Public Safety Drones Market Research, 2033

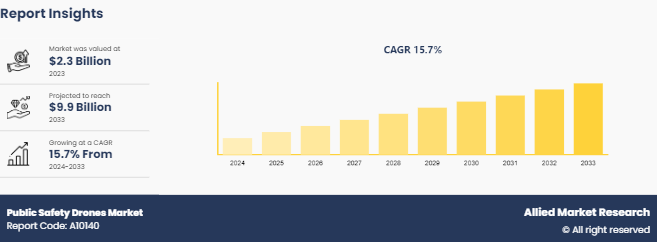

The global Public Safety Drones Market Size was valued at $2.3 billion in 2023, and is projected to reach $9.9 billion by 2033, growing at a CAGR of 15.7% from 2024 to 2033.

Market Introduction and Definition

Public safety drones, also known as emergency response drones, are unmanned aerial vehicles (UAVs) designed for use by law enforcement, fire departments, and emergency medical services. These drones enhance situational awareness, expedite response times, and improve overall safety during emergencies. They are equipped with cameras, thermal imaging sensors, and other advanced technologies to assist in various operations such as search and rescue, disaster management, and surveillance. The Public Safety Drones Industry exists due to the increasing need for efficient and rapid response solutions in emergencies, driven by advancements in drone technology and the growing emphasis on public safety and security. Key benefits include real-time data collection, cost-effective operation, and the ability to access hard-to-reach areas swiftly.

Key Takeaways

- The Public Safety Drones Market Size study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2032.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major public safety drones industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious Public Safety Drones Market Growth objectives.

Recent Key Strategies and Developments

- In February 2024, DJI, a global leader in drone manufacturing, launched the DJI Matrice 30 drone specifically designed for public safety applications. The Matrice 30 integrates advanced AI capabilities for real-time situational awareness and features enhanced durability and payload capacity, catering to the stringent requirements of public safety agencies worldwide.

- In March 2024, FLIR Systems, a provider of thermal imaging solutions, announced the acquisition of a small drone startup specializing in aerial surveillance technologies. This strategic acquisition aims to bolster FLIR's portfolio in public safety drones by incorporating cutting-edge surveillance capabilities, strengthening its market position in critical infrastructure monitoring and emergency response sectors.

- In April 2024, Airbus Defense and Space expanded its geographical footprint in the public safety drone market by establishing a new production facility in the United States. This facility will focus on manufacturing Airbus' latest line of high-altitude surveillance drones, leveraging local talent and resources to meet growing demand from U.S. federal agencies and law enforcement.

- In May 2024, the European Union Agency for the Operational Management of Large-Scale IT Systems in the Area of Freedom, Security and Justice (EU-LISA) announced a pilot project in collaboration with several European drone manufacturers. The project aims to integrate drones into cross-border public safety operations, enhancing border surveillance and emergency response capabilities across EU member states.

Key Market Dynamics

The Public Safety Drones Market is experiencing robust growth driven by increasing applications across law enforcement, firefighting, search and rescue operations, and disaster management. One of the primary drivers propelling market expansion is the heightened effectiveness of drones in enhancing operational efficiency and safety outcomes. For instance, drones equipped with thermal imaging cameras enable firefighters to swiftly identify hot spots and assess fire spread, significantly improving response times and reducing property damage.

However, despite these advancements, the market faces challenges. Regulatory complexities and privacy concerns regarding drone usage remain significant hurdles. Stringent regulations governing airspace and data privacy are essential to ensure safe and lawful drone operations. Moreover, concerns about data security and potential misuse of drone technology underscore the need for robust regulatory frameworks and ethical guidelines.

Nevertheless, the public safety drones market presents substantial opportunities for growth. Technological advancements such as AI-powered autonomous drones and the integration of machine learning algorithms are poised to revolutionize public safety operations further. These advancements enable drones to autonomously perform complex tasks, such as crowd monitoring and environmental monitoring during natural disasters, thereby enhancing situational awareness and response effectiveness.

Market Segmentation

The public safety drones market is segmented into product type, application, component, and region. By product type, the market is categorized into fixed wing drones, rotary wing drones, and hybrid drones. By application, the market is categorized into law enforcement, emergency management, firefighting, search and rescue. By component, the market is categorized into hardware, software, and services. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The public safety drones market is experiencing significant growth globally, with the U.S. emerging as a dominant player due to various factors, including technological advancements, regulatory support, and substantial investments in public safety infrastructure. The adoption of drones by public safety agencies in the U.S. is driven by the need to enhance operational efficiency, improve situational awareness, and ensure the safety of first responders and the public.

One of the key factors contributing to the U.S. Public Safety Drones Market Share dominance is the proactive stance of federal and state governments in integrating drone technology into public safety operations. The Federal Aviation Administration (FAA) has established regulations and initiatives, such as the Integration Pilot Program (IPP) and the Unmanned Aircraft Systems (UAS) Traffic Management (UTM) Pilot Program, to facilitate the safe and efficient integration of drones into the national airspace.

In addition to regulatory support, technological advancements in drone capabilities have propelled market growth. Innovations such as thermal imaging, high-definition cameras, real-time data transmission, and autonomous flight capabilities enable public safety agencies to conduct search and rescue operations, disaster response, and surveillance with unprecedented efficiency and accuracy. For instance, the Los Angeles Fire Department has utilized drones equipped with thermal imaging cameras to enhance firefighting operations and improve situational awareness during wildfires.

