Real Estate Investment Market Research, 2031

The global real estate investment market was valued at $11444.7 billion in 2021, and is projected to reach $30575.5 billion by 2031, growing at a CAGR of 10.7% from 2022 to 2031.

Real estate that produces income or is in some other way meant for investment reasons as opposed to be a primary residence is referred to as real estate investment. Investors frequently own several pieces of real estate, one of which is utilized as a primary residence and the others to produce rental income and profit through price growth. Investing in real estate has different tax consequences than buying a home, which is a common difference.

The ability to create passive income through the collection of rent, move-in fees, pet rent, and other fees is the primary benefit of investing in real estate. In addition, rental properties typically appreciate over time, meaning the value of the property increases yearly. These factors notably contribute toward the growth of real estate investment market. However, slow economic activity after the pandemic has been limiting the real estate investment market growth. On the contrary, growth in urbanization and population drives the commercial and industrial sector, which in turn is expected to propel the demand for real estate investment in the coming years. Furthermore, growth in technological innovations in the industry is propelling the adoption of virtual real estate investment, which is expected to create lucrative opportunities for real estate investment services in future.

The report focuses on growth prospects, restraints, and trends of the real estate investment market. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers; competitive intensity of competitors; threat of new entrants; threat of substitutes; and bargaining power of buyers on the real estate investment market outlook.

The real estate investment market is segmented into Distribution Channel, Property Type and Purpose.

Segment Review

The real estate investment market is segmented into property type, purpose, distribution channel, and region. By property type, the market is differentiated into residential investment, commercial investment, industrial investment, and land investment. The commercial investment is further segmented into office space, retail space, leisure space and others. By office space, the market is further segregated into Class A, Class B and Class C. The industrial investment is further bifurcated into manufacturing plants, warehousedistribution, and others. Depending on purpose, the market is segmented into sales and rental. The distribution channel segment is segregated into public REIT, private REIT, and private real estate investment. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

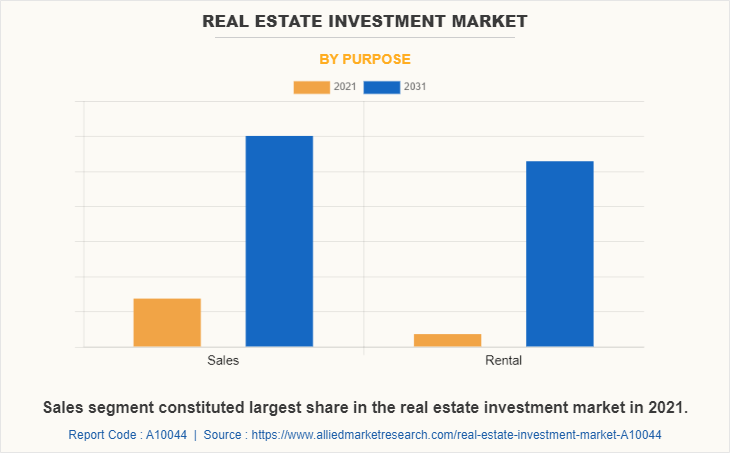

By purpose, the sales segment accounted for the highest share in real estate investment market size. This is attributed to the number of transactions of purchase and sales is growing. In addition, rise in demand for various properties such as residential, commercial, and industrial is driving the growth of the market. Moreover, government initiatives to open up real estate sector for foreign direct investment has boosted the market growth.

