Refrigerator Market Research, 2032

The global refrigerator market was valued at $126.9 billion in 2022, and is projected to reach $220.6 billion by 2032, growing at a CAGR of 5.8% from 2023 to 2032.A refrigerator is an electronic appliance that cools things down by lowering the temperature inside it. It is used in households and commercial set up to keep food fresh and prevent it from spoiling. This cooling process involves different parts such as a compressor, condenser, evaporator, and refrigerant, all working together to make sure the proper functioning of the refrigerator. The refrigerators come in different sizes and styles, to meet the requirements of the customers. It thus allows consumers to purchase food products in bulk and consume it at leisure, and bulk purchases also save money. The market experiences significant growth owing to the increase in use of smart home technologies, increase in access to electrification in rural areas, and rapid expansion of the food and beverages industry.

The development of technology in home appliances has brought considerable growth in demand for smart refrigerators in the Market. Kitchens are the leading generators of food waste and the second-highest users of electricity at home. As a result, manufacturers improvise to improve refrigerators by fusing them with smart technologies including Wi-Fi connectivity, monitoring capabilities, built-in hubs and displays, compatibility with smart homes, interior cameras, and the app interface. For instance, manufacturers such as Samsung, LG, GE, and Bosch have incorporated built-in Alexa, cameras, and InstaView screens, which enable users to check the inside of refrigerators without even opening them completely with the help of apps such as SmartHQ of GE Appliances, ThinQ of LG, Home Connect of Bosch, and Smart Things of Samsung. The producers have come up with these app interfaces to allow customers to simply view the temperature and receive helpful notification alerts from anywhere with the help of internet connectivity.

In developing and underdeveloped economies, electrification is regarded as a potent weapon for progress in all areas. The income, consumption, spending, working hours, and employment status of consumers worldwide have all increased dramatically as a result of increase in access to electricity. The governments of many nations spend a significant amount of money implementing a variety of programs to enhance access to electrification in rural areas and move the effort along more quickly. For instance, a few examples of rural electrification programs that governments around the world have implemented include the Saubhagya Scheme (India), Luz para Todos (Brazil), Programa Nacional de Electrification Rural (Peru), Kenya National Electrification Strategy (Kenya), National Electrification Program (Indonesia), and Rural Electrification Program in the Philippines, Bangladesh, Uganda, and Rwanda. Thus, increase in electrification is significantly increasing the demand for the refrigerators while boosting the growth of the Market.

There are a number of emerging economies with population growth that has progressed gradually and that is primarily made up of middle-class families who have disposable income. In addition, as the food and beverage business has expanded, the trend of increasing packaged food consumption has also sharply grown. As a result, there is a parallel rise in domestic refrigerator demand, which is driving the Market Demand all around the world. The market for meat packaging has expanded as a result of the rise in demand for attractive, high-quality meat packaging that must be kept cold to prevent the growth of bacteria in it. Furthermore, plenty of food and beverages are exported from one location to another and need a specific temperature to stay fresh and delivered, which will help increase the Refrigerator Market Size and also has shown a considerable growth during the Refrigerator Market Forecast.

Moreover, consumers have shifted toward using eco-friendly and energy-efficient refrigerators, which could present new sales opportunities for refrigerator manufacturing companies in the market, contributing to the continuous growth of the refrigerator industry. Furthermore, eco-friendly refrigerators provide various advantages, including lowered operating costs, enhanced functionality, and environmental friendliness of the products. There are magnetic refrigerators that are more economical in use because of the magnetic field utilized in the cooling equation, and it tends to be quieter, safer, and capable of emitting far lower temperatures than conventional gas-compression refrigeration technology. There are a variety of environmentally friendly refrigerators on the market, including the Liebherr Monolith MRB3000, Smeg 24-Inch 50s Style, Bosch B11CB50SSS, Blomberg BRFB1312SS, and Samsung 36-Inch Refrigerator with Family Hub, among others, that provide their customers with toxicity-free materials and energy-efficient appliances. The increased manufacture of refrigerators that are environment-friendly in nature is thus anticipated to fuel the market for refrigerators in the coming years.

