Rail Logistics Market Overview

The global rail logistics market was valued at USD 1,995 billion in 2021, and is projected to reach USD 3,579.7 billion by 2031, growing at a CAGR of 6.1% from 2022 to 2031.

Rail logistics transport is a means of transferring goods on wheeled vehicles running on rails, which are located on tracks. It is one of the most important, commonly used, and cost-effective modes of commute and goods carriage over long as well as short distances. Rail has emerged as one of the most dependable modes of transport in terms of safety. Trains are fast and the least affected by usual weather turbulences, such as rain or fog, as compared to other transport mechanisms. In addition, rail transport is better organized than any other medium of transport. It has fixed routes and schedules. Moreover, its services are more certain, uniform, and regular as compared to other modes of transport.

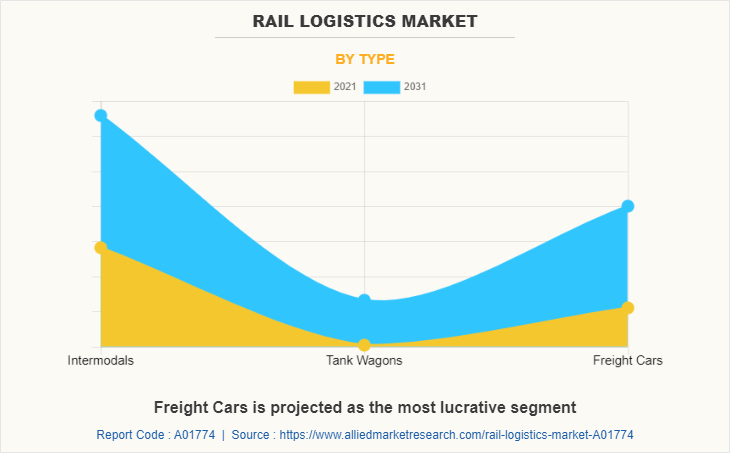

Rail intermodal is a less expensive alternative to truckload transport. In addition, rail intermodal is more fuel-efficient than long-haul trucks. Rail intermodals also aids in reducing in highway congestion and harmful emissions. In addition, with the increasing growth of intermodal transportation, companies are investing in the development of intermodal containers and trailers for better efficiency in terms of carrying goods, which in turn is expected to drive the growth of the segment.

The growth of the global rail logistics market has propelled due to increase in allocation of budget for development of railways and rise in demand for secure, safer, & efficient transport system. However, restrictions associated with cross border freight transport is the factor that hampers the growth of the market. Furthermore, surge in development & testing of autonomous train, and increase in industrial & mining activities are the factors expected to offer growth opportunities during the forecast period.

