Reinsurance Market Research, 2031

The global reinsurance market was valued at $498.7 billion in 2021, and is projected to reach $1344.3 billion by 2031, growing at a CAGR of 10.8% from 2022 to 2031.

Reinsurance is a contract wherein the reinsurance firm or reinsurer or reinsurer broker commits to defend the insurance company or ceding company against the perils covered by the agreement. It aims to lower the net amount at risk from certain hazards such as insolvency and unfavorable market conditions and increase the ceding company's surplus position and financial stability. Additionally, reinsurance enables the ceding firm to increase the amount of risk it can take on any given risk and increase the amount of business it can take on.

The reinsurers have taken several steps to smooth out the earnings of primary insurers since they are eager to provide value-added services to them. From merely addressing property disaster risks to covering a wider range of hazards, the focus has significantly shifted. In addition, growth in property catastrophe protection is a major factor expected to drive the reinsurance market growth. However, frail economies, with resultant low insurance infiltration due to lack of disposable income, and globalization & competition from foreign companies, are expected to hinder the growth of the market. On the contrary, digitalization in reinsurance companies is expected to fuel the expansion of the market in future. Moreover, increase in opting for property & casualty reinsurance services and conduit reinsurance by leading sectors is expected to create lucrative opportunities for the market to grow in upcoming years.

The report focuses on growth prospects, restraints, and trends of the reinsurance market. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers; competitive intensity of competitors; threat of new entrants; threat of substitutes; and bargaining power of buyers on the reinsurance market outlook.

The reinsurance market is segmented into Type, Application, Distribution Channel and Mode.

Segment Review

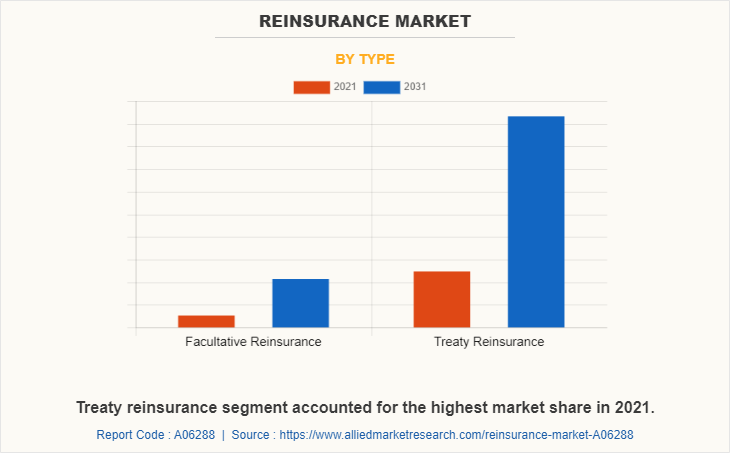

The reinsurance market is segmented into type, application, distribution channel, mode, and region. On the basis of type, the market is bifurcated into facultative reinsurance and treaty reinsurance. Treaty reinsurance is further segmented into proportional reinsurance and non -proportional reinsurance. The proportional reinsurance is further segregated into quota share and surplus share. Depending on application, it is fragmented into property & casualty reinsurance and life & health reinsurance. Life & health reinsurance is further segmented into disease insurance and medical insurance. The distribution channel segment is segregated into direct writing and reinsurance broker. By mode, it is segmented into online and offline. Region-wise, the reinsurance market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type, treaty reinsurance segment accounted for the highest share in reinsurance market size. This is attributed to the fact that risks are less likely to be mitigated and treaty reinsurance is less transactional. Furthermore, the lack of individual underwriting, and reinsurance adoption on the part of the assuming insurer is the main feature of a treaty arrangement.

