Residential Boiler Market Overview

The global residential boiler market size was valued at USD 7.6 billion in 2021, and is projected to reach USD 12.5 billion by 2031, growing at a CAGR of 5.2% from 2022 to 2031.

Residential boiler is the type of heating equipment that generates heat for water heating and space heating applications. It can be used in commercial applications by increasing its capacity. Generally residential boiler systems are hot water boiler systems. Natural gas is the majorly used fuel in residential boilers. Propane is an alternative fuel where natural gas is not available and is expensive when compared with natural gas. Residential boilers are also used to heat water for bathing and cooking. Two technologies used for residential boiler systems include condensing and non-condensing technology.

Rise in demand for space and water heating systems and stringent government regulations toward carbon emissions are the key factors driving the residential boiler market growth during the forecast period. However, high cost associated with production, maintenance, & installation and rise in use of renewable systems in heating of residential areas are anticipated to restrain the growth of the residential boiler market during the analyzed time frame.

Conversely, technological advancement toward improving energy efficiency of residential boilers is projected to create opportunity for key players to maintain pace in the market in the coming years.The residential boiler market is segmented into type, technology, fuel type, and region.

Segment Overview

Depending on type, the residential boiler market analysis is categorized into water tube boiler, fire tube boiler, and electric boiler. As per technology, it is classified into condensing and non-condensing. By fuel type, the market is fragmented into coal fired, gas fired, oil-fired, and others. Region-wise, the residential boiler market forecast is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Based on type, fire tube is the fastest growing segment during the forecast period. This is attributed to increase in demand for boilers, owing to rise in disposable income, volatile climatic conditions, and others is projected to fuel the growth of the residential boiler market during the analyzed time frame.

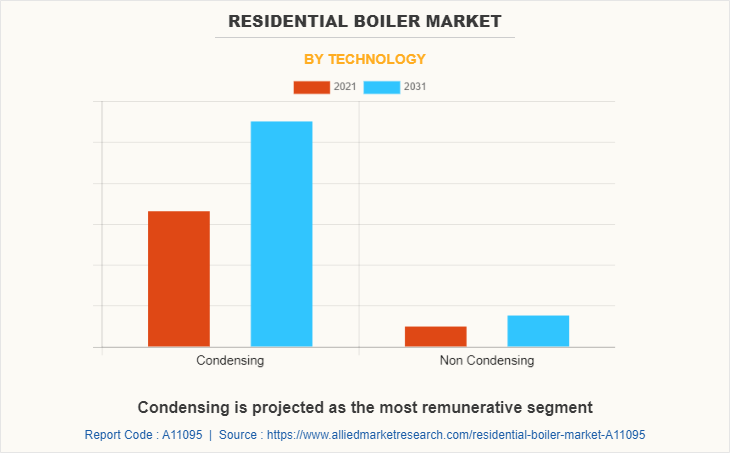

Based on technology, condensing is the largest segment during the forecast period. Owing to rise in demand for boilers from space heating and water heating applications is expected to drive the growth of the residential boiler market during the analyzed time frame.

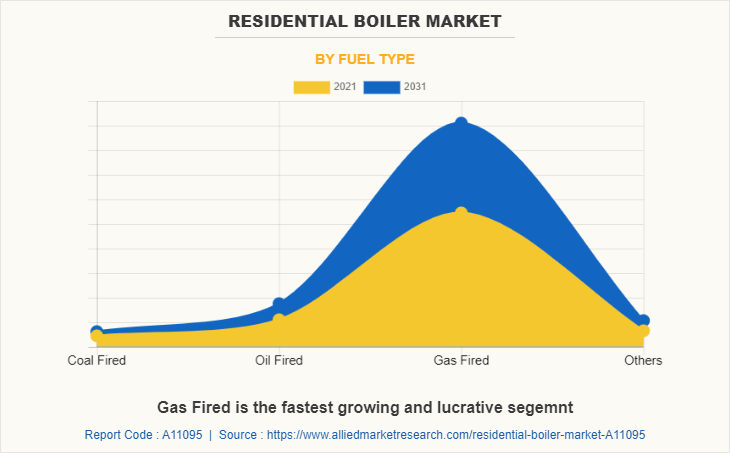

Based on fuel type, gas fired held the highest market share during the forecast period. This is attributed to rise in demand for space heating and hot water coupled with stringent government regulations toward reducing carbon emissions is expected to increase the demand for gas fired residential boilers, thereby driving the growth of the market in the coming years.

