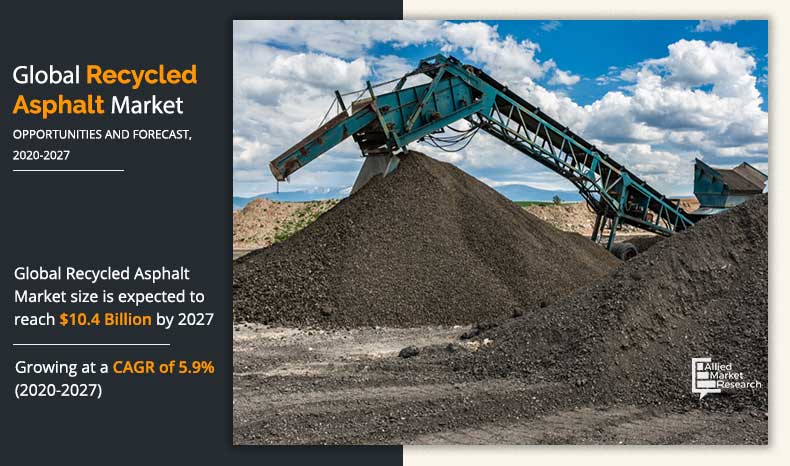

The recycled asphalt market was valued at $7.1 billion in 2019, and is anticipated to generate $10.4 billion by 2027. The market is projected to experience growth at a CAGR of 5.9% from 2020 to 2027.

Recycled asphalt processing is done by crushing the surface layer of existing asphalt site. The recycled asphalt is used in reconstruction and resurfacing purposes. They are also used in preparing asphalt shingles for roofing. Moreover, it reduces consumption of natural resources such as water and coal. Shingles and ground tire rubber are able to be integrated into asphalt. This reduces the virgin material need while providing an incredibly useful for home materials that would otherwise be in landfills.

Just as reclaimed asphalt is integrated into new asphalt, so are shingles. Nearly 10 million tons of shingles are disposed of each year with nearly 1.5 million tons be reused in asphalt. Shingle waste is generated from either manufacturer waste or tear offs from roofs.

The recycled asphalt market is segmented on the basis of type, application, and region. By type, the market is bifurcated into hot recycling and cold recycling. By application, the market is divided into patch material, hot-mix asphalt, temporary driveways & roads, road aggregate for unpaved roadways, interlocking bricks, new asphalt shingles, and energy recovery.

By region, recycled asphalt market analysis is done across North America, Europe, Asia-Pacific, and LAMEA. The key players operating in the market are Tokuyama Corporation, Evonik Industries AG, Merck Millipore Limited, Nippon Chemical Industrial Co. Ltd., PQ Group Holdings Inc., Occidental Petroleum Corporation, CIECH S.A., Sinchem Silica Gel Co. Ltd., Shijiazhuang Shuanglian Chemical Industry Co. Ltd., and Kiran Global Chem Limited.

Recycled Asphalt Market, by Type

By type, the recycled asphalt is divided into hot recycling and cold recycling. The hot recycling segment dominated the market share in 2019. This was attributed to benefits such as repaving is performed as either a single or multiple pass operation on-site. As the work is done on-site it reduces logistics cost and drives the market growth. Moreover, it is also expected to grow at a higher CAGR during the forecast period, owing to ease of handling and processing.

By Type

Cold recycling is projected as the most lucrative segment.

Recycled Asphalt Market, by Application

The application segment is divided into patch material, hot-mix asphalt, temporary driveways & roads, road aggregate for unpaved roadways, interlocking bricks, new asphalt shingles, and energy recovery. The patch material segment dominated the market share in 2019, owing to wide use of recycled asphalt in re-surfacing and potholes. However, the road aggregate for unpaved roadways segment is expected to grow at a higher CAGR during the forecast period, owing to rising applications of recycled asphalt in unpaved roads as they have more fraction of aggregates that reduce use of virgin material for the same.

By Application

Road aggregate for unpaved roadways is projected as the most lucrative segment.

Recycled asphalt Market, by Region

By region, the recycled asphalt market analysis is done across North America, Europe, Asia-Pacific, LAMEA (Latin America, Middle East, and Africa). North America dominated the market in 2019, owing to highly developed recycling process technologies. However, Asia-Pacific is projected to grow at a higher CAGR during the forecast period, owing to rising application of recycled asphalt in reconstruction, resurfacing, and base development activities.

By Region

Asia-Pacific is projected as the most lucrative market.

Key Benefits For Stakeholders

- The report provides an in-depth analysis and recycled asphalt market forecast along with the current and future market trends.

- This report highlights the key drivers, opportunities, and restraints of the recycled asphalt market along with the impact analyses during the forecast period.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the recycled asphalt industry for strategy building.

- A comprehensive analysis of the factors that drive and restrain the recycled asphalt market growth is provided.

- The qualitative data in this report aims on recycled asphalt market trends, dynamics, and developments.

- The recycled asphalt market size is provided in terms of revenue.

- The report provides extensive qualitative insights on the significant segments and regions exhibiting favorable recycled asphalt market share.

Global Recycled Asphalt Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | OWENS CORNING, CertainTeed Corporation, GAF, ASAHI KASEI CORP., Cherry Companies, WIRTGEN GROUP, PAVEMENT RECYCLING SYSTEM, INC., Downer EDI Limited, THE KRAEMER COMPANY, LLC, Lone Star Paving |

Analyst Review

According to the insights from various executives, the recycled asphalt market is expected to grow significantly during the forecast period. The market is witnessing increased demand from last few years as the environmental benefits and cost reduction. In-addition, the usage of water is also decreased in large quantity as recycled asphalt requires less amount of water in preparation in comparison to preparation of virgin asphalt. Recycled asphalt remains cost effective, provides environmental & sustainable impact, and performs well. It is however restrained by limited use of the material as it is prone to fatigue cracks, impartial blending, unbalanced aggregate fractions, and rutting. Recycled asphalt is used in hot & warm mix asphalt production, half warm mix asphalt production, on-site cold reuse, plant cold re-use, unbound road layers, and other civil engineering applications. Meanwhile, development of custom solutions and technologies to create high-quality asphalt through recycling processes is expected to offer lucrative opportunity for the recycled asphalt industry growth.

The total market size of global Recycled asphalt Market is $7.1 billion in 2019.

Bodean Company, CertainTeed, Cherry Companies, Downer Group, GAF Materials, Lone Star Paving, Owens Corning, Pavement Recycling System, Inc, The Kraemer Company, LLC, and Wirtgen Group are the emerging players in the industry.

Patch material and road aggregate for unpaved roadways industry is the major are of development in the industry followed by hot-mix asphalt and interlocking bricks.

Construction industry is projected to increase demand for recycled asphalt market.

Growing resurfacing, construction, and increased application in asphalt roof shingles are emerging trend in the market.

The most influencing segment is hot recycling segment.

North America holds the maximum market share of the Recycled asphalt market in 2019.

Resurfacing, re-pavement, potholes, base, shoulders, alleys and others are some of the applications that are expected to drive the adoption of Recycled asphalt.

Loading Table Of Content...