Real-Time Payments Market Overview

The global real-time payments market size was valued at $13.8 billion in 2021, and is projected to reach $123 billion by 2031, growing at a CAGR of 24.5% from 2022 to 2031. Growing demand for instant transactions, expansion of e-commerce, regulatory support, integration with AI and blockchain, and global shifts toward cashless economies and digital banking are contributing to the growth of the market.

Market Dynamics & Insights

- The real-time payments industry in North America held a significant share of 39% in 2021.

- By deployment mode, the on-premises segment dominated the segment in the market, accounting for the revenue share of 67% in 2021.

- By enterprise size, the large enterprise segment dominated the industry in 2021 and accounted for the largest revenue share of 76%.

- By industry vertical, the retail and e-commerce segment is the fastest growing segment in the market, growing at a CAGR of 27.4% from 2022 to 2031.

Market Size & Future Outlook

- 2021 Market Size: $13.8 Billion

- 2031 Projected Market Size: $123 Billion

- CAGR (2022-2031): 24.5%

- North America: dominated the market in 2021

- Asia-Pacific: Fastest growing market

What is Meant by Real-Time Payments

A real-time payments is an inter-bank, fully electronic payment system in which irrevocable funds are transferred from one bank account to another, and where confirmation back to the originator and receiver of the payment is available in one minute or less. Real-time payments are attractive to businesses and consumers because they are cheaper, faster, more efficient, and potentially lower-risk means of moving money compared to traditional methods.

Real-time transaction processing, payment device flexibility, reduced transaction time, and increase in convenience are some of the major benefits provided by real-time payments, which propels the market growth. In addition, massive adoption of real-time payments among merchants, as well as increase in usage of smartphones and faster connectivity, has enabled retailers and customers to conduct real-time payments via their smartphones, propelling the growth of market. However, increase in data breaches and difficulties in replacement process of point-of-sale (POS) terminals hamper growth of the market. On the contrary, developing economies offer significant opportunities for real-time payments companies to expand their offerings, owing to factors such as growth in the middle-class segment, rapid urbanization, rise in literacy level, and increase in tech-savvy younger generation. Moreover, growth in developments & initiatives toward digitalized payments is anticipated to provide a potential growth opportunity for the market.

Real-Time Payments Market Segment Overview

The real-time payments market is segmented into component, deployment mode, enterprise size, verticals, and region. On the basis of component, it is segmented into solution and service. The solution segment is further segregated into payment gateway solution, payment processing solution, and payment security and fraud management solution. By payment method, it is sub segmented into cards, eWallet, automated clearing house (ACH), and others. The services segment is further divided into professional services and managed services. By deployment mode, the real-time payments market is segmented into on-premises and cloud. On the basis of enterprise size, it is segmented into large enterprises and small and medium-sized enterprises (SMEs). Based on verticals, the real-time payments market is segmented into BFSI, IT and telecommunications, retail and e-commerce, government, energy and utilities, and others Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

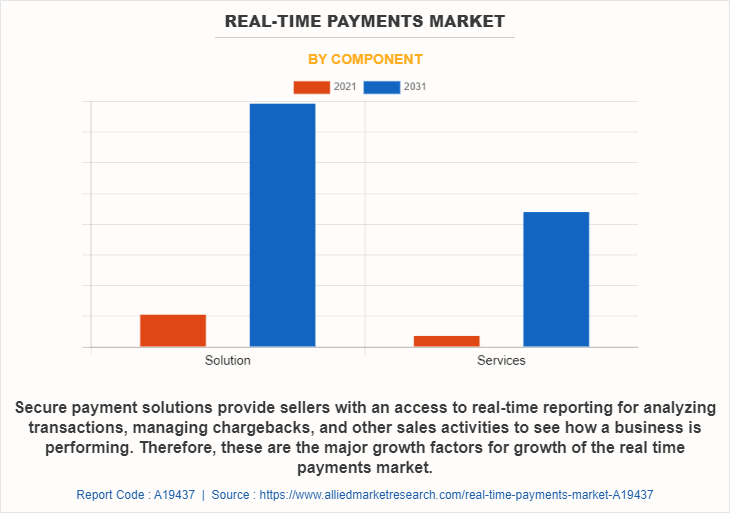

On the basis of component, the solution segment is the fastest growing segment in the real-time payments industry. This is attributed to the fact that real-time payments solutions engage in enhancing connectivity, quickly processing payments, and providing a better user experience. In addition, it provides customers with convenient, secure, and flexible online payment options while shopping via smartphone, desktop, or tablet. The end-to-end payment solutions enhance customers’ experience while minimizing risk and improving cash flow. Furthermore, secure payment solutions provide sellers with access to real-time reporting for analyzing transactions, managing chargebacks, and other sales activities to see how a business is performing.