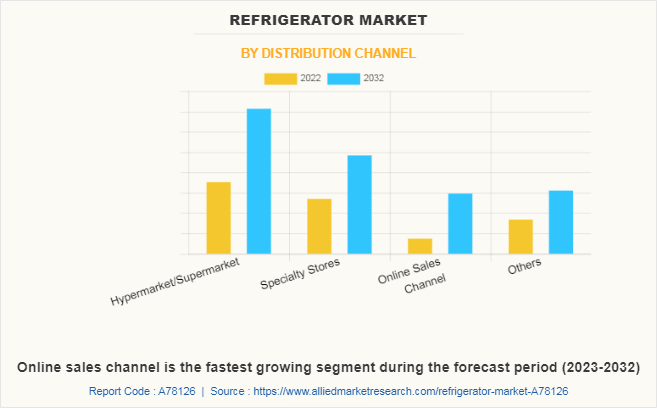

The advent of technological innovation and the boom in digitization have resulted in a completely different experience for both customers and providers in the online retail sectors. The overall demand for products in e-commerce has also been greatly encouraged by the ongoing rise in consumer enthusiasm for online shopping, surpassing internet services, and smartphone penetration rate. In recent years, a lot of merchants have collaborated with one another or have their own websites where customers may learn more about the company and the products they sell. In addition, the availability of a wide range of product options and price comparison tools on online shopping websites facilitates capacity of consumers to compare various products, which has led to an increase in the number of online shoppers in recent years. The World Bank estimates that as of 2021, around 92% of people in North America were active internet users, and around 86% of people in Europe and Central Asia were also active internet users. Furthermore, having access to the internet and online refrigerator supplies has given consumers a platform where they may quickly evaluate several refrigerator types in terms of their features, improvements, and pricing before making a comfortable purchase. For instance, Amazon.com, Flipkart.com, and Walmart.com are just a few of the popular online merchants in the refrigerator market, which is helping in the Refrigerator Market Growth and has huge impact in the Refrigerator Market statistics.

SEGMENTAL OVERVIEW

The refrigerator market is segmented on the basis of product type, freezer, technology, application, distribution channel, and region. On the basis of product type, the market is segregated into single door, double door, side by side, French door, and others. On the basis of the freezer, it is divided into top freezer, bottom freezer, and convertibles. On the basis of technology, the market is bifurcated into inverter and non-inverter. On the basis of application, the market is bifurcated into household and commercial. On the basis of distribution channel, the market is divided into hypermarkets/supermarkets, specialty stores, online sales channels, and others. On the basis of region, the food away from home market is analyzed across North America, Europe, Asia-Pacific, and LAMEA (Latin America, The Middle East, and Africa).

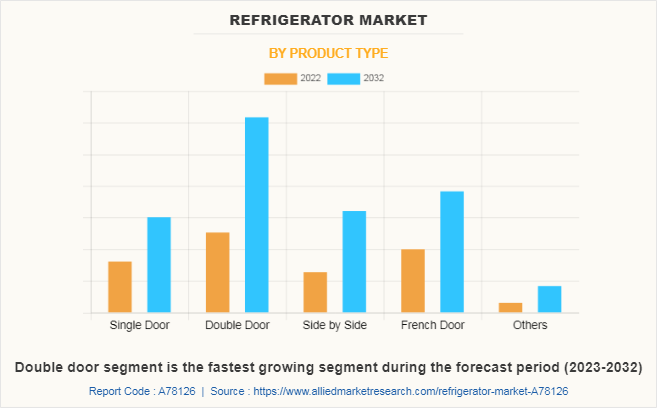

BY PRODUCT TYPE

On the basis of product type, the French door segment dominated the market, garnering a market share of 28.6% in 2022. French door refrigerators have gained a lot of popularity due to their appealing appearance and practical functionality. It has become a very popular option among households and designers as a result of its sleek and modern style. Their attractiveness is further enhanced by the available adjustable panel options, which enable them to easily blend with the contemporary design of the kitchen. In addition, customers today strongly favor consuming food that are fresh and healthy, which has significantly contributed to the rise in the popularity of French door refrigerators. A rise in open-concept kitchen designs has also taken place, making the kitchen the primary focus of the house. The need for visually appealing appliances has increased as a result of the change in kitchen design trends.

