BFSI Sector’s Top 5 Emerging Markets in Q1 2024: Allied Market Research’s Comprehensive Analysis

The BFSI (Banking, Financial Services, and Insurance) sector is witnessing a dynamic wave of innovation and transformation across global markets. AMR has identified the top 5 emerging markets in the Banking, Financial Services, and Insurance (BFSI) sector for the 1st quarter of 2024, offering insight into areas of promising growth and investment opportunities.

Leveraging AMR's proprietary 'Title Matrix Tool', meticulously crafted by our research analysts and parallel teams, these reports are prioritized based on predefined parameters. These criteria encompass relevance, growth potential, client demand trends, key player significance, market size, and other critical factors.

The reports on these top 5 BFSI markets are tailored to address key business inquiries, including current size and forecasts, growth drivers, opportunities, strategies employed by major players, challenges, potential risks, regional dynamics, and the competitive landscape. Furthermore, they integrate retrospective analysis and historical data to furnish a comprehensive understanding of trends and dynamics over time. This strategic approach equips stakeholders with actionable insights to capitalize on emerging opportunities and navigate potential challenges in the evolving BFSI landscape.

Here are the top 5 emerging markets driving innovation, addressing critical financial needs, and shaping the future of the BFSI sector.

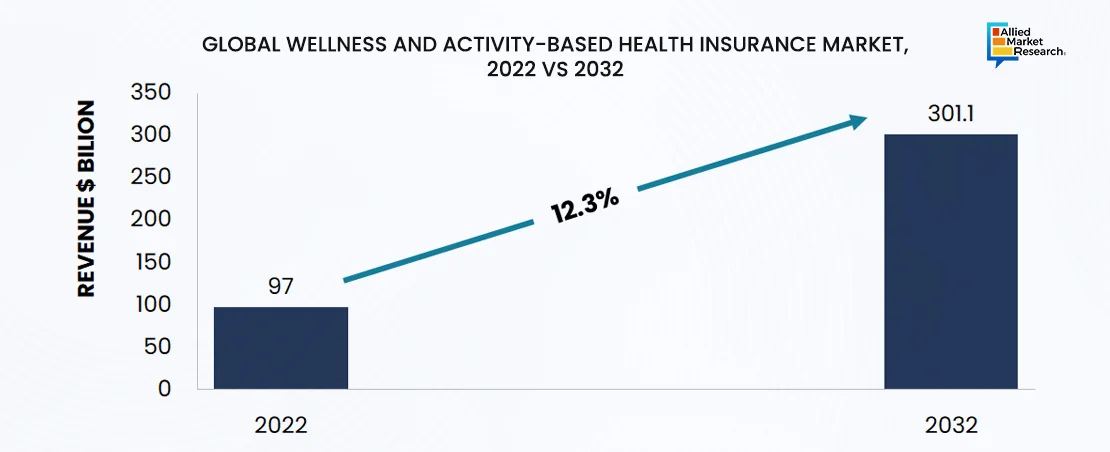

1.Wellness And Activity-Based Health Insurance

The global wellness and activity-based health insurance market is experiencing a surge driven by several key trends and industry shifts. The global industry was valued at $97 billion in 2022 and projected to reach $302.1 billion by 2032. Currently, there is a noticeable increase in health consciousness among individuals, prompting a demand for personalized wellness solutions. Also, with the proliferation of wearable technology, this trend is reshaping how insurance is perceived and utilized. This market is strategically important to research right now due to its potential to revolutionize healthcare financing and improve population health outcomes through incentivizing preventive health measures.

The report provides segmental analysis, offering valuable insights into its diverse components and their contributions to overall market dynamics. Segmented by type, program, service provider, and region, the report delineates key trends and growth drivers within each category. For instance, individual insurance plans sub-segment dominates the market, fueled by increasing demand for policies offering higher returns. Fitness programs emerge as the leading segment, reflecting the growing emphasis on physical well-being. Insurance companies segment lead in service provision, leveraging technological advancements to drive revenue. Regionally, North America stands out, driven by rising income levels and longer life expectancies. This comprehensive analysis enables stakeholders to discern market opportunities and tailor strategies accordingly.

