Table Of Contents

- Importance of Efficient and Secure Cross-border Transactions

- Emerging Trends and Drivers

- Challenges in Cross-Border Payments

- High Transaction Costs

- Regulatory Compliance Issues

- Overview of Existing Technologies in Cross-border Payment

- Society for Worldwide Interbank Financial Telecommunication (SWIFT)

- Ripple (XRP) and Blockchain

- Digital Wallets

- Cryptocurrencies

- Application Programming Interfaces (APIs)

- Real-Time Gross Settlement Systems (RTGS)

- Artificial Intelligence (AI) and Machine Learning

- Strategies Implemented by Cross-Border Payment Service and Solution Providers from 2020-2023

- Looking Ahead

Onkar Sumant

Pooja Parvatkar

Cross-Border Payments: Trends, Importance, and Challenges

The payment, transfer, and transaction processes that allow people, companies, and organizations in one nation to conduct business with counterparts in another are facilitated by the infrastructure, technologies, and financial institutions that are involved. Moreover, achieving this aim entails a variety of services including international wire transfers, currency conversion, and settlement procedures as well as the rapid and seamless flow of funds between various currencies and financial systems. Furthermore, cross border payments are essential to global trade, to simplify the flow of commodities and payments between buyers and sellers in various countries, trade finance services, such as documentary collections and letters of credit, sometimes entail cross-border payment systems. In addition, technology and fintech developments have been integrated in the cross-border payment market. Blockchain technology, smartphone apps, and digital platforms are being used to improve cross-border payment speed, efficiency, and affordability.

Importance of Efficient and Secure Cross-border Transactions

Efficient and secure cross-border transactions are vital for the global economy, fostering international trade and financial stability. Efficiency ensures swift fund transfers, reducing delays that can impede business operations and disrupt supply chains. Rapid transactions bolster economic growth, enhance liquidity, and promote trust between transacting parties. Security, equally crucial, safeguards sensitive financial information and prevents fraudulent activities, instilling confidence in both businesses and consumers. In an era of heightened cyber threats, robust security measures protect against unauthorized access, data breaches, and financial crimes.

For instance, the G20 has set ambitious goals for enhancing cross-border payments. Their vision includes making these transactions faster, cheaper, transparent, and inclusive. Swift progress is being made toward achieving these targets. In August 2023, Swift, a global financial messaging network, announced strong progress toward the G20’s goals, where 89% of transactions processed on its network now reach recipient banks within an hour, surpassing the target set for cross-border payment processing speed.

Emerging Trends and Drivers

Rise in the number of e-commerce transactions is a significant driver of the growth of the cross-border payments market. E-commerce has expanded rapidly throughout the world, allowing companies to contact customers outside of their national borders. The global expansion of online retail platforms has led to an increase in demand for reliable and successful cross-border payment solutions that enable cross-currency transactions. Furthermore, increase in globalization and international trade driven the demand of the market.

Fintech companies such as FIS, Checkout.com, Rapyd, Wise, and others are playing a crucial role in transforming cross-border payments within the e-commerce space. They offer innovative solutions such as real-time currency conversion, secure payment gateways, and simplified checkout processes, enhancing the overall user experience for international shoppers.

Challenges in Cross-Border Payments

High Transaction Costs

High transaction costs, incurred during financial exchanges, can impede economic efficiency and hinder market activities. These costs include various fees, such as brokerage fees, settlement charges, and currency conversion expenses, often incurred in cross-border transactions. Elevated transaction costs can discourage investment, limit capital flows, and disproportionately affect small businesses. In addition, these costs reduce the overall returns on investment, impacting both businesses and consumers. Mitigating high transaction costs is essential for fostering economic growth, promoting fair market access, and enhancing financial inclusion. Innovations in financial technology, regulatory reforms, and the adoption of cost-efficient payment systems play crucial roles in addressing these challenges, ensuring that financial transactions remain accessible, transparent, and conducive to sustainable economic development.

