Refractory Material Market Overview

The global refractory material market was valued at $20.9 billion in 2022, and is projected to reach $31.3 billion by 2032, growing at a CAGR of 4.1% from 2023 to 2032.

The growing modern theme-based building & construction sector has led to rise in the demand for glass used in manufacturing windowpanes, doors, and other building parts. Refractory materials being widely used in kilns and furnaces for thermal insulation purposes in glass manufacturing units may experience a surge in demand.

Refractory materials are specialized heat-resistant materials designed to withstand extremely high temperatures and harsh conditions without undergoing significant physical or chemical changes. These materials are crucial for various industrial processes that involve elevated temperatures, such as in furnaces, kilns, reactors, and other high-temperature applications. Refractory materials are utilized to line and protect the walls, floors, and other surfaces of these structures, providing insulation and durability.

Key Takeaways:

The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers in the refractory material industry.

- The refractory material market is fragmented in nature among prominent companies such as Calderys, Krosaki Harima Corporation, SHINAGAWA REFRACTORIES CO., LTD., Morgan Advanced Materials plc, RHI Magnesita GmbH, Saint-Gobain, Lanexis Enterprises (P) Ltd., IFGL Refractories Limited., Vitcas, AGC Inc.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), public policy analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions for better understanding of refractory material market trend. Moreover, the report covers sub-segments that is studied across all the regions.

- Latest trends in global refractory material industry such as undergoing R&D activities, public policies, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 3,000 refractory material-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global refractory material market.

Market Dynamics

Rapid infrastructure development and increase in demand from the automotive sector has increased iron & steel production in both developed and developing economies such as the U.S., China, and India, where refractory materials are widely used for thermal insulation purposes in kilns, furnaces, incinerators, and other high temperature equipment used in steel manufacturing units.

Moreover, increasing government spending, accommodative policies, and relaxation in mobility restrictions have escalated the production rate of steel. For instance, according to a report published by the Indian Steel Association (ISA), demand for steel increased by 7.2% in 2020-21. This has fueled the growth of the refractory material market growth in the growing iron & steel industry. Furthermore, thriving railways and construction infrastructure may provide an additional push to growth of the iron & steel industry, which is expected to propel the refractory material market growth.

In addition, factors such as recyclability, transparency, and low raw material costs have attracted consumers toward using glass-based materials for a wide range of applications, which, in turn, has increased the production rate of glass where refractory materials are extensively used for thermal stability purposes. This may fuel the demand for refractory material market size during the forecaast period.

However, refractory materials such as ceramic fibers, silica, and alumina pose a threat to humans when exposed to beyond maximum concentration limits. For instance, prolonged exposure to ceramic fiber-based refractory materials may cause skin and upper respiratory irritation. In addition, breathing very small (crystalline) silica particles may cause multiple health hazards such as silicosis or may even lead to death.

This factor restrains customers from buying refractory materials for several end use applications. In addition, several regulatory bodies such as the U.S. Environmental Protection Agency (U.S. EPA), have laid down National Emissions Standards for Hazardous Air Pollutants (NESHAP) Act for manufacturing and use of refractory products in different end use sectors. This hampers growth of the refractory materials market during the forecast period.

On the contrary, refractory materials can be recycled to form secondary raw materials that can be further used to produce low quality refractories. Recyclability of used refractory material depends on initial quality and effectiveness of refractory material. For instance, 100% of high-quality refractory material can be used for producing secondary raw materials while only 30% of refractory material can be recycled from low-quality refractory. This factor reduces overall raw materials costs for producing refractory materials; thus, increasing the set-up of new manufacturing units for producing refractory materials.

