Radiology Services Market Research, 2033

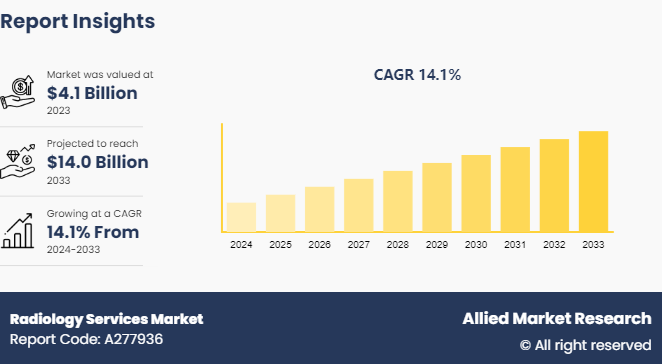

The global radiology services market size was valued at $4.1 billion in 2023, and is projected to reach $14.0 billion by 2033, growing at a CAGR of 14.1% from 2024 to 2033

Market Introduction and Definition

Radiology, or diagnostic imaging, involves a variety of tests that capture images of different body parts using radiant energy. The field encompasses two main areas: diagnostic radiology and interventional radiology, both crucial for diagnosing and treating diseases. Common imaging exams include x-ray, CT scan, MRI, ultrasound, and PET scan.

Radiologists, who are typically medical doctors (MDs) with specialized training in interpreting medical imaging, analyze the results of these tests to support diagnoses. They work closely with radiologic technologists, experts in operating imaging machines, to produce high-quality images. After conducting imaging tests, radiologists provide detailed reports of their interpretations to the referring clinical physicians. Radiology services encompass professional and technical expertise essential for medical imaging, radioisotope services, and radiation oncology, pivotal in modern healthcare diagnostics and treatment planning.

Key Takeaways

- The radiology services market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major radiology services industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

Globally, about one in three adults suffers from multiple chronic conditions, with three out of five global deaths attributed to four major non-communicable diseases (NCDs) such as cardiovascular disease, cancer, chronic lung diseases, and diabetes. As populations age, the duration people live with disability and chronic illnesses increases, pushing the prevalence of multiple chronic conditions (MCC) to nearly three-quarters of older adults in developed countries. This rising incidence of chronic diseases significantly boosts the demand for advanced diagnostic imaging services. The need for precise and timely diagnosis to manage and treat these conditions effectively underscores the crucial role of radiology services in modern healthcare, driving radiology services market growth and innovation in imaging technologies.

Radiology employs high-energy radiation to produce body images, which can expose patients to radiation. Prolonged exposure to radiation can elevate the risk of cancer and other health issues. Radiologists, who conduct and interpret radiological exams, are exposed to radiation throughout their careers. The extent of radiation exposure for radiologists depends on various factors, including the type of exam, the number of exams conducted, the duration of each exam, and the equipment and techniques used. Long-term radiation exposure is associated with risks such as certain cancers, cataracts, and adverse reproductive outcomes. These factors are anticipated to restrain radiology services market size.

Radiology is a dynamic field at the forefront of medical technological advancements, including artificial intelligence and machine learning. Advanced imaging techniques such as Magnetic Resonance Imaging (MRI) , Computed Tomography (CT) , and Positron Emission Tomography (PET) produce high-quality 3D images of the body, aiding in the diagnosis of complex illnesses and the planning of surgical procedures. Machine learning algorithms in radiology automate the processing of radiological images, improving accuracy, speed, and efficiency.

Artificial intelligence can detect early signs of diseases like cancer, stroke, and heart disease. Additionally, virtual and augmented reality technologies create interactive 3D models of organs and tissues, enabling healthcare professionals to visualize and manipulate structures in real-time, enhancing understanding and precision. Cloud-based medical image storage and transmission allow for quicker access to patient data, improved collaboration among healthcare providers, and reduced costs associated with physical image storage and transport.

Global Radiology Services Market Patent Analysis

The patent analysis of the radiology services market highlights innovative products designed to enhance the industry. Companies are regularly investing in intellectual property to advance technology, ensure competitive advantage, facilitate unique product development, and drive the growth of radiology services products.

In May 2023, William Thoburn Randazzo and Eli Cornblath patented a Blockchain-Based Radiology Billing, Radiologist Management, and Radiology Data Tracking System. This innovation introduces a blockchain-based system for radiology billing, radiologist management, and radiology data tracking, generating non-fungible tokens (NFTs) from radiology workflow data recorded in medical records for use in a marketplace. The system includes a non-transitory computer-readable medium that captures relevant data from the radiology information system, picture archiving and communication system, and electronic medical record. It sorts and stores this data as metadata, then transmits it to a smart contract's mint function on the blockchain. The system executes the creation of NFTs based on the metadata, imports the minted NFTs into a marketplace, and provides an interface for users to interact with the NFTs. The marketplace facilitates the collection of payments for radiology clinical services, payment for services rendered, and tracking of performed clinical radiology work.

In April 2024, Koninklijke Philips N.V. introduced a Radiology Workflow Coordination method. This method involves gathering details about an upcoming radiology examination, including the imaging modality to be used, patient information, and data from the radiology examination order. Using this information, role-specific examination complexity metrics are calculated for each personnel role involved in the workflow of the radiology examination. Based on these metrics, advice and/or assistance are provided to the personnel assigned to these roles. Additionally, the method may involve creating a draft communication request by completing a communication request form based on an inquiry and the context of the radiology examination. The requestor can then edit and approve the draft before it is sent to the designated recipient.

