Table Of Contents

- COVID-19: A Key Driver for Travel Insurance Market Growth

- Demographic Shifts

- Partnerships & Collaborations among Travel Insurance Players

- Innovations and Future Landscape

- Digitalization and Online Platforms

- Personalization and Flexible Coverage:

- Blockchain Technology for Claims Processing

- Innovative Coverage for Adventure Travel

- Future Outlook for Market

Onkar Sumant

Pooja Parvatkar

Insights into the Travel Insurance Market

The value of global travel insurance premiums is expected to be almost seven times higher than in 2022 to reach $107 billion in 2032, attaining a growth rate of 20.1%. The report titled “Travel Insurance Market” reflects on the current growth of travel insurance, emphasizing notable trends and opportunities on a global scale as well as across different regions. Business leaders and companies can harness these insights to engage with this significantly growing sector.

COVID-19: A Key Driver for Travel Insurance Market Growth

The COVID-19 pandemic had a profound impact on the travel insurance industry, changing the landscape in several ways. The pandemic highlighted the importance of travel insurance for many travelers. Concerns about cancellations, travel disruptions, and medical emergencies related to COVID-19 led to surge in demand for comprehensive travel insurance. The pandemic accelerated the adoption of digital channels for purchasing travel insurance. Many travelers now prefer to research, compare, and purchase insurance policies online, reducing their reliance on traditional sales channels such as travel agents, thus driving the growth of the travel insurance market.

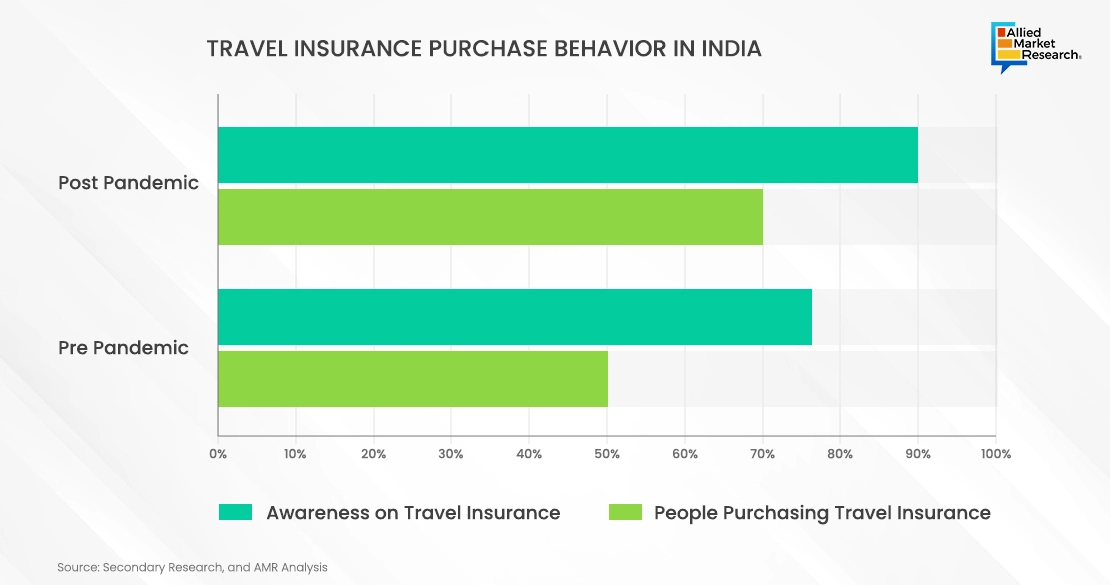

Since the COVID-19 pandemic, the ratio of people using travel insurance has increased significantly. Emerging markets such as India, Indonesia, and Malaysia have seen a significant increase in the number of people using travel insurance since the pandemic as more travelers prioritize safety. For instance, even though 75% population was aware of travel insurance before the pandemic, only 50% chose to purchase insurance unless it was mandatory. However, trends have changed significantly since the COVID-19 outbreak. Post COVID-19, the number of travelers purchasing travel insurance has increased from 50% to 76%.