On the basis of region, North America is the fastest growing region in the real-time payments industry. This is attributed to the rapid adoption of mobile wallets such as Apple Pay and Samsung Pay have contributed towards the growth of real-time payments in North America. In addition, rise in trend of contactless payment during the pandemic increased the adoption of real-time payments methods such as Near Field Communication (NFC), QR codes, and others. Furthermore, the convenience provided by real-time payments, such as quick service and faster check-out experiences at cafes, drive-through and casual dining restaurants, as well as access to coupons, offers, and rewards in the payment experience, are major growth factors for the North American real-time payments market.

The report focuses on growth prospects, restraints, and trends of the real-time payments market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers; competitive intensity of competitors; threat of new entrants; threat of substitutes; and bargaining power of buyers on the real-time payments market outlook.

The report includes top companies operating in the real-time payments market analysis such as ACI Worldwide, Inc., Cognizant, FIS Inc., Financial Software & Systems Pvt. Ltd., Finastra, Fiserv, Inc., Mastercard, Inc., Microsoft Corporation, Mindgate Solutions Private Limited, Montran Corp., PayPal Holdings, Inc., TCS, Temenos AG, Visa Inc., Volante Technologies Inc., Sila, and Rapyd. These players have adopted various strategies to increase their market penetration and strengthen their position in the real-time payments industry.

COVID-19 impact analysis

COVID-19 pandemic had a significant impact on the real-time payments industry, owing to increase in usage and adoption of online & digitalized payment methods among consumers globally. Moreover, banks and retailers are responding to COVID-19 fears by raising limits on their real-time payments transactions so that higher value payments can be made without the need to touch the terminal. This, in turn, has become one of the major growth factors for the real-time payments market during the global health crisis.

What are the Top Impacting Factors in Real-Time Payments Market

Increase in adoption of smartphones and access to high-speed internet

Rate of adoption of smartphones in countries such as Canada, China, and India has significantly increased in past few years. In addition, proliferation of 3G and 4G connectivity has enabled customers to have hassle-free access to conduct payments on their smartphones. Moreover, 5G network is gaining traction across North America, Asia, Europe, and the Middle East, which further propels the real-time payments market growth. Furthermore, extensive growth in distribution networks of smartphone companies has made smartphone devices easily available for end users. For instance, Samsung, Micromax, and Karbonn are major mobile phone brands in rural India, owing to their pan-India distribution channel, thus making rtp payments accessible to the rural population via their mobile phones. Rise in use of smartphones and surge in faster connectivity have enabled retailers and customers to receive and make real-time payments via their smartphones, which propels growth of the market.

Rise in data breaches and security issues while conducting payments

Innovative payment technologies provide significant benefits and convenience to customers. However, increase in data breaches and security concerns is impeding growth of the market. Consumers are hesitant to make payments via real time payment network, as they are concerned about the risk of their financial information being accessed by third-party mobile service providers. Moreover, risk of identity theft and data breaches is also expected to rise in the coming years. This is attributed to use of public Wi-Fi, vulnerabilities in passwords, and phishing attacks. Furthermore, scammers replace real-time payments at merchant outlets with their own codes, and customers end up making payments to fraudsters instead of merchants. All these factors together lead to high risks while making real-time payments, which hampers the market growth.

Rapid digitalization in payments sector

In the post-pandemic society, digital currencies, biometrics, and real-time payments are becoming more common and are widely accepted among consumers to decrease usage of cash. Furthermore, according to a recent payment tracker reportby PYMNTS.com, which is a global leader for data, news, and insights on innovation in payments, technology is expanding to new use cases as its adoption continues to provide contactless options for restaurants, retailers, and contact tracing for COVID-19 tracking in the UK. In addition, introduction of dynamic real time payment credit allows merchants to scan codes of consumers where the system automatically detects fraud. Therefore, rise in developments & initiatives toward digitalized payments sector are anticipated to provide a potential growth opportunity for the real-time payments market outlook.