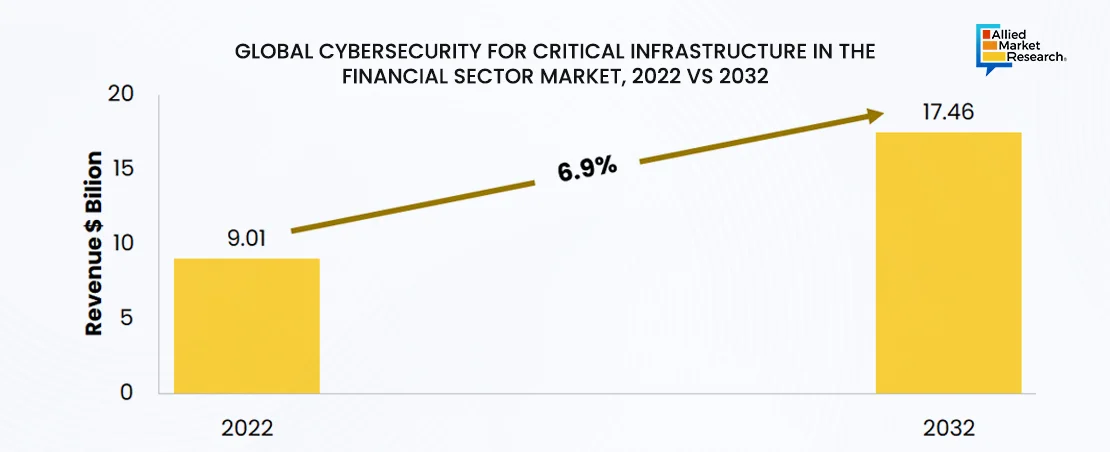

2. Cybersecurity For Critical Infrastructure in Financial Sector

The global cybersecurity for critical infrastructure in the financial sector industry is experiencing a significant surge, driven by the imperative to safeguard essential financial systems with specialized security solutions. This trend is propelled by the increasing sophistication of cyber threats targeting financial institutions, necessitating robust protective measures. The global cybersecurity for critical infrastructure in financial sector market is projected to reach $17,465.33 million by 2032, growing at a CAGR of 6.9% from 2023 to 2032.

This market is strategically important to research right now due to its crucial role in safeguarding the stability and integrity of the financial ecosystem. The report offers Porter's five forces analysis, indicating that the bargaining power of suppliers is influenced by the presence of numerous cybersecurity providers globally, contributing to a competitive landscape. Competitive intensity among competitors is high, driven by the importance of safeguarding critical infrastructure and the constant evolution of cyber threats. The threat of new entrants is moderate, with barriers to entry including technological expertise and regulatory compliance requirements. Substitutes pose a moderate threat, as alternative security measures may offer partial protection but lack comprehensive cybersecurity capabilities. For investors and decision-makers, this analysis provides insights into market competitiveness, helping them identify lucrative investment opportunities and strategic partnerships.

3. Starter Credit Cards

The global starter credit cards market is projected to reach $790.3 billion by 2032, growing at a CAGR of 10.6% from 2023 to 2032. The burgeoning young adult population, coupled with a growing demand for financial independence and credit-building tools, is driving the need for comprehensive reports on the industry. This market is strategically important to research right now due to its significant growth potential and its role in fostering financial inclusion and literacy among young adults.

The report presents a SWOT analysis, highlighting its strengths in promoting financial inclusion and leveraging digital platforms for convenience, which bode well for its growth potential. However, challenges such as limited credit limits and higher fees are notable weaknesses. Opportunities emerge from initiatives to utilize advanced analytics and alternative data sources for credit assessment, while threats include the possibility of restrictive credit risk management practices hindering market expansion. Overall, this analysis provides stakeholders with valuable insights to capitalize on strengths, address weaknesses, seize opportunities, and mitigate threats, facilitating effective navigation of the dynamic starter credit cards market landscape.

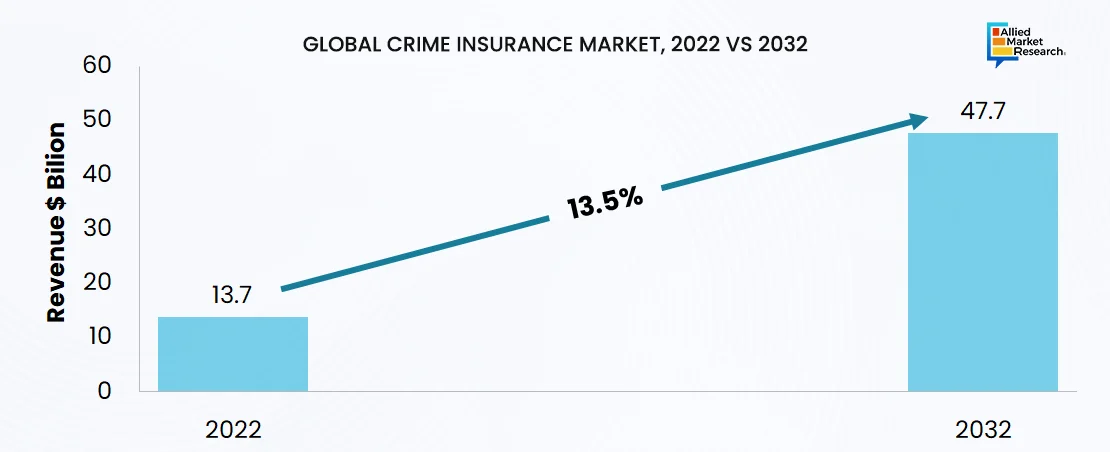

4. Crime Insurance

The global crime insurance market is experiencing dynamic shifts driven by several key trends and projected to reach $47.7 billion by 2032. Heightened awareness of financial vulnerabilities and the proliferation of corporate fraud cases are compelling businesses to seek robust protection against financial losses. Additionally, the increasing reliance on digital technologies is introducing novel cyber threats, necessitating specialized crime insurance coverage. Moreover, stringent regulatory requirements across various industries are mandating proactive risk management approaches, further fueling the demand for comprehensive crime insurance solutions. Given these trends, researching the crime insurance market is strategically vital to understand its evolving landscape and emerging opportunities.

