Protective & Marine Coatings Market Overview:

Global Protective & Marine Coatings Market Size was valued at $18,437 million in 2016, and is expected to garner $31,047 million by 2023, registering a CAGR of 7.7% during the forecast period 2017 - 2023. The protective & marine coatings are used to guard the base construction materials from corrosion and moisture. These coatings, when regularly applied, offer a long-range protection that extends the life expectancy of a structure. There are various types of equipment & buildings that require a protective and/or finish coating, based on environmental requirements and materials involved.

Marine coatings play a key role in protection from corrosion. They have the ability to protect effectively against oxidization for several years, which depends on technical parameters such as fundamental corrosion protection through galvanic, barrier or inhibition effects, enhanced adhesion properties, higher mechanical strength, and crack-resistant properties.

The global protective & marine coatings market is driven by the increase in infrastructure & construction projects in emerging countries, rise in demand for high performance coatings, and environmentally friendly protective coatings. The constant need for repair & maintenance in ships/boats is a contributing factor for the market growth. However, strict environmental regulations on production and usage of protective coatings are expected to restrict the market growth in future. Mergers are expected to remain as the key strategy of the players to widen their brand portfolios and expand the market outreach.

Protective & Marine Coatings Market Segment Review

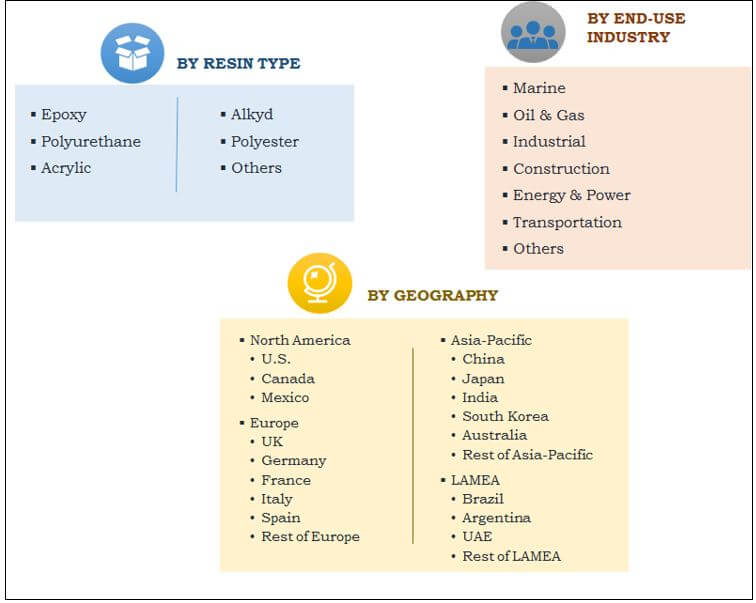

The report segments global protective & marine coatings market based on resin type, end-use industry, and geography. Based on resin type, it is classified into epoxy, polyurethane, acrylic, alkyd, polyester, and others. Based on end-use industry, it is divided into marine, oil & gas, industrial, construction, energy & power, transportation, and others. Geographically, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

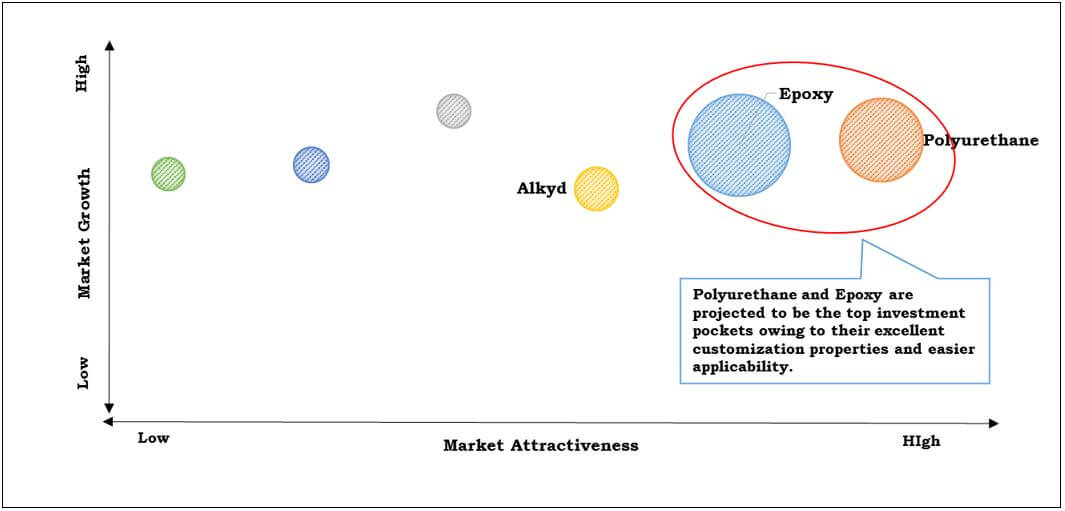

Protective & Marine Coatings Market Top Investment Pockets

In 2015, the polyurethane segment accounted for over one-third of the global protective & marine coatings market share, in terms of volume. Polyurethane & epoxy resins are the top investment pockets in the market, attributed to the varied customization options available and ease in application over other resin-based coatings. Thus, this segment is anticipated to provide high stability and significant return on investment for the stakeholders, owing to its high growth rate and significant revenue contribution.

