Real Estate Investment Trust Market Research, 2032

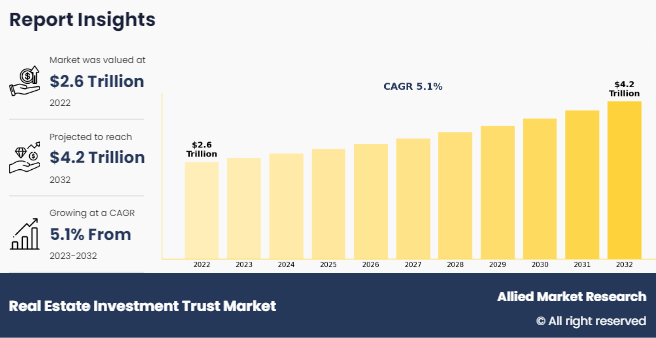

The Global Real Estate Investment trust market was valued at $2.6 trillion in 2022, and is projected to reach $4.2 trillion by 2032, growing at a CAGR of 5.1% from 2023 to 2032.

A Real Estate Investment Trust (REIT) allows investors to purchase units in a portfolio of income-generating real estate assets. Shopping malls, office spaces, hotels, and apartments are numerous instances of assets. These assets are rented or leased to generate revenue for unitholders from the capital they have contributed. REITs are like mutual funds, except their underlying investments are real estate assets rather than stocks. REITs are established as trusts registered with the stock market regulator.

Key Takeaways of Real Estate Investment Trust Market Report

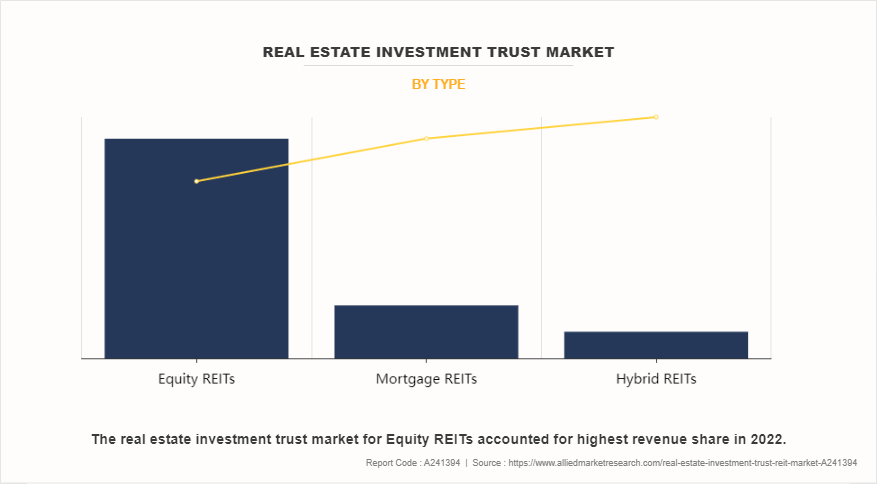

- On the basis of type, the equity REITs segment dominated the real estate investment trust market in terms of revenue in 2022.

