Railway Maintenance Machinery Market Research, 2032

The Global Railway Maintenance Machinery Market size was valued at $4 billion in 2021, and is projected to reach $7.2 billion by 2032, growing at a CAGR of 5.5% from 2023 to 2032. A variety of specialized tools and automobiles intended for the building, upkeep, and restoration of railway infrastructure are referred to as railway maintenance machinery. In order to guarantee the safe and effective operation of rail tracks, signaling systems, overhead lines, and other railway network components, it comprises a variety of devices and equipment. Catenary systems, switches, bridges, tunnels, railway tracks, and other infrastructure components are all inspected, maintained, and repaired using railway maintenance equipment.

The growth in government investment on railway construction projects, the rise in railway electrification projects, and the many advantages of railway maintenance machinery are the key reasons propelling of the railway maintenance machinery market. Furthermore, nations all around the world are spending money on the upkeep, upgrading, and extension of their rail systems. This covers building new train lines, enhancing current networks, and enhancing safety and signalling infrastructure. The sector for railway maintenance machinery is seeing significant demand due to the continual construction of infrastructure.

Railway Maintenance Machinery Market Dynmaics

The building of new railroad lines and the doubling of existing ones are both being approved by various governments. Additionally, they are committed to promoting public confidence in the rail transportation system, improving rail security, and raising awareness of the issue. China is likewise spending a lot of money developing its railway infrastructure. Large railway projects are currently in the development and building phases in numerous countries.In June 2022, the CRISI grant program provided a significant funding boost for transportation improvements.

A total of approximately $368 million was awarded to 46 projects across 32 states and the District of Columbia. Meanwhile, in October 2022, the Indian government made a noteworthy investment of $793.5 million into three rail projects within the state of Haryana. Subsequently, there is a growing need for railway maintenance equipment as more new rail projects are constructed, this is what is causing the railway maintenance machinery market to grow. As a rapid, efficient, and environmentally beneficial mode of transportation, there has been a growth in the number of electrification projects around the world.

According to a March 2023 agreement between India and the Japan International Cooperation Agency (JICA), the Mumbai-Ahmedabad High-Speed Rail (MAHSR), also known as the bullet train project, will be constructed using a $2.2 billion Official Development Assistance (ODA) loan. The introduction of bullet trains is expected to bring about advancements in rail infrastructure, particularly in areas like signaling, track monitoring, and maintenance procedures. These advancements will result in state-of-the-art maintenance equipment that utilizes automation, robotics, and digitalization to enhance the precision and efficiency of maintenance tasks. Consequently, the expansion of the railway maintenance machinery industry has been fueled by a rise in global railway electrification projects.

Railway Maintenance Machinery Market Segmental Overview

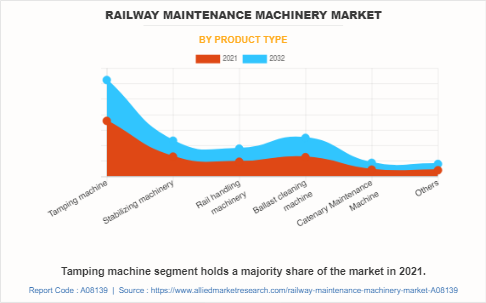

By Product Type:

The railway maintenance machinery market is categorized into various types, including tamping machines, stabilizing machinery, rail handling machinery, ballast cleaning machines, catenary maintenance machines, and others. In 2022, the tamping machine segment dominated the railway maintenance machinery market, in terms of revenue. However, the other segment is expected to grow with a higher CAGR during the forecast period. Moreover, tamping machines are crucial for regular track maintenance. Over time, the ballast can become loose or displaced due to heavy train traffic, environmental factors, or natural wear and tear. Tamping machines help restore the ballast to its proper position and ensure that it is compacted tightly around the railroad ties. This improves track stability and reduces the risk of derailments and accidents.

Education in developing nations such as Chile, India, and Africa is not developing as quickly as their economy. Therefore, a factor impeding the growth of the railway maintenance machinery market is a lack of skilled and available workforce in large businesses in emerging nations. Steps including inspection, replacement, and upkeep of the railroad track's machinery are part of the maintenance process. To be effective, these operations need labor and trained personnel. It follows that a lack of competent labor and low pay in developing nations are expected to impede the expansion of the railway maintenance machinery market.