What are the Key Benefits for Stakeholders

- The study provides in-depth analysis of the global real-time payments market growth along with current trends and future estimations to illustrate the imminent investment pockets.

- Information about key drivers, restrains, and opportunities and their impact analysis on the global real-time payments market share are provided in the report.

- Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the real-time payments market opportunity.

- An extensive analysis of the key segments of the industry helps to understand the real-time payments market trends.

- The quantitative analysis of the global real-time payments market forecast from 2021 to 2031 is provided to determine the market potential.

Real-Time Payments Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 123 billion |

| Growth Rate | CAGR of 24.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 414 |

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Rapyd, Cognizant, Volante Technologies Inc., Temenos AG, Microsoft Corporation, ACI Worldwide, Inc., Finastra, PayPal Holdings, Inc., Financial Software & Systems Pvt. Ltd., TCS, Mastercard, Inc., Montran Corp., Fiserv, Inc., FIS Inc., Sila, Visa Inc., Mindgate Solutions Private Limited |

Analyst Review

The benefits of real-time payment technology, such as rise in convenience, reduced transaction time, and increase in smartphone adoption among end users, drive market growth. By enabling data-driven personalization and enhancing user experience, merchants are increasingly looking to accommodate consumer demand for secure and touch-free transactions via real-time payments. Moreover, consumers continue to use innovative payment technology and even standard credit cards in place of cash. In addition, several key players are enhancing & providing advanced real-time payment options and offering coupons & promotions by directing customers to a landing page or downloadable coupons that can be used for their next purchase.

The COVID-19 outbreak had a significant impact on the real-time payment market and accelerated the usage & adoption of Point of Sale payment terminals, primarily among merchants & retailers. In addition, during the global health crisis, there is an increased usage of real-time payment as it allows customers and employees to better keep their distance & avoid handling potentially contaminated bills or cards.

Some of the key players profiled in the real-time payment market report include ACI Worldwide, Inc., Cognizant, FIS Inc., Financial Software & Systems Pvt. Ltd., Finastra, Fiserv, Inc., Mastercard, Inc., Microsoft Corporation, Mindgate Solutions Private Limited, Montran Corp., PayPal Holdings, Inc., TCS, Temenos AG, Visa Inc., Volante Technologies Inc., Sila, and Rapyd. Major players operating in this market have witnessed significant adoption of strategies that include business expansions and partnerships to reduce supply and demand gaps. With increase in awareness & demand for real-time payment across the globe, major players are collaborating on their product portfolio to provide differentiated and innovative products.

Massive adoption of real-time payments among merchants, as well as increase in usage of smartphones and faster connectivity, has enabled retailers and customers to conduct real-time payments via their smartphones are some of the major trends in the market.

On the basis of component, the solution segment is the fastest growing segment in the real-time payments industry. This is attributed to the fact that real-time payments solutions engage in enhancing connectivity, quickly processing payments, and providing a better user experience. In addition, it provides customers with convenient, secure, and flexible online payment options while shopping via smartphone, desktop, or tablet. The end-to-end payment solutions enhance customers’ experience while minimizing risk and improving cash flow. Furthermore, secure payment solutions provide sellers with access to real-time reporting for analyzing transactions, managing chargebacks, and other sales activities to see how a business is performing.

On the basis of region, North America is the fastest growing region in the real-time payments industry. This is attributed to the rapid adoption of mobile wallets such as Apple Pay and Samsung Pay have contributed towards the growth of real-time payments in North America. In addition, rise in trend of contactless payment during the pandemic increased the adoption of real-time payments methods such as Near Field Communication (NFC), QR codes, and others. Furthermore, the convenience provided by real-time payments, such as quick service and faster check-out experiences at cafes, drive-through and casual dining restaurants, as well as access to coupons, offers, and rewards in the payment experience, are major growth factors for the North American real-time payments market.

E-mail: pramod.borasi@alliedanalytics.com The global real-time payments market size was valued at $13,780.34 million in 2021, and is projected to reach $1, 22,953.61 million by 2031, growing at a CAGR of 24.5% from 2022 to 2031.

ACI Worldwide, Inc., FIS Inc., Finastra, Fiserv, Inc., Mastercard, Inc., Microsoft Corporation, and PayPal Holdings, Inc. hold the market share in real-time payments market.

Loading Table Of Content...

Loading Research Methodology...