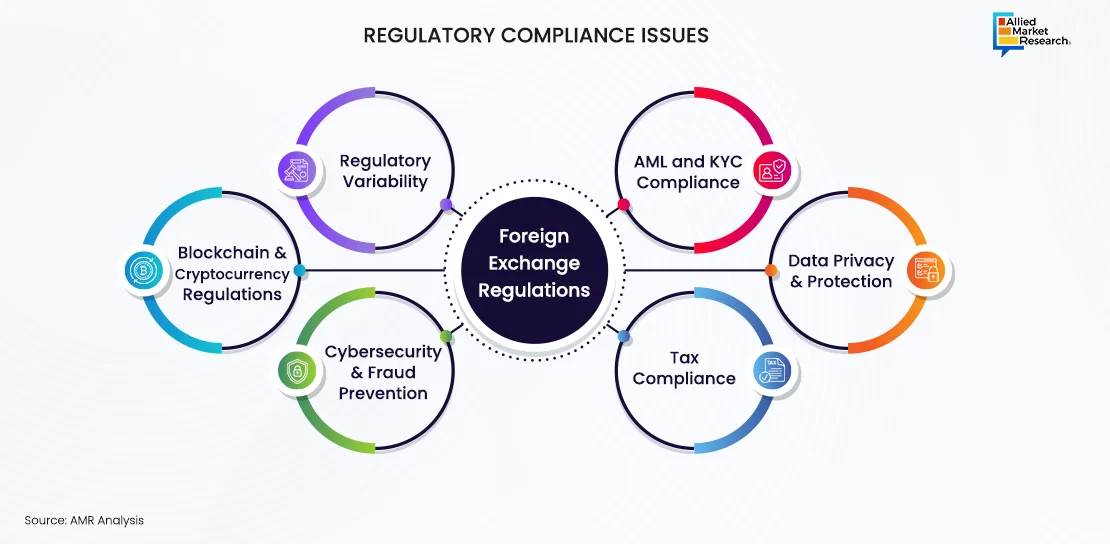

Regulatory Compliance Issues

Cross-border payments encounter regulatory compliance challenges due to the intricate nature of global financial transactions across multiple jurisdictions. Crucial compliance issues in the cross-border payment market are as follows:

Effectively addressing these regulatory compliance challenges demands a deep understanding of international financial regulations, continuous monitoring, and the implementation of robust compliance programs. Collaborative efforts among financial institutions, payment service providers, and regulatory bodies are indispensable for creating a secure, transparent, and compliant cross-border payment ecosystem.

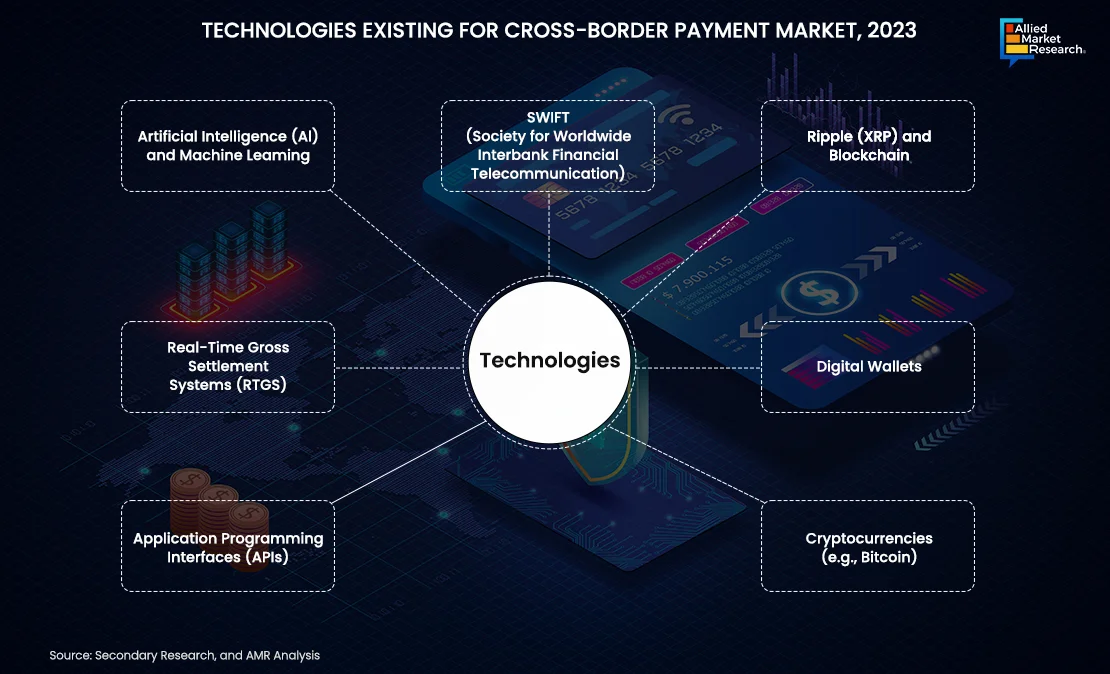

Overview of Existing Technologies in Cross-border Payment

Several existing technologies play a crucial role in cross-border payment, streamlining transactions, reducing costs, and enhancing efficiency.