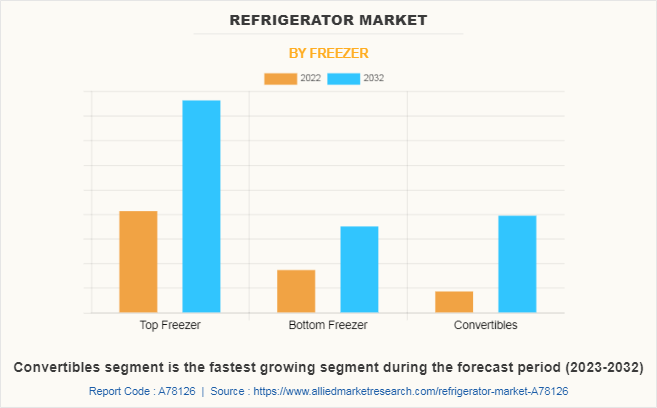

BY FREEZER

On the basis of freezers, the top freezer segment dominated the market in 2022, accounting for 48.2% of the refrigerator market share. Top freezer refrigerators are one of the most common and conventional types of freezers, acknowledged for their simplicity, dependability, and affordability. Frozen food items may be accessed easily as they are appropriately positioned at eye level, making it simpler to find and obtain food items. The flexibility to open the freezer and refrigerator individually helps to preserve the temperature stability of the refrigerator section when accessing the freezer. In addition, top freezer refrigerators are frequently chosen because of their affordable prices, energy efficiency, and usefulness, particularly for individuals who need more freezer capacity than a normal side-by-side or bottom freezer refrigerator may provide. Thus, top freezers segment have attained a high share and will continue to grow in the Market.

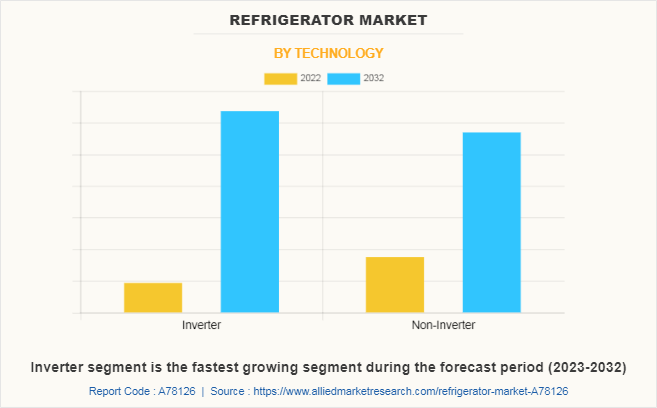

BY TECHNOLOGY

On the basis of technology, the non-inverter segment dominated the market in 2022, accounting for 53.2% of the market share. Refrigerators without inverter technology are the more classic models that have been in use for several decades. Customers are familiar with these models and trust these refrigerators because they have been on the market for a long time and have a significant presence in the market. The refrigerator and freezer compartments are cooled by a fixed-speed compressor, which operates at a given speed and either turns on or off depending on the refrigerator's internal temperature of the refrigerator. As a result of their lower price compared to their inverter counterparts, it makes them more accessible to a larger number of consumers, resulting in rise demand for non-inverter refrigerators.

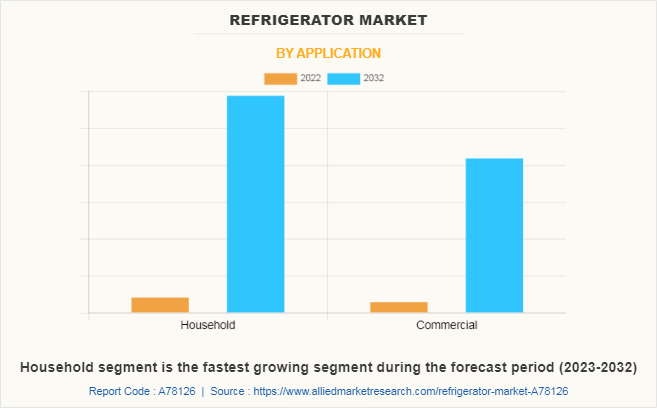

BY APPLICATION

On the basis of application, the household segment dominated the market in 2022, accounting for 50.5% of the refrigerator market share. There are many elements that influence the demand for domestic refrigerators. The expanding global population contributes to increased demand as more families use appliances such as refrigerators to store their food and beverages. In addition, as cities become more crowded and people live in smaller places, small refrigerators that fit into small kitchens act as a necessity. Another factor is the shift in customer preferences toward fresh and perishable foods, which makes refrigeration necessary to preserve quality and extend shelf life. There is a tremendous increase in technological developments, such as smart combinations and adaptable options, which attract consumers looking for convenience in their refrigerators. Overall, these variables influence the Market and spur innovation while supporting the continuous need for residential refrigerators.