The report offers a comprehensive competitive analysis of the crime insurance market, highlighting the strategies adopted by key players to fortify their market position. Leading players such as JS Downey Insurance Service, Nationwide Mutual Insurance Company, and Chubb are leveraging partnerships, product launches, and acquisitions to expand their presence and enhance their offerings. For instance, Risk Placement Services Inc. introduced a new commercial crime insurance product covering various fraud losses. Recent acquisitions, such as Capgemini's agreement to acquire the Finance Crime Compliance division of Exiger, underscore the industry's commitment to enhancing risk management and regulatory compliance services. These strategic maneuvers aim to capitalize on the burgeoning demand for crime insurance, driven by escalating cyber-attacks and the globalization of businesses, thereby propelling market growth.

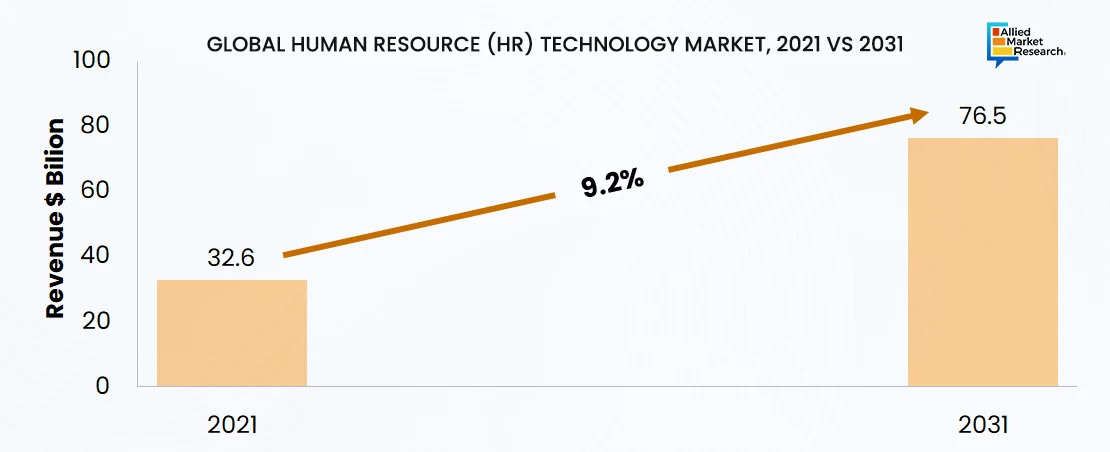

5. Human Resource (HR) Technology

The Human Resource (HR) technology market is poised for substantial growth, with an expected CAGR of 9.2% from 2022 to 2031. The increasing demand for automation in HR processes, especially in recruitment, payroll, and performance management, is a significant driver of market expansion. Moreover, the shift towards hybrid and remote work models is accelerating the adoption of advanced HR technologies to enable efficient employee onboarding, communication, and management across diverse locations. The report highlights major trends like the integration of artificial intelligence and analytics in HR technology, the emergence of employee experience platforms, and the evolution of talent management systems. This market is strategically important to research right now due to its pivotal role in enhancing organizational efficiency, fostering employee engagement, and navigating the evolving landscape of hybrid work models.

The report offers a comprehensive regional analysis, highlighting key trends and growth drivers across different geographies. North America dominated the market in 2021, fueled by a strong focus on business process improvements and enhanced HR analytics capabilities. However, Asia Pacific is poised to witness significant growth during the forecast period, driven by the increasing adoption of HR technology solutions to navigate complex HR tasks and streamline operations. The rapid expansion of businesses in the region, coupled with the rising demand for talent management and recruitment solutions, is driving the adoption of HR technologies.

The Bottom Line

Each of these emerging markets in the BFSI sector presents distinct opportunities and hurdles. For market players and stakeholders seeking to navigate these dynamic landscapes, comprehensive analysis and strategic insights are essential. By staying abreast of market dynamics, emerging trends, and competitive landscapes, stakeholders can make informed decisions, foster innovation, and play a pivotal role in shaping the future of finance globally. Contact Allied Market Research analysts today for detailed insights, comprehensive reports, and strategic guidance tailored to the BFSI sector. Gain a profound understanding of market trends, opportunities, and challenges that will drive the evolution of banking, financial services, and insurance in Q1 2024 and beyond.