Table Of Contents

Onkar Sumant

Pooja Parvatkar

B2B Payments in 2024: The Acceleration of Digital Transformation

B2B payments involve the transaction of value denominated in currency from buyer to supplier between businesses for goods or services supplied in the market, irrespective of whether a payment is made in one country or internationally. B2B payments contain corporate expenses such as business-related per-diem or travel. In addition, B2B payments among two entities are predisposed by several factors, such as frequency, volume, interest charges, and sector, which do not impact customer payments.

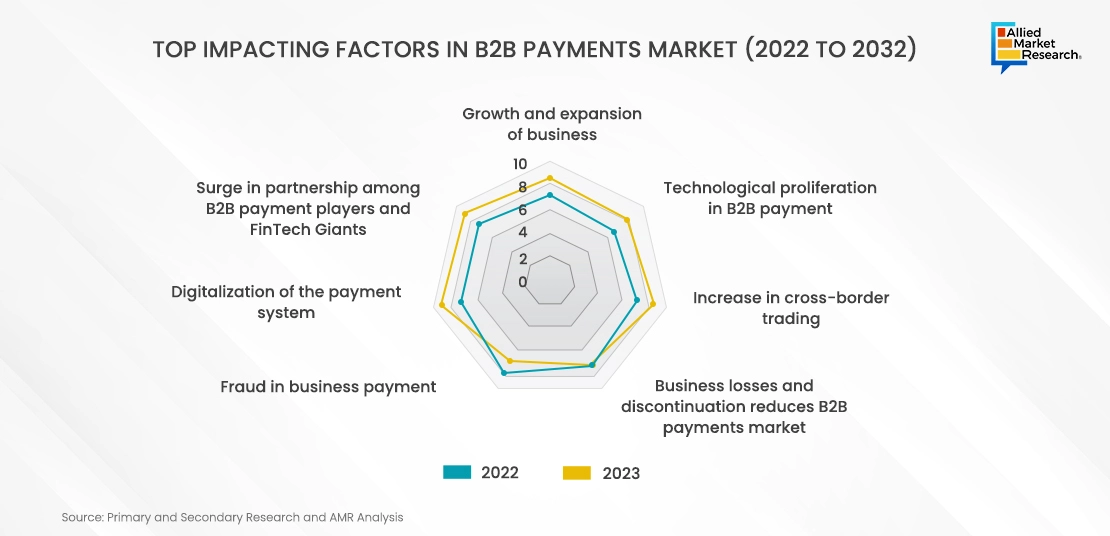

Over the last decade, the B2B payments market revolved around paper-based, manual processes. However, there has been a significant shift toward cloud-based, automated payment systems. This digitization has simplified the buying and selling process, making it more efficient and faster for B2B buyers and suppliers to make payments. Also, the current wave of digitalization provides an appropriate real-time actionable insight that facilitates merchants to identify trends and patterns to take strategic decisions. Thus, rise in initiatives and strategic advancement in incorporating digital technology leads to surge in the growth of the B2B payment market.

Moreover, businesses deal with different countries for their expansion, which boosts cross-border business transactions. Payment platforms in cross-border business can offer seamless payments channeled along an inclusive network of payment corridors, which can consistently provide fast, reliable payments to a wide range of global destinations. Such factors are anticipated to offer lucrative growth opportunities for the B2B payment market.

Trends in the B2B Payment Market in 2023

The B2B payment landscape is witnessing fast digital transformation, driven by several key trends. Firstly, there is a growing adoption of real-time payments, enabling groups to streamline transactions. Secondly, the blockchain era is enhancing protection and transparency in B2B transactions, lowering fraud risks. Thirdly, the integration of AI and Machine Learning is optimizing charge methods, imparting insights for better choice-making. Lastly, there's a shift towards cell payments, permitting businesses to make payments anytime, anywhere, accelerating the digitization of B2B payments.

Expansion of Real-time Payments: Real-time B2B payments are revolutionizing how businesses manage their finances, offering a level of speed and agility compared to previous years. This transformation is particularly significant for businesses utilizing Buy Now Pay Later (BNPL) solutions, as it provides them with immediate access to funds, enabling them to optimize their cash flow and working capital management. Real-time payments are not only enhancing the efficiency of B2B transactions but also contributing to a more streamlined and transparent payment experience. Moreover, real-time B2B payments are expected to play a pivotal role in shaping the future of business transactions, driving further growth and innovation in the B2B payments landscape. For instance, in January 2022, Rupifi, a finance company operating in the B2B payment sector, raised $25 million to expand its product portfolio of B2B Buy Now Pay Later (BNPL) and SME-focused Commercial Card, as well as product reachability to several marketplaces, to serve its merchants. It will enable flexible and no-EMI credit for small businesses while providing SMEs flexibility to manage expenses without any additional costs for shorter periods. Such investment projects are expected to contribute to the expansion of business and create scalable growth opportunities for the B2B payment market. However, companies are continuously maintaining a stable payment channel for B2B transactions to get a better and faster supply of goods and services. For instance, in June 2022, Cardlay, a Danish B2B FinTech firm, integrated payment Cloud Solution with SAP Concur Expense that benefits its operations from carbon-neutral and secure virtual card offering without changing the current bank relationship. Furthermore, expansion in business and its processes includes dealing with new supply chains for getting different types of goods & services to further sell to customers; thus, increasing the expansion of businesses. This results in a significant surge in demand for B2B payments, thereby driving the market growth.