BY DISTRIBUTION CHANNEL

On the basis of distribution channel, the hypermarket/supermarket segment dominated the market, garnering a market share of 28% in 2022. Moreover, the business in this sector acknowledges the importance of convenience as their primary objective and are constantly striving to improve the shopping experience by optimizing layouts, extending product lines, and delivering convenient services to suit changing customer demands. Thus, supermarkets and hypermarkets help shoppers save significant time and effort by providing a wide range of goods under one roof, including groceries, apparel, household goods, electronics, and others. In addition, plenty of parking spaces, and extra features such as in-store bakeries, delis, and pharmacies add to the convenience and allure of the customers.

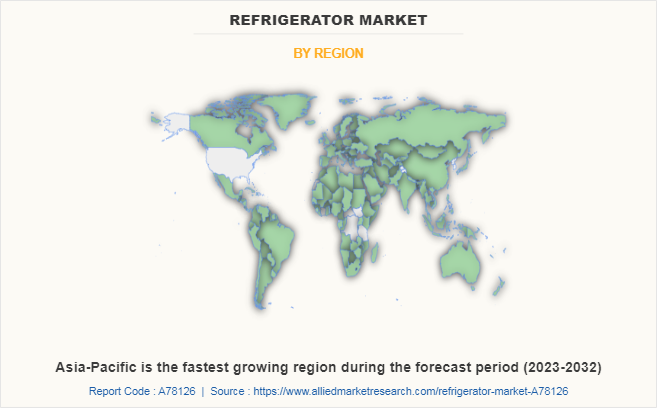

BY REGION

Asia-Pacific was the largest market with 36.2% of the market share in 2022, while LAMEA is estimated to be the fastest-growing market owing to a decline in the unemployment rate and rates is helping the growth of the market in the region. Low-and middle-income individuals in LAMEA prefer to invest in small-sized freezers since they are cheaper and use less energy. However, ongoing concerns with the supply of water and electricity create a need for energy-efficient products to deal with electricity challenges. For instance, LG Electronics and Defy Appliances are two of leading corporations of South Africa, both of which invest heavily in marketing initiatives in the region. The major players invest a lot of money in advertising campaigns to bring in potential customers for the company.

There is a rapid growth of Asia-Pacific household appliance market due to increased industry and product modernization. Moreover, it is anticipated that the Refrigerator Market would grow as a result of the production of new appliances, including smart appliances and functions that cater to specific consumer needs. As a result, there is rapid growth of the market for refrigerators due to changing lifestyles, increase in awareness, easy access to products through expanded retail channels, and simpler access to consumer finance.

LG Electronics, Panasonic Holdings Corporation, Robert Bosch GmbH, Hitachi, Ltd., Haier Inc., Samsung, Godrej, MIRC Electronics Limited, AB Electrolux, Whirlpool Corporation, Voltas Limited, Havells India Limited, Midea, Hisense International, and Liebherr are the major companies profiled in the Market report. These manufacturers are constantly engaged in various developmental strategies such as partnerships, mergers, acquisitions, and new product launches to gain a competitive edge and exploit the prevailing refrigerator market opportunities. Samsung is the largest producer and seller of electronical electrical appliances across the globe. It is a multinational electronics company with 228 subsidiaries located all over the world, including 9 regional headquarters for the consumer electronics (CE) and information technology & mobile communications (IM) divisions, 5 regional headquarters for the device solutions (DS) division, and the subsidiaries of the Harman division. Haier Inc. is a leading manufacturer and distributor of home and kitchen appliances. It has a wide portfolio of products containing large household appliances, refrigerators, washing machines, air-conditioners, freezers, kitchen appliances, interconnected air-conditioners, and channel services business.

- LG has announced a launch of new model of InstaView French Door Refrigerator which comes with UVnano technology to add more redefined luxury items under their refrigerator category.