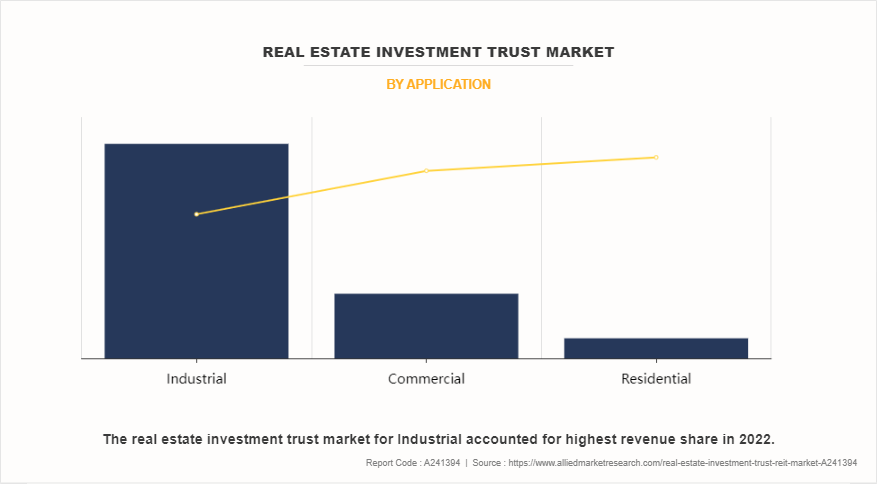

- On the basis of application, the industrial segment dominated the market share in terms of revenue in 2022.

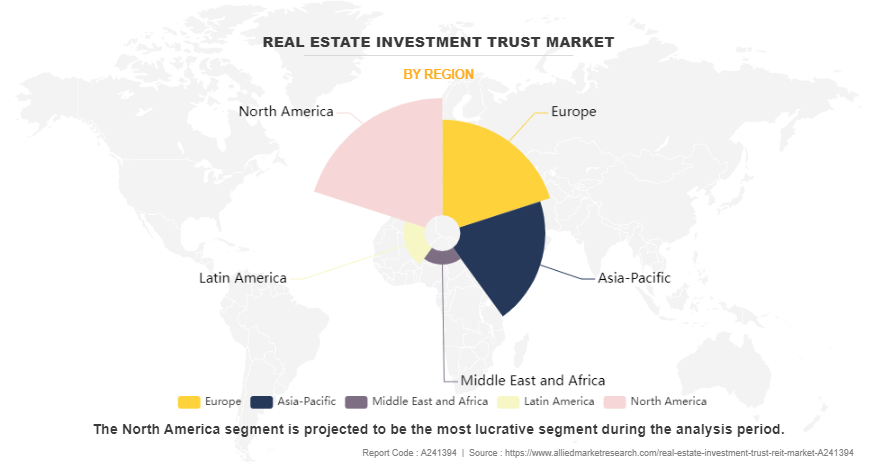

- Region wise, North America dominated the real estate investment trust market size in terms of revenue in 2022. However, the market in Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

The real estate investment trust market size is driven by the integration of advanced technologies such as data analytics and proptech solutions. These innovations enhance operational efficiency, streamline decision-making processes, and provide valuable insights into market trends for REITs. Furthermore, the adoption of artificial intelligence (AI) in real estate has the potential to revolutionize property valuation, underwriting, and predictive analytics, offering REITs a competitive advantage in an evolving market landscape. The use of AI-driven technologies can optimize capital allocation strategies, enabling REITs to make informed investment decisions and capitalize on emerging opportunities within the real estate sector.

However, high initial costs in implementing AI and proptech solutions in real estate involve significant upfront costs, which can be a barrier for some REITs despite the long-term benefits. On the contrary, AI has the potential to improve operational efficiency across various real estate sectors such as healthcare and hotels, leading to increased demand for data centers and towers that will provide lucrative growth opportunities to the real estate investment trust market in the upcoming years.

Market Dynamics

Artificial Intelligence Integration in Real Estate

AI integration in real estate drives the growth of the real estate investment trust market by enhancing operational efficiency, improving decision-making processes, and providing valuable insights into market trends. AI can help automate various aspects of property management, such as lease administration, rent collection, and maintenance scheduling, leading to cost savings and enhanced tenant experiences. In addition, AI-driven chatbots can enhance tenant communications and provide faster and more personalized services, streamlining property management processes. The future of REITs is expected to continue at a rapid pace, with AI playing a significant role in property valuation, portfolio optimization, risk management, and tenant engagement. By leveraging AI technologies, REITs can make more accurate and data-driven investment decisions, resulting in improved performance and enhanced risk-adjusted returns for investors.