Increase in cross-border trading: Globally, businesses and financial service providers are launching cross-border innovations to support businesses to streamline and strengthen B2B payments. Rise in the number of B2B payments transaction is observed, owing to the need for secure, reliable, and efficient means of fund transfer across different countries. Therefore, the demand for B2B payments continues to rise as companies are increasingly looking for secure means of payment.

Companies, nowadays, are also engaging in international trade and expanding their existing business operation beyond their domestic boundaries, which further expands the need for cross-border payment solutions. For instance, SWIFT, a global financial messaging service, introduced a Beneficiary Account Validation (BAV) service in 2021, allowing banks to verify a beneficiary’s account information prior to the payments being made. This will mitigate the risk of payment failure on account of incorrect data, which removes a key point of resistance in cross-border transactions.

Moreover, the cross-border transaction involves suppliers, wholesalers, retailers, and businesses that require B2B payments to deal with each other, thereby increasing the need for B2B payments. Furthermore, several e-commerce platforms connect buyers with sellers globally. These include Amazon, Alibaba, and others, which act as intermediaries, collecting payments from buyers and transferring the amount to sellers from different countries; thereby facilitating B2B payments.

Hence, there is an increase in partnerships between big techs and B2B payment providers, further facilitating cross-border trading. For instance, in June 2022, Payoneer, a commerce technology company, completed the collaboration with Fiserv to streamline the cross-border payouts to sellers, vendors, contractors, and consumers across borders. Therefore, cross-border payments are rising globally, particularly for businesses serving the gig economy and marketplaces, and boosting the growth of the B2B payments market.

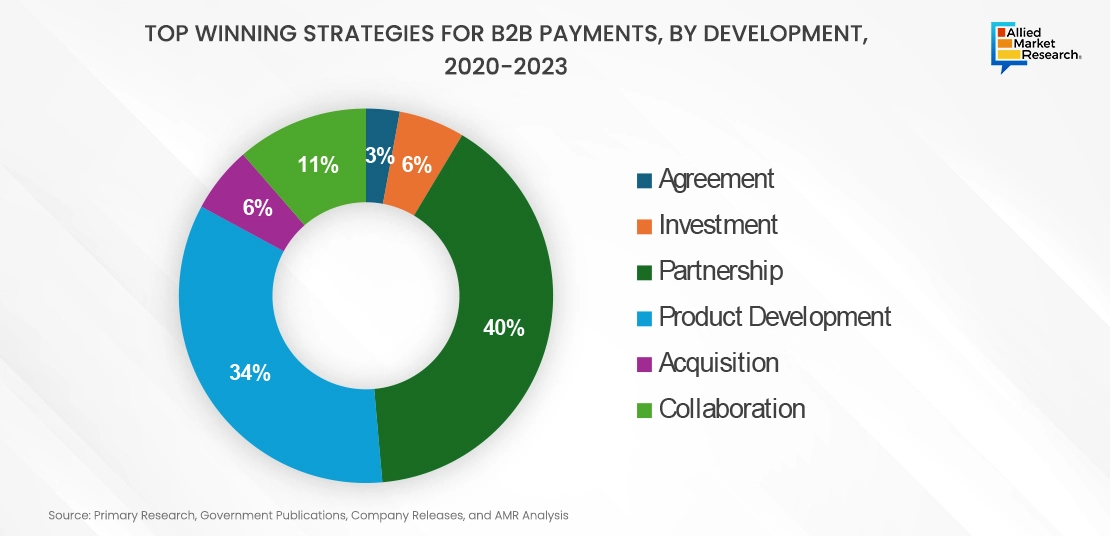

Winning strategies for B2B payments development encompass a range of approaches, including strategic agreements to foster innovation, investments in technology for enhanced capabilities, partnerships for expanded reach, product development for tailored solutions, acquisitions to accelerate growth, and collaborations to drive industry-wide progress. By leveraging these strategies effectively, businesses to stay ahead in the dynamic B2B payments landscape, offering innovative and efficient solutions that meet the evolving needs of their customers.

Impact of Government Regulation on the Global B2B Payment Market

All well-governed B2B payment solution vendors are able to demonstrate due diligence to ensure regulatory compliance in applicable fields. Government regulations mandate several aspects of payment developments such as real-time payments in the B2B mobility industry, driven by five major trends, namely evolving powertrain technology, development of digital infrastructure, digitalizing of workflows and business processes, rapid shift in B2B payment experiences, and rising instant and device-agnostic payments. A few notable instances of important regulations include:

- The European Commission’s planned revision of its payments Cross-Border payment Directive. This is a strategic move toward the secure transfer of data, enabling B2B mobility players to generate additional value by using data from other industries.

- Similarly, the European Union is simplifying the European toll systems to safeguard that a single on-board unit is compatible with all electronic toll operators.

