Railway Traction Motor Market Statistics 2030 -

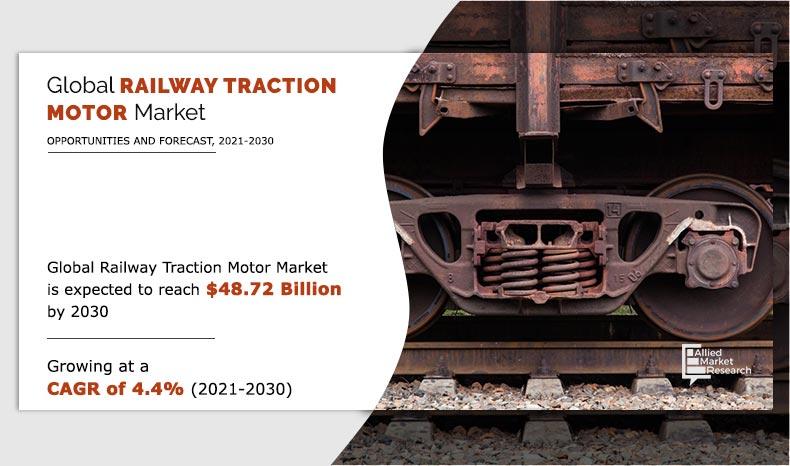

The global railway traction motor market was valued at $31.44 billion in 2020, and is projected to reach $48.72 billion by 2030, registering a CAGR of 4.4% from 2021 to 2030.

A traction motor in railways constitutes an electric motor that converts electrical energy into torque energy, and it is connected to a shaft, resulting in linear motion. Traction motors are powered by electricity and generate the power to rotate the wheels of the train. The turning force produced by traction motors is transmitted to the wheels via the driving gear unit and axle. Traction motors are typically mounted in the railway rolling stocks where the wheels are housed. Reduced number of components for fewer items requiring maintenance and reduced frequency. Completely sealed structure and improved accessory devices such as cooling fans help keep noise levels low in railway traction motors.

The growth of the global railway traction motor market is driven by incorporation of traction motors in railway engines, lower emission, low manufacturing & maintenance cost and reduction in loss in performance. However, the factors such as rise in price of materials used for production and high investment cost restrain the market growth. On the contrary, increase in R&D and increase in allocation of budget for development of railways is expected to provide lucrative growth opportunities for the market.

The railway traction motor market is segmented on the basis of type, application, and region. By type, the market is categorized into DC traction motor, AC traction motor and synchronous AC traction motor. By application, it is classified into diesel locomotive, electric multiple units, electric locomotives and diesel-electric locomotives. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key players profiled in the railway traction motor market report include ABB Group, Saini Group, ALSTOM, Bombardier, BHEL, Hyundai Rotem Company, Mitsubishi Electric Corporation, Siemens AG, Sulzer Ltd. and VEM Group.

Incorporation of traction motors in railway engines

Railway is a preferred choice and more economical for mass transportation of goods and products for longer distances as compared to roadways. Further, performance of railway engines and motors has increased in terms of speed and safety of the locomotives, owing to technological advancements. In addition, versatile benefits of traction motors, such as compact design, power efficiency, durability, and low maintenance costs, fuel their adoption in the railways. Thus, traction motors have become a significant component in railway locomotives. Moreover, the popularity of metro locomotives, especially in urban areas, is also projected to drive the demand for railway traction motors during the forecast period.

Low manufacturing and maintenance cost

The popularity and wide application of electric motors in various application industries has led to easy availability of sophisticated semiconductors, powerful magnets, and other components such as casing. Further, the multiple application of traction motors in locomotives, multiple electric units, and heavy machineries in industrial and OEM (Original Equipment Manufacturers) has eased the cost of production and maintenance associated with railway traction motors. In addition, the electrical and magnetism principles governing the working of these traction motors have simplified their construction and assembling compared to other conventional power sources, lowering the costs associated with manufacturing and maintenance. Thus, the cost benefits associated with production and aftermarket services of railway traction motors is anticipated to drive the market growth over the next few years.

By Type

AC traction motor is projected as the most lucrative segments

Rise in price of materials used for production

Traction motors are subjected to extreme temperatures, resulting from friction between fast-moving components and parts. Hence, materials used for their production are often durable, strong, and of fine quality.

