RegTech Market Research, 2033

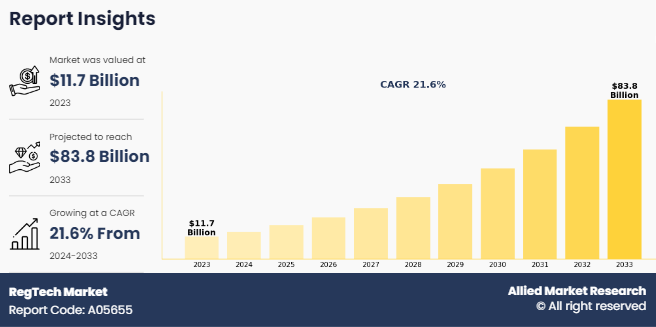

The global RegTech market size was valued at $11.7 billion in 2023, and is projected to reach $83.8 billion by 2033, growing at a CAGR of 21.6% from 2024 to 2033. RegTech market is a regulatory technology, that consists of different software and tools that enhance regulatory processes by using cutting-edge technologies such as artificial intelligence, cloud computing, machine learning, and big data. In addition, RegTech market consists of a group of companies that helps businesses comply with main functions such as reporting, compliance, regulatory, and monitoring. Furthermore, RegTech market helps minimize the risk of human error by automating processes and ensuring companies with more effectiveness in reaching insurance regulatory compliance. Rise in the adoption of advanced technologies such as cloud computing, application programming interfaces (APIs), data analytics, artificial intelligence, robotic process automation (RPA), chatbots, and machine learning, which improves the quality of reported data across various regimes & jurisdictions, boosts the market growth. In addition, an increase in collaboration between national regulators & financial institutions for businesses & governments drives the global market growth. However, concerns over consumer data privacy and conflicting regulations across different jurisdictions globally are some of the factors that hamper the market growth.

On the contrary, many regulatory bodies are adopting strategies and investing in RegTech industry to enhance their business processes and expand their product offerings. In addition, General Data Protection Regulation (GDPR) guidelines has made it mandatory to protect consumers' personal data. As a result, RegTech market providers take GDPR into account certain personal data-related activities, which is expected to boost the market growth during the forecast period.

Furthermore, an increase in the use of cutting-edge technologies, an increased need for intelligent financial systems, and expanding digitalization are all contributing to the market's expansion. Moreover, the market is anticipated to expand throughout the projected period due to the rise in internet service use and developments in AI technology. It is also anticipated that the adoption of cloud computing will enable the scalability, flexibility, and cost-effectiveness of banking systems, as well as the development of machine learning and other advanced technologies to enable real-time data processing and reduce latency.

On the other hand, the rise in online payment modes in bank transactions and rise in adoption of internet solutions are the key factors that are expected to drive the growth of the market in the future. The increase in strict regulations and compliance propels global regtech market growth. However, high initial cost and expense considerations are expected to hamper market growth. The lack of consumer knowledge and awareness can deter businesses from adopting these technologies. Furthermore, the surge in integration of advanced technologies is one of the major factors creating numerous opportunities for the market. Moreover, the growing adoption of analytics solutions is expected to offer remunerative opportunities for the expansion of the global regtech market trends during the forecast period.

The report focuses on growth prospects, restraints, and trends of the regtech market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as the bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, the threat of substitutes, and bargaining power of buyers, on the regtech market.

Key Findings:

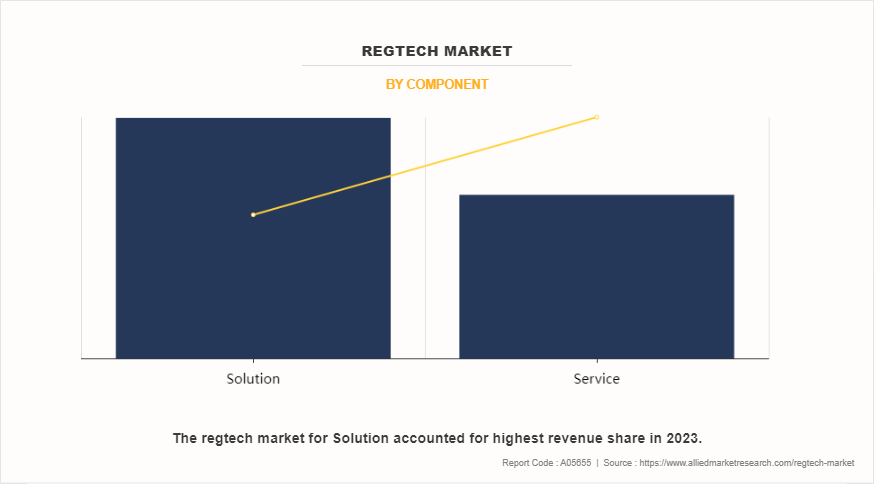

By component, the solution segment accounted for the largest market share in 2023.