- Panasonic announced the expansion of its home appliance segment, with the launch of 43 new models of refrigerator and 24 new models of washing machine ahead of the Indian festive season to attract large number of audience towards energy saver products under the home appliances segment.

- Godrej Appliances launched a refrigerator with 6 in 1 Convertible Freezer Technology which available in two of its frost-free refrigerator ranges -Godrej Eon Vibe and Godrej Eon Valor, the 6 in 1 convertible technology delivers a freezer temperature of -25°c, which is lowest in the category to cater to the underlying need for more storage and lasting preservation of food, especially during this pandemic.

- Samsung announced the expansion of new online stores for its B2B customers to enables more small and medium-sized enterprises in over 30 countries worldwide including Europe, Southeast Asia, and the Middle East.

- Electrolux launched a new product line of refrigerators at EuroCucina in Milan, Italy to add more products offering innovative and environmentally friendly in their refrigerator category.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the refrigerator market analysis from 2022 to 2032 to identify the prevailing refrigerator market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the refrigerator market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global refrigerator market trends, key players, market segments, application areas, and market growth strategies.

Refrigerator Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 220.6 billion |

| Growth Rate | CAGR of 5.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 529 |

| By Technology |

|

| By Product Type |

|

| By Freezer |

|

| By Distribution Channel |

|

| By Application |

|

| By Region |

|

| Key Market Players | Haier Inc., LG Electronics, Midea, Robert Bosch GmbH, MIRC Electronics Limited, Godrej, Havells India Limited, Voltas Ltd., Liebherr-International AG, Whirlpool Corporation, Hisense International, Hitachi, Ltd., Panasonic Holdings Corporation, Samsung Group, AB Electrolux |

Analyst Review

This section provides the opinions of top-level CXOs in the refrigerator market. According to them, an increase in demand is anticipated for refrigerators, and this trend may not change during the forecast period. The prices of refrigerators and their parts have increased significantly, as a result of rise in freight and raw material expenses. The refrigerator market is anticipated to experience high-value growth as the economic condition of consumers gets better and more of them are inclining toward premium and stylish products, but volume growth may be impacted as first-time buyers may deal with inflationary pressures. Consumer durable goods manufacturers reported that retail trade partners are stocking up more on refrigerators and other electronic products in the mid to premium price range and are being concerned about doing the same on entry-level products. Moreover, the senior executives predicted that the industry as a whole is expected to expand in value beyond pre-pandemic levels. The mass market still struggles, while the premium and mid-level segments are doing significantly well after the pandemic. The refrigerator appliance makers hope that internet-connected "smart home" products to help alter their businesses and the breadth and depth of their client relationships, however not all customers opt for it at present. According to Henry Kim, the U.S. director of ThinQ, an LG platform primarily targeted at assisting products exploit innovative technology, LG Electronics Inc. reported that less than half of the smart home devices it has sold are still connected to the internet. The company is aggressively attempting to boost its percentage in coming years as it helps to gather data about how the consumers make use of the product. Whirlpool Corp. claimed that more than half of its smart appliances including refrigerators are still connected though it declined to provide any details.

Furthermore, the increase in access to electrification and rise in demand and rapid expansion of the food & beverage industry have significantly driven the refrigerator market. The growth in demand for energy-efficient and eco-friendly refrigerators is expected to boost the market in terms of sales and overall growth. Thus, it is expected to see steady growth in the refrigerator industry in the anticipated period.

The global refrigerator market was valued at $126,863.9 million in 2022, and is projected to reach $220,591.8 million by 2032, registering a CAGR of 5.8%.

The forecast period in the Refrigerator market report is 2023 to 2032.

The base year calculated in the Refrigerator market report is 2022.

The double door segment is the most influential segment in the Refrigerator market report.

The company profile has been selected on the basis of revenue, product offerings, and market penetration.

The top companies analyzed for global Refrigerator market report are LG Electronics, Panasonic Holdings Corporation, Robert Bosch GmbH, Hitachi, Ltd., Haier Inc., Samsung, Godrej, MIRC Electronics Limited, AB Electrolux, Whirlpool Corporation, Voltas Limited, Havells India Limited, Midea, Hisense International, and Liebherr

Asia-Pacific holds the maximum market share of the Refrigerator market.

The market value of the Refrigerator market in 2022 was $220,591.8million.

Loading Table Of Content...

Loading Research Methodology...