Segment Overview

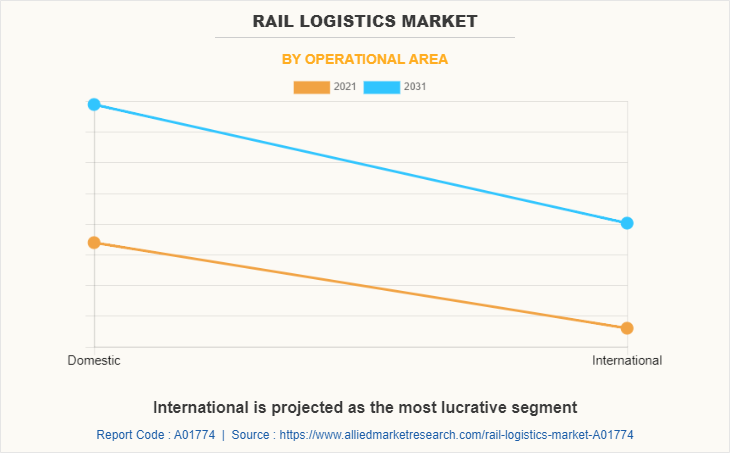

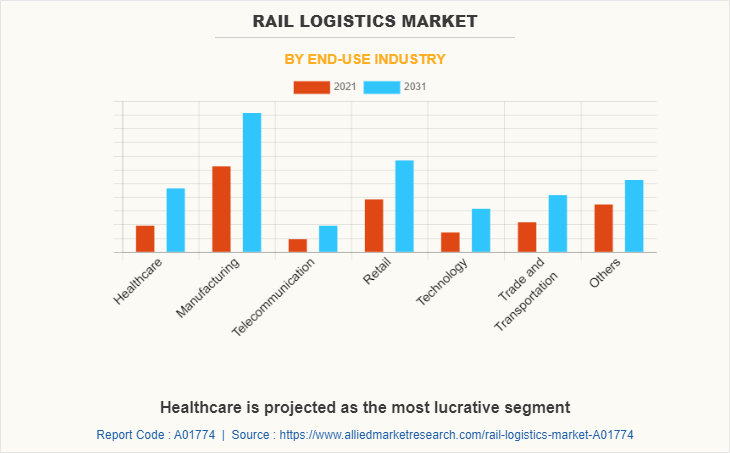

The rail logistics market is segmented on the basis of type, operational area, end-use industry, and region. By type, it is fragmented into intermodals, tank wagons, and freight cars. By operational area, it is classified into domestic and international. By end-use industry, it is categorized into healthcare, manufacturing, telecommunication, retail, technology, trade and transportation, and others. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Players

Some leading companies profiled in the rail logistics market report comprises A.P. Moller-Maersk, CEVA Logistics AG, C.H. Robinson Worldwide, Inc., DB Schenker, Deutsche Post DHL Group, DSV A/S, Geodis, FedEx, Kuehne+Nagel International AG, Nippon Express Co., Ltd., Schenker Deutschland AG, and United Parcel Service of America, Inc.

Market Drivers

Increase in allocation of budget for development of railways

The developing countries such as India, China, and others are focused toward the development of their railway infrastructure by allocating higher budget. For instance, India allocated a budget of around $15.06 billion for the railways, with total capital expenditure outlay of $30.80 billion for the financial year 2021-2022, which highlighted an increase of 33% in total capital expenditure for 2021-22 over $22.4 billion for 2020-21. Similarly, various countries across the globe are continuously increasing their rail budget to deploy latest technologies and improve their infrastructure. For instance, the UK government invested over $6.28 billion in new & enhanced rail infrastructure and rolling stock in 2019-2020. Moreover, upsurge in budget allocation acts as a key factor that drives the growth of the global rail logistics market.

Rise in demand for secure, safer, and efficient transport system

According to the fact sheet of the World Health Organization (WHO), road traffic injuries are the leading cause of fatality among people aged between 15 and 29 years, thus accounting for 1.25 million deaths every year due to road accidents. In addition, 90% of the world's fatalities on roads occur in low and middle economical countries, though such countries have approximately 54% of the world's vehicles. Therefore, rise in need for safe, secure, and efficient transportation system significantly contributes toward the growth of the global rail logistics market. Railway transportation is considered as the safest and economical mode of transportation, which has boosted the demand for railways.

Latest trains are equipped with on-board cameras, sensors, and communication devices. Moreover, such trains in most locations run underground or at the ground level and are highly secured by fences or walls to prevent trespassing, which propels the growth of the market. In addition, modern advanced trains consume less energy due to better acceleration, traction, and braking system, resulting in reduction of energy consumption by around 30% based on the degree of automation. For instance, in February 2022, Alstom launched its first French hybrid train in partnership with SNCF Voyageurs. This electric-diesel-battery regional train is equipped with two energy storage systems, which offer reduced energy consumption and greenhouse gas emissions, with a solution that makes it possible to adapt to existing diesel fleet without the need to modify the current infrastructure. Furthermore, such trains can provide a flexible way to coordinate in terms of frequency, which results in the improvement of the system performance in all aspects, which boosts the growth of the rail logistics industry.

Restrictions associated with cross border freight transport

Each country has its own infrastructure, train protection systems, signals & safety regulations, and operating regulations. Cross-border trains must comply with the operating regulations of the country they pass through. For instance, a train is required to be formed in accordance with the country-specific regulations, i.e. the wagon sequence as well as the length and weight of train must meet the respective requirements.

Moreover, there are several other factors such as variety of regulations regarding traffic management, or lack of communication resulting from different languages, which affects the cross border freight transport. These factors can result in delay in delivery of products or goods to destination through rail, which in turn can result in increase in transportation cost. Thus, restrictions associated with cross border freight transport is anticipated to limit the growth of the rail logistics market during the forecast period.

Increase in industrial & mining activities

Rapid industrialization, with global increase in population boosts the demand for valuable minerals or other geological materials such as clay, chalk, dimension stone, rock salt, metals, limestone, coal, oil shale, gemstones, potash, and gravel. Industries need transportation networks to move raw materials and finished goods efficiently. Freight transportation by rail has proved to be more cost effective and reliable compared to road transport.

