PVC Additives Market Research, 2033

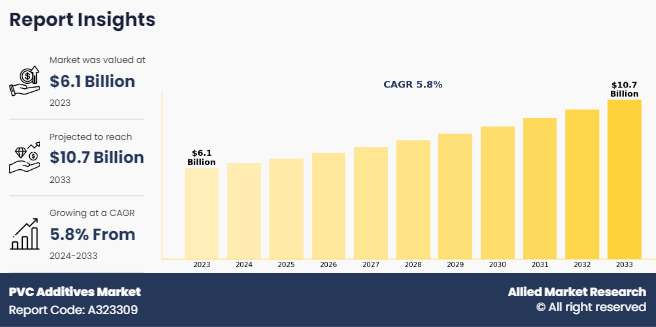

The global PVC additives market was valued at $6.1 billion in 2023, and is projected to reach $10.7 billion by 2033, growing at a CAGR of 5.8% from 2024 to 2033. The surge in construction activities worldwide, coupled with a growing trend towards substituting traditional materials with PVC (Polyvinyl Chloride), has significantly propelled the demand for PVC additives. These additives play a crucial role in enhancing the performance and durability of PVC-based products used in construction.

Introduction

PVC additives are substances added to polyvinyl chloride (PVC) during its manufacturing process to modify its properties or enhance its performance. These additives are used for various purposes such as to improve flexibility, impact resistance, provide thermal stability, offer UV resistance, and coloration of PVC products. Common types of PVC additives include plasticizers, stabilizers, lubricants, fillers, pigments, and flame retardants. Each additive plays a specific role in tailoring PVC to meet the requirements of applications such as pipes, fittings, flooring, packaging, and cable.

Key Takeaways

- The global PVC additives market has been analyzed in terms of value ($million). The analysis in the report is provided on the basis of type, application, 4 major regions, and more than 15 countries.

- The global PVC additives market report includes a detailed study covering underlying factors influencing the industry opportunities and trends.

- The key players in the PVC additives market are Addivant, Arkema, BASF SE, CLARIANT, Dow, Eastman Chemical Company, Evonik, Solvay, SONGWON, and The Lubrizol Corporation.

- The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the PVC additives industry.

- Countries such as China, the U.S., India, Germany, and Brazil hold a significant share in the global PVC additives market.

Market Dynamics

PVC additives play a crucial role in enhancing the thermal stability and weatherability of PVC products. UV stabilizers and thermal stabilizers are commonly used to prevent PVC from degrading when exposed to sunlight, heat, and harsh weather conditions. This is particularly important for outdoor applications such as window profiles, roofing membranes, and outdoor furniture, where prolonged exposure to environmental factors causes premature deterioration if proper additives are not incorporated. In addition, PVC versatility, coupled with its cost-effectiveness and durability, has positioned it as a preferred alternative in sectors ranging from construction to healthcare. According to the European Council of Vinyl Manufacturers, PVC is primarily a building material, 70% of all PVC produced in Europe goes into windows, pipes, flooring, roofing membranes, and other building products. All these factors are expected to drive the demand for the PVC additives market during the forecast period.

However, regulatory compliance and mounting environmental concerns present significant hurdles to the growth of PVC additives. According to the European Chemicals Agency’s (ECHA) investigation, PVC additives such as plasticizers, heat stabilizers, and flame retarders pose risks to people and the environment. To limit the use of these additives and to minimize releases of PVC microparticles, regulatory action is necessary. As governments intensify their focus on environmental protection and public health, stringent regulations governing the use of chemicals and additives have emerged, imposing stringent restrictions on PVC formulations. Compliance with these regulations often entails costly and time-consuming processes for additive manufacturers, thereby impeding innovation and market growth. All these factors hamper the PVC additives market growth.

PVC additives contribute to the development of innovative recycling technologies and processes that enable the efficient recovery and reuse of PVC materials. Advanced additives improve the efficiency of mechanical recycling methods, such as shredding and extrusion, by minimizing degradation and enhancing material compatibility, thereby increasing the yield and quality of recycled PVC products. For instance, compatibilizers and impact modifiers are key additives that improve the compatibility between different plastics such as PVC during recycling. In addition, additives facilitate chemical recycling processes, wherein PVC materials are broken down into their constituent monomers for subsequent repolymerization, enabling the regeneration of PVC without quality loss. All these factors are anticipated to offer new growth opportunities for the PVC additives market during the forecast period.

