Table Of Contents

- Top Impacting Factors

- 1. Rise in investment in businesses with sustainable practices

- 2. Decreased exposure to sustainability related risks

- 3. Cost cutting and risk mitigation along with better returns offered by sustainable finance

- 4. Growing awareness of sustainability among various sectors

- Trends in Sustainable Finance Market

- 1. Rising adoption of advanced technologies

- 2. Growing emphasis on sustainability and corporate responsibility

- Application and Use Cases

- Competitive Landscape

Onkar Sumant

Sumeet Pal

Sustainable Finance: A Visionary's Guide to Responsible Banking

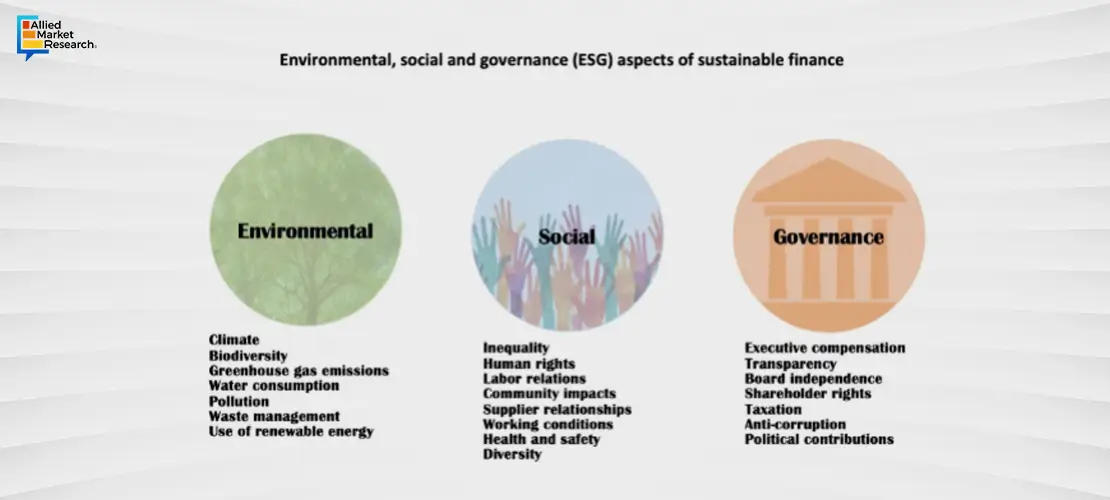

Sustainable finance is defined as investment decisions that take into account the environmental, social, and governance (ESG) factors of an economic activity or project. Environmental factors include mitigation of the climate crisis or use of sustainable resources. Social factors include human and animal rights, as well as consumer protection and diverse hiring practices. Governance factors refer to the management, employee relations, and compensation practices of both public and private organizations. It has become a significant movement driven by regulators, institutional investors, and asset managers globally. Furthermore, sustainable investing covers a range of activities, from putting cash into green energy projects to investing in companies that exhibit social values including social inclusion or good governance.

According to the European Union, whose Green Deal Investment Plan aims to raise $1.14 trillion to help pay the cost of making Europe net zero climate change emissions by 2050, sustainable finance plays an important role in the world’s transition to net zero by channeling private money into carbon-neutral projects. Sustainable finance plays a key role in promoting the transition to a carbon-neutral and sustainable environment. By supporting projects that prioritize resource efficiency, healthy ecosystems and promote the circular economy, it helps reduce waste generation, promotes recycling and reuse, and protects ecosystems. Through the integration of environmental, social, and governance (ESG) factors into investment analysis and reporting, it enables investors to make informed decisions and holds companies accountable for their environmental impact. Thus, businesses are incentivized to adopt sustainable practices, improve their environmental performance, and reduce their ecological footprint. By providing financial support to green startups and research and development in the field of sustainability, it drives the creation of new solutions for environmental challenges. Therefore, sustainable finance is a path toward the peaceful coexistence of environmental well-being and financial prosperity.

Top Impacting Factors

1. Rise in investment in businesses with sustainable practices

Investing in businesses and projects with sustainable ESG practices is on the rise, as the demand for finance professionals with expertise in this niche yet rapidly growing field is rapidly increasing. Furthermore, a report by the United Nations’ Intergovernmental Panel on Climate Change makes the urgent case for integrating ESG, among other factors, into investment decisions for fast, actionable impact on the environment. Moreover, market leaders in the space are demonstrating that thinking differently about environmental and social performance can drive change that delivers more business value while harnessing the power of enterprise to deliver better outcomes for people and the planet. For instance, in January 2024, Societe Generale and IFC, a member of the World Bank Group, have signed a collaboration framework agreement to accelerate on sustainable finance in developing countries, as part of both institutions’ shared ambition to contribute to the UN Sustainable Development Goals (SDGs) and strong commitment to the environmental transition and sustainability.

2. Decreased exposure to sustainability related risks

ESG-related issues, such as rising sea levels, inflated senior management compensation, or human rights violations in a product’s supply chain, can carry major?risks to banks’?finances?and reputations. Moreover, climate change may put up to 15% of banks’ balance sheets at risk. Therefore, sustainable banking products can help mitigate a bank’s exposure to ESG-related risks and improve profitability. Green financing policies in China, for instance, were found to have a positive impact on banks’ non-performing loan ratios. Furthermore, stakeholders are comparing banks based on their sustainability pledges.?By putting in place?an effective?ESG?strategy?and targets, banks can show their commitment to sustainability, promote their credibility, and reduce risks of green washing.

