Real Estate Market Research - 2031

The Global Real Estate Market was valued at $28,917.7 billion in 2021, and is projected to reach $48,923.3 billion by 2031, registering a CAGR of 5.3% from 2022 to 2031. The real estate market includes buying and selling of residential, commercial, and industrial properties such as flats, bungalows, offices and villas.Real estate represents property that consists of the land and dwellings. Multi-family (apartment) housing and building or complex, multi-unit housing complex, land, farms, ranches, commercial and industrial facilities or infrastructure, and others are included in the real estate market.

Real Estate Market Introduction and Definition

Recent surge in the need for industrial and commercial infrastructure construction is a prime factor contributing to industry expansion. Moreover, there is likely to be increased growth of purchasing power parity (PPP) among other countries including India and China which is estimated to fuel the expansion of the industry. Also, the increase in the demand for homes fosters the industry progress. population trends and trends in consumption behavior are impacting on housing choices and housing market requirements. This shift is especially apparent as millennials and generation Z create new demand for urban environments that prioritize walkability and amenities while also feeling like a quasi-community.

On the other hand slow economic growth in developed countries directly affects the real estate market growth. Finally, there is a prediction that the development of infrastructure investments by the government will continue to support growth in the real estate sector. One prominent trend is the growing emphasis on sustainability and eco-friendly practices. Like a flourishing garden, green building initiatives are sprouting across the real estate market, with developers incorporating energy-efficient features, eco-friendly materials, and smart technologies into their projects.

Reality estate firms in the real estate market use several strategies to outsmart the other players. Reality firms gain a competitive advantage by drawing attention to special services or features. Moreover, effective communication with contractors, architects, lenders and other industry insiders can give much needed access to resources, ideas, and resources for those who work with real estate businesses. This brings about the need for integrating with other firms that are accredited so that the services offered to clients will be inclined to the provision of full packages that will deliver superior outcomes.

The real estate market is mainly driven by urbanization in developing countries. People from small villages and towns are migrating to cities to improve their living standards. Increase in industries around large cities has led to expansion of cities. In addition, governments of several nations such as the U.S. and Australia offer real estate loans at lower rates for long term and concession for first time home buyers, respectively. In addition, governments of several other nations such as Poland, the U.S., and Canada offer schemes such as Golden Visa and affordable housing schemes to encourage buyers.

Moreover, large number of tourist destinations in countries such as France, the Netherlands, Dubai, Singapore, and Malaysia also attract real estate buyers. Furthermore, The real estate market has witnessed significant growth over the past decade, owing to increase in the land-related real estate transaction in the commercial, industrial, and residential projects around the globe.

However, there has been a very low rate of growth in the residential real estate market in developed nations as major cities have reached saturation considering expansion, which acts as a restrain for the real estate market growth.

In addition, during the outbreak of the COVID-19 pandemic, construction, manufacturing, hotel, and tourism industries were majorly affected. Manufacturing activities were halted or restricted. This led to decline in construction activities, thereby restraining the growth of the real estate market. Conversely, industries are gradually resuming their regular manufacturing and services. This is expected to lead to re-initiation of real estate companies at their full-scale capacities, that helped the real estate market to recover by end of 2021.

Real Estate Market Segmentation

The real estate market is segmented into material, application, end user and region.

On the contrary, governments in several developing nations such as India have planned new cities such as Dream City in Gujarat and New Kanpur, which would have commercial, industrial, and residential zones, which is expected to provide lucrative opportunities for the market growth.