Segments Overview

The PVC additives market is segmented on the basis of type, application, and region. On the basis of type, the market is categorized into stabilizers, impact modifiers, processing aids, lubricants, plasticizers, and others. On the basis of application, the market is segregated into pipes & fittings, profiles & tubing, wire & cable, rigid sheet & panel, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

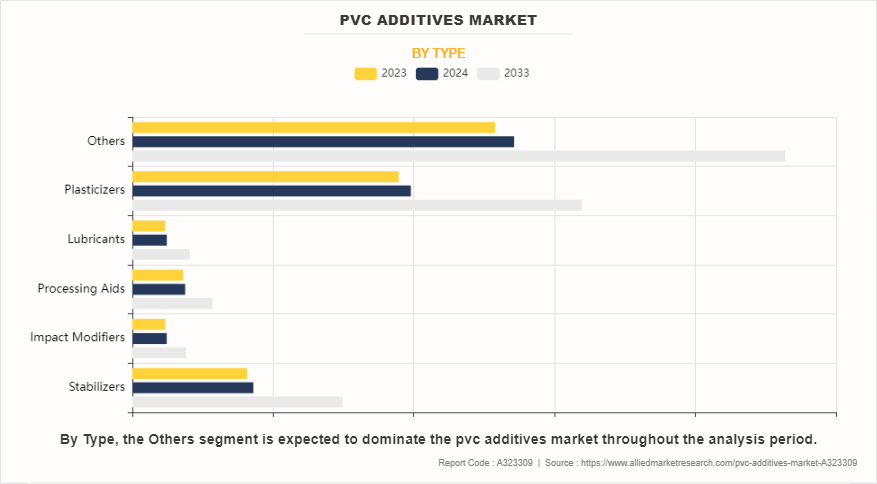

By type, the others segment accounted for more than two-fifths of global PVC additives market share in 2023 and is expected to maintain its dominance during the forecast period. In others segment include fillers, Flame retardants, and pigments. Fillers are substances added to PVC formulations to improve properties such as strength, stiffness, and thermal conductivity. With the increase in demand for lightweight and durable materials in construction and manufacturing sectors, fillers play a crucial role in achieving the desired balance of properties in PVC products. In addition, the aesthetic appeal of PVC products is a significant factor driving the demand for pigments, as they allow manufacturers to create visually appealing finishes that meet consumer preferences and design trends.

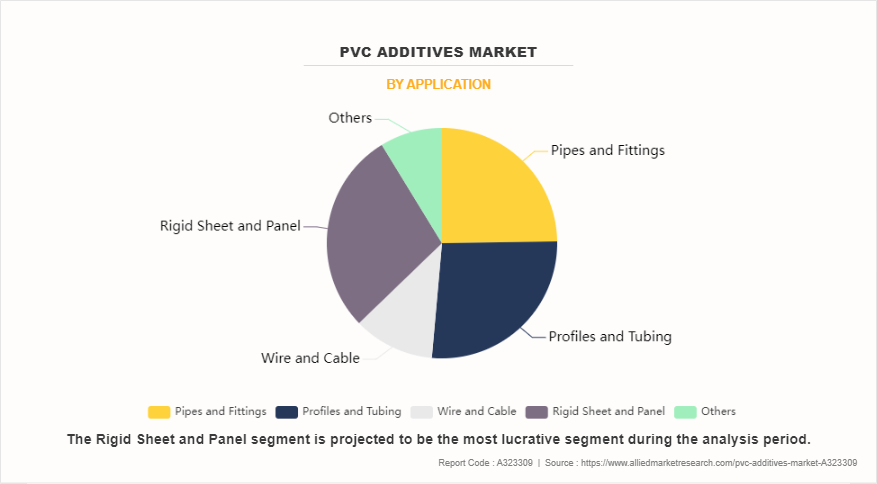

By application, the rigid sheet & panel segment accounted for more than one-fourth of global PVC additives market share in 2023 and is expected to maintain its dominance during the forecast period. The versatility and durability of PVC make it a preferable material for manufacturing rigid sheets and panels used in diverse industries such as construction, automotive, and packaging. These rigid PVC products offer excellent resistance to weathering, impact, and chemicals that makes them ideal for outdoor and indoor applications requiring structural integrity and longevity. Moreover, regulatory requirements and consumer preferences for sustainable and environmentally friendly materials are driving innovation in PVC additives.