3. Cost cutting and risk mitigation along with better returns offered by sustainable finance

Sustainable businesses deliver financial returns in the short and long term while generating positive value for society and operating within environmental constraints. Organizations that fail to address environmental and social risks are less resilient to these challenges, and so they put their own existence at risk. In addition, environmental and social risks can also be material financial risks. In an ever more complicated and interconnected world, an integrated approach to risk management is essential. Thus, creating a sustainable business can deliver significant cost savings and efficiencies. For instance, using fewer resources, such as carbon or water will have a direct impact on costs and provide stable returns.

4. Growing awareness of sustainability among various sectors

Sustainability is an increasingly important issue for many people, especially in the business world. For business owners, leaders, and administrators, sustainable business practices are becoming imperative. According to NASA, it is more than 95% likely that human activity is causing the planet to get warmer. The human industry is a big part of climate change because of its reliance on land, resources, fossil fuels, and non-stop production and consumption. Therefore, growing awareness about sustainability among various sectors is expected to propel investors to make investment in businesses, which are more sustainable and considers the ESG reliance.

Trends in Sustainable Finance Market

1. Rising adoption of advanced technologies

The increasing digitization of businesses across industries plays an important role in driving sustainable finance. The accelerated adoption of advanced technologies such as artificial intelligence, blockchain, and the Internet of Things (IoT) is fostering efficiency, innovation, and new business models. Companies are leveraging these technologies to streamline operations, enhance customer experiences, and gain a competitive edge.

2. Growing emphasis on sustainability and corporate responsibility

As awareness of environmental and social issues grows, consumers and investors alike are favoring businesses that demonstrate a commitment to ethical practices and environmental management. This shift in consumer preferences is compelling companies to integrate sustainable practices into their operations, creating opportunities for eco-friendly products and services. The green transition is not only a response to market demand but also a proactive measure to mitigate climate risks, making sustainability a driving force behind the growth of various industries.

Application and Use Cases

Sustainable finance is reshaping the financial landscape by driving capital towards initiatives that prioritize environmental and social responsibility. In the energy sector, sustainable finance plays a vital role in supporting renewable energy projects, such as wind and solar farms, through investments and green bonds. This accelerates the shift towards cleaner energy sources as well as contributes to the reduction of carbon emissions. Furthermore, sustainable finance is influencing corporate strategies, with businesses integrating environmental, social, and governance (ESG) considerations into their decision-making processes. The issuance of green bonds and the implementation of sustainable investment practices are motivating companies to adopt ethical and sustainable practices, creating a positive effect throughout industries.

In the realm of renewable energy, sustainable finance facilitates investments in solar and wind projects, driving the global transition towards clean energy sources. The issuance of green bonds and sustainable investment funds provides critical funding for such initiatives, propelling the growth of sustainable energy infrastructure. Moreover, corporate sustainability, where sustainable finance aligns financial strategies with environmental, social, and governance (ESG) principles attracts conscientious investors as well as encourages companies to adopt responsible business practices, creating a paradigm shift towards ethical governance and social responsibility. On the contrary, sustainable finance supports initiatives in sustainable agriculture, urban development, and social impact projects, showcasing its versatility as a catalyst for positive change across a spectrum of industries.

Competitive Landscape

Leading market players with diverse product offerings seek growth opportunities in the sustainable finance market to fragment their position. The following developments show the competitive strength of leading companies operating in the sustainable finance industry such as UBS, Franklin Templeton, JPMorgan Chase & Co., State Street Corporation, BlackRock, Inc., and others. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

In January 2024, Luxembourg, Switzerland, and UBS Optimus Foundation are joining forces to scale up impact investing globally. The Government of Luxembourg and the SDG Impact Finance Initiative (SIFI) announced a new partnership to mobilize private capital at scale in support of the UN Sustainable Development Goals (SDGs) in developing economies.

In October 2023, Franklin Templeton and ClearBridge Investments launched a global value equity fund named the FTGF ClearBridge Global Sustainability Improvers Fund. The fund marks a significant step towards investing in companies demonstrating notable enhancements in their Environmental, Social, and Governance (ESG) profiles.

In June 2023, J.P. Morgan Securities Services announced the launch of its Sustainable Investment Data Solutions for institutional investors, available through Fusion by J.P. Morgan. The solution enables investors to readily extract value from sustainable investment data supplied by providers through technology-enabled normalization, management, calculation, and screening capabilities.

In November 2022, State Street Corporation issued $1 billion in senior unsecured bonds, including a $500 million bond as the first one under its Sustainability Bond Framework, which allows it to issue green, social, and sustainability bonds.

In October 2022, BlackRock launched its new Sustainable Global Allocation UCITS Fund in Europe, designed to be “a core sustainability holding” for investors. According to BlackRock, the new fund is being introduced following investor demand for an ESG version of the firm’s $15 billion BGF Global Allocation Fund, one of the leading multi-asset portfolios in the EMEA market.

In February 2022, Amundi US expanded its range of global sustainable equity funds to include Pioneer Global Sustainable Equity Fund, the new name of Pioneer Global Equity Fund. These funds offer investors actively managed global growth, global value, or global core strategies led by experienced portfolio management teams that incorporate ESG (environmental, social and governance) factors into their investment process.

In conclusion, it is projected that the sustainable finance sector will be more inventive, dynamic, and interconnected than ever in 2024. It is expected to face its share of challenges but also presents ample opportunities for growth and transformation. Companies that can navigate these changes effectively will not only contribute to the industry's evolution but also pave the way for a more sustainable and efficient future in the sustainable finance industry.