Society for Worldwide Interbank Financial Telecommunication (SWIFT)

SWIFT is a messaging network used by financial institutions globally to securely and efficiently transmit information related to financial transactions.

For example, banks and financial institutions use SWIFT to communicate and execute international money transfers. The SWIFT code is an integral part of cross-border transactions, ensuring standardized communication.

Ripple (XRP) and Blockchain

Ripple utilizes blockchain technology to enable real-time, secure, and low-cost cross-border payments. Blockchain ensures transparency, traceability, and immutability of transactions.

For example, Ripple's platform, RippleNet, facilitates instant cross-border payments. It connects banks and payment service providers globally, allowing them to settle transactions quickly and with lower fees.

Digital Wallets

Digital wallets leverage mobile and online platforms to store and manage digital currencies, simplifying cross-border payments for individuals and businesses.

For example, PayPal and Venmo enable users to send and receive money internationally through their digital wallet platforms. These transactions are often faster and more cost-effective than traditional methods.

Cryptocurrencies

Cryptocurrencies are decentralized digital currencies that use cryptography for security. They offer a borderless and efficient alternative for cross-border transactions.

For example, Bitcoin can be used for international money transfers without the need for traditional banking intermediaries. However, due to its volatility, stablecoins such as USDC and USDT are also gaining popularity for cross-border transactions.

Application Programming Interfaces (APIs)

APIs facilitate the integration of different software systems, allowing seamless communication and data exchange between various platforms.

For example, Open banking APIs enable financial institutions to connect and share information securely. This connectivity enhances the efficiency of cross-border transactions by automating processes and reducing manual intervention.

Real-Time Gross Settlement Systems (RTGS)

RTGS systems enable the instantaneous settlement of high-value transactions, providing real-time and irrevocable transfers.

For example, the Eurosystem's TARGET2 (Trans-European Automated Real-time Gross Settlement Express Transfer System) allows financial institutions to settle euro-denominated transactions in real-time across borders.

Artificial Intelligence (AI) and Machine Learning

AI and machine learning technologies are used to enhance fraud detection, risk management, and decision-making processes in cross-border payments.

For example, AI-powered fraud detection systems analyze transaction patterns to identify and prevent fraudulent activities, providing an additional layer of security in cross-border transactions.

Strategies Implemented by Cross-Border Payment Service and Solution Providers from 2020-2023

A comprehensive analysis of the recent developments and growth curves of various companies have helped to understand the growth strategies along with their potential effect on the market. Collaboration, expansion, and product launch are strategies adopted by the cross-border payment service and solution providers from 2020-2023.

Furthermore, key players have adopted various strategies for enhancing their services in the market and improving customer satisfaction.

For instance, in August 2022, American Express launched digital, cross-border payment solution for U.S. small businesses. It enables safe domestic and international business-to-business (B2B) payments for American companies. With this innovative digital service, business customers may use a straightforward, mobile-friendly portal to transfer payments funded from their business bank account to their suppliers in over 40 countries, in a variety of currencies.

Moreover, in August 2022, American Express launched a platform called Global Pay. It will act as a digital solution that will let U.S. businesses make secure domestic and international B2B payments. With this innovative digital solution, business customers can use an easy-to-use, mobile-friendly portal to transfer payments funded from their business bank account to their suppliers in over 40 countries, in a variety of currencies.

These strategies by the key players operating at a global and regional level are expected to help the market to grow significantly during the forecast period.

Looking Ahead

Increase in demand for cross-border payment services results from global economic interconnection and expanding international trade. Fintech progress and digital advancements revolutionize cross-border payments, simplifying and speeding up transactions. Rise in cross-border e-commerce platforms heightens the necessity for secure payment solutions. Mobile payment systems and real-time payment trends facilitate convenient international transactions. Opportunities arise for customer-centric, cost-effective systems prioritizing transparency. Aligning trade finance and cross-border payments offers comprehensive solutions for international businesses. Overall, these developments reflect a dynamic landscape, driven by technological innovation and evolving consumer needs, shaping the future of cross-border transactions.

By embracing these principles and staying ahead of technological advancements, firms can navigate challenges and seize opportunities in the dynamic BFSI industry. This is where AMR can help businesses seize opportunities and monetize them to the best of their ability.