Segment Overview

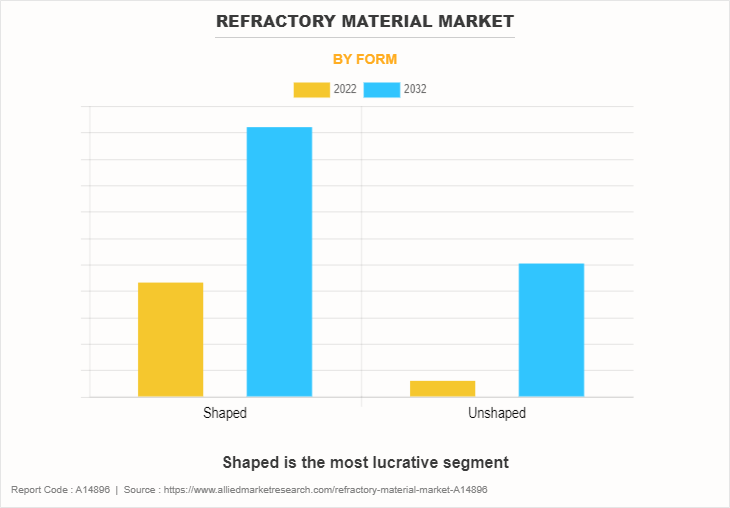

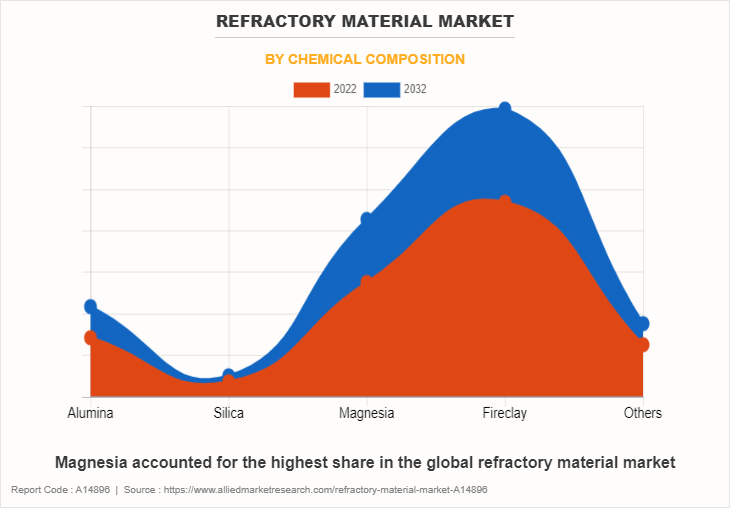

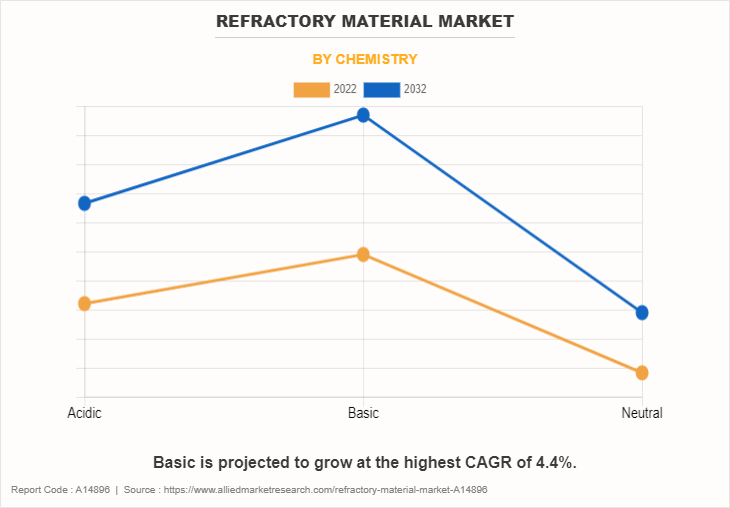

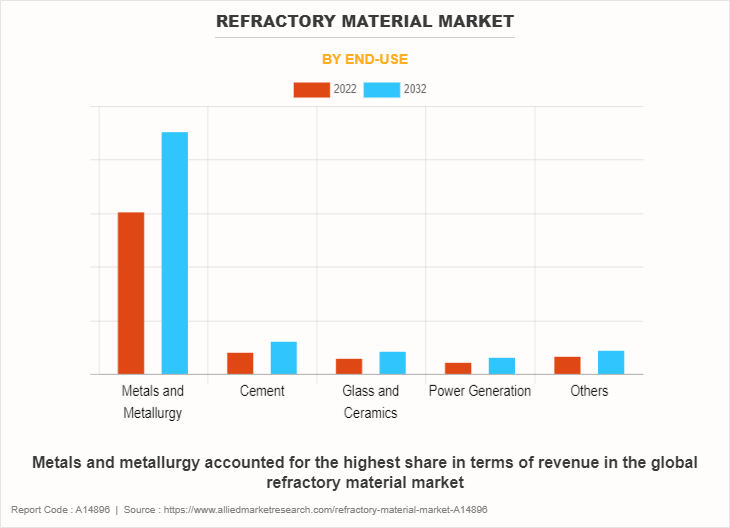

The refractory materials market is segmented on the basis of form, chemical composition, chemistry, end use, and region. On the basis of form, the market is categorized into shaped and unshaped. On the basis of chemical composition, it is divided into alumina, silica, magnesia, fireclay, and others. On the basis of chemistry, it is fragmented into acidic, basic, and neutral. By end use, it is classified into metals & metallurgy, cement, glass & ceramics, power generation, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The shaped segment accounted for the largest share of 58.9% in 2022. Utilization of shaped refractory materials for providing exposure to high temperatures in various end use sectors such as cement manufacturing, iron & steel, glass manufacturing, and others is the major key market trend in the global market. Increase in population has led to growth of the building & construction sector, which has led cement manufacturers to produce high quality cement where shaped refractory materials are widely used in furnaces, kilns, incinerators, and reactors exposed at high temperatures. For instance, according to a report published by the National Investment Promotion and Facilitation Agency, the construction output in India is expected to grow by 7.1% year-on-year by 2025. This is expected to boost the growth of shaped refractory materials in the building & construction sector.

The fireclay segment accounted for the largest share of 44.8% in 2022. Rise in population has led to rise in building & construction activities, which has escalated the production rates of cement where fireclay-based refractory materials are widely employed in incinerators and kilns to withstand high temperatures. This is expected to drive the growth of the refractory material market for fireclays. Moreover, both developed and developing economies are constantly engaged in building smart cities and upgrading roads and bridges, which, in turn, has led cement manufacturers to increase their production capacities.