Global Protective & Marine Coatings Market Analysis

Consumption of protective & marine coatings in North America and Asia-Pacific is expected to increase, owing to the increase in shale gas exploration and construction industry. Emerging markets, such as China and South Korea in Asia-Pacific, are expected to witness the highest demand during the forecast period, owing to the substantial growth in construction sector.

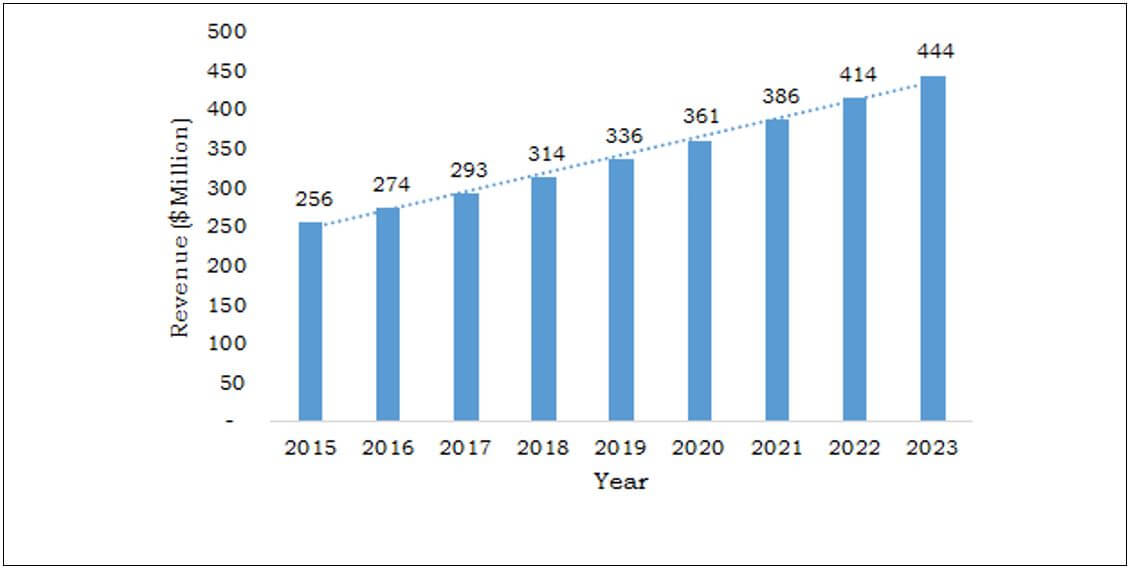

Australia Protective & Marine Coatings Market, 2015-2023 ($Million)

Major companies have adopted agreement, product launch, expansion, and merger strategies to sustain the intense market competition. Key players profiled in the report include 3M Co., AkzoNobel N.V., BASF SE, Hempel A/S, Kansai Paints Co., Ltd, Nippon Paints Co. Ltd., PPG Industries, Inc., The Sherwin-Williams Company, The Dow Chemical Company, and Wacker Chemie AG.

The other players (not profiled in the report) operating in this market are Axalta Coating System Ltd., Ashland Inc., Clariant International Ltd., Diamond Vogel Paints, Jotun A/S, RPM International, Inc., Royal DSM N.V., Solvay S.A., and Sono-Tek Corporation.

Key Benefits for protective & marine coatings Market:

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and their protective & marine coatings market share for building strategies.

- It outlines the current trends and future scenario of the protective & marine coatings market size from 2016 to 2023 to understand the prevailing opportunities and potential investment pockets.

- Major countries in four major regions, namely, North America, Asia-Pacific, Europe, and LAMEA have been mapped according to their individual revenue contribution in the protective & marine coatings market analysis at regional and country level.

- The key drivers, restraints, and opportunities and their detailed impact analyses are elucidated in the study.

- The profiles of key players along with their contribution in protective & marine coatings market growth are enlisted in the report.

Protective & Marine Coatings Market Report Highlights

| Aspects | Details |

| By Resin Type |

|

| By End Use Industry |

|

| By Geography |

|

| Key Market Players | BASF SE, THE DOW CHEMICAL COMPANY, 3M CO., NIPPON PAINTS CO. LTD., THE SHERWIN-WILLIAMS COMPANY, PPG INDUSTRIES, INC., HEMPEL A/S, KANSAI PAINTS CO., LTD, WACKER CHEMIE AG, AKZONOBEL N.V. |

Analyst Review

Currently, environmental protection paint has enhanced. There are more investments in the field of non-hazardous chemical materials, owing to the progress in formulation & technology. This trend has led the raw material to grow in price, such as resins, additives, and pigments.

The coatings market is witnessing steady growth rate, such as threat of environmental regulations and alternatives. Regulatory and environmental issues drive the paint & coatings industry to update continually. Paint manufacturers focus on reducing the volatile organic compound (VOC) content in solvent-based paints, waterborne coatings, powder coatings, and other high-solids formulations, resulting to increase in the market share.

The Asia-Pacific protective & marine coatings market presents promising opportunities, owing to high growth rate of the infrastructure in emerging countries. Moreover, the demand for epoxy, polyurethane, and acrylic resin is expected to increase in emerging countries, owing to growth potential for construction industry and demand for environmental coatings.

Loading Table Of Content...