Therefore, the continued regulation and government subsidies are expected to provide incentives for the adoption of payment solutions, including B2B payments. Therefore, government regulations will continue to develop and shape this emerging market.

In addition, federal and state governments are improving their regulations for various laws, which apply to the B2B payment sector that is involved in the rapid developments for B2B payments. For instance, in 2018, the U.S. government mandated that e-invoice is required by businesses to pay suppliers. This is due to e-invoicing being an integral part of a well-organized financial supply chain, improving the end-to-end process of B2B transactions, as it connects the end-to-end process of businesses to payment systems.

Similarly, in 2022, the Germany government also mandated B2B electronic invoices in accordance with European Directive 2014/55/EU, with the objective to establish a clearance system. This has become an unstoppable trend for the adoption of e-invoices that requires private companies and public administrations to modernize their invoicing systems. This helps to create the right conditions to strengthen the security of B2B payment and bolster resources and tools by promoting the development of innovative solutions and inclusive financing solutions.

Technological Proliferation in B2B Payments

In recent years, the B2B payment sector has undergone significant advancements with the emergence of innovative technologies, keeping in pace with market change and customer experiences for transparent, secure, and reliable business transactions. Business owners are shifting their focus toward the latest technology based B2B payment solutions. This shift underscores a growing recognition of the benefits of modernizing payment processes and receiving payments in more efficient and innovative ways. For instance, the shift from physical cards to digital payment solutions, including transfers, eChecks, BNPL solutions, and more, focuses on utilizing working capital benefits such as virtual accounts and payment platforms.

Moreover, mobile payments and cross-border payment solutions as well as the utilization of new technologies, including artificial intelligence (AI) and the Internet of Things are playing a considerable role in business success and enabling improved shopping experience for consumers. For instance, in January 2022, Mastercard incorporated the AI technology in Mastercard Track Business payment Cross-Border Payment, enabling businesses to pay suppliers instantly through virtual cards. As a result, the latest developments by the company are expected to help suppliers unlock working capital requirements and meet the cash flow crises caused by the disruptions of the global supply chain in the wake of a pandemic.

In addition, automation in the payment system has accelerated its demand among business owners, in networking and connecting with various suppliers, wholesalers, and retailers globally. Automated clearing house (ACH) is a form of B2B payments that is faster and more efficient than the traditional methods. Therefore, technological advancement in the field of B2B payment enables key players to diversify their product portfolio and get better user experience, thereby contributing to the market growth during the forecast period.

Leading companies in the B2B payments sector are employing a variety of winning strategies to drive growth and innovation. They are entering strategic agreements to enhance their offerings and reach, making significant investments in technology to improve payment efficiency and security, forming partnerships with fintech firms and industry players to expand their capabilities, focusing on continuous product development to meet evolving customer needs, pursuing strategic acquisitions to gain market share and access new markets, and engaging in collaborations to establish industry standards and drive collective progress. These strategies collectively enable companies to stay competitive, enhance customer satisfaction, and drive long-term success in the dynamic B2B payments landscape. Below are some strategies taken by major players in the past few years.

SMEs and large corporates have perceived various changes in business processes, operations, and industrial automation. However, organizations are increasingly shifting towards digitalization from conventional payment systems to cope with ongoing business competition and mitigate data security concerns. Digitization of inflow and outflow of cash functions often enables significant operational efficiency, materially better rewards in lower costs, cash management, risk mitigation, error reduction, and improved transparency while making the entire process electronic.

Furthermore, increased investments from B2B players, FinTech giants, and investment advisory firms in expanding the business presence and product offerings regarding B2B payment solutions propel the market growth. For instance, in August 2022, Jarvis Invest, India’s first AI-investment advisory firm, made a strategic investment of $600,000 to expand its global presence and launch new B2B products in a key market in UAE. The investment will create new abilities for the company for the generation of additional profits by expanding the business portfolio of B2B payment systems.

Furthermore, in July 2022, the global B2B payments and invoicing network, TreviPay, unveiled a new B2B payment method for the specific needs of large, mid-size, and small businesses, facilitating the trade connection of 90,000 buyers and 80,000 seller locations globally.

B2B payments also empowers merchants to provide trade credit to business buyers for creating more profitable and authentic trading relationships. In addition, the B2B payment network supports clients with constantly changing distribution models and global development by automating composite billing needs and streamlining account receivable and account payable workflows. Hence, such expansion strategies associated with product portfolios are expected to improve their B2B payment process in the upcoming years.

Conclusion

In conclusion, the B2B payments landscape is undergoing a rapid transformation driven by digitalization, technological advancements, and regulatory developments. The shift towards cloud-based, automated payment systems, the growth of real-time payments, and the rise in cross-border trading are key trends shaping the market. Companies are adopting innovative strategies such as strategic partnerships, investments in technology, and product development to stay competitive and meet the evolving needs of their customers. Additionally, government regulations and initiatives are playing a crucial role in shaping the future of B2B payments, creating opportunities for growth and innovation in the market. For further information on the market, get in touch with AMR analysts.