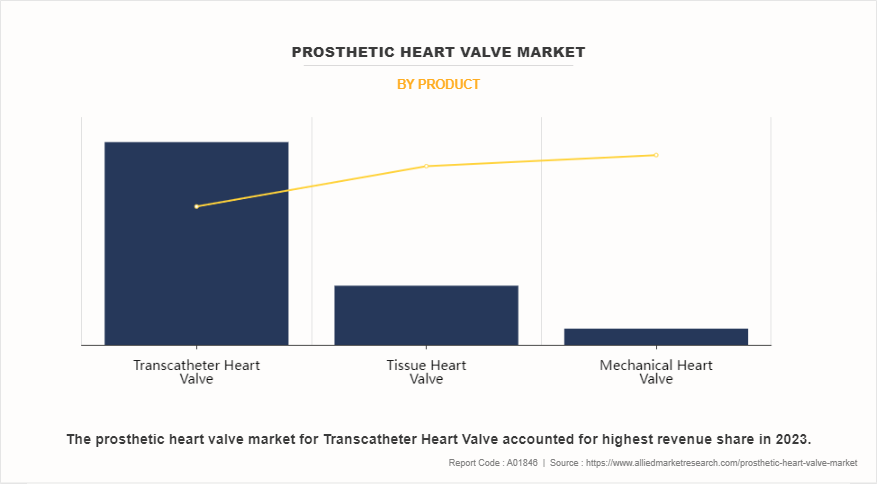

- By product, the transcatheter heart valve segment dominated the global prosthetic heart valve market in terms of revenue in 2023 and is expected to register the highest CAGR during the forecast period.

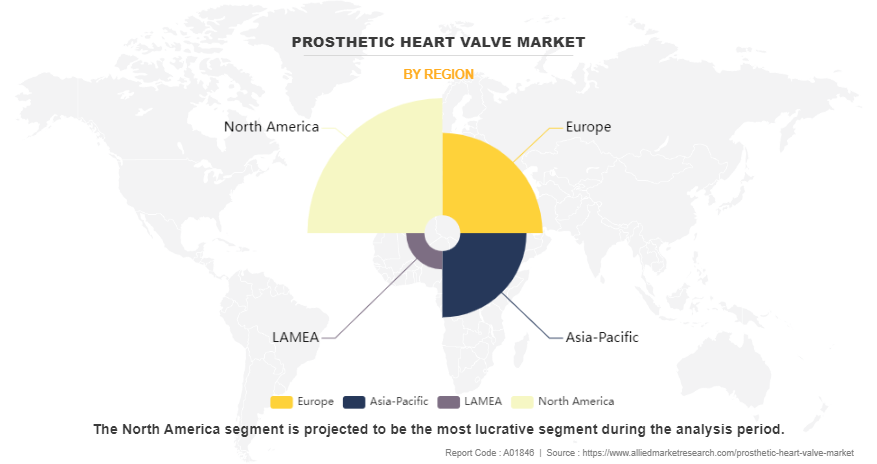

- By region, North America dominated the market in terms of revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

Rise in prevalence of valvular heart diseases, increase in geriatric population, shift towards sedentary lifestyle of people, novel advancements in heart valves, increase in awareness regarding surgical treatment options, and growing demand for minimally invasive surgeries are the major factors propelling the market growth. For instance, according to the American College of Cardiology, approximately 5 million Americans are detected with heart valve disease annually. In addition, according to Centers for Disease Control and Prevention (CDC) 2022, 40,000 babies were born with congenital heart defect every year in the U.S. Thus, patients with congenital heart defects require surgical intervention to repair or replace the damaged valve, which drives prosthetic heart valve market size.

Aging populations worldwide led to the rise in prevalence of age-related cardiovascular conditions, including heart valve diseases. Elderly individuals are more prone to valve degeneration and dysfunction, necessitating surgical interventions such as valve replacement. Consequently, the growing geriatric demographic contributes to the increasing demand for prosthetic heart valves, as these devices play a crucial role in restoring cardiac function and improving quality of life in older adults.

In addition, increasing awareness and education about heart valve diseases among patients, caregivers, and healthcare professionals contribute to market growth. Improved understanding of disease risk factors, symptoms, and treatment options leads to earlier diagnosis, timely interventions, and better outcomes for patients with valve disorders. Patient advocacy groups, medical societies, and educational campaigns play a vital role in raising awareness, reducing stigma, and promoting access to care, thereby driving demand for heart valves and propel the prosthetic heart valve market share.