For instance, the government of India’s upcoming mega construction projects such as World One Tower, Mumbai, and Char Dham Expressway where cement and other building materials will be majorly used for the project completion has led the cement manufacturing sectors to increase their production capacities.

The basic segment accounted for the largest share of 42.6% in 2022 and is expected to register the highest CAGR of 4.4% during the refractory material market forecast. The utilization of basic refractory materials in sectors such as oil & gas, metal fabrication, mining, and others is the major key market trend in the global refractory material market share. Rise in the transport sector has increased demand for oil & gas where basic refractory materials are widely employed in both offshore and onshore platforms in kilns and incinerators to withstand high temperatures. This boosts growth of the refractory material market during the forecast period. In addition, growing population has increased demand for consumer goods, which has led the chemical manufacturing industry to witness a significant increase in demand where basic refractory materials are used for thermal stability purposes.

The metals and metallurgy segment accounted for the largest share of 71.9% in 2022. Rise in development of the automotive industry has surged growth of the iron & steel sector where refractory materials are widely employed for thermal stability purposes. This may act as one of the key drivers responsible for growth of the refractory material market in the metal & metallurgy sector. Furthermore, increasing building and construction activities have motivated steel production in emerging economies. This is projected to positively drive growth of the refractory material market in the iron & steel manufacturing sector. In addition, increasing foreign direct investment (FDI) inflow in metal & metallurgy sector, owing to attractive incentives and accruing benefits offered by various governments may .

Asia-Pacific garnered the largest share of 78.1 % in 2022. Utilization of refractory materials in sectors such as power generation, iron & steel, cement manufacturing, and others is the major key market trend in Asia-Pacific. Proliferating demand for iron & steel from various end use sectors such as industrial, construction infrastructure, and automotive have led iron & steel manufacturers to increase their production capacities where refractory materials are widely used for temperature stability purposes. This is a key driver for the growth of the refractory material industry.

Moreover, the cement industry in India is growing rapidly, owing to increasing spending on housing and infrastructure activities where refractory materials are used in furnaces and kilns to withstand high temperatures. For instance, according to a report published by India Brands Equity Foundation, the Indian cement industry is expected to add around 80 million tons (MT) capacity by 2024.

Competitive Analysis

The global refractory material market profiles leading players that include Calderys, Krosaki Harima Corporation, SHINAGAWA REFRACTORIES CO., LTD., Morgan Advanced Materials plc, RHI Magnesita GmbH, Saint-Gobain, Lanexis Enterprises (P) Ltd., IFGL Refractories Limited., Vitcas, AGC Inc. The global refractory material market report provides in-depth competitive analysis as well as profiles of these major players.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the refractory material market analysis from 2022 to 2032 to identify the prevailing refractory material market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the refractory material market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global refractory material market trends, key players, market segments, application areas, and market growth strategies.

Refractory Material Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 31.3 billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 509 |

| By Form |

|

| By Chemical Composition |

|

| By Chemistry |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | Calderys, AGC Inc., IFGL Refractories Limited., Saint-Gobain, Vitcas, Lanexis Enterprises (P) Ltd., RHI Magnesita GmbH, Morgan Advanced Materials plc, SHINAGAWA REFRACTORIES CO., LTD., Krosaki Harima Corporation |

Analyst Review

According to CXOs of leading companies, the global refractory material market is expected to exhibit high growth potential. Refractory materials are used to withstand high temperatures in kilns, furnaces, incinerators, and reactors in a variety of end-use sectors such as iron & steel, glass manufacturing, and cement production. High temperature equipment that require efficient thermal insulation lining for minimizing heat losses through the equipment can be accomplished with the use of refractory materials. In addition, refractory materials enhance the thermal stability of the system and prevent the outer shell of the heating equipment from being overheated. In this way, it increases the shelf life of the heating equipment. Furthermore, the corrosion resistance property of refractory materials enables the consumers to use them in both acidic and basic atmospheres.

Additionally, the refractory materials market is full of opportunities stemming from global industrial growth, technological advancements, sustainability initiatives, and the expansion of end-user industries. Strategic investments in research and development, innovation, and collaboration can position industry stakeholders to capitalize on these opportunities and contribute to the continued evolution of the refractory materials market.

The CXOs further added that sustained economic growth and the development of metal fabrication sector have surged the popularity of refractory materials.

Increase in iron and steel production, escalating demand from glass industry, and technological advancements are the upcoming trends of refractory material market in the world.

Metals and metallurgy is the leading application of refractory material market.

Asia-Pacific is the largest regional market for refractory material.

The global refractory material market was valued at $20.9 billion in 2022, and is projected to reach $31.3 billion by 2032, growing at a CAGR of 4.1% from 2023 to 2032.

Key players operating in the global refractory materials market include Calderys, Krosaki Harima Corporation, SHINAGAWA REFRACTORIES CO., LTD., Morgan Advanced Materials plc, RHI Magnesita GmbH, Saint-Gobain, Lanexis Enterprises (P) Ltd., IFGL Refractories Limited., Vitcas, and AGC Inc.

Loading Table Of Content...

Loading Research Methodology...