Data Analytics for Capital Allocation

Data analytics for capital allocation drives the real estate investment trust market growth by enabling REITs to allocate capital more effectively and maximize returns for investors. By leveraging data to identify market trends, assess property performance, and make informed investment choices, REITs can optimize their portfolio allocation strategies and enhance risk-adjusted returns for investors. This data-driven approach allows REITs to navigate economic uncertainties and capitalize on emerging opportunities within the real estate sector. As the technology continues to mature, data analytics will become an essential tool for REITs, bridging the gap between traditional investment strategies and the dynamic, data-driven future of real estate investing. Therefore, the integration of data analytics for capital allocation drives the growth of the industry.

High Initial Costs of Implementing AI and Proptech Solutions in Real Estate

The high initial costs of implementing AI and proptech solutions in real estate limit the growth of the REIT market size. These upfront investments required to integrate AI technologies may deter certain REITs from fully leveraging the benefits of advanced solutions, hindering their ability to enhance operational efficiency and competitiveness. The financial burden associated with adopting AI and proptech solutions can restrict the capacity of REITs to optimize property management processes, automate tasks, and improve tenant experiences, ultimately impacting their ability to capitalize on emerging opportunities within the real estate sector. Despite the long-term potential benefits of these technologies, the initial costs may pose challenges for REITs looking to stay competitive and drive growth in a rapidly evolving market environment.

Segment Review

The real estate investment trust market is segmented on the basis of type, application, and region. On the basis of type, the market is categorized into equity REITs, mortgage REITs, and hybrid REITs. On the basis of application, the market is differentiated into industrial, commercial, and residential. On the basis of region, it is analyzed across North America (the U.S., and Canada), Europe (the UK, Germany, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Argentina, and rest of Latin America), and Middle East and Africa (GCC Countries, South Africa, and rest of Middle East and Africa).

By type, the equity real estate investment trust market segment acquired a major share in 2022. This is attributed to the fact that these REITs generate a steady income stream for investors through rents and leases, offering a reliable source of dividend income and long-term capital appreciation. Moreover, equity REITs are highly liquid, allowing investors to easily buy and sell shares on major stock exchanges, which is a significant advantage compared to direct real estate investments. As the real estate market continues to evolve, equity REITs will remain a key driver of growth within the real estate investment trust market, offering investors a unique opportunity to capitalize on the dynamic and technology-driven future of real estate investing.

By application, the industrial segment acquired a major real estate investment trust market share in 2022. This is attributed to the manufacturing and logistics companies that are increasingly realizing that they do not need to own their real estate, creating an opportunity for industrial REITs to acquire more properties crucial to the industrial sector, such as distribution centers. The rise in online sales has led to an increased demand for warehouse space, while supply chain challenges have prompted industrial companies to lease more space for inventory storage. However, the residential segment is expected to be the fastest-growing segment in the real estate investment trust market forecast period. This is attributed to the increasing demand for REITs, which offer a diversified portfolio of real estate assets and provide consistent income and capital appreciation to investors. Furthermore, the REIT market has been expanding its product offerings to cater to specific sectors within the real estate industry, such as residential properties. This trend aligns with the growing preference for REITs as a means to invest in real estate without the responsibility of managing or owning the properties directly.

Region-wise, North America dominated the real estate investment trust market in 2022. This is attributed to the fact that the market's composition has changed significantly since the Great Financial Crisis, with alternative property types such as data centers, cold storage facilities, cell towers, and healthcare properties comprising 64% of the U.S. REIT market size by the end of 2022, according to Bloomberg. Furthermore, REITs have demonstrated robust operational performance and are well-equipped to navigate economic uncertainties, including recessions. However, Asia-Pacific is considered to be the fastest-growing region during the forecast period. This is attributed to the increasing market capitalization of REITs in the Asia-Pacific region, coupled with the expansion of the REIT universe and the emergence of new markets embracing REIT concepts, which indicates a positive trajectory for the growth of the sector. As more Asian countries plan to introduce their versions of REITs, global investors will have increased opportunities for investment in the region, further fueling the growth of the Asia-Pacific real estate investment trust industry.