Furthermore, the advancements in medical technology play a pivotal role in driving the prosthetic heart valve market growth. The development of transcatheter heart valves, for example, has revolutionized the treatment landscape by offering less invasive alternatives to traditional open-heart surgery. These innovative devices can be delivered through catheters, reducing surgical trauma, shortening recovery times, and expanding treatment options for patients deemed high risk or ineligible for conventional surgery. For instance, in March 2024, Medtronic plc, a global leader in healthcare technology, announced that the U.S. Food and Drug Administration (FDA) has approved the Evolut FX+ transcatheter aortic valve replacement (TAVR) system for the treatment of symptomatic severe aortic stenosis. The latest Evolut FX+ TAVR system maintains the valve performance benefits of the legacy Evolut TAVR platform and is designed to facilitate coronary access. Thus, rise in advancements in medical technology provides lucrative prosthetic heart valve market opportunity.

However, the high cost of prosthetic heart valves and availability of alternative options for treatment of heart valve disease are some of the major factors limiting the growth of the market. Other fluid mechanics characteristics, such as pressure drops, regurgitation volumes, or turbulence, can also be approximated using computational tools, which is another important driver of the heart valve repair and replacement business. Furthermore, the availability of computational tools allows for accurate valvar disease detection, which leads to proper treatment, boosting the prosthetic heart valve repair and replacement industry.

Furthermore, the growing preference for minimally invasive procedures, such as transcatheter valve replacement, among patients and healthcare providers. These procedures offer shorter recovery times, reduced risk of complications, and improved patient outcomes compared to traditional open-heart surgery, contributing to the growth of the prosthetic heart valve market. The necessity for transcatheter aortic valve replacement (TAVR) surgeries has grown as the prevalence of valvular heart disease has increased, thus propelling the market for prosthetic heart valves. Additionally, the ongoing research into tissue-engineered valves and novel materials holds promise for further improving the durability, biocompatibility, and functionality of prosthetic heart valves, driving market growth through enhanced patient outcomes and expanded treatment indications.

Moreover, government initiatives and healthcare policies also drive the prosthetic heart valve market. Investments in healthcare infrastructure, research and development, and public health programs can drive innovation, improve access to cardiac care services, and facilitate the adoption of advanced prosthetic heart valve technologies. For instance, the Food and Drug Administration (FDA) plays a crucial role in expanding the indications for these devices, such as the transcatheter aortic valve replacement (TAVR) valves, which have been expanded to include low-risk patients with severe aortic stenosis.

Additionally, regulatory frameworks and reimbursement policies play a crucial role in shaping market dynamics, influencing product development, market access, and adoption rates of prosthetic heart valves across different regions. Further, guidelines on prosthetic heart valve management in infective endocarditis emphasize the importance of the endocarditis team, clinical management, optimal medical therapy, and the indication for surgery. The presence of intra-cardiac prosthetic materials could guide decision-making in the context of the endocarditis team, but further investigations are needed to shed light on these challenging interrogatives.

Segments Overview

The prosthetic heart valve market size is segmented into product and region. On the basis of the product, the market is segregated into mechanical heart valve, tissue heart valve, and transcatheter heart valve. The tissue heart valve segment is further bifurcated into stented tissue heart valve and stentless tissue heart valve. Region wise, it is analyzed across North America, Europe, Asia-Pacific, LAMEA.

By Product

The transcatheter heart valve segment dominated the global prosthetic heart valve market share in 2023. The same segment is expected to register the highest CAGR during the forecast period. This is attributed to its minimally invasive nature, associated benefits, surge in cardiovascular disorders, and surge in demand of cardiac valve replacement therapy. In addition, advancements in transcatheter heart valve technology, such as improved valve designs and delivery systems, have further enhanced procedural outcomes and expanded the eligible patient population. As a result, the transcatheter heart valve segment continues to lead the prosthetic heart valve market.

By Region

The prosthetic heart valve industry is analyzed across North America, Europe, Asia-Pacific, LAMEA. North America dominated the market in 2023 and is expected to maintain its dominance during the forecast period. The well-established infrastructure, technological advancements in devices, innovation and research and development activities have led to an increased demand for prosthetic heart valve, which drives the market growth in this region. In addition, the rise in prevalence of allergic conditions, early adoption of advanced prosthetic heart valve delivery devices, favorable reimbursement policies, and the presence of major pharmaceutical companies within the region focused on prosthetic heart valve products further propels the market growth.

However, Asia-Pacific offers profitable opportunities for key players operating in the prosthetic heart valve market and is expected to register the fastest growth rate during the prosthetic heart valve market forecast period, owing to the rise in prevalence of allergies and anaphylaxis, especially in developing nations with increasing urbanization. The growth in awareness about prosthetic heart valve auto-injectors as a life-saving treatment, improvement in healthcare infrastructure, and favorable government initiatives promoting access to essential medicines are expected to drive the demand for prosthetic heart valve products in this region. Furthermore, increasing adoption of transcatheter heart valve replacement procedures in the Asia-Pacific region is fueling market expansion. TAVR offers a less invasive alternative to traditional open-heart surgery for patients with severe aortic stenosis, particularly elderly or high-risk individuals which support the market growth.