By deployment mode, the on-premise segment accounted for the largest market share in 2023.

By enterprise size, the large enterprises segment accounted for the largest market share in 2023.

By application, the anti-money laundering and fraud management segment accounted for the largest market share in 2023.

By end user, the banks segment accounted for the largest market share in 2023.

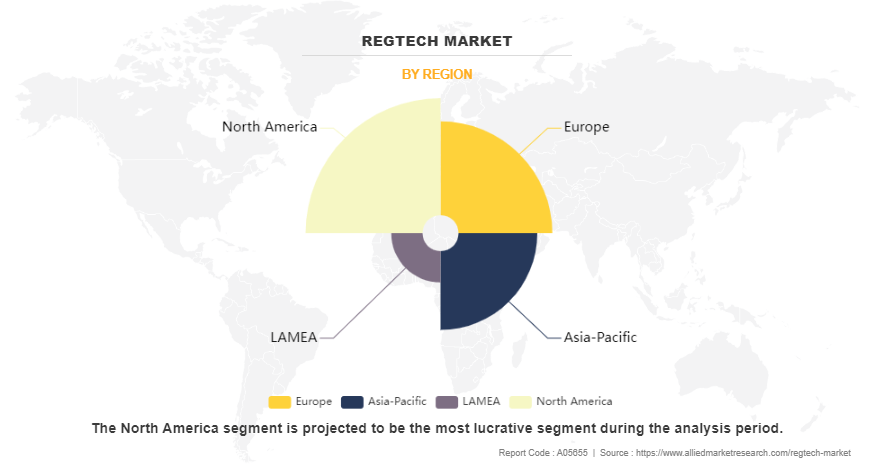

Region-wise, North America generated the highest revenue in 2023.

Segment Review

The RegTech market share is segmented on the basis of component, deployment model, enterprise size, application, end users, and region. By component, the market is bifurcated into solution and service. On the basis of deployment model, it is divided into on-premise and cloud. By enterprise size, the market is divided into large enterprises and small and medium-sized enterprises. On the basis of application, it is classified into anti-money laundering (AML) & fraud management, regulatory intelligence, risk & compliance management, regulatory reporting, and identity management. As per end user, it is segmented into banks, insurance companies, FinTech firms, IT & telecom, public sector, energy & utilities, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of component, the solution segment dominated the regtech market in 2023, as financial institutions and organizations are increasingly adopting regtech market solutions to meet stringent regulatory requirements related to anti-money laundering and combating financial crimes. However, the service segment is projected to attain the highest CAGR during the forecast period, as organizations are increasingly seeking tailored compliance solutions that meet specific regulatory and compliance needs. As a result, demand for professional services like implementation, customization, and training is growing.

By region, North America dominated the market share in 2023, driven by the region's well-established gaming infrastructure, widespread adoption of digital technologies, and a large base of regtech market enthusiasts. However, the Asia-Pacific is projected to attain the highest CAGR during the forecast period. This growth is driven by the increasing popularity of regtech market opportunity in countries like China, South Korea, and Japan, where security culture is deeply embedded. The region is also witnessing significant investments in security infrastructure.

Competition Analysis:

Competitive analysis and profiles of the major players in the regtech market outlook include ACTICO GmbH, Acuant, Inc. (IDology), Ascent Technolofies Inc., Broadridge Financial Solutions, Inc., Complyadvantage, Metricstream inc., Nice LTD., Thomson Reuters Corporation, Wolters Kluwer N.V, and IBM Corporation. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the growth of the regtech market globally.

Recent Development in Regtech Industry

In June 2024, Ventia launched RegTech, a generative AI solution to streamline how employees query Ventia’s document library for information about internal standards, compliance, and operating procedures. The solution designed as an AI chatbot handles employee requests for information and searches for answers within Ventia’s online document system delivering these to employees quickly and efficiently.

Top Impacting Factors

Increased adoption of advance technologies

Rise in demand for advanced technologies and efficient operations in fraud detection is a significant driver of the RegTech market forecast. Technologies include using IoT devices and AI technology to automate processes and operations in businesses such as BFSI, telecommunication, and healthcare. Hence, by automating processes and operations, businesses can improve efficiency, reduce costs, and enhance productivity. Moreover, these advanced technologies enable more accurate data analysis, predictive modeling, and process automation, allowing organizations to streamline data storage activities and improve efficiency across several industries. Such factors are further expected to significantly contribute to the growth of the RegTech market.

In addition, implementation of AI and cloud technologies helps in determining specific inefficiencies and avoiding them by simulating business processes in different scenarios. Hence, several companies and government authorities are leveraging advanced technologies intending to improve business operations. For instance, in June 2024, Ventia launched RegTech, a generative AI solution to streamline how employees query Ventia’s document library for information about internal standards, compliance, and operating procedures. The solution designed as an AI chatbot handles employee requests for information and searches for answers within Ventia’s online document system delivering these to employees quickly and efficiently. Therefore, such initiatives are expected to further accelerate the use of technologies, driving the growth of the RegTech market.