Moreover, significant investments by public safety agencies and private companies are fostering the growth of the market. In 2020, the New York City Police Department (NYPD) invested in a fleet of drones to enhance its emergency response capabilities, including monitoring large public gatherings and conducting tactical operations.

The U.S. public safety drone market also benefits from strong collaboration between technology developers and public safety agencies. Companies like DJI, FLIR Systems, and AeroVironment are actively partnering with law enforcement and fire departments to develop customized drone solutions tailored to specific public safety needs.

Competitive Landscape

The major players operating in the public safety drones market include DJI, Parrot Drones, Yuneec, AeroVironment, Lockheed Martin, Draganfly Innovations, FLIR Systems, Aeryon Labs, EHang, and Insitu.

Other players in the public safety drones market include Textron Systems, Kespry, Altavian, senseFly, Delair, Aerialtronics, Thales Group, Schiebel Corporation, IdeaForge, Matternet, CyPhy Works, SkySpecs, Airware, Swift Engineering, and Skydio.

Industry Trends

- March 2023 – U.S.: DJI launched the DJI Matrice 300 RTK, designed specifically for public safety operations. This model offers enhanced flight time and advanced AI capabilities for search and rescue missions.

- June 2023 – U.S.: Axon and Skydio announced a partnership to integrate Skydio drones with Axon’s digital evidence management platform, Evidence.com. This integration aims to streamline public safety workflows by providing seamless access to drone footage.

- January 2024 - UK: The UK government granted funding to a consortium led by Vodafone to develop a drone traffic management system. This system is intended to enhance the safety and efficiency of drone operations for public safety applications.

- April 2024 - Germany: Microdrones, a German drone manufacturer, expanded its product line with the introduction of the md4-3000, a heavy-lift drone designed for emergency response and disaster management scenarios.

- February 2024 - China: EHang announced the launch of its new autonomous aerial vehicle (AAV) specifically designed for urban public safety applications, including emergency medical services and firefighting. The EHang 216 AAV offers rapid response capabilities.

Key Sources Referred

DJI

Parrot

Yuneec

FLIR Systems

AeroVironment

Draganfly

Skydio

Autel Robotics

Kespry

PrecisionHawk

senseFly

Elistair

Axon (formerly Taser International)

Aeryon Labs

Altavian

Aibotix

Intel Corporation

Lockheed Martin

Textron Systems

Aerialtronics

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the public safety drones market analysis from 2024 to 2033 to identify the prevailing public safety drones market Public Safety Drones Market Opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the public safety drones market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global public safety drones market trends, key players, market segments, application areas, and market growth strategies and Public Safety Drones Market Forecast.

Public Safety Drones Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 9.9 Billion |

| Growth Rate | CAGR of 15.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Product Type |

|

| By Application |

|

| By Component |

|

| By Region |

|

| Key Market Players | AeroVironment, Autel Robotics, Parrot, DJI, FLIR Systems, Kespry, Skydio, Draganfly, Yuneec, PrecisionHawk |

Analyst Review

The Public Safety Drones Market is undergoing a significant transformation, driven by advancements in drone technology and increasing adoption across various public safety agencies. Public safety drones are utilized in multiple scenarios, including search and rescue operations, disaster management, surveillance, and firefighting. These drones provide real-time data and enhanced situational awareness, which is crucial for first responders and law enforcement agencies to make informed decisions swiftly. The integration of AI and machine learning in drones enhances their capabilities, allowing for autonomous operations and advanced data analytics.

One of the critical factors propelling the market is the growing emphasis on safety and security by governments worldwide. Regulatory frameworks are evolving to support the deployment of drones in public safety roles, addressing concerns related to privacy and airspace management. The market is also benefiting from increased funding and investments in drone technology, which fosters innovation and the development of more sophisticated and reliable drones.

Regionally, North America and Europe are at the forefront of adopting public safety drones due to their advanced infrastructure and significant investments in public safety technologies. Meanwhile, emerging economies in Asia-Pacific and Latin America are gradually recognizing the potential of drones in enhancing public safety and are beginning to invest in this technology. Collaborative efforts between public safety agencies and private companies are driving the development and deployment of customized drone solutions tailored to specific needs.

Moreover, the COVID-19 pandemic has underscored the importance of drones in maintaining public safety. Drones have been extensively used for monitoring compliance with lockdown measures, delivering medical supplies, and disinfecting public spaces. This period has accelerated the adoption of drones and highlighted their value in emergency response scenarios.

The global public safety drones market was valued at $2.3 billion in 2023, and is projected to reach $9.9 billion by 2033, growing at a CAGR of 15.7% from 2024 to 2033

The Public Safety Drones Market is product type, and region. 2024-2033 would be the forecast period in the market report.

The rotary wing drones segment held the largest market share in 2023 and is expected to grow at the fastest rate during the forecast period. The global Public Safety Drones Market were valued at $1.5 billion in 2023.

The Public Safety Drones Market is analyzed across North America, Europe, Asia-Pacific, LAMEA. 2023 is the base year calculated in the Public Safety Drones Market report.

The top companies that hold the market share are Inmarsat, KVH Industries, Intelsat, SES, Cobham SATCOM, Viasat, SpeedCast, Marlink, Telenor, Satellite, and Hughes Network Systems.

Loading Table Of Content...

Loading Research Methodology...