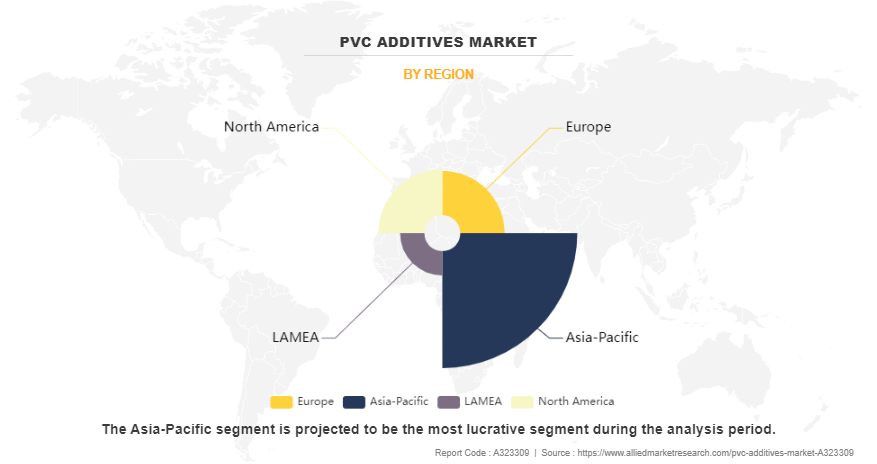

Asia-Pacific accounted for more than half of the global PVC additives market share in 2023 and is expected to maintain its dominance during the forecast period. The surge in population and rise in standards of living are fueling the construction of new residential and commercial buildings driving the need for PVC additives. According to the United Nations Population Fund, The Asia and the Pacific region has 60% of the world’s population around 4.3 billion people and includes the world’s most populous countries such as China and India. These additives play a crucial role in improving the performance and longevity of PVC products, ensuring they meet stringent quality and safety standards amidst diverse environmental conditions prevalent in the Asia-Pacific region such as high temperatures, humidity, and exposure to UV radiation.

Competitive Analysis

Key players in the PVC additives market include Addivant, Arkema, BASF SE, CLARIANT, Dow, Eastman Chemical Company, Evonik, Solvay, SONGWON, and The Lubrizol Corporation. Apart from these major players, there are other key players in the PVC additives industry. These include KANEKA CORPORATION, Akzo Nobel N.V., LANXESS, Mitsubishi Chemical Group Corporation, ADEKA CORPORATION, Wacker Chemie AG, Nouryon, and Sumitomo Chemical Co., Ltd.

In the global PVC additives market, companies have adopted strategies such as product launch strategies to expand the market or develop new products. For instance, in September 2023, BASF SE launched the industry’s first biomass balance offerings for plastic additives. This new range of plastic additives contributes to the replacement of fossil feedstock with renewable raw materials according to a certified biomass balance approach. Moreover, in October 2022, Clariant launched new additives at K 2022 to support plastics sustainable evolution. This anti-scratch additive for PP & TPO formulations boosts reuse potential of plastics used in consumer applications.

Parent Market Overview

The expansion of the plastic additives market is driven by surge in demand for consumer durable goods. Plastic additives such as stabilizers, plasticizers, flame retardants, and colorants are commonly used to improve the properties of plastics such as PVC, polyethylene, polypropylene, and polycarbonate. China's prominence as a major producer of plastic materials extends to its considerable influence in the PVC additives industry. PVC is widely used in construction applications such as pipes, fittings, profiles, and roofing membranes, where additives are essential for enhancing properties such as impact strength, flexibility, and weather resistance. In addition, the automotive industry growth, particularly in the electric vehicle (EV) segment, contributes to the demand for plastic additives including PVC additives used in automotive components. As Asia-Pacific leads the transition toward electric mobility, there is a heightened need for additives that improve the performance, durability, and safety of PVC-based materials used in EV applications.

Historical Trends of PVC Additives

- The early to mid-20th century marked the developing stages of PVC additives, with the commercialization and initial applications in various industries such as construction, automotive, and packaging. Companies such as Dow Chemical, BASF, and Arkema emerged as pioneers, producing additives to enhance the performance and versatility of PVC materials in diverse applications.