Demand for freight wagons is high in countries such as the U.S., China, and Russia, owing to increase in demand for replacements and the strong growth of the manufacturing sector. Availability of custom-made and technologically advanced wagons such as chemical & pressure tank wagons and car-carrier & low-loader container-carrying wagons drive the rail logistics market growth for freight wagons. Moreover, increased mining activity in emerging economies is expected to positively impact the market for freight transportation. This has resulted in increase in industrial & mining activities, which is opportunistic for market expansion.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the rail logistics market analysis from 2021 to 2031 to identify the prevailing rail logistics market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the rail logistics market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global rail logistics market trends, key players, market segments, application areas, and market growth strategies.

Rail Logistics Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Operational Area |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | DB Schenker, CEVA Logistics, A.P. Moller – Maersk A/S, C.H. Robinson Worldwide, Inc., DSV A/S, Deutsche Post DHL Group, FedEx Corporation, Nippon Express Co., Ltd., Geodis Group, Deutsche Bahn AG, Kuehne + Nagel International AG, United Parcel Service Inc. |

Analyst Review

The rail logistics market is expected to witness significant growth, owing to rise in allocation of budget for development of railways and surge in demand for secure, safer, & efficient transport system.

Autonomous trains are automated transit systems, operated automatically without any human involvement and are monitored from the control station. These trains operate with higher frequencies having the capability of transporting a large number of passengers and freights at a faster pace compared to road transport. Therefore, various countries are focused on developing, testing, and adopting autonomous train technology to reduce human intervention and participation. For instance, in May 2021, France's national state-owned railway company SNCF and its partners Alstom, Bosch, Spirops, Thales and the Railenium Technology Research Institute began testing a modified Regio 2N regional train as a prototype autonomous regional train for France’s rail network.

Moreover, autonomous trains are safer, secure, flexible, and efficient as compared to traditional manually operated trains, which increases the popularity of autonomous train technology. Thus, rise in development and testing of autonomous train is opportunistic for the market expansion.

In order to gain a fair share of the market, major players adopted different strategies, for instance, partnership, product launch, and product development. Among these, product launch is the leading strategy used by prominent players such as A.P. Moller – Maersk, CEVA Logistics AG, C.H. Robinson Worldwide, Inc., DB SCHENKER, GEODIS, Deutsche Post DHL Group, DSV A/S, and FedEx.

The global rail logistics market was valued at $1,995.0 billion in 2021 and is projected to reach $3,579.7 billion in 2031, registering a CAGR of 6.1%.

The leading application is in domestic logistics.

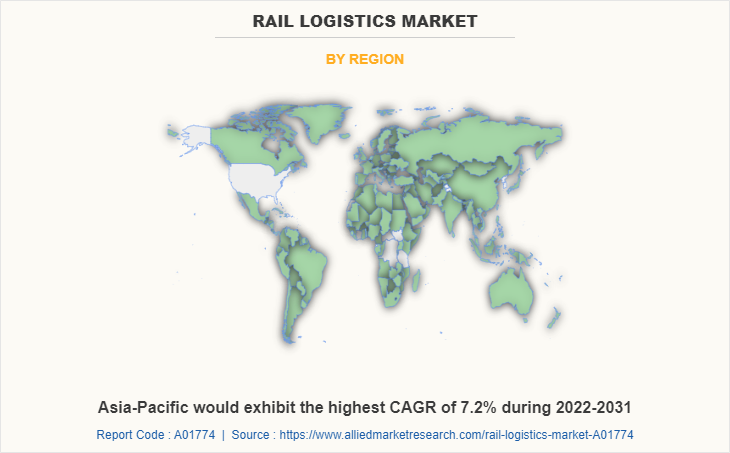

The largest regional market is Asia-Pacific.

Some leading companies include A.P. Moller-Maersk, CEVA Logistics AG, C.H. Robinson Worldwide, Inc., DB Schenker, Deutsche Post DHL Group, DSV A/S, Geodis, FedEx, Kuehne+Nagel International AG, Nippon Express Co., Ltd., Schenker Deutschland AG, and United Parcel Service of America, Inc.

The upcoming trends include research and development associated with autonomous trains, and technological advancements.

Loading Table Of Content...