Moreover, the Internet of Things (IoT) and internet services are being included in the products which are expected railway maintenance machinery market outlook. IoT adoption facilitates effective track and transit maintenance. Improvements in the rail infrastructure and the use of IoT technology have also been made to increase the effectiveness of the railway systems. For instance, in July 2022, as part of a phased upgrade to the tamping fleet, System7 train Holding GmbH and Colas Rail UK's train service business unit created a new autonomous tamping bank.

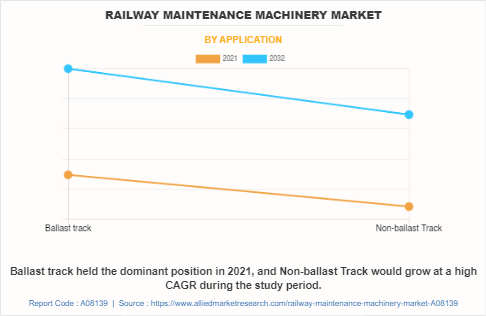

By Application:

The Railway Maintenance machinery market is divided into ballast track and non-ballast track. In 2022, the ballast track segment dominated the railway maintenance machinery market, in terms of revenue, and non-ballast is expected to witness growth at a higher CAGR during the forecast period. Ballast tracks are designed to be resilient and absorb the impact and vibrations caused by moving trains. The ballast layer acts as a cushioning material, reducing the stress and strain on the tracks. It helps distribute the dynamic loads and vibrations caused by trains, minimizing the transfer of these forces to the underlying subgrade. This not only improves the overall ride quality for passengers and reduces track wear and tear, but also extends the lifespan of the tracks.

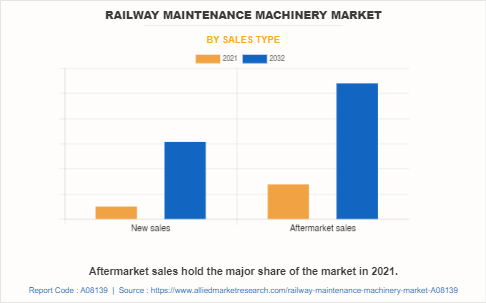

By Sales Type:

The Railway Maintenance Machinery Market is divided between new sales and aftermarket sales. The aftermarket segment dominated the railway maintenance machinery market share in terms of revenue in 2022 and is anticipated to register a higher growth rate throughout the forecast period. The availability of aftermarket services and spare parts allows customers to extend the lifespan of their railway maintenance machinery. By replacing worn-out components, conducting regular maintenance, and addressing issues promptly, customers can optimize the performance and longevity of their equipment. This not only benefits the customers but also enhances the reputation of the machinery manufacturer or supplier.

The Railway Maintenance Machinery Market is witnessing various obstructions in its regular operations due to COVID-19 pandemic and inflation. Earlier, all trains were not operating because of the lockdown and eventually led to reduced demand for railway maintenance machinery. However, the COVID-19 has subsided, and the major manufacturers in 2023 are performing well. Contrarily, the rising global inflation is a new major obstructing factor for the entire industry.

The inflation, which is a direct result of the Ukraine-Russia war, and few long-term impacts of the coronavirus pandemic, has introduced volatility in the prices of raw materials used for machineries. In addition to this, the cost of oil & gas has also increased, and many countries, especially the countries in Europe, Latin America, and developing economies in Asia-Pacific, are experiencing severe negative impacts in the industrial production, including the production of various machineries. However, India and China are performing relatively well. In addition, inflation is expected to worsen in the coming years, as the possibility of the ending of the war between Ukraine and Russia is less. However, with the continued talks between different countries, a peace agreement between Ukraine and Russia can be devised.

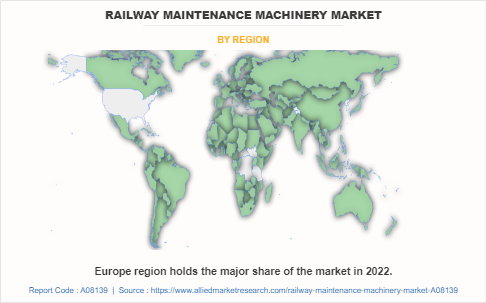

By Region:

Europe accounted for the highest market share in 2022 and LAMEA is expect to dominate the railway maintenance machinery market forecast by growing with the highest CAGR. Europe has one of the most extensive railway networks globally, covering numerous countries and connecting major cities and regions. In addition, the railway maintenance machinery market growth is expected to surge as countries prioritize the expansion and improvement of their rail networks to meet growing transportation demands. The extensive infrastructure requires regular maintenance and upkeep, leading to a higher demand for railway maintenance machinery eventually positively the railway maintenance machinery market overview.