In October 2021, Bayer Aktiengesellschaft patented a method for the Generation of Radiological Images. This invention relates to the creation of radiological pictures of an examination area on an object under inspection. Based on measured radiological images of an examination region that show blood vessels with decreasing contrast intensity over time, the invention generates false radiological images of the examination area that show blood vessels with constant contrast intensity.

Market Segmentation

The radiology services market share is segmented into product type, application, technology, end user, and region. On the basis of product type, the market is divided into stationary digital radiology systems and portable digital radiology systems. As per application, the market is segregated into cardiovascular imaging, chest imaging, dental imaging, orthopedic imaging, and others. On the basis of technology, the market is bifurcated into computed radiology and direct digital radiology. As per end user, the market is segregated into hospitals, diagnostic centers, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The North American region's aging population has resulted in a larger frequency of chronic diseases, driving up demand for advanced diagnostic imaging services. Concurrently, significant investments by manufacturers and supportive government programs focused at improving healthcare infrastructure have accelerated radiology services industry growth. These advancements not only provide access to high-quality radiology services, but they also promote innovation in imaging technologies and improve overall patient care across North America.

On November 27, 2023, Radiology Partners (RP) , a leading radiology practice in the U.S., announced the launch of its RPX AI orchestration platform on Amazon Web Services (AWS) . RPX AI, RP's AI orchestration and integration platform, was designed to utilize AWS HealthImaging—a HIPAA-eligible service for storing, analyzing, and sharing medical images at petabyte scale. By leveraging AWS HealthImaging, RP aims to enhance its capability to seamlessly deploy a suite of AI tools across any reading platform. This initiative created a highly accessible and adaptable solution for hospitals and health systems, facilitating the delivery of high-quality, technology-enabled care.

Competitive Landscape

The major players operating in the radiology services market forecast include CodaMetrix, Enlitic Inc., Siemens Healthineers, DeepTek Inc., Philips Healthcare, Coreline Soft, DeepHealth, Inc., Equium Intelligence, GE Healthcare, and TeleRay.

Recent Key Strategies and Developments

- On November 29, 2023, GE HealthCare launched a new AI suite at RSNA 2023, the annual radiology and medical imaging conference held in Chicago. The newly introduced product, named the MyBreastAI suite, aims to streamline radiologists’ workflows and enhance early detection of breast cancer in patients.

- In June 2023, SimonMed Imaging, one of the largest outpatient medical imaging providers and radiology practices in the United States, announced the introduction of simonONE, offering affordable, rapid, non-invasive whole body MRI screening directly to patients.

- In November 2023, MCRA, a prominent privately held independent Clinical Research Organization (CRO) and advisory firm specializing in medical devices, diagnostics, and biologics, announced the inauguration of its AI & Imaging Center. This center, the first of its kind, offered an integrated solution overseen by former FDA imaging specialists, encompassing the entire lifecycle of medical device products.

Industry Trends

- In January 2024, Carestream Health launched a new x-ray system named DXR-Excel Plus, featuring enhancements aimed at simplifying workflow and boosting productivity.

- In February 2024, Royal Philips, a global leader in health technology, announced the launch of the Philips CT 5300 system equipped with advanced AI capabilities. Designed for diagnosis, interventional procedures, and screening, this flexible X-ray CT system enhances diagnostic confidence, streamlines workflow efficiency, and maximizes system uptime. These improvements contribute to better patient outcomes and increased productivity within radiology departments.

Key Sources Referred

- Radiological Society of North America

- U.S. Department of Health and Human Services

- Indian Radiological & Imaging Association

- WHO

- Association of Academic Radiology

- Innovate Healthcare

- Society for Interventional Radiology

- Association of Program Directors in Radiology

- American Roentgen Ray Society

- American College of Radiology

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the radiology services market analysis from 2024 to 2033 to identify the prevailing radiology services market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the radiology services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global radiology services market trends, key players, market segments, application areas, and market growth strategies.

Radiology Services Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 14.0 Billion |

| Growth Rate | CAGR of 14.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 320 |

| By Product Type |

|

| By Application |

|

| By Technology |

|

| By End User |

|

| By Region |

|

| Key Market Players | Equium Intelligence, DeepHealth, Inc., DeepTek Inc, Enlitic Inc., Siemens Healthineers, Coreline Soft, CodaMetrix, Philips Healthcare, TeleRay, GE Healthcare |

The upcoming trends in the global radiology services market include the adoption of AI and machine learning, increased use of tele-radiology, advancements in imaging technologies, and a growing focus on personalized and preventive care.

The leading application of the radiology services market is diagnostic imaging.

Asia-Pacific is the largest regional market for radiology services.

The radiology services market was valued at $4.1 billion in 2023, and is estimated to reach $14.0 billion by 2033, growing at a CAGR of 14.1% from 2024 to 2033.

The major players operating in the radiology services market include CodaMetrix, Enlitic Inc., Siemens Healthineers, DeepTek Inc., Philips Healthcare, Coreline Soft, DeepHealth, Inc., Equium Intelligence, GE Healthcare, and TeleRay.

Loading Table Of Content...