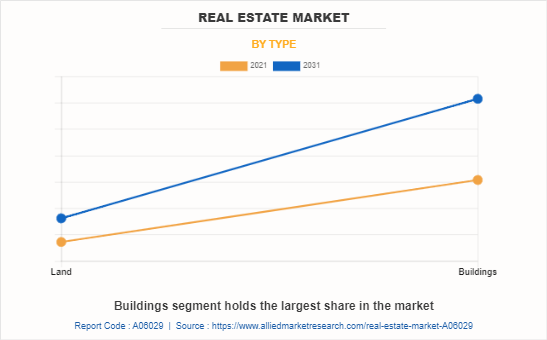

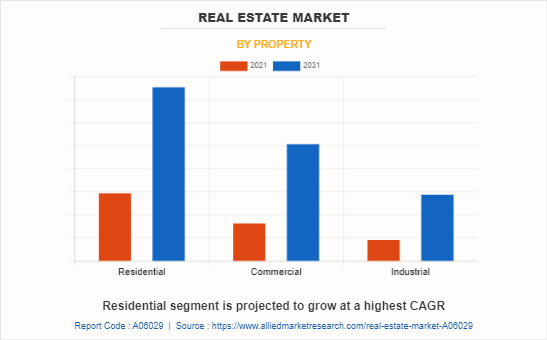

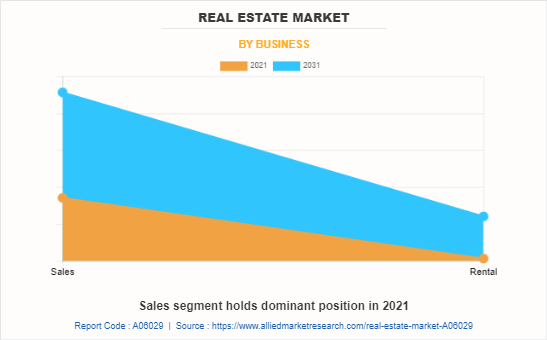

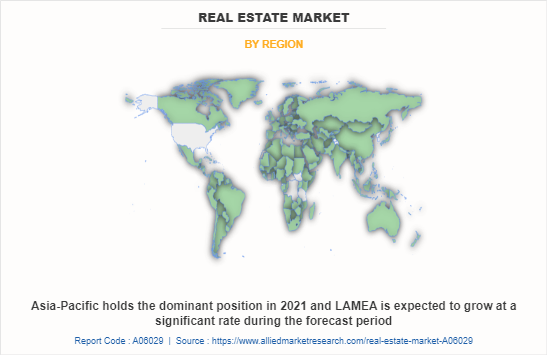

The real estate market forecast is made on the basis of type, property, business and region. By type, the real estate market is bifurcated into land and buildings. By property, the real estate is categorized into residential, commercial, and industrial. By business, the market is divided into sales and rental. By region, the real estate market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, France, Italy, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

On the basis of type, in 2021 the buildings segment dominated the real estate market, in terms of revenue, and is expected to witness growth at the highest CAGR during the forecast period. As per property, in 2021, the residential segment led the real estate market and is expected to exhibit highest CAGR in the near future. By business, the sales segment led the real estate market in 2021, in terms of revenue and is anticipated to register highest CAGR during the forecast period. Region-wise, Asia-Pacific garnered the highest revenue in 2021; however, LAMEA is anticipated to register highest CAGR during the forecast period.

Competition Analysis

The key players having significant real estate market share included in the report are American Tower, AvalonBay Communities, Ayala Land Inc., Gecina, Link REIT, Prologis, Segro, Simon Property Group, Sinar Mas Land, and Welltower.

Major companies in the real estate market have adopted business expansion, agreement and acquisition as their key developmental strategies to offer better products and services to customers promoting real estate market growth.

Key Benefits For Stakeholders

- The real estate market report provides a quantitative analysis of the real estate market segments, current real estate market trends, real estate market size, estimations, and dynamics from 2021 to 2031 to identify the prevailing market opportunities.

- The real estate market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth real estate market analysis report segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global real estate market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the real estate market players.

- The report includes the analysis of the regional as well as global real estate market trends, key players, market segments, application areas, and market growth strategies.

Real Estate Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 48.9 trillion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 220 |

| By Property |

|

| By Business |

|

| By Type |

|

| By Region |

|

| Key Market Players | SEGRO plc, Link REIT, Simon Property Group Inc., Ayala Land Inc.,, sinar mas land, American Tower Corporation, Welltower Inc, sinar mas land, Prologis, Gecina Inc., AvalonBay Communities Inc. |

Analyst Review

The real estate market value is high for the residential and commercial sector, owing to growth in investment for the projects. For instance, Ardian, a leading private investment house, raised more than $800 million for investment in commercial property assets in Germany, France, and Italy.

The market has witnessed significant growth over the past decade, owing to increase in the land-related real estate transaction in the commercial, industrial, and residential projects around the globe. For example, in September 2019, Gladstone Land Corporation acquired more than 400 acres of farmland in California. It entered into lease agreements with respective firms to operate the property. These firms are anticipated to focus on growing a variety of berry crops. Hence, growth in the number of such projects is expected to increase the demand for land around the globe.

Furthermore, the factor such as increase in focus toward affordable warehouse structures has significant impact over the market growth in the recent years. In addition, increase in investment in commercial construction activities is expected to drive the global real estate market growth.

The market players are acquiring other companies and enhancing their business growth to increase their market potential in terms of geographic and customer-base expansion. For example, in September 2019, Gladstone Land Corporation acquired more than 400 acres of farmland in California. It entered into lease agreements with respective firms to operate the property. These firms are expected to focus on growing a variety of berry crops. Hence, growth in the number of such projects is expected to increase the demand for land around the globe. Among the analyzed geographical regions, LAMEA is expected to account for the highest revenue for the real estate market forecast followed by Asia-Pacific, Europe, and North America.

The global real estate was valued at $28,917.7 billion in 2021, and is projected to reach $ 48,923.3 billion by 2031, registering a CAGR of 5.3% from 2022 to 2031.

The forecast period considered for the global real estate is 2022 to 2031, wherein, 2021 is the base year, 2022 is the estimated year, and 2031 is the forecast year.

The latest version of global real estate report can be obtained on demand from the website.

The base year considered in the global real estate report is 2021.

The top companies holding the market share in the global real estate report American Tower, AvalonBay Communities, Ayala Land Inc., Gecina, Link REIT, Prologis, Segro, Simon Property Group, Sinar Mas Land, and Welltower.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

By property, the residential segment is the highest share holder of real estate.

Loading Table Of Content...

Loading Research Methodology...