Based on region, asia-pacific region is the highest revenue contributor. This is attributed to economies, such as China, India, Japan, South Korea, and Australia, are taking efforts to minimize the greenhouse gas emissions, increasing investment toward green buildings, and adopting efficient heating products, which are anticipated to fuel the growth of the Asia-Pacific residential boiler market in the coming years.

Impact of COVID-19 outbreak on the market

The outbreak of COVID-19 has negatively impacted various industries and countries across the globe. Attributed to the lockdown imposed, globally, decrease in the growth rate of industries, such as construction & building, transportation, oil & gas, and energy sectors, has been witnessed. This has further declined the need for heating appliances, which, in turn, is expected to hamper the growth of the residential boiler market in the next one year. In the Europe region, economies, such as Germany, France, Spain and, Italy, are following stringent measures, such as attaining social distance and limiting movements, to prevent the spread of coronavirus, thereby resulting in shutdown of production facilities.

Furthermore, as LNG and crude oil prices declined in the second quarter of 2020, the overall revenue of gas fired boilers diminished in the second quarter of 2020. These factors collectively resulted in declined growth of the global residential boiler market in 2020; however, the market is expected to recover by the end of the second quarter of 2021. On the contrary, after extensive R&D toward creating vaccines, pharmaceutical companies successfully created coronavirus vaccines, which are expected to minimize the impact of the virus and fuel the growth of the global economy. This is expected to recover the growth of the residential boiler market in the coming years.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the residential boiler market analysis from 2021 to 2031 to identify the prevailing residential boiler market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the residential boiler market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global residential boiler market trends, key players, market segments, application areas, and market growth strategies.

Residential Boiler Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Technology |

|

| By Fuel Type |

|

| By Region |

|

| Key Market Players | Noritz Corporation,, Lennox International, Ferroli S.p.A, Robert Bosch GmbH, Burnham Holdings,, SPX Corporation, Slant/Fin Corporation, Viessmann Manufacturing Company, Inc., Ariston Thermo SpA, Bradford White Corporation |

Analyst Review

According to the CXOs of leading companies, rapid growth of the heating equipment industry and rise in demand for environment-friendly heating systems are the key factors attributed to the leading position of Europe in the global residential boiler market. The Asia-Pacific region is further expected to provide lucrative opportunities to leading residential boiler manufacturers, owing to its huge potential to set up manufacturing plants and surge in demand for residential boilers from the region.

Increase in demand for space and water heating applications from residential sectors is the key factor driving the growth of the global residential boiler market during the forecast period. However, cost associated with production, maintenance, and installation of boilers is anticipated to hamper the growth of the market. On the contrary, increase in government investments in the residential construction industry and technological advancements in residential boilers are projected to provide remunerative opportunities for the key players to maintain the pace in the residential boiler market in the coming years.

Among the analyzed regions, Europe is expected to account for the highest revenue in the market during the forecast period, followed by Asia-Pacific, North America, and LAMEA. Europe accounted for 38.9% of the total global residential boiler market share in 2021 and is expected to maintain its dominance during the forecast period.

Increase in demand for residential boilers from residential applications, including homes, farmhouses, holiday homes, apartments, and others to keep homes warm and heat water is anticipated to drive the growth of the global residential boiler market. However, rapid growth of the renewable energy industry along with emerging renewable alternatives, such as solar, for heating systems is projected to restrain the growth of the residential boiler market in the coming years.

Additional growth strategies, such as expansion of production capacities, acquisition, and partnership in the development of the innovative products from manufacturers have helped to attain key developments in the residential boiler market trends.

By type, the fire tube boiler segment held the highest market share of about 62.0% in 2021 and is expected to maintain its dominance during the forecast period. This is attributed to the rise in demand for boilers for space heating and water heating applications from residential applications.

The key players operating and profiled in the report include Ariston Thermo SpA, Bradford White Corporation, Burnham Holdings, Inc., Ferroli S.P.A., Lennox International, Noritz Corporation, Robert Bosch GmbH, Slant/Fin Corporation, SPX Corporation, and Viessmann Manufacturing Company, Inc. Other players operating in the value chain of the global residential boiler market are AC Boilers SpA, Saudi Boiler, Parker Boiler, A.O. Smith, and others.

Increase in demand for space and water heating applications from residential sectors is the key factor driving the growth of the global residential boiler market during the forecast period.

Loading Table Of Content...