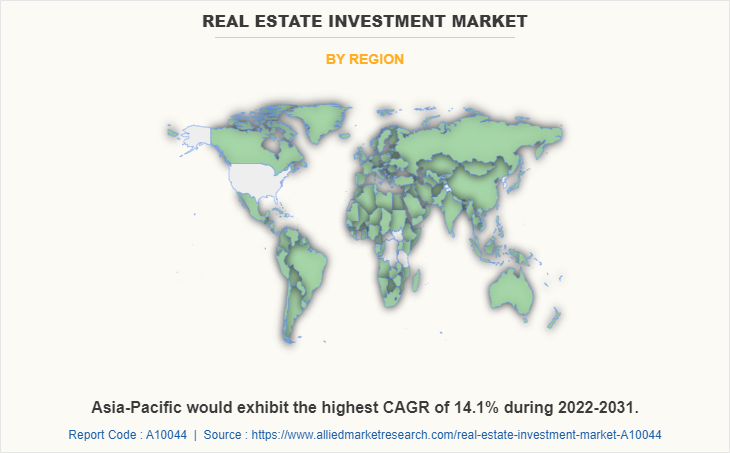

By region, Asia-Pacific is expected to grow at the highest CAGR during the forecast period in real estate investment market share. This is attributed to the fact that Asia-Pacific is an emerging economy with real estate investment companies, where real estate market is witnessing growth, owing to increased infrastructure development projects. Further, economic recovery and growth in construction demand are significantly driving the market growth.

Key players operating in the global real estate investment market analysis include ATC IP LLC, AVALONBAY, INC., Ayala Land, Inc., Brookfield Asset Management Inc., Gecina, Link Asset Management Limited, Prologis, Inc., SEGRO, Simon Property Group, L.P., CBRE, Jones Lang LaSalle IP, Inc., New World Development Company Limited, Colliers, NMRK, Welltower, Cadre, and Roofstock, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the real estate investment industry.

Top Impacting Factors

Rise in Demand for Industrial and Commercial Development

Rise in demand for industrial and commercial infrastructure developments urges customers to invest in real estate investment services. In addition, in emerging economies such as China, India and South Korea, foreign investment in commercial real estate is positively influencing the market growth. For instance, according to In and Out Korea 2021, a report released by CBRE Korea, a global commercial real estate service company, foreign investment in Korean commercial real estate reached US$19 billion in 2021, an increase of 2%.

Furthermore, rapid surge in the global population as a result of increase in migration has led to rapid urbanization and increase in real estate investment adoption. This factor is expected to fuel the demand for real estate investments. Moreover, rise in demand for commercial buildings is expected to continue to drive the market growth in developed regions. Moreover, increase in industrialization in economies, such as Asia-Pacific and LAMEA, is expected to boost the global market development in the real estate investment domain.

Increase in Public–Private Partnerships (PPP)

Public–private partnerships are characterized as a joint venture between government and private sector companies for the construction of public infrastructure systems. In this type of partnership, a private company handles the project with the help of technical and operational assistance from the government. Therefore, growth in public–private partnerships in different countries, such as India and China, would continue to fuel the growth of the real estate investment industry by real estate investment companies. For instance, in September 2021, Edelweiss Group has invested $3,350 billion in realty developer Hubtown’s two under-construction residential projects in Mumbai, the financial capital of India, through its non-banking finance company ECL Finance and two funds-Edelweiss India Real Estate Fund and EREF Onshore Fund-managed by the group. Similarly, China has adopted the public–private partnerships model, under which private companies will invest in government infrastructure projects. Thus, increase in public-private partnerships (PPP) is propelling the growth of the market.

Rise of Residential Construction Industry

Growth in the demand for residential development benefits the growth of real estate investment market. The U.S. Census Bureau and the U.S. Department of Housing and Urban Development collectively announced for the current residential construction statistics for the month of June 2022, which states that 1,424,000 units of housing completions are expected by July 2022. Moreover, the construction industry is to grow to US$8 trillion by 2030, driven by countries such as China, the U.S., and India. Hence, the construction industry is anticipated to represent a much bigger part of the global economy by 2030. Considering the growth in urban population and increase in residential construction industries, the real estate investment market is projected to grow at a significant rate.

Furthermore, rapid urbanization and real estate investment challenge has affected the residential construction industry all over the globe. The urban population growth is concentrated in emerging economies of the world, which additionally makes real estate investment market crucial as these regions have high development rate for residential infrastructure.