Demographic Shifts

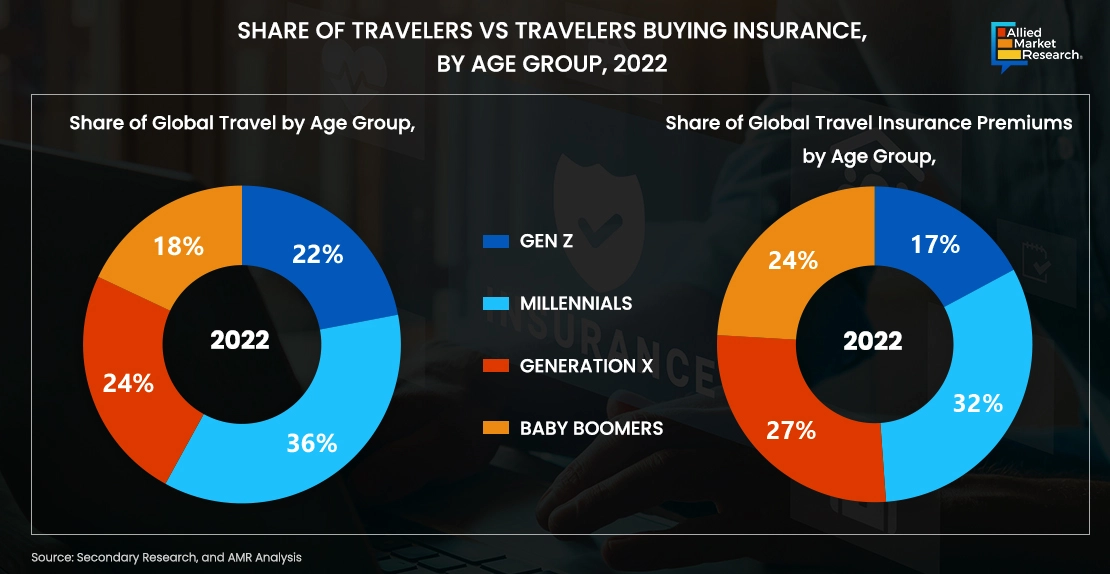

The travel insurance industry is experiencing significant development and increasing its demographic appeal. In most regions, younger age groups, particularly Millennials and Generation Z, travel frequently for various reasons, accounting for almost 60% of trips in 2022. In addition, travel insurance is popular among all age groups, especially seniors and Generation X in Western markets. These two age groups represent a significant percentage of the people who make up more than 50% of travel insurance buyers and are driving the market growth.

Seniors, who are often more vulnerable to health problems, are increasingly willing to purchase travel insurance that offer comprehensive medical coverage. The COVID-19 pandemic has shown the importance of having adequate health insurance, which also covers the costs of COVID-19 treatment, hospitalization, and emergency medical evacuation, thus, driving the market growth.

Partnerships & Collaborations among Travel Insurance Players

Partnerships play a key role in the travel insurance industry by facilitating distribution, improving product offerings, and expanding market reach. By leveraging strategic partnerships, insurance companies can better meet the diverse needs of travelers and adapt to changing market trends. Travel insurance companies often partner with online aggregators and comparison sites to increase their reach and visibility. These platforms allow users to compare different insurance policies based on coverage, price, and other features, helping travelers make informed decisions. In addition, insurers can work with travel agents and online booking platforms to offer insurance options as part of the booking process. This partnership makes it easier for travelers to purchase insurance when booking flights, hotels, or vacation packages. Below mentioned are partnerships and collaborations in the travel insurance sector registered in recent years.

Innovations and Future Landscape

Rise in innovation demonstrates the travel insurance industry's ability to adapt to changing consumer needs and new trends in the global travel industry. Advancements in technology and changing travel patterns lead to new innovations aimed at improving the availability, flexibility and reliability of travel insurance products and services.

Digitalization and Online Platforms

Many travel insurance companies have moved to digital platforms that allow customers to purchase policies, manage claims, and access support services online or through mobile apps. Digital platforms provide convenience, accessibility, and real-time updates, improving the overall customer experience. In September 2022, insurtech startup, InsuranceDekho, expanded its service offering by launching travel insurance on its online platform. The company has partnered with leading insurance organizations such as Reliance General, Bajaj Allianz, ICICI Lombard, and others to offer travel insurance services on a regular basis.

Personalization and Flexible Coverage:

Travel insurance providers offer customizable policies to meet the individual needs of travelers. Customers can choose specific insurance options, additional options, and deductibles depending on their destination, activity, and risk factors. Also, in response to the global pandemic, many travel insurance companies have introduced coverage for COVID-19-related costs, including medical costs, trip cancellations, and quarantine costs.

Blockchain Technology for Claims Processing

Some travel insurance companies are exploring blockchain technology to streamline claims processing and improve transparency. Blockchain-based systems can securely store and verify travel insurance policies, speed up claims processing, and reduce administrative costs. For instance, in January 2022, Etherisc, an open-source decentralized insurance protocol, launched a blockchain-based insurance application called FlightDelay. This app can issue policies and independently process payments for trip delays and cancellations, leveraging blockchain technology for automated claims processing and secure payments.

Innovative Coverage for Adventure Travel

With rise in popularity for adventure travel and extreme sports, insurers are developing specific insurance options for activities such as hiking, diving, and skiing. These policies provide comprehensive protection against injuries, property damage, and trip disruption associated with adventure travel. In October 2021, Travel Insured International, Inc. launched cruise travel protection plan that provides coverage up to $50,000 in accidental & sickness medical expense and up to $250,000 in medical evacuation coverage. It also provides protection for missed cruise connection, cruise disablement, and cruise diversion.

Future Outlook for Market

The future of the travel insurance market is expected to evolve significantly due to various factors that are changing the travel landscape. Technological advances, changing consumer behaviour, and global events such as the COVID-19 pandemic are driving the market growth. Technological advancements are revolutionizing the way users purchase, manage, and report travel insurance. Mobile apps, AI-powered chatbots, and digital platforms provide convenience and personalization, enhancing the overall customer experience. Consumer inclination towards travel insurance is also changing. Higher awareness of the health and safety issues caused by the pandemic has highlighted the importance of comprehensive protection. Travelers are increasingly looking for policies that offer protection against unexpected events, including medical emergencies, cancellations, and trip interruptions.

Partnerships with airlines, travel agencies, and online platforms are anticipated to further expand distribution channels and reach a wider audience. In addition, rise in educational initiatives are expected to play a key role in increasing consumer understanding and awareness of the benefits and options of travel insurance. Overall, the future of the travel insurance market lies in innovation, adaptability, and customer-focused solutions that meet the changing needs of travelers in an increasingly complex global environment. Get in touch with AMR analysts for more information.