Renewable Fuel Market Research, 2031

The global renewable fuel market size was valued at $1.0 trillion in 2021, and is projected to reach $2.0 trillion by 2031, growing at a CAGR of 7.9% from 2022 to 2031.

The renewable fuel market major focuses on the indicators that are comprehensively included while conducting a thorough analysis. The key indicators include detailed value chain analysis, porter's five forces, top player positioning, market dynamics, covid impact, patent analysis, renewable fuel market size and renewable fuel forecast in terms of value($Million) and volume(TWh), and top winning strategies that have helped understand the growth strategies adopted by the key players and their potential impact on the renewable fuel market.

There are numerous benefits of using renewable fuels. Renewable fuels are a way to achieve net-zero carbon emissions and reduce greenhouse gases. They can also be produced from a variety of feedstocks, including municipal waste, potentially reducing the amount of waste that enters landfills. Renewable fuels will also increase world’s energy security by allowing more production of fuels. Renewable fuels can also be used in existing transport mediums.

Renewable fuels can be categorized as one of the ways of the energy transition. The shift from conventional fuels to renewable fuels benefits everyone throughout the value chain. From raw material, and provider to end user, every stage/process involved benefits from it as well as the earth. The manufacturers and industry sector benefits through it by reducing their carbon footprint similarly transport, aviation, cooling & heating, and power industry also benefits from renewable fuels. The major challenge to the market is fluctuating prices of feedstock.

However, rising awareness amongst people for reducing individual carbon footprint has opened new opportunities for the market. Moreover, as renewable fuels are cheaper than conventional ones, the option to choose also encourages the market. Recently, the major players are focused on offering fuels and advertising extensively by targeting consumers through benefits and cost-effectiveness. Continuous R&D activities are being carried out to innovate, enhance, and explore new possibilities in the field.

The renewable fuel market is experiencing an increased demand worldwide. Government assistance has greatly influenced the demand for biomass-based fuels because biomass-based diesel combustion is less negative than crude oil-based diesel combustion. In India, the Union Budget 2022-23, the allocation for the Solar Energy Corporation of India (SECI), which is currently responsible for the development of the entire renewable energy sector, stood at US$132 million.

Similarly, in the U.S., the investment tax credit (ITC) is earned when qualifying equipment, including solar hot water, photovoltaics, and small wind turbines, are placed into service. The credit reduces installation costs and shortens the payback time of these technologies. The Consolidated Appropriations Act (2016) extended the ITC for three years, but Congress then passed a two-year delay in 2020. It is supposed to phase down to 10% in 2024 (from 26%in 2021). The aforementioned benefits initiatives from governing bodies encourage renewable fuel market growth for renewable fuels.

The raw material for the manufacture of renewable fuels is not available easily. There are several rules and regulations that need to be adhered to. This complicates the easy availability of raw materials. The price of crude oil worldwide directly affects the price of gasoline, which is the main substitute for biofuel. Consequently, the demand for biofuel drops as the price of crude oil falls. When the supply of soybean, canola oil, animal fat, and distillers corn available to industry operators increases, industry operators are more likely to receive favorable feedstock prices leading to higher production and margins.

However, when prices of feedstock increases, the prices for renewable fuels increase as well. Similarly, when the price of crude oil falls, consumer switches back to crude oil and thus, renewable fuels demand is discouraged. Thus, renewable fuel market is greatly hampered by fluctuating raw material prices and hence, act as a restraint for renewable fuel market growth.

The presence of large corporations in the renewable fuel market and also has to compete with energy fuels from fossil fuel and other non-renewable sources of fuels and thus, it makes the market highly competitive. Capital investment in R&D to enhance the existing properties is high. High capital investment makes the renewable fuel market highly competitive, as innovation in the field is high.

Availability of options leave more choices for buyers, thus, decreasing the switching cost. In addition, the purchase quantity of renewable fuel is high in volume, as the requirement for various end uses is high. Moreover, backward integration is low and is attributed to the fact that leading companies manufacturing renewable fuel have the capital and capability for production and led to Renewable Fuel Market Growth.

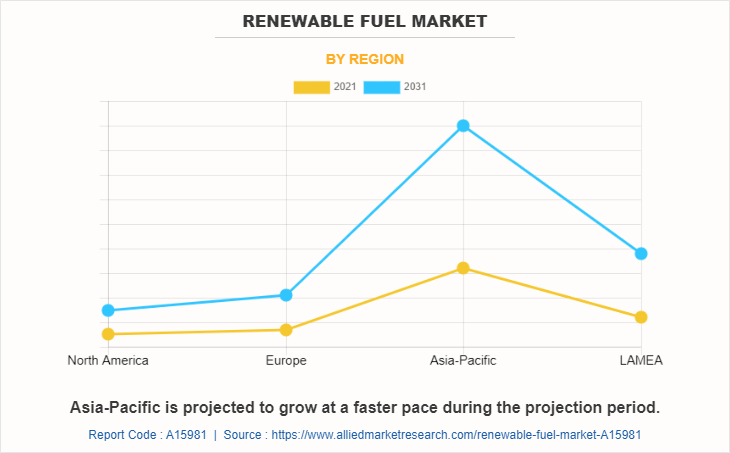

The Renewable Fuel Market Analysis is done on the basis of source, application, and region. Depending on source, the market is classified into geothermal, biofuels, hydropower, wind, solar, and other. By application, the market is divided into cooling & heating sector, power sector, transportation sector, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA (Latin America, the Middle East, and Africa).

By Type

Wind segment is projected to grow at faster pace during the projection period.