- The 1960s witnessed significant advancements in PVC additive technology, driven by increasing demand and expanding applications. Additive manufacturers introduced new formulations to improve PVC's flexibility, weatherability, and flame resistance, paving the way for widespread adoption in building materials, automotive components, and consumer goods.

- In the 1970s, PVC additive technology underwent further evolution with the development of novel processing aids, heat stabilizers, and impact modifiers. These innovations contributed to enhanced processing efficiency, product quality, and durability, fueling the growth of PVC additives in industries such as healthcare, electronics, and agriculture.

- The 1980s marked a period of innovation in PVC additive formulations, focusing on addressing environmental concerns and regulatory compliance. Additive companies invested in research and development to produce eco-friendly alternatives to traditional additives, including lead stabilizers, phthalate plasticizers, and heavy metal-based pigments.

- The 1990s witnessed a surge in demand for PVC additives driven by globalization and technological advancements. Additive manufacturers focused on developing additives with improved performance, sustainability, and compatibility with recycling processes, meeting the evolving needs of industries worldwide.

- By the early 2000s, PVC additive technology evolved to incorporate advanced materials and processing techniques, enabling the production of high-performance and environmentally friendly additives. Additive companies introduced bio-based additives, renewable polymers, and recyclable formulations to support the transition toward a more sustainable PVC industry.

- In the 2010s, PVC additive technology continued to advance with a focus on digitalization, innovation, and regulatory compliance. Additive manufacturers developed smart additives, antimicrobial agents, and UV stabilizers to address emerging challenges and opportunities in industries such as construction, healthcare, and packaging.

- In the 2020s, the PVC additives market experienced further evolution with a growing emphasis on sustainability, circular economy principles, and regulatory compliance. Innovations such as bio-based plasticizers, recyclable additives, and eco-friendly stabilizers aimed to reduce environmental impact and support the transition to a more sustainable PVC industry in alignment with global climate goals.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pvc additives market analysis from 2023 to 2033 to identify the prevailing pvc additives market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the PVC additives market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pvc additives market trends, key players, market segments, application areas, and market growth strategies.

PVC Additives Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 10.7 billion |

| Growth Rate | CAGR of 5.8% |

| Forecast period | 2023 - 2033 |

| Report Pages | 340 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Evonik, Eastman Chemical Company, Dow, BASF SE, The Lubrizol Corporation, Songwon, Addivant USA, LLC, CLARIANT, Solvay, Arkema |

Analyst Review

According to the opinions of various CXOs of leading companies, the PVC additives market is expected to witness growth during the forecast period owing to rapid infrastructure development and construction activities and replacement of conventional material with PVC. The widespread adoption of PVC in construction applications has catalyzed a corresponding increase in the demand for PVC additives. These additives play a crucial role in enhancing the performance, functionality, and longevity of PVC-based products used in diverse construction applications. For instance, additives such as stabilizers, plasticizers, and impact modifiers are incorporated into PVC formulations to improve weather resistance, impact strength, and thermal stability, ensuring that PVC products withstand the rigors of diverse environmental conditions and structural requirements.

Moreover, the replacement of conventional materials with PVC is driven by factors such as cost efficiency, ease of manufacturing, and sustainability considerations. PVC additives enable manufacturers to fine-tune the properties of PVC materials to meet specific application requirements, thereby expanding the scope of applications for PVC in construction projects. From piping systems and roofing membranes to window profiles and flooring materials, PVC-based products find extensive use in both residential and commercial construction, driving sustained demand for PVC additives.

The PVC additives market was valued at $6.1 billion in 2023, and is estimated to reach $10.7 billion by 2033, growing at a CAGR of 5.8% from 2024 to 2033.

Asia-Pacific is the largest regional market for PVC Additives.

Rigid sheet and panel is the leading application of PVC Additives Market.

Growing emphasis on recyclability and circular economy is the upcoming trends of PVC Additives Market in the world.

Rise in construction activities and replacement of conventional material with PVC are the leading drivers for the PVC Additives Market.

Asia-Pacific is the fastest growing region for the PVC Additives Market.

Key players in the PVC additives market include Addivant, Arkema, BASF SE, CLARIANT, Dow, Eastman Chemical Company, Evonik, Solvay, SONGWON, and The Lubrizol Corporation.

Loading Table Of Content...

Loading Research Methodology...