Similarly, other industries such as automotive, aerospace, and industrial also require fine quality of raw materials, resulting in increase in prices of metals and other materials required for production. In addition, unstable exchange rates of foreign currencies have inflated prices for traction motor manufacturers. Thus, rise in prices of materials used for production is expected to fuel the growth of the global railway traction motors market in the projected years.

By Application

Electric Locomotives is projected as the most lucrative segments

Increase in R&D

Significant transformation owing to increasing investment in R&D for enhancement of railway system in the region is expected to increase the potential of railway traction motor and will provide enhanced product features for different applications. R&D represents a key trend stimulating growth of the railway traction motor market. Government initiatives to promote the electric motor usage will support the electric motor demand. The combination of increasing investment in R&D and government initiatives is expected to provide major opportunities for growth in the global railway traction motor market in future.

Covid-19 Scenario Analysis

The railway traction motor market is affected by financial crisis and economic slowdown, owing to the present pandemic situations, which hampers the industry growth. Countries such as China, Japan, the U.S, and Germany, accounted for a major share in the global transportation industry and are projected to experience a drastic impact, owing to COVID-19 pandemic. Companies with a global supply chain related to traction motors are expected to witness COVID related disruptions, owing to hold over component supply from various countries and lockdowns across the globe. In addition, companies with international supply chains may requires to analyze critical components that are in short supply and should consider strategies for alternative sourcing.

By Region

LAMEA would exhibit the highest CAGR of 6.3% during 2021-2030.

Key Benefits For Stakeholders

- This study presents analytical depiction of the global railway traction motor market analysis along with current trends and future estimations to depict imminent investment pockets.

- The overall railway traction motor market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global railway traction motor market with a detailed impact analysis.

- The current railway traction motor market is quantitatively analyzed from 2020 to 2030 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Railway Traction Motor Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

According to the perspective of the CXOs of the leading companies, presently, the railway traction motor market is witnessing a steady growth. Increasing incorporation of traction motors in railway engines, and the advantages such as lower emission, easy maintenance and lighter weight, are among the primary factor supplementing the growth. Moreover, increase in R&D, reduction in loss in performance and increase in allocation of budget for development of railways are the key factors that boost the adoption of railway traction motors.

Companies such as ABB GROUP, Alstom, Bombardier, Siemens Mitsubishi Electric Corporation among others are the prominent manufacturers of railway traction motors. As per the CXOs, price range is the base of the railway traction motor market according to which the application is classified into different categories.

Key players profiled in the railway traction motor market report include ABB Group, Saini Group, ALSTOM, Bombardier, BHEL, Hyundai Rotem Company, Mitsubishi Electric Corporation, Siemens AG, Sulzer Ltd. and VEM Group

Among the analyzed regions, Europe is the highest revenue contributor, followed by Asia-Pacific, North America, and LAMEA. On the basis of growth rate, LAMEA is expected to grow at lucrative rate during the forecast period, owing to increase in development of railway network and transportation industry in Latin America and Africa.

The global railway traction motor market was valued at $31,442.80 million in 2020, and is estimated to reach $16,857.82 million by 2030, at a CAGR of 3.5% during the forecast period.

There are certain upcoming trands in railway traction motor industry such as Increase in R&D and increase in allocation of budget for development of railways

The sample for global railway traction motor market report can be obtained on demand from the AMR website. Also, the 24*7 chat support and direct call services are provided to procure the sample report.

The railway traction motor market is affected by financial crisis and economic slowdown, owing to the present pandemic situations, which hampers the industry growth. Countries such as China, Japan, the U.S, and Germany, accounted for a major share in the global transportation industry and are projected to experience a drastic impact, owing to COVID-19 pandemic.

Product launch, agreement, product development, business expansion, partnership, collaboration and merger are among key top key strategies adopted by the top players to increase their revenue in railway traction motors

The company profiles of the top market players of railway traction motor service industry can be obtained from the company profile section mentioned in the report

LAMEA will provide more business opportunities for railway traction motors in future

By application, electric locomotives segment is the most influencing segment growing in the railway traction motors report

Mexico, Spain, South Korea, Middle East and Africa are the key matured markets growing in the railway traction motors report

Rise in price of materials used for production and high investment cost are one of the key known and unknown adjacencies impacting the railway traction motors market

Loading Table Of Content...