By type, hydropower dominated the renewable fuel market share for 2022. However, the wind segment is projected to grow at a higher CAGR during the forecast period. This is attributed to increased investment and a rise in projects (ongoing and planned) for wind energy across the globe.

By Application

Power sector is projected to grow at a faster pace during the projection period.

By application, the power sector segment was the highest revenue contributor to the market. The same is projected to grow at a higher CAGR owing to increased demand for electricity throughout. Renewable fuels are diverted toward the power sector to fulfilling rising energy demands. Renewable fuels being carbon-neutral sources of power are highly in demand from the industrial and commercial sectors as companies are moving toward reducing carbon emissions.

By region, Asia-Pacific has the highest renewable fuel market share. The same is projected to grow at a higher CAGR during the forecast period. This can be attributed to several populated economies that have risen the demand for electricity. Moreover, sustainable fuel projects also contribute toward the region’s growth for renewable fuel industry.

The key players operating in the renwable fuel industry are Clean Energy Fuels, Cosan SA, Exxon Mobil Corporation, My Eco Energy, Neste, Renewable Energy Group, Shell plc, Suncor Energy Inc., Total Energies, and Valero Energy Corporation. The players in the market have adopted several strategies, such as product launches and business expansion, to sustain the market competition.

Recent Strategic Developments Undertaken By Key Players

- In July 2022, Shell Nederland B.V. and Shell Overseas Investments B.V., subsidiaries of Shell plc, have taken the final investment decision to build Holland Hydrogen I, which will be Europe's largest renewable hydrogen plant once its operational in 2025.

- The NTPC is expected to commission India’s largest floating solar power plant in Ramagundam, Telangana by May-June 2022. The expected total installed capacity is 447 MW.

- In May 2022, Renewable Energy Group, Inc. (REG), a global producer and supplier of bio-based diesel, has entered into strategic collaboration agreements with CFN and Pacific Pride, two of North America's largest cardlock fueling networks, to provide cleaner fuels through their branded cardlock networks.

- In March 2022, Finnish refiner Neste made a billion-dollar investment in a joint venture with U.S.-based oil company Marathon Petroleum Corp that is expected to make it the world's first and only renewable fuels maker with global capacity.

- In October 2021, Adani Green Energy Ltd. (AGEL) acquired SB Energy India for US$ 3.5 billion to strengthen its position in the renewable energy sector in India.

- In August 2021, Copenhagen Infrastructure Partners (CIP) signed an investment agreement with Amp Energy India Private Limited to facilitate joint equity investments of US$ 200 million across Indian renewable energy projects.

- In July 2021, National Thermal Power Corporation Renewable Energy Ltd. (NTPC REL), NTPC's fully-owned subsidiary, sent out a tender to domestic manufacturers to build India's first green hydrogen fueling station in Leh, Ladakh.

COVID-19 impact analysis

The COVID-19 (coronavirus) pandemic and associated social distancing guidelines have reduced overall energy consumption, resulting in a decline in demand for energy, including biomass-powered electricity. However, there was sharp increase registered in energy demand worldwide according to the International Energy Agency (IEA). After a 0.3% decline due to the COVID-19 pandemic in 2020, global power generation rebounded by 5.5% in 2021, above its 2010-2019 average growth (2.5%/year) and exceeding its 2019 level by 5.2%.

The growth in global power generation was pulled by BRICS countries (8.5% in 2021, 10% above their 2019 level), where electricity consumption increased noticeably, especially in China (9.7%), India (4.8%), Russia (6.4%) and in Brazil (9.5%); in China, most of the increase in power generation came from coal, wind, and solar. Wind and solar being significant contributors for the same. Thermal power generation (64% of the global power mix in 2021) strongly recovered in 2021(5.7%), while wind and solar generation continued to rise at a steady pace (16.0% and 23.0%, respectively).

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the renewable fuel market forecast from 2021 to 2031 to identify the prevailing renewable fuel market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities and further aids in renewable fuel market forecast

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global renewable fuel market trends, key players, market segments, application areas, and market growth strategies.

Renewable Fuel Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 2034.6 billion |

| Growth Rate | CAGR of 7.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 249 |

| By Type |

|

| By Application |

|

| By Region |

|

| By Region |

|

| Key Market Players | Clean Energy Fuels Corp., My Eco Energy, Neste Corporation (Finland), Total Energies, Cosan S.A., Exxon Mobil Corporation, Valero Energy Corp., Suncor Energy Inc., Shell Plc., Renewable Energy Group |

Analyst Review

The renewable fuels market is highly consolidated in nature. It has applications in various industries such as automotive, cooling & heating, electricity, and others. The recent trends in the market show a sharp upsurge in the renewable fuels market due to growing concerns over carbon emissions. Several policies and regulatory guidelines are pushing toward reducing carbon emissions or else incurring penalties. Moreover, increased emphasis on boosting energy installed capacity is prompting nations to invest in renewable fuel projects, which further promotes the market growth for renewable fuels. The market growth is hampered by fluctuation in feedstock price and logistics & transportation cost.

Collaboration and joint ventures are recent trends in the renewable fuel market.

The leading application of renewable fuels is power sector

Asia-Pacific is largest regional market for Renewable Fuel

The top companies are Clean Energy Fuels, Cosan SA, Exxon Mobil Corporation, My Eco Energy, Neste, Renewable Energy Group, Shell plc, Suncor Energy Inc., Total Energies, and Valero Energy Corporation.

The market size of the renewable fuel is $1 trillion in 2021.

Loading Table Of Content...

Loading Research Methodology...