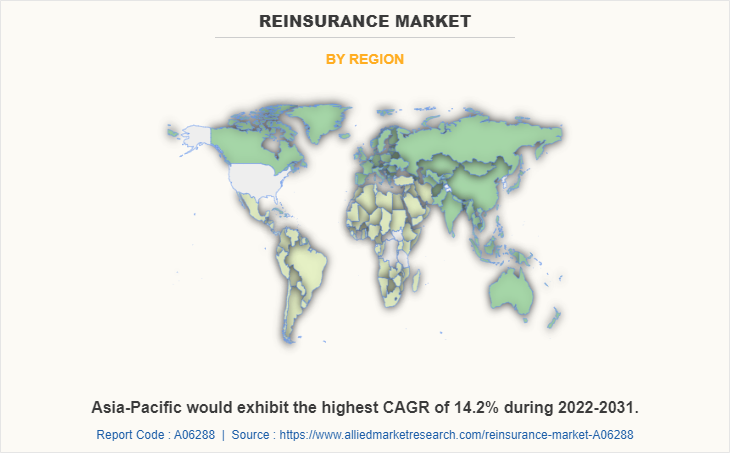

By region, Asia-Pacific is expected to grow at the highest CAGR during the forecast period in reinsurance market share. This is attributed to the fact that reinsurance is in demand in Asia-Pacific as domestic insurers look for financial resources to cover such enormous risks. This is due to natural catastrophes occurring more frequently.

Key players operating in the global reinsurance market analysis include AXA XL, Barents Re Reinsurance Company, Inc., Berkshire Hathaway Inc., BMS Group, China Reinsurance (Group) Corporation, Everest Re Group, Ltd., Hannover Re, Lloyd’s, MAPFRE, Markel Corporation, Munich RE, RGA Reinsurance Company, Swiss Re, The Canada Life Assurance Company, Tokio Marine HCC, SCOR, and Next Insurance, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the reinsurance industry.

Top Impacting Factors

Helps Insurance Companies Acquire more Clients

Reinsurance policy is mainly useful for guarding against insolvency for businesses. It guarantees that insurance providers have the financial means to pay all valid claims made by their customers in reinsurance service. This fortifies the company's foundation and allows them the assurance to accept greater risk and serve more clients. Moreover, it helps insurers remain solvent by recovering the amounts paid to claimants during an insurance claim in reinsurance domain. In addition, it protects against catastrophic losses by lowering the net liability for individual risks. Furthermore, reinsurance increases the insurer's capacity to bear the financial burden during uncommon and significant catastrophes, providing the latter with more protection for its equity and solvency. Additionally, insurers can underwrite policies covering a larger quantity or volume of risk without excessively raising administrative costs to cover their solvency margins. Thus, this factor is propelling the growth of reinsurance market.

Reduces Risks on Insurance Companies

An insurance firm assumes a significant level of risk when it insures a sizable number of customers on its own. Reinsurance is a better option to lower that risk since it enables insurers to share part of the risk rather than bear the entire risk alone. In addition, an insurance business can be approached by a person who wants insurance advice. However, a reinsurance firm can provide insurance companies with reliable insurance guidance when an insurance company wants insurance advice. Moreover, to lower the chance of significant claim payouts, reinsurance transfers risk to a different firm. This allows the reinsurance companies to reduce the risk of insolvency and reinsurance challenge and continue their businesses. Thus, this factor is driving the growth of reinsurance market.

Controls Competition Among Insurers

Due to their mutual reliance on one another to reduce risk, insurance businesses in the sector have strong relationships with one another. Reinsurance is therefore beneficial for the insurance industry since it reduces competition and raises staff morale. Additionally, the earnings made by the insurance firm are one of the many aspects of a corporation that reinsurance stabilizes. The original insurer's earnings, nevertheless, can be severely harmed by large claims if the greater risks are still borne. Hence, the reinsurance firms maintain a healthy relationship within the insurance firms to aid each other in need. Thus, the fact that reinsurance controls competition among insurance is fueling the growth of the reinsurance market .

Type Insights:Reinsurance Services

The reinsurance market is primarily divided into life and non-life reinsurance services. Key services include proportional reinsurance, where risks are shared based on an agreed percentage, and non-proportional reinsurance, which covers excess loss beyond the insurer's capacity. These services provide primary insurers with risk management solutions, driving global demand for reinsurance.