Competition Analysis

Competitive analysis and profiles of the major players in the railway maintenance machinery market are provided in the report. Major companies in the report include System7 Rail Holding GmbH, MER MEC S.p.A, Fluor Corporation, Loram Maintenance of Way, Inc., Harsco Corporation, Geatech Group s.r.l., Plasser & Theurer, Sinara Transport Machines Holding, CRRC Corporation Limited and China Railway Construction Corporation Limited. Major players to remain competitive adopt development strategies such as product launch, business expansion, acquisition, collaboration, and others. For instance, in May 2022, MER MEC S.p.A., which is an Italy based manufacturer of railway maintenance machinery, expanded its business in Japan by signing three new contracts for advanced diagnostics of Japan's rail and metro network. Furthermore, in January 2021, Loram Maintenance of Way, Inc. acquired Montana Hydraulics, LLC for increasing the range of its rail maintenance equipment offerings that include maintenance and repairing of the tracks.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the railway maintenance machinery market segments, current trends, estimations, and dynamics of the railway maintenance machinery market analysis from 2021 to 2032 to identify the prevailing railway maintenance machinery market opportunities.

- The railway maintenance machinery market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the railway maintenance machinery market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the railway maintenance machinery market players.

- The report includes the analysis of the regional as well as global railway maintenance machinery market trends, key players, market segments, application areas, and market growth strategies.

Railway Maintenance Machinery Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7.2 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2021 - 2032 |

| Report Pages | 230 |

| By Product Type |

|

| By Application |

|

| By Sales Type |

|

| By Region |

|

| Key Market Players | MER MEC S.p.A., Harsco Corporation, System7 Rail Holding GmbH, Geatech Group s.r.l., Plasser & Theurer, China Railway Construction Corporation Limited (CRCC High- Tech Equipment Co. Ltd), Sinara Transport Machines Holding, CRRC Corporation Limited, Fluor Corporation (American Equipment Company), Loram Maintenance of Way, Inc. |

Analyst Review

Railway maintenance machinery is used for smooth and effective operation of railway tracks. Tamping machines, stabilizing machinery, and rail handling machinery are some of the railway maintenance machineries used in the railway industry.

An increase in government spending on new railway construction projects is anticipated to drive the growth of the railway maintenance machinery market. For instance, the German government plans to spend $125 billion on expanding railway infrastructure by 2030. In addition, a rise in the number of railway electrification projects globally is expected to boost the growth of the market.

Major players are adopting geographical expansions and product launches as key developmental strategies to improve their product portfolio, and thereby drive the growth of the market. For instance, in September 2021, System7 Rail Holding GmbH, which is an Austria based railway maintenance machinery, expanded its business over Poland and launched System7 tamping machine for railway maintenance applications.

Moreover, rise in adoption of internet of things (IoT), cloud-based system, and internet systems in railway maintenance machinery owing to features such as continuous support, high-speed services, and scalability fuels the growth of the railway maintenance machinery market. By using IoT in railway maintenance machinery, it improves the maintenance services of the track system.

Machines used for maintenance of railway systems are getting technologically advanced. However, implementation of these systems can be expensive for railway departments of some countries owing to the use of advanced technology. Conversely, technological innovation in railway maintenance machinery is expected to provide lucrative opportunities for the railway maintenance machinery manufacturers.

The Railway Maintenance Machinery Market size was valued at $ 3,945.2 million in 2021.

Based on the product type, the tamping machine holds the maximum market share of the Railway Maintenance Machinery Market in 2021.

The Railway Maintenance Machinery Market is projected to reach $ 7,223.3 million by 2032.

An increase in government spending on the construction of railway projects and the surge in the number of railway electrification projects are the key trends in the Railway Maintenance Machinery Market.

The product launches and expansions are key growth strategies of Railway Maintenance Machinery industry players.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

The High cost of the machineries is the effecting factor for Railway Maintenance Machinery Market.

The latest version of Railway Maintenance Machinery Market report can be obtained on demand from the website.

Loading Table Of Content...

Loading Research Methodology...