Competitive Analysis

Key players such as Shockwave Medical Inc and Medtronic plc have adopted product approval and acquisition as key developmental strategies to improve the product portfolio of the microbial identification market. For instance, in April 2023, Shockwave Medical Inc., a global medical device company acquired Neovasc Inc. Neovasc Inc. is a medical device company engaged in developing heart valves and reducers to treat heart diseases. This acquisition is expected to help the company to strengthen its product portfolio.

Recent Developments in the Prosthetic Heart Valve Industry

In February 2024, Edwards Lifesciences Corporation announced the company’s EVOQUE tricuspid valve replacement system is the first transcatheter therapy to receive U.S. Food and Drug Administration (FDA) approval for the treatment of tricuspid regurgitation (TR). The EVOQUE system is indicated for the improvement of health status in patients with symptomatic severe TR despite optimal medical therapy (OMT), for whom tricuspid valve replacement is deemed appropriate by a heart team.

In March 2023, Abbott announced that the U.S. Food and Drug Administration (FDA) has approved the company's Epic Max stented tissue valve to treat people with aortic regurgitation or stenosis. This device is the latest addition to Abbott's Epic surgical valve platform which has a decades-long history of safety and strong clinical outcomes, with an optimized design to further improve valve blood flow.

In March 2023, Abbott announced that the U.S. Food and Drug Administration (FDA) has approved the company's Epic Max stented tissue valve to treat people with aortic regurgitation or stenosis. This device is the latest addition to Abbott's Epic surgical valve platform which has a decades-long history of safety and strong clinical outcomes, with an optimized design to further improve valve blood flow.

In March 2022, Edwards Lifesciences announced that it received approval from the U.S. Food and Drug Administration (FDA) for the MITRIS RESILIA valve, a tissue valve replacement specifically designed for the heart's mitral position.

In May 2021, Medtronic plc, the global leader in medical technology, announced that it received the CE (Conformite Europeenne) Mark of the Evolut PRO+ TAVI System, the newest-generation Medtronic TAVI system.

In August 2021, Medtronic plc, the global leader in medical technology, announced that the U.S. Food and Drug Administration (FDA) approved self-expanding transcatheter aortic valve replacement (TAVR) system, the Evolut FX TAVR system.

In December 2021, Edwards Lifesciences announced that it received approval from the U.S. Food and Drug Administration (FDA) for the use of the Edwards SAPIEN 3 transcatheter valve with the Alterra adaptive prestent (SAPIEN 3 with Alterra) for patients with severe pulmonary regurgitation.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the prosthetic heart valve market analysis from 2023 to 2035 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the prosthetic heart valve market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global prosthetic heart valve market trends, key players, market segments, application areas, and market growth strategies.

Prosthetic Heart Valve Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2035 |

| Report Pages | 212 |

| By Product |

|

| By Region |

|

| Key Market Players | Meril Life Sciences Pvt. Ltd., LivaNova PLC, Medtronic plc, Edwards Lifesciences Corporation, Artivion, Inc., Labcor Laboratorios Ltda, Boston Scientific Corporation, ShockWave Medical, Inc., Abbott Laboratories, JenaValve Technology, Inc. |

Analyst Review

Rise in demand for efficient and high-quality heart valve devices for the treatment of heart valve diseases is significantly high, which is expected to offer profitable opportunities for the expansion of the market. Moreover, a rise in awareness among the people regarding prosthetic heart valve replacement procedures is anticipated to boost the market growth.

In addition, the surge in burden of cardiovascular diseases and aging population across the globe have resulted in rise in demand for advanced prosthetic heart valve, thus driving the growth of market. Moreover, market players invest in the development of technologically advanced heart valves with increased clinical indications and improved efficacy and quality, which is expected to drive the growth of the market.

Furthermore, North America accounted for the largest share in terms of revenue in 2023. This growth is attributed to rise in prevalence of heart valve diseases such as mitral valve, adoption of transcatheter heart valve, availability of reimbursements schemes, and early diagnosis of valvular heart diseases. However, Asia-Pacific is expected to witness highest growth during the forecast period owing to rise in awareness about heart valve conditions, surge in prevalence of aortic and mitral valve disease, and increase in healthcare expenditure is also expected to boost market growth.

The total market value of prosthetic heart valve market is $8.6 billion in 2023.

The market value of prosthetic heart valve market in 2035 is $30.3 billion.

The forecast period for prosthetic heart valve market is 2024 to 2035.

The base year is 2023 in prosthetic heart valve market.

North America is accounted for the largest market share in 2023 owing to well established healthcare infrastructure, substantial investments in research and development, and the widespread availability of prosthetic heart valve products.

Among product, transcatheter heart valve segment dominated the global market in 2023 and is expected to maintain its dominance during forecast period.

Increase in prevalence of valvular heart disease among general population and growing demand for minimally invasive surgeries are some of the key factors driving the market growth

A prosthetic heart valve is an artificial device used to replace a damaged or dysfunctional natural heart valve.

Loading Table Of Content...

Loading Research Methodology...