Report Coverage & Deliverables

Technology Insights:

Technological innovations like predictive analytics, artificial intelligence, and blockchain are reshaping the reinsurance market. These advancements are enabling improved risk assessment, underwriting, and claims processing, contributing to the reinsurance market growth services globally.

Application Insights:

Reinsurance applications are widely used in sectors such as health, property, casualty, and life insurance. Property and casualty reinsurance holds a significant reinsurance market share, driven by increasing risks related to natural disasters and regulatory pressures.

Regional Insights:

North America and Europe dominate the reinsurance market value, largely due to the presence of established reinsurers and a mature insurance industry. In contrast, the Asia-Pacific region is experiencing robust growth, driven by increasing demand for reinsurance services and growing awareness of risk management.

Key Companies & Market Share Insights:

Key companies like Munich Re, Swiss Re, and Berkshire Hathaway maintain substantial market share through innovative solutions and strong financial performance. Their leadership in the global reinsurance market is supported by extensive networks and regulatory compliance.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the reinsurance market forecast from 2021 to 2031 to identify prevailing reinsurance market opportunity.

- In addition to the market research, important drivers, restraints, and opportunities are covered as well.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the reinsurance market segmentation assists in determining the prevailing market opportunities.

- According to their contribution to global market revenue, the major countries in each region are mapped.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global reinsurance market trends, key players, market segments, application areas, and market growth strategies.

Reinsurance Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Distribution Channel |

|

| By Mode |

|

| By Region |

|

| Key Market Players | Barents Re Reinsurance Company, Inc., Next Insurance, Inc., The Canada Life Assurance Company, Everest Re Group, Ltd., BMS Group, Lloyd’s, Hannover Re, Swiss Re, AXA XL, SCOR, MAPFRE, China Reinsurance (Group) Corporation, Berkshire Hathaway Inc., Munich RE, RGA Reinsurance Company, Tokio Marine HCC, Markel Corporation |

Analyst Review

Reinsurance significantly contributes to capital optimization, supports solvency, and improves the effectiveness of risk transfer in the insurance industry. Due to the numerous difficulties insurers have been experiencing as a result of shifting market conditions, the most recent reinsurance solutions have been aiding the growth of the industry. Moreover, in an effort to acquire risk protection & distribution and enhance capital, many insurers are turning to the use of various forms of reinsurance.

During the pandemic, as insurers have been more concerned with controlling their risks, the demand for reinsurance solutions has increased significantly in several areas. On the contrary, demand has decreased in a few areas where federal governments were active. However, reinsurance demand has increased significantly as a result of the current volatility brought on by the pandemic, which has driven insurers to a desire to protect their books.

The reinsurance market is segmented with the presence of regional vendors such as AXA XL, Barents Re Reinsurance Company, Inc., Berkshire Hathaway Inc., BMS Group, China Reinsurance (Group) Corporation, Everest Re Group, Ltd., Hannover Re, Lloyd’s, MAPFRE, Markel Corporation, Munich RE, RGA Reinsurance Company, Swiss Re, The Canada Life Assurance Company, Tokio Marine HCC, SCOR, and Next Insurance, Inc. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnerships to reduce supply and demand gaps. With increase in awareness & demand for reinsurance across the globe, major players are collaborating on their product portfolio to provide differentiated and innovative products.

The Reinsurance Market is estimated to grow at a CAGR of 10.8% from 2022 to 2031.

The Reinsurance Market is projected to reach $1,344.29 billion by 2031.

Increase in demand for various insurance plans is anticipated to drive reinsurance market growth during the forecast period. Additionally, the COVID-19 pandemic increased awareness of the need for life insurance among the general public.

The key players operating in the reinsurance market analysis include AXA XL, Barents Re Reinsurance Company, Inc., Berkshire Hathaway Inc., BMS Group, China Reinsurance (Group) Corporation, Everest Re Group, Ltd., Hannover Re, Lloyd’s, MAPFRE, Markel Corporation, Munich RE, RGA Reinsurance Company, Swiss Re, The Canada Life Assurance Company, Tokio Marine HCC, SCOR, and Next Insurance, Inc.

The key growth strategies of Reinsurance Market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...