Varied and conflicting regulations across different jurisdictions

Various laws set different standards & regulation across different jurisdictions with an increased unified approach taken by financial centers toward regulation. This becomes a crucial factor for RegTech market companies to elaborate solutions across various regulations such as MiFID II, GDPR, and others, which brings an inter-regulation conflict and therefore hinders the growth of the RegTech market. For instance, in the U.S., banks stand by the Dodd-Frank Act, while in Europe MiFID II regulations are considered for businesses under its jurisdiction.

Furthermore, the RegTech solutions frequently necessitate significant investments in R&D and testing. Developing solutions that can accommodate the complexities of numerous regulatory systems raises the costs for RegTech market. firms. They must account for differences in data formats, reporting standards, and legal interpretations, which can stifle innovation and make providing cost-effective solutions more difficult. Therefore, higher development costs in varied and conflicting regulations across different jurisdictions hamper the RegTech market

Increased General Data Protection Regulation (GDPR) concerns across region

The growing concerns around General Data Protection Regulation (GDPR) compliance across regions are creating numerous opportunities for the growth of the RegTech market. As businesses increasingly process and store large volumes of sensitive personal data, adherence to stringent data protection laws such as GDPR become critical to avoid hefty fines and reputational damage. RegTech market solutions are disrupting the regulatory landscape by providing technologically advanced solutions within the financial industry. In addition, the General Data Protection Regulation (GDPR) guidelines become a mandatory application over the consumers personal data. It governs the use of personal data and introduces a right for individuals to object to profiling, which is therefore expected to create lucrative opportunities for the market in terms of gaining trust & build service loyalty in the market. Therefore, with GDPR requirements, the RegTech solution providers have an opportunity to improvise technology implications by taking the GDPR into account, which is expected to offer numerous opportunities for the market growth during the forecast period.

RegTech Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 83.8 billion |

| Growth Rate | CAGR of 21.6% |

| Forecast period | 2023 - 2033 |

| Report Pages | 401 |

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Thomson Reuters Corporation, Ascent Technologies, Inc., ACTICO GMBH, IBM Corporation, ACUANT, INC., NICE Ltd., ComplyAdvantage, Wolters Kluwer N.V, Broadridge Financial Solutions, Inc., METRICSTREAM INC. |

Analyst Review

The RegTech market is experiencing dynamic trends and robust growth as a result of several important factors, including an increase in the complexity of global laws across industries, which is driving demand for advanced RegTech solutions. Businesses want agile solutions that can read and adapt to changing compliance standards, as well as automate and optimize operations to decrease operational pressures. Artificial intelligence, machine learning, and data analytics are allowing RegTech systems to provide predictive insights, risk assessment, and anomaly detection, increasing risk management techniques and preventing financial crimes.

Moreover, the RegTech market is experiencing rapid evolution, driven by advancements in technology and increasing regulatory complexities across industries. The integration of blockchain technology is enhancing transparency and security in financial transactions and regulatory reporting. Cloud-based solutions are gaining traction due to their scalability, cost-effectiveness, and ease of deployment, enabling businesses to manage compliance more efficiently.

The RegTech market is fragmented with the presence of regional vendors such as Thomson Reuters, NICE Ltd., and International Business Machines (IBM). North America and Europe dominated the RegTech market, in terms of revenue in 2023, and are expected to retain their dominance during the forecast period. However, Asia-Pacific is expected to experience significant growth in the future, owing to emerging economies, and an increase in government support toward banking & financial industries for implementing RegTech solutions in the region. Some of the key players profiled in the report include ACTICO GmbH, Acuant, Inc., Ascent, Broadridge Financial Solutions, Inc., ComplyAdvantage, MetricStream Inc., and Wolters Kluwer N.V. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry. For instance, in December 2024, Broadridge Financial Solutions, Inc. launched an innovative AI-powered algorithm insights service for NYFIX. Driven by real-time liquidity mapping, the service is designed to empower asset managers, hedge funds, and other buy-side firms to achieve unprecedented accuracy, seamless workflow integration, and proven cost efficiency.

The RegTech (Regulatory Technology) market is experiencing significant growth driven by increasing regulatory compliance requirements, technological advancements, and a surge in digital transformation across industries.

Anti-money laundering and Fraud Management are the leading applications of the RegTech Market.

North America is the largest regional market for RegTech in 2023.

$83.8 billion will be the estimated industry size of RegTech in 2033.

ACTICO GmbH, Acuant, Inc.(IDology), Ascent Technologies Inc., Broadridge Financial Solutions, Inc., Complyadvantage, Metricstream Inc., Nice LTD., Thomson Reuters Corporation, Wolters Kluwer N.V, and IBM Corporation are the top companies to hold the market share in RegTech.

Loading Table Of Content...

Loading Research Methodology...