Report Coverage & Deliverables

Type Insights:

The real estate investment market is segmented into direct and indirect real estate investments services, including real estate investment trusts (REITs), rental properties, and real estate crowdfunding. Investment services such as property management, financial advisory, and legal services are critical for optimizing returns and minimizing risks.

Technology Insights:

Technological advancements like AI, big data analytics, and blockchain are driving growth in the real estate investment growth by enhancing decision-making, improving property valuation, and streamlining transactions.

Application Insights:

Key applications include residential, commercial, and industrial properties, with residential investments dominating the market share due to increasing demand for housing and rental properties. Such factors drive the real estate investment market share

Regional Insights:

North America and Europe hold the largest market value due to high capital inflows real estate investment value and mature markets, while Asia-Pacific shows rapid growth, fueled by urbanization and infrastructure development.

Key Companies & Market Share Insights:

Leading companies include Blackstone Group, Brookfield Asset Management, and CBRE Group, which maintain significant market share through diversified portfolios and global operations.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the real estate investment market forecast from 2022 to 2031 to identify prevailing real estate investment market opportunity.

- In addition to the market research, important drivers, restraints, and opportunities are covered as well.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the real estate investment market segmentation assists in determining the prevailing market opportunities.

- According to their contribution to global market revenue, the major countries in each region are mapped.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global real estate investment market trends, key players, market segments, application areas, and market growth strategies.

Real Estate Investment Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 30575.5 billion |

| Growth Rate | CAGR of 10.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 424 |

| By Distribution Channel |

|

| By Property Type |

|

| By Purpose |

|

| By Region |

|

| Key Market Players | Gecina, Avalonbay Communities, Inc., Link Asset Management Limited, Ayala Land, Inc., American Tower Corporation, Brookfield Asset Management Inc. |

Analyst Review

The real estate investment market has witnessed significant growth over the past decade, owing to increase in land-related transactions in the commercial, industrial, and residential projects across the globe. For instance, in September 2019, Gladstone Land Corporation acquired more than 400 acres of farmland in California. It entered into lease agreements with respective firms to operate the property. These firms will focus on growing a variety of berry crops. Hence, growth in number of such projects is expected to increase the demand for land across the globe. Furthermore, increase in focus toward affordable warehouse structures has a significant impact over the market growth in the recent years. In addition, increase in investment in commercial construction activities is expected to drive the growth of the global real estate investment market.

Real-estate investors were expecting bigger rentals or profits if the property is sold to the market as properties often improve in value over time. This led to increase in more investments in real estate markets during the pandemic. Additionally, internet-based real estate platforms allowed users to invest in properties from their homes which was a convenient option.

The real estate investment market is analyzed with the presence of regional vendors such as ATC IP LLC, AVALONBAY, INC., Ayala Land, Inc., Brookfield Asset Management Inc., Gecina, Link Asset Management Limited, Prologis, Inc., SEGRO, Simon Property Group, L.P., CBRE, Jones Lang LaSalle IP, Inc., New World Development Company Limited, Colliers, NMRK, Welltower, Cadre, and Roofstock, Inc. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnerships to reduce supply and demand gaps. With increase in awareness & demand for real estate investment across the globe, major players have collaborated on their product portfolio to provide differentiated and innovative products.

The real estate investment market is estimated to grow at a CAGR of 10.7% from 2022 to 2031.

The real estate investment market is projected to reach $30,575.47 billion by 2031.

Rise in demand for industrial and commercial development, increase in public-private partnerships (PPP) and rise of residential construction industry majorly contribute toward the growth of the market.

The key players profiled in the report include ATC IP LLC, AVALONBAY, INC., Ayala Land, Inc., Brookfield Asset Management Inc., Gecina, Link Asset Management Limited, Prologis, Inc., SEGRO, Simon Property Group, L.P., CBRE, Jones Lang LaSalle IP, Inc., New World Development Company Limited, Colliers, NMRK, Welltower, Cadre, and Roofstock, Inc.

The key growth strategies of real estate investment market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...