Competition Analysis

Competitive analysis and profiles of the major players in the real estate investment trust market include Prologis, Inc., American Tower Corporation, Crown Castle, Realty Income Corporation, VICI Properties, Digital Realty Trust, Alexandria Real Estate Equities, Inc., Link Real Estate Investment Trust, Essex Property Trust, and SEGRO. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Recent Developments in the Real Estate Investment Trust Industry

- In November 2023, 1031 Crowdfunding launched the Covenant Senior Housing REIT, Inc., which aims to create new ways for senior living investors to grow their holdings. The newly formed REIT stands as its own company, and 1031 is the REIT’s sponsor. With the launch, 1031 Crowdfunding focused on “exchange-type vehicles” and working with investors interested in “non-correlating assets who want to invest in senior housing”.

- In July 2023, Extra Space Storage Inc. and Life Storage, Inc. completed their previously announced merger, following approval by the shareholders of both companies. The combined entity is among the largest REITs in the MSCI U.S. REIT Index, with an enterprise value of approximately $46 billion.

- In July 2023, Public Storage and Blackstone Real Estate Income Trust, Inc. formed an agreement for Public Storage to acquire Simply Self Storage (“Simply”) from BREIT for $2.2 billion.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the real estate investment trust market analysis from 2022 to 2032 to identify the prevailing market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network on the real estate investment trust market outlook.

- In-depth analysis of the real estate investment trust market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as real estate investment trust market trends, key players, market segments, application areas, and market growth strategies.

Real Estate Investment Trust Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.2 trillion |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 267 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Essex Property Trust, American Tower Corporation, Realty Income Corporation, VICI Properties, Prologis, Inc., Link Real Estate Investment Trust, SEGRO, Digital Realty Trust, Crown Castle, Alexandria Real Estate Equities, Inc. |

Analyst Review

In India, in April 2023, NSE Indices Ltd, an arm of the National Stock Exchange (NSE), launched the country’s first-ever Real Estate Investment Trusts and Infrastructure Investment Trusts index, Nifty REITs and InvITs Index. The index aims to track the performance of REITs and InvITs that are publicly listed and traded on the NSE. A real estate investment trust (REIT) or an infrastructure investment trust (InvIT) is an investment vehicle that owns revenue-generating real estate or infrastructure assets.

Key players in the real estate investment trust market adopt partnership, acquisition, and product launch, as their key development strategies to sustain their growth in the market. For instance, in July 2023, Extra Space Storage Inc. and Life Storage, Inc. completed their previously announced merger, following approval by the shareholders of both companies. The combined entity is among the largest REITs in the MSCI U.S. REIT Index, with an enterprise value of approximately $46 billion. In addition, in February 2024, Equiton, a leading private real estate firm, formed a new partnership with the John Molson School of Business at Concordia University to support innovative research into Canada's real estate investment landscape. Therefore, such strategies adopted by key players propel the growth of the real estate investment trust market.

The key players in the real estate investment trust market include Prologis, Inc., American Tower Corporation, Crown Castle, Realty Income Corporation, VICI Properties, Digital Realty Trust, Alexandria Real Estate Equities, Inc., Link Real Estate Investment Trust, Essex Property Trust, and SEGRO. These players have adopted numerous strategies to increase their marketplace penetration and strengthen their position in the real estate investment trust market.

The size of the global real estate investment trust market was valued at $2,604.70 billion in 2022 and is projected to reach $4,228.72 billion by 2032.

The key players operating in the global real estate investment trust market include Prologis, Inc., American Tower Corporation, Crown Castle, Realty Income Corporation, VICI Properties, Digital Realty Trust, Alexandria Real Estate Equities, Inc., Link Real Estate Investment Trust, Essex Property Trust, and SEGRO.

Partnership, product launch, and acquisition are the key strategies opted by the operating companies in this market.

The real estate investment trust market is segmented on the basis of type and application. Based on type, the market is categorized into equity REITs, mortgage REITs, and hybrid REITs. Based on application, the market is differentiated into industrial, commercial, and residential.

Loading Table Of Content...

Loading Research Methodology...